I

STITUTIONAL

CREDIT

FOR

AGRICULTURE IN

BANGLADESH

by

MD

.

FERDOUS ALAM

,

B.

Se

.

Ag

.

Eeon

.

(Hons)

,

M

.

Se

.

Ag

.

Econ

.

A thesis submitted in partial fulfilment of the requirements

for

the degree of

Master

of

Agricultural Development

Economics

at the Australian

National University

July, 1981

DECLARATION

Except where otherwise indicated, this dissertation is my own work.

ACKNOWLEDGEMENTS

I express my deep sense of gratitude to my supervisor, Dr D.M. Etherington, Convenor, MADE Program for his valuable

suggestions, comments and the overall guidance to the completion of the study. lowe him a great intellectual debt for his help in suggesting and interpreting the different econometric techniques used in the study.

Dr D.P. Chaudhri deserves special thanks for his valuable suggestions from time to time on different conceptual issues on rural credit. I am indebted to Dr David Evans for his kind help In solving many of the statistical problems encountered in the study.

I am thankful to Mr Thong Ly for his help in handling computer problems at different stages of data analysis.

Mrs Bridget Boucher deserves special thanks for her constant help throughout the whole period of the MADE course and particularly in carefully going through the manuscript.

due to Mrs Daphne Boucher for typing the manuscript.

Thanks are

I express my heartfelt gratitude to my parents whose painstaking efforts and encouragement paved the way to the higher

ABSTRACT

The study relates to an analysis of the short- term production loans obtained by the borrowers of the Janata Bank (a Nationalised Commercial Bank), Co- operative (financed by Central Co- operative Bank), Integrated Rural Development Program, IRDP

(financed by Sonali Bank, a Nationali sed Commerci al Bank) and the Bangladesh Krishi Bank, BKB (Agriculture Bank) under the normal credit program in Bangladesh. The study aimed at evaluating lending policies, examl nl ng borrower characteristics , finding out the factors i nfluencing the supply of credit and measuring the

magnitude of non- interest costs in loan transactions from the formal sources.

The characteristics of the borrowers were well reflected by the lending policies of the respective credit institutions.

Borrower characteristics between the Integrated Rural Development Program and the Co- operative were found to be similar in 75 per

cent of the attributes tested. This was significantly different to the borrowers of the Bangladesh Krishi Bank. The Integrated Rural Development Program and the Co- operative were found to be the institutions oriented towards smaller farmers while the Bangladesh Krishi Bank was for larger farmers . The Janata Bank accommodated most of the borrowers of medium farm Slzes.

The study identified four factors namely, stated demand (self assessed requirement) for credit, the land, financial

Stated demand for credit and the land appeared as the most important significant factors determining supply of credit. Education, on the pooled observation, was found to have significant positive effect on credit supply. The negative sign in the variable

Financial Endowment for the Integrated Rural Development Program and the Co- operative reflects the fact that borrowers with a higher

financial endowment were disbursed a lower amount of credit. This is in line with their lending policies. This model of regression explained 58 per cent of the variation In the institutional credit supply. A substantial portion of the credit needs of the borrowers remains unsatisfied.

Non- interest costs, i t appeared from the study, are not only substantial but have all the characteristics of fixed costs. They decreased rapidly as loan sizes went up. Non- interest

transaction costs were found to be 5.04 per cent, 8.05 per cent, 6.54 per cent and 10. 59 per cent respectively for the borrowers of the Janata Bank, the Co-operative, the Integrated Rural Development Program and the Bangladesh Krishi Bank. The effective rate of interest on formal loans thus becomes much higher than the mere

formal official rate of interest. The overwhelming majority (i.e. , smaller) of the borrowers had to face the higher regions of the

CONTENTS

ACKNOWLEDGEMENTS ABSTRACT

LIST OF TABLES LIST OF FIGURES

LIST OF APPENDIX TABLES GLOSSARY OF TERMS

CHAPTER 1

2

INTRODUCTION

1.1 Features of Bangladesh Agriculture

1.2 Place of Agricultural Credit in Bangladesh 1. 3 Extent of Credit Operation by Formal Credit

Agencies

1.4 The Problems of Agricultural Credit 1. 4.1 Fund Limitation

1.5 1.6 1. 7 1. 8

1. 4. 2 Repayment and Bad Debt Problems 1. 4. 3 Problems Relating to Differential

