I

I

t

doc. no

W}gslztg4

ETJROPEAN COMMIS SIO]'{

DIRECTORATE-GENERAL

FOR

AND FINANCAL AFFAIRS

-i- \b r,

E7

Fl

t:Z

ztt r\

,*

*'

*

*

*

*

*

**

PRICE

AND

COST

COMPETITIVEF{ESS

Zndquarter

1994

PART

{:

QUARTERLY REPORT

PART

2:

TABLES AND

CHARTS

-C

ON{PETITIVENESS

A1\{

ONGST

I

NDUSTRIALISED

C

OLINTRI

ES

QUARTERLY

REPORT

-

SECOND

QUARTER

1994

This report provides

a

periodic

assessnrent

of

the

macroeconomic conlpetitiveness

of

the

EU

and

20

industrialised economies

on

the

basis

of

a

number

of

cost and price

indicators.

It

appears

quarterly.

It

consists

of

two

parts.

Pa,rv

/

offers an

analysis

of

recent developments.

The

discussion

is

illustrated

by a

small

number

of

tables

and

graphs.

part

2

provides more detailed

information.

For

eaclt

country,

changes

in

nominal and

real

effective

exchange rates

are

presented

in

the form

of

tables

and

graphs.

The

nominat effective

exchange

rate

(NEER)

ainis

to

track

changes

in

the

uutu.

of

a

nation's currency

relative

to

the

currencies

of

its

principal

trading partners.

It

is

calculated

as

a

weighted

average

of

the bilateral

exchange rates

u'ith

those currencies.

The

real

effective

exchange

rate (REER)

aims

to

assess

a nation's

competitiveness

relative

to its

principal

conrpetitors

in

international

markets.

It

corresponds

to

the

NEER

deflated

by

selected

relative

(or

'effective')

cost

or

price deflators. Part

?

of

the

report

presents

real

rates based

on the GDP

deflator,

the

deflator

of

export

prices,

the

deflator

of

producer

prices

in

manufacturing,

unit

labour

costs

(ULO

in

manufacturing as

well

as

unit

labour

costs

in

the econonty

as

a

whole.t

The

discussion

in

Part

1 focuses

on

rates based

on

the

latter

two

deflators.

1987, the year

of

the

Louvre

Accord

and

the last realignment

of

the

1980s,

is

taken

as

the

base

period

for

the

various indices calculated.

This

does

not

imply"

that

1987

exchange rates should be treated

as

equilibrium

rates.

part

I

of

the

report

starts

with

suntmary

of

nrain developntents

since

1987.

It

consists

of

two

sections.

The

y'ru

t

sccriotz

presents

exchange

rate

developrnettts

of

the

US

dollar,

the

Japanese

yen

and

a

basket

of

EU

currencies

relative

to

twenty

industrialised

nations.

In

this

first

section

the bilateral position

of

the

European

Union

relative

to

the

United

States, Japan

and the

EFTA

countries

is

also

examined.

The second sectiol? con'tments

on

exchange rate deveioplnents among

tlte cottntries

of

the

Union.

A technical annex providcs furthcr details.

PART

1

COMPETITIVENIESS

AMONT

G

S

T

II\IDIJ

S

TRIAL

TZED

COIJNTRTES

QUARTERLY

REPORT

2tto

QUARTen

1994

EVOLUTION

OF

THE MACROECONOIWC COMPETITIVENESS

OF

THE

EUROPEAN

UNION

MAIN

CONCLUSIONS

In

the second

quarter of

1994:

The nominal effective

exchange

rate

of

the

US dollar

declined

r.is-a-vis

European currencies

for

thefirst

time

since

the

second

quarter

of

last !'ear.

ln earlv Ma],

and late

June,

the

Fed

and other

central

banks even

intervened rn support

of

the

dollar,

butthe dollarcontinued its

dechne

inthe

firsthalf

oJull'.

The

3o/o

effective appreciation

of

European currencies

led

to

an

equii,alent

loss

in

the

European Union's cost

competitivcness.

.

European currencies continued

their

decline relative

to

the

Japanese

yen,

albeit

at a slou' quarterll'

rate

of

l%.

As

a

result, the cost competitiveness

of

the European

manufacturing industrv

relative to

its

Japanesecompetitors rmproved

bf'ttte

sameamount.

.

EU unit labour

costs,

u,hich

had

been

nslng

since the

third quarter

of

1990- stabilised

relative to

those

in the United

States, Japan

and the other industrial nations. The

recent moderation

in

\4'agedemands and

inflationary

pressures

in the

Union

appears

to

have made an

important

contribution.

Since

the

first

EMS crisis

(since

the

third

quarter of

1992):

.

The European Union

has

w-itnesseda significant

imprgvement

in its

cost competitiveness relative

to

the US

(b), lZ%)

and particularll',

Japan

(b)'

29%). These gains have been caused b1'

the

depreciation

of

the Europ€an currencies relative

to

the

US dollar

and the

Japanese

ven.

Iacreases

in

EU

ielative unit

labour

costs have had

anegativc,

but relativeh'smaller

effcct.

.

The

Union's

cost

competitivsness relative

to

the

Alpine

countries rmproved because

of

the

appreciation

of

the Ssiss Franc

and

Austrian

Schilling

The

cost performance

of

Su'rtzerland

and

Austria

has becn

very similar to that of

the Union.

The Union's

cost competitiveness

relative to

the

Nordic

countnes, hou'ever,

has

deteriorated

because

of

the

depreciatron

of

the

Nordic

currencies

and

reductions

in

relative

unit

labour

costs achieved

in

Furland

and,

to

a

lesserdegree.

Sweden..

The currencies

of

the counlnes

that

devalued

or

depreciated

against the

DM

follou'rng

the crises in

the European

Monetary

System,

have improved

their

cost competitiveness

relative to their parhers

rnthe

European

Union. In all ofthesecountries (uiththeexception of

Porhrgal), relative

umt

labour

costs have declined, assisting

the

r\ecessary

adjustments.

In

Portugai too, the rate

of

increase in

relative

unit

labour costs has

slorved

dou,n

sigmficantlv since

the

tlurd

quarter

of

1992.

Thc

currenc)'depreciations that occurred

behvesn September 1992

and

August

1993 appear

to

have

contributed

to

the

correction

of

previous misaligtments.

Over

a

longer perspective

(since

the

first

quarter of

1987):

.

The relative cost perforrruu"l€

of the

Union's non-mrmufacturing sectors has

been

much better

than

that

of

manufactunng industry'.

As

a

consequence

the

cost

mmpfiitiveness

of

Europe's

manufacturing industry

has detenorated

by

2%%. wtrile the competitive position

of

the

Union's

emnom)'as

a

u'hole

has

improved bv

4t/zo/o..

