Trading strategies with implied forward credit default swap spreads

Full text

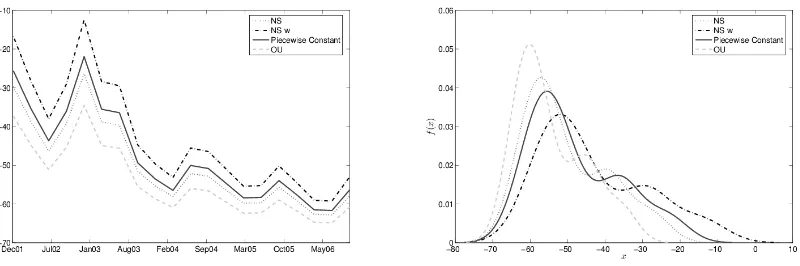

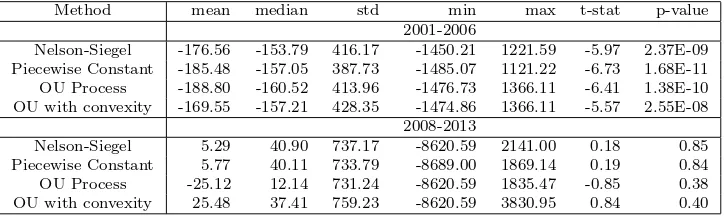

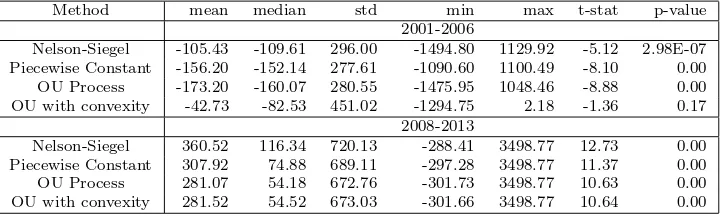

Figure

Related documents

The conditional dependence structure of insurance sector credit default swap indices. North American Journal of Economics and Finance, Volume

The inter-dependent default risk structure between the protection buyer, protection seller and the reference entity in a credit default swap are characterized by their

The buyer of credit default swap receives credit protection, whereas the seller of the swap guarantees the credit worthiness of the product.. In this transaction, the risk

Increase in credit default swap spreads indicated that as long as credit risk of Euribor panel banks and euro area sovereigns increase so does Euribor basis swap

Along with the more traditional credit ratings, CDS spreads reflect the riskiness of sovereign bonds and both are linked to the sovereign bond yields spreads, which have

CREDIT DEFAULT SWAP (CDS) SPREADS: THE ANALYSIS OF TIME SERIES FOR THE INTERACTION WITH THE INTEREST RATES AND THE GROWTH IN TURKISH ECONOMY.. BILAL

Mots clés : credit default swap, risque de crédit, modèle structurel niveau d’endettement, volatilité Using a new dataset of bid and offer quotes for credit default swaps,

Since default process is an important factor in measuring credit risk and pricing credit derivatives, if there are big gaps between credit spreads and default spreads, it would