Rates of Interest

Scope and Objectives of the Study Design of the Study

Limitation of the Study Outline of the Study

FORMAL AGRICULTURAL CREDIT INSTITUTIONS

Page I I I

lV lX Xl

Xll

X l l l

1 1 2 3 6 6 8 8 12 13 14 15 16

2.1 Introduction 16

2.2 Integrated Rural Development Program (IRDP) 17 2.2.1 Lending Procedure for Short-Term

Loans at IRDP 2. 3 Co-operatives

2. 3.1 Lending Procedures of Central Co-operative Bank

2.4 Bangladesh Krishi Bank (BKB)

19 20

CHAPTER

2. 5 Nationalised Commercial Banks (NCBs)

2.5.1 Lending Procedures of Janata Bank

Page

24 25

2.6 Special Agricultural Credit Program (SACP) 26 2. 7 Rural Finance Experimental Project (RFEP) 28 2.8 Other On-Going Experiments Relating to

Rural Credit 33

2.9 Field-Action Cum Research Project 34

3 CHARACTERISTICS OF THE BORROWERS OF RURAL

LENDING INSTITUTIONS 35

4

5

3. 1 Introduction

3.2 Distribution of Land of Borrower Respondents

3. 3 Comparison Between Borrower Household Distribution and Rural-Household Distribution