Amongst

the larger Union

members, France

and

ltall'

have

improved their competitive position in

manufactu.iog

b)'

7o/oand

l5%.

respectivelt'-

uhile

Geimanl' and Spain have

recorded

losses

of

14%and

5%%. The United Kingdom's competitive performance has rmproved

b1 1%

Amongst

the

I

COMPETITIVENESS AMONGST INDUSTRIALISED

COUNTRTES

QUARTERLY

REPORT

-

SECOND

QUARTER

1ee4

I.

TNTERNATIOI\{AL

DEVELOPMENTS

1.

Uailsd_Slalst

In

the second

quarter of

1994,

the

nominal

effective

exchange

rate

of

the

US

dollar

declined by a

tittle

over

2o/" (see

Table

1)t.

Most

public

attention has focused

on

the

value

of

the dollar

re,lative

to

the

Japanese

yen and

the

Deutschmark, and much less on

the value

of

the

dollar

relative

to

othen currencies such

as

the Canadian

dollar

(Canada

is

an

important trading partner

cf

the US). While the US

dollar

weakened

in the

second

quarter relative

to

the

DM

(by 3%%)

and

the

yen

$y

a%),

it

strengthened relative

to

the

Canadian

dollar (by 3%).

The2o/o

reduction in

the nominal effective exchange rate

of

the

US dollar reflects

dl

of these

developments.

'

l

The weakness

of

the

US dollar

relative

to

the

Japanese

yen and

the

German

mark

has

been caused

by

a number

of

factors,

including the

depressed

US

bond markets, the

US-Japan

trade dispute

and

the stronger than expected recovery in Europe and

Japan.

The

dollar

had

been

on

an

upward trend

since the

first

EMS

crisis in

the

third

quarter

of

1992. This upward trend was

first intemrpted

in the second quarter

of

last year, when the

dollar

depreciate{

by

3%o.

The dollar

recovered

quickly

however, rising

by

more

than

3Yr% in the second half

of

last year. The decline

of the

dollar this year

appears

to

be

of

a

longer duration.

Still,

it

is important

not

to

exaggerate

the

implications

of

the

current

dollar

weakness.

In

the

second

quarter

of

1994,

both the

nominal and

reaP effective

exchange rate

of

the

US

currency

were

still

slightly

above the rates observed

during

the

same

period

of

the year before.

The ZYonominal depreciation

of

the dollar

in

the

second quarter

of

1994led

to

a

ZVzo/oimprovement

in

the

cost competitiveness

of

the US manufacturing

industry

and

a

l%o/o

improvement

in

the

cost competitiveness

of the

US economy

as

a

whole.

The

profitability of

American exports,

however, did not improve

during

the

second quarter

of

this

year'.

a

Vzo/oincrease

in

relative

export

prices was offset

by

an

equivalent rise in

relative

unit

labour

costs3.

The exchmge rates considered are averages of daily exchange rates.

Uriless othenrise stated, relative unit labour costs in marfufacturing are used as deflator.

The

relatire

e4porl pnofitabilit-vof m

economy

is

defineda

theratio

of

relative exportprice

indices andrelatiye urut labour costs

in

the economl'as a r*'hole (expressedin

national currencies).It

is an indicatorof

t

rABLE 1: MAGffOECOIJOM|C COMPmnVENESS OF Tl{E UMTED STATES,

Jnpen

ANp THE EUROPEAN UMON'

RH.ANVE TO TWENTY INTXJSTRTAL COUNTRIESA

B/OLUTION IN MAT.TUFACruRNG INDUSAY B. ElrOLtmON lN WttOLE ECOi'IOMY%

Chanqe

Iluring

seond

quarter 199,'f {94 Arl / 9{ A1)LtsA

Japan

Eat12tSA

Japanzu12

I.IEER (11

uLc

{2}REm

Fl

a.2

2.8

1.44.4

0.3

{.0

-2.5

3.1

1.4-2.2

2.8

1.40.5 {.3

4.2

-1.7 2.5

1.2%

Chanoe

Since the first EMS

criis

{91U

/ gA 03}tsA

Japan

At

n

ttSA

Japanzu12

NEER (1)

ulc

(2)REm

0)

8.5 g2.5

-r's.+4_1

0.1

4.54.1 T2.7

-11.68.s

32.50.6

-1.49.1

30 6-15.4 0.6 -14.9

%

Chanoe

Since the Louwe Agreement

pa

a2 / 87 Qfl

rrsA

Japan

EIJ 12t

sA

Japq!

€u

!?

NEER (1)

uLc

{2} REER (3)€.7

€.9

-17.8

47.2 -9.5 33.2

€.8

10.3 2.7

-9.7

3.6

€.5

47.2

-14 6

8.7

6.8

2.3

4.7

Source : DG ll.D.4 EC

(1)

NEER = l.lominalEftctire

Excharge Rate. A mirurs means a depreciation of the NEER.(2)

ULC

= Relatirre Unit Labour Costs (in national cunency).(3) REER = Real Efuc'tire Exchange Rate = relatir,e unit labour costs (in common cunency)

A minus means an improrement in cost competitiwness.

Since

the

first

EMS

crisis

in

the

third

quarter

of

1992,

the

nominal

effective

exchange rate

of

the

US dollar

has risen

by

8%%.

The

dollar

appreciation has caused

a4o/o

detenoration

in the cost

competitiveness

of

the

US

manufacturing sector

md

a

9o/odeterioration

in the

cost

competitiveness

of

the

US

economy

as

a

whole

The

cost

perfbrmance

of

the US'manufacturing industry

has

traditionally

been better than

that

of

the LIS economy

as

a

whole.

The

long-term

trend

has been

for

the

US

to

notch

up

significant gains

in

cost

competitiveness

through

reductions in manufacturing

unit

labour costs

and

a depreciating

doltar. Since

the Louvre

Agreement

of

19E7,

US

unit

labour

msts

in

manufacturing

have decreased

by

9o/a

relative

to

those

in

other industrial

countries and

the dollar

has

depreciated by

almost

10oA.

Both

factors have contributed

to the

1E7o

improvement in

the

cost competitiveness

of the

US

manufacturing industry

since

the

first

quarter

of

1987.

Crraph

1illustrates

that

most

of

these gains were made in the period befween the

first

quarter

of

lg87 (Louwe

agreement) and the

third

quarter

of

1992 (the

fust

crisis in

I

30

20

0

-10

-20

-30

GRAPH

1DEVELOPMENT OF COST

COMPETIIVENESS

(1)

RELATIVE TO INDUSTRIAL PARTNERS

SINCE THE LOUVRE ACCORD

10

re2Q3/87O1

(2)

Ee4Q1/e2O3

(2)

E3e4Q2/e4O1

(2)

United States

Japan

European Union

(1) Cost competitiveness as measured bythe nominal efiec{ive

ercfange rde deftated by unit bbot, co6ts in MANUFACTURING. Aminus means an improrrernentin cosl competitiveness. (2) Expressed as the natural lognnlhm of the ralio (n %)

2.

