Pension fund valuation

Full text

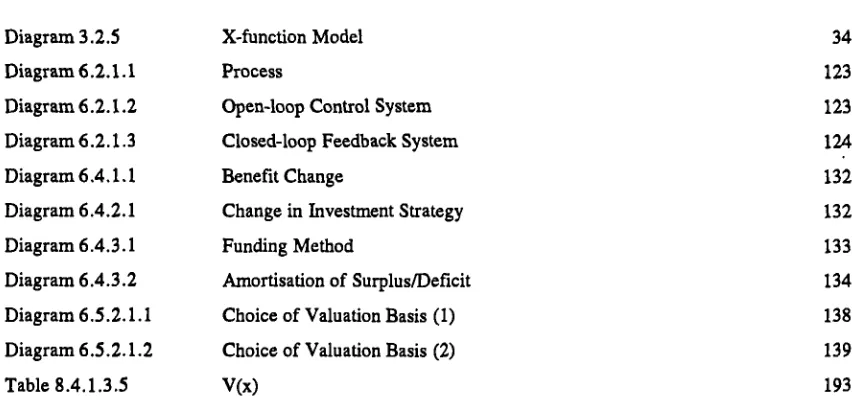

Figure

Related documents

The objective of the pension fund is to maximize the expected modified utility of its final wealth/final outcome at the death time

7. The net asset value of a unit shall be based on the market value of the fund’s assets, less any liabilities of the real estate fund and any tax likely to be due should the

A 20–year loan of 20, 000 may be repaid under the following two methods: (i) amortization method with equal annual payments at an annual e↵ective rate of 6.5% (ii) sinking fund

Keywords: Own risk and solvency assessment (ORSA), Almenni collective pension fund (ACPF), pension contribution, pension benefits, risk analysis, actuarial position,

Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate based on the fund’s average daily net assets—and the fund pays

To this projected cash flow series, an appropriate, market-derived discount rate is applied to establish an indication of the present value of the income

Pension Fund assets can be invested in commercial notes of joint-stock companies stated in Article 105 paragraph (1) item h) of the Law except those issued by banks, if

The Board of Directors of PYN Fund Management Ltd can temporarily suspend the redemption of fund units if, in the view of the Fund Manager, the equal treatment of fund unit hold-