3. 4 T-test on Different Attributes

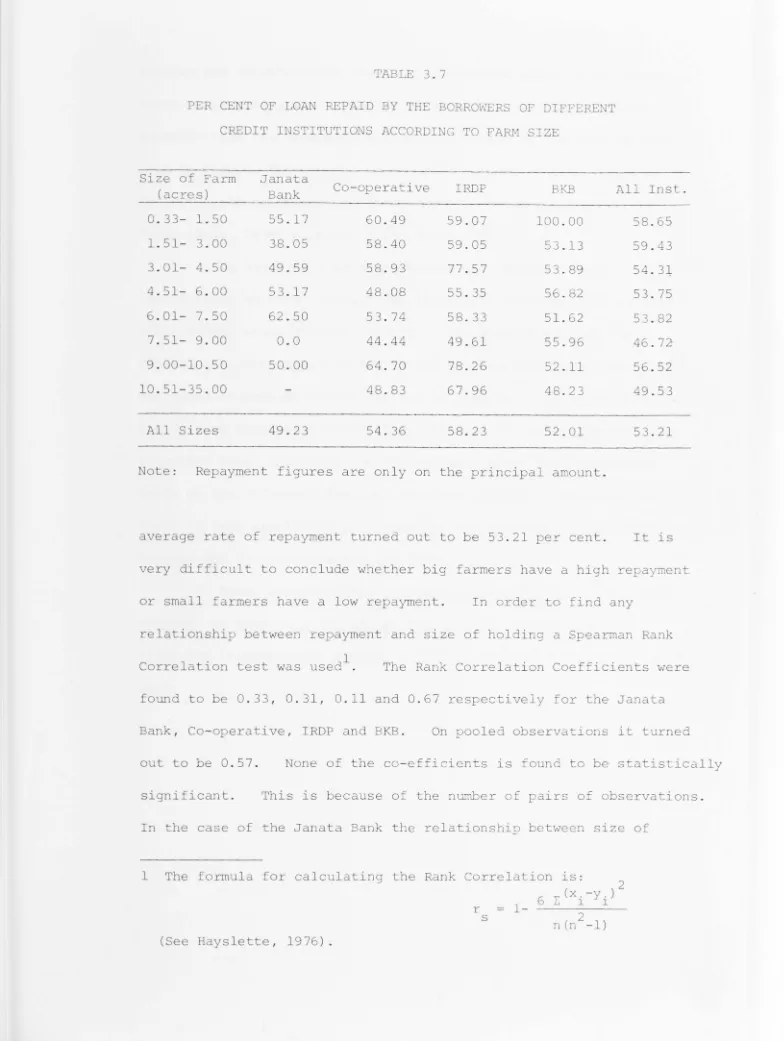

3.5 Repayment of Loan by Different Farm Size Group

FACTORS INFLUENCING SUPPLY OF FORMAL CREDIT

35 35 36 43 49 52

4. 1 Introduction 52

4. 2 Land 52

4. 3 Amount of Credit Need 54

4.4 Level of Education and Financial Endowment 54

4. 5 Regression Model and Interpretation 55 4.6 Test Concerning the Mean Difference of

Credi t Obtained 59

4. 7 Credit Gap Between Requirement (Demand) and

Fulfilment (Supply) 62

COST OF BORROWING FORMAL CREDIT

5.1 Introduction

5.2 Market Structure of Formal Credit

5. 3 Supply-Price Relationship of Formal and Informal Credit

5.4 Empirical Evidence on Borrowing Costs

CHAPTER Page

6

REFERENCES

5.6 Contrasts Between Mean Transaction Costs of Borrowing

5. 7 Nature of Transaction Costs of Borrowing SUMMARY AND CONCLUSION

6.1 Summary 6. 2 Conclusions

6.3 Policy Implications

*

*

*

86 87 99 99 105 107

Table 1.1

LIST OF TABLES

Title

Estimated Agricultural Credit Requirement During the Two Year Plan 1978- 80

1.2 A Partial Assessment of Short-Term Agricultural

1. 3

Credit Requirement

Extent of Loan Disbursement, Recovery and Outstanding in Agricultural Sector By Credit Institution in Bangladesh