Japan

In

the

second

quafter

of

lgg4,

the

nominal

effectiie

appreciation

of

the

yen

accelerated to

37o

from

lo/o

in

the

first euarterr

The appreciation

of

the

Japanese

yen

relative

to

the

US

dollar was much

stronger

than

its

appreciation

relative

to

the

European currencies4. The 3Yo appreciation

of

the yen led

to

an equivalent decline

in

the

cost competitiveness

of

the

Japanese

manufacturing sector, because

relative

unit

labour

costs remained constant

These

latest

developments appear

to

be

a

continuation

of

a

trend that

became

firrnly

established

in

the

early

1990s.

Table

I

illustrates

that

since

the

third

quarter

of

1992

relative

unit

labour

costs

in

manufaauring

have

hardly

budged.

This

implies

that

the

nominal effective exchange

rate

of

the

yen has become

the

sole determinant

of the

cost

competitiveness

of

Japanese

manufacturing

industry

(see

Cnaph

2).

As the

yen

has

appreciated

by

32%yo

in

nominal

terms,

cost competitiveness has

deteriorated

by

the

same percentage.

a

The 1?$ rate declined from an averageof

107.54in

thefirst

quarterof

1994to

103.22 )'en perdollar

in

thesecond quart€r

of

1994. More recently, the yen has strengfhenedto

97.37 +lS (12.7.1994). The ven appreciatedonl.v

slightl)'relative to

theDeutsctrnark

theli(DM

rate declinedfrom

62.43in

thefirst qrurter

of

1993 to 62.18 yJn per Deutschmark in the second quarterof

1994. More recentl-v-, the ven has lost some etround relativeJapanese

manufactufers

tppear

no longer

capable

of adjusting to

the

rising

value

of

the yen

by reducing

unit labour

costs (as they

did

so successfully

in

the second

half

of

the

1980s

when the yen appreciated

by

more

than

5A%

between 1985 and

1988)

The

rate

of

technologrcal progress and

the flexibility

of

the

Japanese

labour market

system

seem

to

have reached

their limits.

Consequently,

profit

margins have

been

squeezed

significantly. Caused by

an

llo/o

reduction in

relative

export

prices (expressed

in

nationat

currency),

the export

profitability of

the

Japanese

economy has declined

by almost

10o/osince the

third

quarter

of

1992.

An

alternative response

to

the current yen crisis could

be

a

reduction in the costs

of

non-labour inputs

into

the production

process.

Most

Japanese losses

in

cost

competitiveness have

occurred

only

recently,

i.e. in

the

period

after the

first

crisis

in

the

EMS

(see

Graph

l).

In

the

period

before,

the

1l%

rise

as a

whole

is examined.

This

analvsis

the

Member States.

Intra-Union

in the value

of

the yen was largely offset by

a

reduction in

unit

labour

costs.

I

3.

European

Union:

In this

section,

the

cost competitiveness

of

the EU

may

obscure diverging

developmentb

among

developments are presented

in

Sestion

II.

The compefirtve

position of

the

European

Union

relative to other

industrial

countries

In

the

second

quarter

of

1994,

the competitive position

of

the

European Union

deteriorated

by

lyzYo,

mainly due

to

the nominal appreciation

of

its

currencies

relative

to

the

US

dollar

(see

Table 1). The

Union's

real

ef;Fective

exchange rate

based

on unit

labour

costs

in the

manufacturing sector rose

for

the

first

time

since

the

third

quarter

of

1992 (see

Graph

2).

In

a more

positive

development,

relative

unit

labour

costs

stabilised. They had

been

rising

since

the third

quarter

of

1990.

The

recent

moderation

in

wage

demands

and

inflationary

pressures

in

the Union

appears

to

have

made

an

important contribution.

The nominal and real depreciation

of

the European

curencies, which

came

to

an end in

the

second

quarter

of

1994,

had

commenced

u'ith

the

first EMS

crisis

in

September

lgg2.

Since

the

third

quafter

of

1992,

the

EU

manufacturing

industry

has

recorded

a

IT/2aA gain

in

cost competitiveness,

in

spite

of

a

4Yzatorise

in

relative

unit

labour

costs,

Thus,

the

recent improvements

in

the

competitive position

of

the EU

should

completely

be

sttributed

to

a

nominal depreciation of

European currencies.

t

If

we

consider

developments

in

the

economy as

a

whole,

the picture

looks

even

brighter

thanks

to a better

cost pedormanc€

of

the Union.

The

rise

in

relative unit

laboun costs since the

Louwe

Agreement

is limited

to

2YzYoas

opposed

to

l0Y2%

in

the

manufacturing sector.

This

has

contributed

to

a

4y2%

improvement

in the

Union's

cost

competitiveness

and

a

sYr%

rise

in its

export

profitability.

The

implication

is

that

European economy as

a whole

is

more competitive nou'

than

it

was

at the

time

of

the

Louvre Agreement.

The competitive

position of

the

European Union

relative to

the

Ilrttud

Stales and Japan

In

the

second

quarter

of

1994,

th"

European

cirrrencies

(and

the

German

Marks)

appreciated

relative

to

the US dollar

for

the

first

time

since

the

second

quarter

of

last

year.

In

early

May

and late June,

the

Fed and

other

major central banks even intervened

in

support

of

the

dollar. The Union's

currencies continued

to

depreciate

relative

to

the

Japanese

yen, albeit

at a slower

pace

than

in

the

first

quarter. The 3o/o

depreci+tion

of

the dollar and lo/o rppreciation

of

the yen

were

reflected

in

equivalent

changes in

European cost cornpetitiveness,

as

EU unit

labour costs stabilised relative

to

those

in

the

United

States

and

Japan (see

Table 2).

Since

the

third

quarter

of

1992,

the European Union

has

witnessed

a

significant

improvement

in

its

cost

competitiveness

relative

to

the

US

(by

tzoh)

and

particularly,

Japan

(by

29"/").

These gains have been

caused

by the depreciation

of

the

European

currencies

relative

to

the

US dollar (by

17Vr%)

and

the

Japanese

yen

(by

3lYzo/o).Increases

in

EU

unit

labour

costs

relative

to

the US (6tA%)

and Japan (3t/r%)

contiriued

to

have

a

negative effect on

the competitive

position

of

the

Union

and,

from

a

longer-tenn perspective, could pose serious problems.

Since

the finst

quarter

of

1987,

EU

unit

labour

costs

in

rnanufacturing have

risen

by

ll|zYo

relative

to

those

in

the

United

States.

This

has

led

to

a

l7%o/o

deterioration in

the

Union's competitive

position relative

to the

US

(see

Graph

3).

Relative

unit

labour costs in the economy as

a

whole

have hardly changed,

limiting

losses

in

European

cost

competitiveness

to

2o/o.

EU unit

labour

costs

relative

to

Japan have

risen

in

both the manufacturing sector

(by l9%)

and the economy as a

whole

(by

17%).