1.4 Extent of Loan Recovery By Different Credit

3.1

Institutions

Distribution of Land and Farms According to Small, Medium and Large Categories

3.2 Percentage Distribution of Household/Borrowers

3. 3

3. 4

3.5

3.6

According to Size of Farm

T-value Regarding Mean Attributes Between Different Credit Institutions

Summary of the Hypotheses of Different Attributes Based on T- test

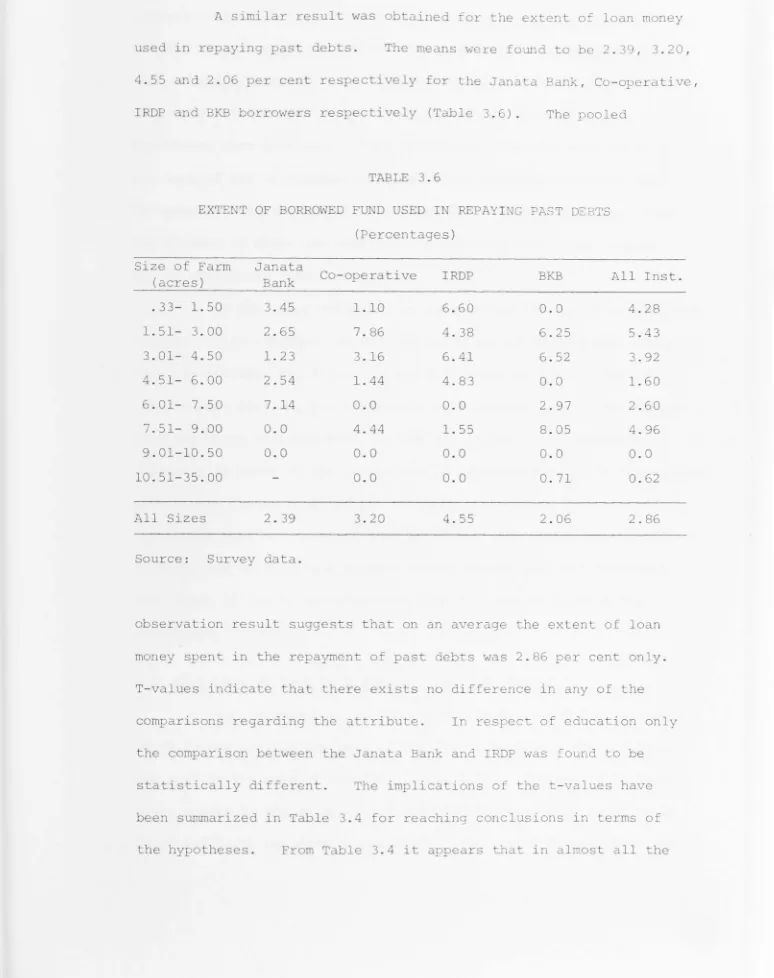

Extent of Borrowed Money Used In Consumption Expenditure for the Family

Extent of Borrowed Money Used In Repaying Past Debts

3. 7 Per Cent of Loan Repaid by the Borrowers of

4.1

4.2

4. 3

Different Credit Institutions According to Farm Size

Result of the Spearman Rank Correlation Test Between Size of Credit and Size of Farm Result of the Regression Analysis Explaining

Credit Behaviour of the Formal Sources Based on the Model Y _ XSI XS2 XS 3 XS4 E'

i - a 1 2 3 4 l

Result of F- tests on the Pooled Institutions for Testing Hypotheses of Parameter Stability 4.4 Result of the T-test for Comparing Differences

5.1

of Mean Size of Credit Among Different Credit Institutions

Farmer ' s Cost of Borrowing in Bangladesh From the Agricultural Development Bank (now BKB) in 1962- 63 by Loan Size Groups

Table

5.2

Title

Number of Farms and Breakdown of the Transaction

Costs Per Hundred Taka of Credit Received by

the Borrowers of Janata Bank and BKB According to Size of Credit

5. 3 Number of Farms and Breakdown of the Transaction

5.4

5 .5

5.6

5. 7

5.8

Costs Per Hundred Taka of Credit Received by the Borrowers of Janata Bank and BKB According to Size of Farms

Result of the Spearman Rank Correlation Test Between Size of Credit and Transaction Cost Per Hundred Taka of Credit Received

Result of the Spearman Rank Correlation Test Between Size of Farm and Transaction Cost Per Hundred Taka of Credit Received

T- test Ratios to Examine the Contrast Between

Mean Transaction Cost of Borrowing in Different Credit Institutions

Result of the Regression Analysis Based on Model 2

Y.

=

a + S.X. + S2X'l l l l

Result of Regression Analysis Based on Model

S

Y.

=

aXl

Page

80

81

83

84

86

88

[image:10.793.40.768.0.1100.2]Figure

3.1

3.2

3. 3

LIST OF FIGURES

Title

Lorenz Curve Showing Inequality In the Borrower Selection Compared to National Rural Household Distribution

Distribution of National Rural Household and

Borrower Household According to the Size of Farms

Histogram Showing the Distribution of Land

According to Small, Medium and Large Farm Sizes

4. 1 Credit Fulfilment Curves and Credit Gap In

4.2

5. 1

5 .2

5. 3

5.4

5.5

5.6

Different Credit Institutions

The Place of Co- operative Credit In the Small

Farmers Demand and Supply of Capital

Hypothetical Price-Quantity Relationship In

Formal and Informal Source of Credit

Average Transacti on Cost Per Hundred Taka of

Credit Received and Frequency Distribution of Loans for the Borrowers of Janata Bank

Average Transaction Cost Per Hundred Taka of Credit Received and Frequency Distribution of

Loans for the Borrowers of Co- operative

Average Transaction Cost Per Hundred Taka of Credit Received and Frequency Distribution of Loans for the Borrowers of IRDP

Average Transaction Cost Per Hundred Taka of Credit Received and Frequency Distribution of

Loans for the Borrowers of BKB

Average Transaction Cost Per Hundred Taka of

Credit Received Based on the Model

8

Y.

=

a.XTable A. l

A.2

A. 3

A. 4

LIST OF APPENDIX TABLES

Title

Two Way Classification Showing Mean Size of

Credit Obtained by the Borrowers of Janata Bank Two Way Classification Showing Mean Size of

Credit Obtained by the Borrowers of Co-operative Two Way Classification Showing Mean Size of

Credit Obtained by the Borrowers of IRDP Two Way Classification Showing Mean Size of

Credit Obtained by the Borrowers of BKB

A.5 Result of the Regression Analysis on the Pooled

A.6 A. 7 A.8 A. 9 A.10 B. l

B.2

B. 3

B. 4

C.l

D.l

E.l

F.l

Observation Based on Model XSl XS2 XS 3 X

4S4 El'

Yi

=

a 1 2 3Correlation Matrix of Different Variables on Individual Credit Institutions

Correlation Matrix on the Pooled Observation

Between Different Sets of the Credit Institutions Distribution of Credit According to Farm Size by

the Borrowers of Different Credit Institutions Distribution of Credit According to Size of

Credit by the Borrowers of Different Credit Institutions

Predicted Credit Fulfilment Against Requirement Based on Credit Fulfilment Equations

Mean Transaction Costs (Non- Interest) of

Borrowing (in Taka) According to Size of Farm Mean Transaction Costs (Non- Interest) of

Borrowing (in Taka) According to Size of Credit Result of the Regression Analysis on the Pooled

Observation Based on Model 2

Yi

=

a+

SlX+

S2 X Result of the F- test for the Hypothesis ofParameter Stability Between Credit Institutions Regional Differences in Some of the Main

Variables by Institutions

Measurement Problems and Definition of Variables

List of Sample Borrowers of Different Credit Institutions in Different Districts Under Study Map Showing the Districts Under Study

[image:12.791.39.756.68.1093.2]GPRB GEP

Bangladesh Bank

NCBs

Janata Bank BJSB

CCB

UCMPS

Co- operative

IRDP TCCA BKE BARD Taccavi SACP RFEP ASSARD FCS KSS Arnan Acre Taka

GLOSSARY OF TERMS

Government of the People' s Republic of Bangladesh Government of East Pakistan (Now Bangladesh)

Central Bank of Bangladesh Nationalised Commercial Banks One of the NCBs

Bangladesh Jatiya Samabaya Bank (Apex Co-operative Bank)

Central Co- operative Bank (Co- operative Bank at secondary level)

Union Co- operative Multi Purpose Societies (Co-operative Societies at primary level)

Societies at UCMPS level who recelve loans from Central Co-operative Bank

Integrated Rural Development Program (a two tier Co- operative system based on Comilla- type

Co- operatives who receives its agricultural fund for lending from Sonali Bank, one of the NCBs)

Thana Central Co- operative Association

Bangladesh Krishi Bank (Bank deals with agricultural lending)

Bangladesh Academy of Rural Development

A special kind of loan administered by government agencies and advanced at the time of crop failure , natural disasters etc.

Special Agricultural Credit Program Rural Finance Experimental Project

Asian Survey on Agrarian Rural Development Farmers ' Co- operative Societies

Krishak Samabaya Samity (Societies at village level) Rice planted in July-September and harvested in