Nevertheless,

the

European

Union

has benefited

from

a large improvement

in its

cost

cornpetitiveness relative

to

Japa4

as

the European currencies have depreciated

by

no

less

than

3lr/206

relative

to

the

Japanese

yen (see Table 2).

s

The DIW$ rate decreased from an av€rageof

1.722 in tbe first qr:arterof

1994 to I .660 Deutschmark per dollara

TAALE 2 : MACRC}EGOIiIC}MIC COMPET1TIVEilESS OF TTE zuROPEAN T,T.IION

ffi-ATIVE

TO THE UNITED STATES AT{D JAPAT.IA

EI/OLUTION lN MAI,JUFACTURNG INDI STRY B, N'OLUTION IN WIIOLE ECOT{OMY%

Chanqe

tsA

JapanDuring

scond

eurrter

lggf

{9{ 02 / 94Al)

USA

&pan

NEER (1)

uLc

(21 REER (3)3.2

0.3

3.5

-0.9

-0.2

-1.1

3.2

-0.9

-0,5

0.12.7

-0.9

oA

Chanoe

tsA

Since the

fird

EMS cridsp4

A2 / 92 a3)Japan

tSA

JapanIrEER (1)

ttrc

t2)REm

F)

-17.4

-31.6

t6.4

3.5

-12.1

-2p.2

-17.4

-31.6

0.1

1.7

-17.3

-30.5

%

Cfianoe

Since the Louwe Agreement

(g

A2 / 87all

Jaoan

LISA

JapanusA

NEER (11

uLc

(2)REER (31

2.O

-31.3

15.4

18.9

17.6

-18.3

2.0

0.1 2.1

-31.3

17.4

-

19.6

Source : DG ll.D.4 EC

(1) NEER = I'lominal Efiecti\€ Excfnrge Rate. A minus means a depreciation of the NEER.

(2)

ULC

= Relatir,e Unit Labour Costs (in national cunency),(3) REER = Real Eftclir,e Exchange Rate = relatir,e unit labour costs (in comrnon cunency)

A minus means an improlement in cost competitilerpss.

The

compditive

position of

the

European

Union

relative

to

the

EFTA

countries

ln

the

second

quarter

of

1994,

the

changes

in

European

Union relative to

the

EFTA

countries

3).

Unit

labour

costs

in the Union

continued

to

rise

(by

l%)

the cost

competitiveness

of

the

were

relatively

minor

(see Table

more

rapidly than

those

in

Finland

In

the finst

quarter

of

1994,

the

Swiss

franc

(21/zo/o),the

Swedish

krona

(4oh) and the

Finnish markka (4Yr%) experienced a

more

significant nominal

appreciatioq contributing

to

an

improvement

of

aroun

d

3% in the

competitive

position

of

the

EU

relative

to

these

countries.

Since

the

third

quarter

of

lggzrthe EU

currencies have depreciated

relative

to

the

Swiss

franc (lOVr%) and

the Austrian

schilling (sYr%).

Consequently,

the

competitive

position

of

the

EU

relative

to

Switzerland

and

Austria

has

improved

by

lfh

and

5o/o,fne

elsuing

losses

in

EU

comp€titiveness

were

especially

notable

in

relation

to

Sweden

(31%)

and Finland

(26%),

as

these countries

not

only

devalued

their

currencies

but

also

achieved

major reductions

in

unit

labour costs

in

manufacturing

relative

to

the

EU.

In

Finland,

the

social partners have agreed

for

three

years

in

a

row

not

to

raise nominal

wage

levels.

Looking

back

further

in

time, the Union's competitive

performance

in

comparison

with

Finland

is

even

worse

(a

decline

of

55oh

since

the

first

quarter

of

1987),

but

losses

relative

to

Sweden are

limited

to

15oh.

The cost competitiveness

of

the

Union

relative

to

Switeerland improves

by

15Yz%,

but

deteriorates

by

51/zoArelative

to

Austria

(see Graph

4).

a

TAALE 3 :MSROECOI,|OMIC COMPETTTIVENESS OF THE EUROPEAI UNION

RELATI\E TO EFTA CO UN TRIES

\

E\OLUTION IN MAIIUFACTURING INDUSTRY B. E\DLUTION IN \TIJI-IOLE ECONOMY%

Chame

During second quarter

1994 (9402

/ 9401)

Auslria

Finland

filorwev SwedenSwitzerland

AusfriaFinland

l{orway Sweden SwitzerlandNEER (1)

ulc

(21REER (3)

-0.2 0.3 -0.3 0.6

0.2-0.2 1.1 -0.4 0.1

-0.6-0

3

1.4 -0.7 0.6

-0.4-0.2 0.3 -0.3 0.6

0.2-4.2 0.3 0.3 -0.0

-0.1-0.4 0.6 -0.0 0.6

0

1% Chanoe

Since

the

f,rst

EMScrisis

{94

02,

92 A3}Austria

Finland

Norwav SwedenSwiEerland

Ausiria Finland ibrwav

Sweden SwiEerlandI{EER (1)

rrLc (2) REER {3)

-5.5 8.9 3.7

21.5

-10.30

5 15.9

-14

7.8

-1.0-5.1 26.2 2.2

31.0.

-11.2-5.5

89

3.7

21.5

-10 3-3.0 25

2.7 16

06

-8.4 11.6 6.4 23.5

-9.8o/o

Chanoe

Since

the Louvre

Agreenert (94 02

/

8701)

Austria

Finland

Norwav SwedenSwitzerland

Aus*riaFinland

t{orway Sweden SwitrerlandNEER {1)

uLc {a

REER F)

-7.3 72.6 5.6 23.4

-6.913,6 26.5 -3.4 -6.7

-9.25.3

550

2.A

15.2

-15.4-7.3 n.6

5.6 23.4

-6.91.5

-28

9.9

-121

-3.6-6.0 19.1 16.1

85

-10.2Source.DGi; D4EC

(1) NEER = Mmrnai Efectire Exct-ange Rate. A minus rreans a depeciation of 1fe NEER

(2)

ULC

= Relairw Unrt Labour Costs (in rnlronalcunerrcy).-(3) REER = Reai Effectrre ExcfarBe Rate = relatire untt labour coots (in common cunerny)

t

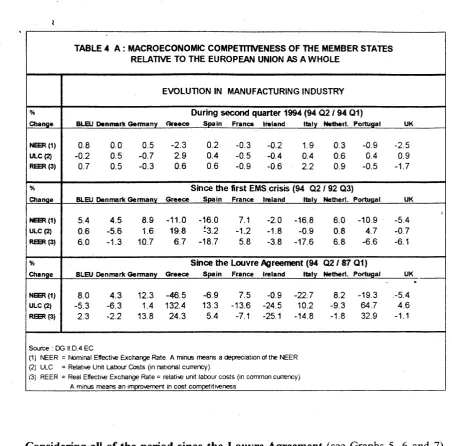

Ir.