November-January

Unit of measurement of land

1 acre . 4046 hectare, or 2.4711 acre

=

1 hectareUnit of currency in Bangladesh

1.1 Features of Bangladesh Agriculture

Bangladesh is basically an agricultural country comprlslng

a total area of 55 ,126 square miles. It is characterized by the

highest population density (1, 337 persons per square mile) and the

lowest land-man ratio (1:3) of any country In the world. The

distribution of land is highly skewed with 11.07 per cent of the

total rural household owning no land against 3.05 per cent owning

about 25.72 per cent of the total land area. The contribution of

agriculture to GOP has been around 60 per cent with little variation

over time. The main export items are jute goods and raw jute which

contributed 71.11 per cent of the total foreign exchange earning

during 1978- 79 (Government of the People ' s Republic of Bangladesh

(GPRB) , 1979a, p .113) . Agriculture absorbs 78 per cent of the total

labour force (World Bank, 1979, p .162) . It has a land area of about

35.3 million acres of which 20.4 million acres are cultivable. The

average cropping intensity is 148 per cent. Productivity in

agriculture is very low compared to other countries but land is very

fertile . Shortage of food grains lS a chronic problem. Per capita

GOP was Taka 729, or approximately 48.6 US dollars in 1978-79 (GPRB,

1979a, p .l) . The great majority of the people are illiterate: the

literacy rate is only 20.17 per cent (GPRB, 1979b). Over

four-fifths of the population are considered to be below the poverty line

1.2 Place of Agricultural Credit in Bangladesh

The importance of agricultural credit In a country like

Bangladesh is enormous, for on the one hand the country is

characterized by the mass poverty of the rural poor while on the

other hand agriculture contributes significantly to the overall

economic development of the country. The poor farmers can not even

produce adequate food for their families . Under such circumstances

buying any input, even traditional ones , to ralse productivity is hardly a possibility for many of them. Providing credit facilities to enable them to raise better crops by buying improved inputs of

seeds and fertilizers has an important role to play in raising

productivity and levels of living.

Controversy exists as to whether capital is a constraint

to production. Recent views propounded by T.W. Schultz (Schultz, 1979) indicates that in traditional agriculture capital is not a

significant constraint on production. There are certainly opposite

schools of thought. But such a broad generalisation may not be true in all the developing countries and is not expected to be true

in Bangladesh. Human factors are indeed important but so too lS capital. In order that a credit program may lead to greater output, there must be a desire on the part of the farmers to invest more

capital. Such a desire exists in the overwhelming majority of small farmers in Bangladesh which results from the realization that

there are profitable investments which they can not undertake with

their present holdings of capital.

Governments often use agricultural credit as an instrument

purposes such as to encourage diversification in to a particular crop or to promote the adoption of a given technology. World Bank experlence has made i t clear that institutional credit is an

essential complement to structural changes such as land redistribution. Since such changes usually lead to the disruption of traditional or non-institutional sources of farm credit, institutional credit often becomes essential to fill a vacuum (Baum, 1976). A lack of credit has been seen as the key impediment to the introduction of new

technology (Morss et al, 1976).

Today in Bangladesh, there are about four persons to one acre of cultivated land and by the end of the century there will be only half an acre for four persons (Faaland and Parkinson, 1976). A vast majority use wooden ploughs and a pair of bullocks for

cultivation which results in low efficiency in land preparation and, consequently, low productivity. In such a socio-economic situation the introduction of modern imputs and technology (even appropriate technology) accompanied by agricultural credit can effectively raise farm productivity and thereby the well being of a great many people.

1.3 Extent of Credit Operation by Formal Credit Agencies

The Agricultural Credit Structure in Bangladesh consists of two components: institutional or formal and non-institutional or informal sources. There are five major agencies in the formal sector which supply credit at the farmer level . These are:

(i) Bangladesh Krishi Bank (Agricultural Development Bank);

(iii) Integrated Rural Development Program

(Comilla Type Co- operatives) ;

(iv) Nationalised Commercial Banks (six

in number); and

(v) Government Taccavi Loan.

The Taccavi loan is not a regular source of finance. This

lS essentially a distress loan advanced at the time of crop failure

or natural disasters. The other four agencies are the regular

-source of agricultural finance. nationalised Commercialised Banks carne

to the arena of agricultural finance in 1973 while the Bangladesh

Krishi Bank and the Bangladesh Jatiya Samabaya Bank are the oldest

agricultural lending agencies.

There is no reliable estimate of the total credit

requirement in Bangladesh. Most of the available credit estimates

!

seem to have been made preponderantly on the basis of the short- term

fund requirements of the farmers for seeds, fertilizers , irrigation

and pesticides (Choudhury, 1979, p .83) . The total credit

requirement as estimated by the Planning Commission for the years

1978- 80 are shown below (Table 1.1) . The estimated credit

requirement for 1979- 80 represents a ratio of about 16 per cent of

the contribution of Taka 37,430 million estimated to be made by the

agricultural sector to the GOP during the same period, i .e . , 1979-80

(GPRB, 1978a, p .143) . Using the current input standard, the Planning

Commission's assessment seems to have largely underestimated total

credit requirements. For example, the credit requirement for one

season Aman crop alone which was planted on 70 per cent of 20.45

TABLE 1.1

ESTIMATED AGRICULTURAL CREDIT REQUIREMENT DURING THE TWO YEAR PLAN 1978-80

Taka in Million

Credit Requirement 1978- 79 1979-80 Total

Short-term credit (for fertilizer, seeds , irrigation, pesticides and hired labour)

Medium and long-term credit (for

cattle, land improvement, fisheries ,

3670

livestock etc. ) 630

Total 4300

Source: GPRB, 1978a, p .142.