INTRA-UNION DEVELOPMENTS

In

the

second

quarter

of

1994,

no major shifts

in

intra-European

competitiveness

occurred

(see

Tables

44.

and

48)

The

most

interesting

development

was

the

first

significant appreciation

of

the

ltalian lire

since

the

third

quarter

of

1992, that

rvas

linked

with

the

coming

into office

of

a

conservative alliance. The

2o/onominal

appreciation

of

the

lire

led

to

an equivalent loss

in

the cost

competitiveness

of

the Italian

manufacturing

industry.

More

recently,

the

lire

has

weakened

again, reflecting

the

uncertainties

surrounding the economic policies

of

the

new

government. The

British

pound,

that

had

appreciated since

the

first

quarter

of

1993, depreciated

by

zYr%

in

norninal and

by

lt/z

real terms. The pound

has been

under pressure in

part

because

of the weakness

of

the US

dollar

relative

to

the

German

mark. The

2%o/o

depreciation

of

the

Greek drachma

was

again

insufficient

to

compensate

the

3Yo

nse

in unit

labour

costs,

which

led

to

a

t/zo/odeterioration

in the

Greek

competitiveness.

The

1%

depreciation

of

the

Portuguese

escudo had more positive effects, contributing

to a

small

improvement

in

the

competitiveness

of

the Portuguese economy

(/z%)

Most

other currencies were relatively

stable. Relative

unit

labour

costs

in

manufacturing declined

in

Germany,

France,

Ireland

and

the

BLEU,

but

increased

in the remaining

Union

member

states.

.Since

the September

lggl

ERM

crisis,

fwo

groups

of

countries can be distinguished.

The

lirst

group

comprises

the countries that were forced

to

devalue

(or

let

float)

their

currency against

the

DM,

hence

improving their

cost

competitiveness against

their EU

partners:

Spain

(181/r%),

Italy

(17%%), Portuga.l

(61/r%),

the

United Kingdom

(:6%)

and

lreland

$%)

In

all of

these

countries

(with

the exception

of

Portugal)

relative unit

labour costs have declined, aiding

the

necessary

adjustments. The currency depreciations

which

occurred between September 1992 and

August

1993 appear

to

have contributed

to

the correction

of

previous misalignments.

The

second

group

includes

the

core

ERM

countries,

which kept their

central

parities

unchanged, recording

significant

losses

in

cost

competitiveness.

Germany

(101/zo/o),

the

Netherlands

(7o/o),

the

BLEU

(6'A)., and

France

(6a/o).

Denmark

stands

out,

because

it

has

managed

to

offset

the

nominal effective

appreciation

of

its

currency

by

a

corresponding

improvanent

in its

relative

cost

perfiormance.

Of

the

other countries

in

this

second

group

only

France has

recorded

a drop

in unit

labour

costs

relative

to

the

Union

as

a

whole.

The competitive position

of

Greece,

which

never entered the

ERM,

has

also deteriorated

(by

6Yzo/o).in

spite

of

the

continuing depreciation

of

the

drachma. Relative

unit

labour

costs have risen

by

20Yo,

well

above

the

rates

of

increase

recorded

by

other

member

I

TABLE

4

A

: MACROECONOMIC COMPETTIh ENESS OFTllE

MEMBER STATES RELATIVE TO THE EUROPEAII UNION AS A WHOLEEVOLUTION

N

TilANUFACTURING INDUSTRY%

Ctranoe

During

secondquarter

f994 (94Q2194

Q1)BLEJ llcnnark Germanv

fleece

Smin France lipland

ltalv

lletherl.Portisal

UK NEER (11uLc e)

REER (3'

0.8 -0.2 0.7

0.0 0.5

-2.30.5 -0.7

2.90.5 -0.3

0.60.2 -0.3

-0.20.4

-05

-0.40.6 -0.9

-0.61.9

0.4 2.2

0.3 -0.9

-2.50.6 0.4

0.90.9 -0.5

-1.7%

Ctranoe

Slnce

the

first

EMS,crisb(94

02 /

92 A3)BLBJ llenmarlt Gcrmany

Grccce Spain Frane lrcland

ltalv

llethed.Porfusal

Ul( I.EER {1}uLc (2) REER (31

5.4 4.5 8.9

-11.0

-16.00.6 -5.6 1.6 19.8

!S.Z6.0 -1.3 10.7 6.7

-18.77.1

-1.2 5.8

-5.4

-o.7

-6.1 6.0

0.8 6.8 2.0

1.8

3.8

-10 9

4.7 -6.6 -16.8

-0.9 -17.6

% Chanoe

Since

the

LouvreAgreenent

(94

02 /

87Oll

BLRf Denrmrk Glermany

Greece Spain

France

keland

ltaly

ilefterl.

Port4al

UX?{EER {1)

ulc

(2) REER t3)-46.5

132.4

24.3

-5.4 4.6 -1.1 -6:9

13.3

5.4

8.0 4.3

12.3-5.3 -6.3

1.42.3 -2.2

13.87.5

-0.9

-n.7

8.2

-19.3-13.6

-24.5 1A.2 -9.3

U.7

-7.1

-25.1

-14.8 -1.8

32.9Source : DG ll.D.4 EC

(1) t\iEER = l.Jominal Efiectiw Excfnrge Rate. A rrfnus rneans a depreciation cf ttE NEER

(2)

ULC

= Relatire Unrt Labour Costs {in nattonal cunerrcy)(3) REER = Real Effectile Excharge Rate = relatie unrt labour costs (in commofl cunerrcy) A minm means an irnororernent in cost comoetittvetress

Conside.ing

all of

the

period

since

the

Louvre

Agreement

(see Graphs

5,

6

and 7),

only

two

countries

-

4mong those having adjusted

their

exchange rate since September

1992

-

have significantly strengthened

their

competitive position

in

the

Union:

Italy

(by

l5o/o)

and

lreland

(by

25%'1,

The United Kingdom's

competitive perfbrmance

has

improved

by

a

meagre 1%.

Spain

and

Portugal

have recorded losses

of

St/zo/oand 33o

,respectively.

The poor

perfbrmance

of

Porfugal

should be

attributed

to

a rise

in

relative

unit

labour

costs

of

almost

65oh,.

second

only

to

Crreece

(where

unit

labour costs

have

risen

by

no.less

than

132%).

However, the

rate

of

increase

in

Portuguese

unit

labour

costs has slowed

down

significantly

since

the

third

quarter

of

1992.

Greece

witnessed

the greatest loss

in cost

competitiveness

of

all

EU

member states

(241/zo/o),

which

offers

at

least

a partial

explanation

of

the recent speculative pressures on

its culrency.

Amongst

the

larger

Union

members,

France

has managed

to

improve

its

competitive position

by

7o/o,

wfule

Gerrrany

recorded

a

14% loss

in

competitiveness.

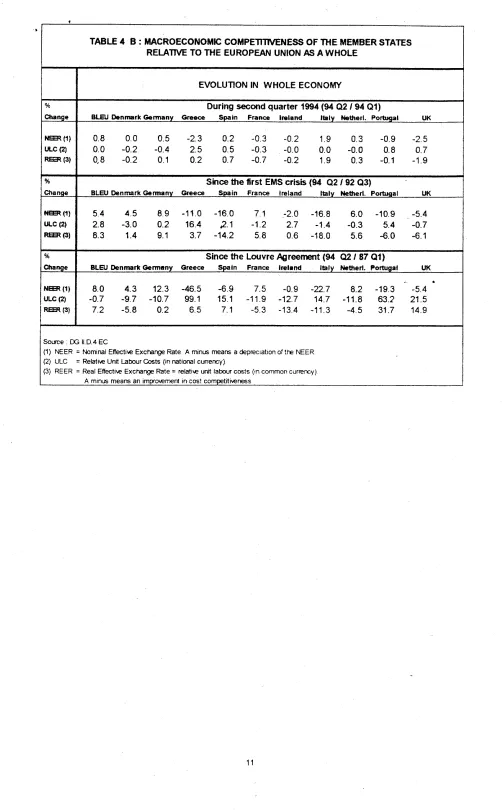

[image:13.593.53.506.21.467.2]TABLE

4

B :

MACROECONOMilC GOMPETTTTyENESS OF THE MEMBER STATES REI.ATIVE TO THE EUROPEAN UNION AS A WHOLEEVOLUTION

lN

WHOLE ECONOITTYYo

Chanoe

During

s€condquarter

1994 (9402 /

94Oi)

BLEIJ llenmark Germany

Greece

Spa.in

Francr Inlsnd

ttaly

lStherl.Porbrqal

UK NSER (1)rJLc f2) REER (31

0.8 0.0

0.50.0 -0.2

-0.40,8 -0.2

0.1-2.3 2.5 0.2

0.2 -0.3

-0.20.5 -0.3

-0.04.7 -a.7

-0.21.9 0.3 -0.9

-2.50.0 -0.0 0.8

a.71.9 0.3 -0.1

-1.9% Chanoa

Stoice

the

first

EMScrisb (94

A2/

9203)

BI-EIJ Denrmrk Germsny

Gireece

Spain

France

lreland

ltalv

llettrerl.Portuqal

UK I|EER {1}ulc{a

RER (3)5.4

4.52.8

-3.08.3

1.48

9

-11.0

-16.00.2 16.4

2.t

9.1 3.7

-14.27.1 :2.0

-16.8-1.2 2.7

-1.45.8 0.6

-18.06.0 -10.9

-5.4-0.3 5.4

-O.75.6 €.0

-6.1C|rance

Since

the

LouvreAgreerurt (94

02,

87Ot)

BLEU

llenmrl

GermanvGreece Spain

France

lrelend

ltafv

l{atherl.Portuoal

UK NEER {r}uLc (4

REER (3)

-22.7 8.2 -19.3

-5.414.7

-11.8 63.2

21.5-11.3 -4.5 31.7

14.98.0 4.3

12.3

-46.5-0.7 -9.7

-10.7

99.'l7.2 -5.8 0.2

6.5-6.9 7.s

-0.915.1 -11.9

-12.77

.1

-5.3

-13 4Source : DG ll.D.4 EC

(1) NEER =fJominal EfrectieExcharpeRate AminusmearsadeprecratronoftfBl€ER (2)

ULC

= Relatne Unit Labour Costs (in rutional cunercy)(3) REER = Real Efiectiw Excharge Rate = relatiw unit labour cmts {rn common currercy) A minus mear6 an impro\€rnent in cost competrti\eness

[image:14.593.37.539.21.831.2]lllDl]'lAr{ - r

9s4t07i07

GRAPTI

2

NONIINAI, AND REAL

EFFECTTVE EXC]I.IANGE

RATT,S

\/IS.A-\/IS

IC2O

NOl/INAL

IFFTCTIVE

IXCI-IANGI

RATESVIS A

VIS

ICzO.

1987

Ql

( PERI OD

=

100

AVIRAGE }

150

1{0

130 120

110

100 9C

80

UNII

LABOUR

COSTS

IN

|t,|ANUFACTURINGINMJSIRY

ViS A

VIS

ICzO,

1987

Ql

=

1OO150

t40 t30 t20 t10

100 00 BO

1.40

ll0

120

t10

100 so

BO

70

-r-.-r-l--

'1993

1S!.1UNiT

LABOUR

COSTS

IN

TOTAL

ECOI{OMYvIS

A VIS

1C20, 1987

Q1

=

100

110

110 120 110 100 90

80

tal

t40

lJo

12

t10 t00

90

BO

70

VIS A

VIS

ICzO,

IIlD

!4lAR

-

t994lA7

107GRAPH

3

NONllN,\L

AND REAL

EFPECTM

EXCFIANGE

RAT ES

YIS-A-VIS ECl2

NOftIINAL IFFECT

IVE

EXCIIAI'IGI

RATTSvIS

A

VIS

EC12.

1987

Ql =

10u

1s0

1{0

lJo

120

lt0

100

90 80

70

lu

:.

t50 t40

t_Jo

t20

t"10

100 90 80 70

::.:

:

:.

:19S3

1894UNII

LABOUR

MSTS IN

MANUFACTURING

INDTJSTRYVIS A VIS E012,

1987

Ql

=

100

1J0

120

110

100 90

80 70

t30 t20

110 100 EO 60 70 tB87 1988 lgSs lggo 1993 1994

UNIT

LABO{JR

COSTS

IN

IOTAL

VIS A

VIS

ECT?, 1987

Q1tC0f\0['lY

=

100

1J0

120 110

100

90

80

70

tJo t20

t_10

t00

90 EO 70

t993

IrtDl4lAR

-

19e4rc7n7

GRAPH

4

N0NIINAI- AND

REAL

EFFECTI\/[,

EXCHANGE,

RATE,S

VIS-A-\/IS

ECI2

100 90

UNIT

LABOUR

MSTS

IN

MANUFACTURING INU.JSIRY

VIS A

VIS

IC12,

1987

Ql

=

1Ot]t20

110

t00

9(}

EO 70

130 120

tt0

[00

90 80 70 60

lJo

t20 t10

100

so

BO

70

1JO

120

l-lro

l-100

t-eol.

80

t-

70t--

6Q'----.-...|--...-.-...-.-'-'...'''''''I'''''''''''''''

1SS3

19q.11JO 120

110 100 90 80

70

UNIT

LABOUR

C0STS

IN

IOTAL

tcOt\0fvlf

VIS A

VIS

ECL?,

1987 Q1

=

1OONOT/|IML

TFFECTIVE

EXCIIAI,IGE RATESil

tD l4l

AR

-

1994107lgt

GRAPH

5

NONTINAL EFFECTIVE E,XCTIANGE RATES

VIS.A-VIS

E,(]I2

f{OI.,|INAL EFFECI

IVT

EXO{AME

RATESVIS A VIS

EC12,

1987

Ql =

100

NCI-,{INAL

ViS

AIFFECT

IVE

EXO{ANGE

RATESVIS

EC12,

, 1987

Ql

=

100

i

---:

:

-\;

filDl4lAR -

1ee4

07i07

GRAPH

6

REAI-

EFFECTIVE

EXCIIANGE

RATES

\/IS-A.\/IS

E,CI2

UNIT

LABOUR

COSTS

IN

MANUFACTURING

INUJSIRY

VIS A

VIS

EC12.

1987

Ql

=

100

.--..-.i.:,:.:.'.'.,....'.'.--i..'...J-,,.:.:ffi.:,

lm

1993

1994UNIT

LABOUR

COSTS

IN

MANUTACTURING

INUJSIRY

VIS

A

VIS

8C72,

1987

Ql

=

100

..-.: .... .."-.. ..--'..'..-..i...'-..'...- -i . ..-...re.'..'.i.r,.i-*

{::"!

i\*l i

-i'1,-J

\!

:.,--i-f6l__---Ti

,-.-F'.

Y

:ii!!\-:

:

i

i

\-fffi'],

:

i

i

:

:

:\

|t,{0

t20

110

lrlDl4lhR -

1994fi7t07

GRAPH

7

RT,AI- EFFEC'TIVE EXCTIANGE RATES

VIS-A.VIS

ECI2

UNIT

LABOLJRCOSTS

IN

TOIAL

[CO|\OMYVIS A VIS

EC12

,

1987

Ql =

100

UNI

T

LABCXJR COSTSVIS A VIS

ECl

2 ,IN

I0TAL

tCOt\0MY1987 Q1

=

100

i... ...-.-'*.- -.--...i ..'..'.1 r...'.... "i "'....'.. "'..

i ,'

:

'[6^Dl:

t_40tlcl

!20 t10

PART

2

TABLES

ANID

CIfiRTS

doc. lltrg5n/|9+EN

PRICE

AND

COST

COMPETITI\,'EI\ESS: TABLES

AN]-D

CHARTS

Tables

and charts containing indices

of

COMPETITIVENESS derived

from

indices

of

NOMINAL

EFFECTME

EXCHANGE RATES

and

PRICE AND

COST PERFORMANCE

are attached hereafter

The

EC12,

the

ERM and

20

INDUSTRIAL COUNTRIES

are

presenled

in

the

following order.

Period coverage

Base period

:

1974-19%l'l0.z

:

1987

=

100

tlon-EC

Eurooe

(1)

EC12

(21

ERM

(4)

Denmark

(5)

Germany

(6)

Greece

$pain

France

lreland

Italy

Netherlands

Portugal

United Kingdom

(14)

Austria

( 1

5)

Finland

(16)

Nonruay(I7

)

Sweden

(18)

Switzerland

FJon-Eurooe

(19)

Aus;tralia

(20)

canada

(211

Japan

(22)

usA

(7)

(8)

(e)

(10)

(1

1)

(12',1

(13)

Each

country (or

country

bloc) is compared with

(other)

.

INDUSTRIAL

COUNTRTES

.

EUROPEAN COMMUNITY

COUNTRIES

.

ERM COUNTRIES

Nationai

price and cost indices (in national cunency and in USD) and bilateral

USD

exchange

rates

for

all countries are given

in

tables on the last 6 pages of

the

dossier.

A

brief technical

annex

is attached.

IND]

CA

TORS

VtS-A-VIS

OTHER

EC72

OF COMPET]T]VENESS

BASE

L}BT

:

1OO

INDUSTRiAL

COUNTRI

ES

( ICzO

)1f,o

720/

lto

too

BO

BO

70

15d!

7ZO

110

1(}0

go

80

70

t:/

7L

73 7+

75

INDI

CA

TORS

VTS-A-VTS

OTHER

92

72

\-'

\

\

76 T7 78

79

BO

81 82

85 84

€5 E6

87 88

Bs

90

ERM

OF COMPETITIVENESS

BASE

1gB7

lNDI/STRTAL

COUNTRI

ES

( ICzO

)t

91

9J

:

100

'-.7

130

tzcl

110

10c]

90

8C)

70

130

120

11tl

100

9t)

8Cr

7tl

7r\

A1

/l

72

ECIz

AS

COI{PARET'TITH

OTHER

IIIDUSTRIAL

COUT.ITRIES

(IC)

BASE

3

87

.**i-.-*--+

!

t

'"nlCE (Co:3T) CSlFEIIrtvlr€SS!

A€aL EFfECTIIE EXCrt**C[trTE

r: r PRIC€ (COST l PERFORf{AIICEr

.

(tfLATlv€ FFICE tCOSlt tl.lOEX tN A Ofi+l(''lC|nREHCYI

13

Oofiti,tL r

ttELArIvE pRtcE (cosrt trf,rEx lH NArto+talctnn€r|cy)

r+--.---t

IGIF.I'EFLAIO9 (,l{II LAAOUE -UNIT LAAOtn PRODT,CER DEFLATOR OF!3.

EXCt{ANGE. :GD?.DEFLATOR I,}IIT LABOIJFI''III

LAaouT PRoDt,,cEI DeFLAToR oF ttl'El8

:

CoSt lN IoT. cO3I lN ITaN PRICESOF

TOIAL €XPORTS;!RaTE

:.

COSI lN ToT. cOST lN t{AN pRtcEsOF

lotaL EIpORTS: ECOI-|OHY IHDUSTRY HAN( FACI. (G + 'S'

r

t 75 : 106.l

| 76 t 98.( r- 77: 100.5

| 73 : lO3.I . It r 112.7

It

t tO r 118.3

I Ol : 100-;

t t: : ?6.a

t tS : 90.7

r a{ r 83.7

tt

I t5 r 85.6

-r la r t3.O

t 17 r t00.0 r lt r 98.7

I It r !5.8 It

I t0 r t07.3 r fl r l0<.8 . ,2 r 109.2

r t3 : 100.(

It

r tt? r lO2.?

r tt3 r 98.3

I tt{ : 98.2

I fil r t6.5 r )42 r 9?.9

tt

lrt.5

to?.1

103 .0

105 .0

I 15.0

tl?.(

!0c.9 98 .3

9? .6

85.(

85. I

93.3 100.0 9?.8 !(.5 105.( t0t.5

106 .8 98.<

100 .2 95-3 96.0

,<.o

95. I

99.5

9l .0

9l .9 95.1

105 .2

rrt.5

95 .2 90. (

d5.4 80 .2 80.8 88 .5 100.0 9A.2 96.0 106.7

l0( .6

t 0e.0 102 .9

t0(.5 l0l.l t01.3

,9.4

100.8

103 .3

96.8 99.6 102. I 109.? I10.3 95.0 92.2 87.5 42.2 83.2 ,3 .2

lo0. o

r8 .5

t5.8

106 .2

t03.7

lg7 .< 98. I

tr.5

t6.o

t6. o

N.4 t6.0

93.5 90.4 91.?

t7 .<

l0?.( lo5. 7

93.? 9l .0

,8?.7 as.0

85.(

93.9 I O0.0

t8 .3 95.7

t07.8

r oJ.s

t09.6 t02.6

lo< .2

loo.7

1o0.9

t9.

t

100.8

I37.5 l2( .5 123.3 t24.O ls2.l l5<.2 112.6 l0(.7

t5 -8

45.9 85.3

r3 .5 1o0.0

,8 .4

,s.4

106.4 la2 .9

l0s.(

95. 9

97 .6

93.7 93.5

tl.7

9t.0 77.r 79.18l .5

63. I

85.3

88.I 89.(

92.O 91.7 95. 3

98 .0 99.(, 1o0.0 1o0.3

lo0. (

100 .8 101.9

103 ,6

104 .8

ta<.7 l0(.9

105.0

105 ,2 105.3

81.7 82 .0

83 .5 84 -7

87.1-9t.2

93 .2 93. e

96 .6

98 .2

99 .8

99 .7

1o0.0-99.1

99 .0 99. I

99 .7

lol.(

102,7 102. 7

102 .8 102. ?

t 02.5 102.3

72-2, 73. t

75. 3

75.7

79 .6

83. t

84 .6

86.3 89. I 92.2 91.7

. 9<.5

100.0

99.8

100,6 100.3

t01.7

103 .4 107.3

r07.t

107.9

I 08.3 ... l08.( .

108.( 75. I 77.4 80.8 82 -< 82,7 a? .2 84-3 8e .l

91.3 94.6

97 .S

99.7

t 00.0

9i.9

lo0. (

t9.8

100.8

t 02.o 102.(

to?.o

102.5 102. 7

105 .o

105.2

68 .0

72 .6

76.4 7E.g 77-5 t!8.8 a2.8 46.9 ?t -5

95.3 r00. I

100.( loo. o

.t9. t

l0l.t tor..3 lo?.8 lo{.0 107.o 106.8 lo?.9 lg?.9

lc.2

lo8.( t I t I' IERII

AS

COI'IPAREDI{ITH

OTHER

INI}USTRIAL

BASE

:

87

I : PRICE (CO:T ) CO}rO€TITIVIh€SS : REAL EFFECTI\E €XCf{AHGE RATE :: t r (RELAT'VE fRtCE (COST) INDEX lN A COmTON CTRRENCY) ::

af-a---

---:---.4

r rGDP-DEFLATOR tlllT LAEOtn $llT LABOtn PRODTCER

tttEAR , COSI 'lN TOT. COST IN tlAN PRICES OF

I t ECO}TOHY INDI STRY HANUFACT.

DEFLATOE OF ::

TOTAL EXPF TS: r

(G. S) ::

l.ror.{INAL €FFECT I\E

EXCHANGE

, RATE

: PRICE (COST ) FERFORP|ANCE

: (RELATIVE PRICE (COST) INDEX IN NATIOI.|AL CURRET*CY) r

+----+---L

:GDP-DEFLAT0R UNI T LABOUF UNIT LABOTR PRODUCER DEFLAIfi OF t

: COST I t{ TOT . COST lN l{AN PR t C€S OF TOTAL €PORTS T

: ECONO|{Y INDUSTRY HANUFACI. (G . S, t

75l 75! 77: ?8: 79: 80: 8l :

8t: 85: 81 :

E5! 862 37: 88: 89! 90: 9l :

92: 93:

l03. I

97 .S 99 .6

102 .3

llt.6

t17.4 100 .2

95 .9 90. 7

83.9

84 .2

93.(

100.0 98. ?

95,a

106 .5

l0(.1

108 .5 '

oQ o

lll.5 l0r -2 t.02.0 loa -2 I 14.0

12t.7

l0(-3

97 -7

o.t

85. (

85 .5 93.6 100. 0

97.3 9( .0 t04.6 t01.9 106.3 og.l I00.8 9?. I 93.7 96 .0

t05.0 ll?.(

95 .0 90.8

f s.a

80.7

8l .6 89 .0 100.0

97 .4

95.0

toi.s

103. 3

t07.7 101.? 102.8 95.5 99.3 lol.9 los.9 It0.l

95 .0 92.4 87.8 42.8 8(.0 95.( t00.0

97 .9

95 .6

r05.9 103.( 107. I 98.0 92.4 89 .5 93.( 96.7

l0l .7 1A4.7

92 .5 90. 3

87.4

83 .0

45.5

9(. I 10e.0

93 .3 96.6 107.7 105.9 109.( l0:.d 130.6 I 18.5 117.7 118.7 126.7 l?9.<

t 09.3 102.2 9( .3 86 .2 85.3 93.6 100.0 98.2

95 .5 106.6

I 03 .4

105 .2

97.l

e0.(

82 .2 84 .6 86 .2

ae. t 90. 7

91.7 93.8

96 . 1-'

97.3 98.7 99.8 100.0 10c.0 99.9 99.9 100.7 lc:.1 103.0

85. 3

85. (

86.7 87.8 90.0

9<.1

95 .4

95 .6 97.8 e9. I t00.3 100 .0

t00.0

99. I

98.(

98.1 98.6 100.1

l0t . t

77 .2

7? .7 79.7 80.9 83.7 86.9 a7 .9 88.8 91.0 93.6 95.7 95-0

,100 .0

QO)

99.5

98 .8 I0c . 0

t0l.< lo(.8

?8 -7

81.(

8<.<

85.9 85.9

85. I

86-9 90 -(

93.1 96. O

98.5

99 -7

t00.o

99.7

t00.!

99-3 100. 0

100.9

100 .9

70.8

?5.S

7t.3 8!.5

BO. ?

a€.

t

8< .688.(

92.7

36.3

100.

(

1o0.5 t00..olo0.o

t0l,2

t01.0

102.

(

t0l.l

r05 .5

:952: : 933 :

:93(: : 9(l :

z9a2:

t:

l0l .5 97.8 97-8

9b .: 97.6

99 .8 96.0

95 .8 93-9

q5 .0

t 03 .2 99.9 100.1

98 .2

9e .5

99.3

95.9

95 .9 94.4 95.9

t 03.9

!00.5 I 00,.8 99. ?

100 .8

102.9 103.0 103.2

103 .2 103.3

t0l.e

t0i.:

101.0

r 00.8 100.5

l0(.6

105.3

105 .5

105 .5

105 .3

100. 7

tct-0

t0t.l

l0l .3

t0t.5 103.3 105.9 106.5 105.6 106.7

98 .7

94 .9 94.8 93. r