1978-80

4090 7760

820 1450

4910 9210

Taka 5, 726 million on the basis of Taka 400 per acre credit for seed, fertilizers and pesticides (GPRB, 1977; pp .26,37) .

TABLE 1.2

A PARTIAL ASSESSMENT OF SHORT-TERM AGRICULTURAL

Farm Size (acres) up to 2.50 2.50 - 5.00 5.00 and above

Total

CREDIT REQUIREMENTS

Farms a (Per Cent)

66 23 11 100

Area a (Per Cent)

23 34 43

100

Credit Requirement (in million Taka)

1317 1947 2462

5726

a Data on farm size and land holding have been taken from a survey carried out by the Bangladesh Institute of Development Studies in 1974.

[image:18.788.20.765.37.1058.2]After making adjustments for those who would not need credit and also those who need i t but can not be extended the same

(lack of credit worthiness , low absorption capacity etc .), i t can be safely assumed that the total short-term credit requirement for the total cropped area of 30.44 million acres in 1976-77 will be far above the official estimate of Taka 4,300 million for 1978- 79.

The Credit Program during the Two Year Plan 1978- 80

consisted of two components: (i) the normal credit program of the Bangladesh Krishi Bank, Co- operatives (both types) and Nationalised Commercial Banks; and (ii) the Taka 1,000 million Special Agricultural Credit Program. The total amount of credit disbursed by all the

credit agencles under the normal program during 1978- 79 amounted to Taka 1,259. 7 million. In addition, the Special Agricultural Credit Program contributed Taka 413. 7 million. Thus the aggregate

disbursement of agricultural credit by all the agencies in 1978-79 amounted to Taka 1,673.4 million recording a 4.07 per cent lncrease over the disbursement of prevlous years (Bangladesh Bank Annual Report 1978- 79) . The total amount of credit disbursed by both programs constituted only 38. 91 per cent of the estimated credit

requirement for the year 1978- 79 . However, in terms of actual credit requirements, the institutional contribution will be much

lower than that. Even the Two Year Plan also documented that

institutional credit is highly inadequate to meet the demand (GPRB, 1978a, p .141) .

1.4 The Problems of Agricultural Credit

The success of a credit program depends mainly on the

lenders and borrowers. But some factors are really beyond the

control of these parties. The limitation of available funds is a

genuine constraint to institutional lending. On the other hand

the keen necessity of spending money in urgent need as well as crop

failure due to natural calamities are beyond the control of

borrowers. All of these factors have a chain effect on each other. Spending borrowed money in so called unproductive ways (from the

philosophy of loan point of view) weakens credit worthiness , results in the non- repayment of loans and has serious implications for the rate of inflation. On the other hand non- repayment increases the total outstanding to the lender and ultimately results in the

bankruptcy or near bankruptcy of the credit institutions. Because

of the bad debt problems perhaps some institutions (Nationalised

Commercial Banks and Bangladesh Krishi Banks) do cover the general

sector also rather than the agricultural sector alone .

In terms of resource commitments, the NCBs which held 96

per cent of the total bank deposits of Taka 14,509 million in

October 1977 advanced only four per cent in the rural areas. with

the advance of BKB and BJSB the ratio rises to about nine per cent

(Choudhury, 1979) . Hence i t is evident that the lack of funds lS

not an excuse for the low institutional share to agricultural

lending; rather what matters is the unwillingness to divert significant

amounts to agriculture. The reasons are obvious: the sacrifice of

the business profit in the industrial sector and the riskiness of

the non- repayment in agriculture. This indicates that formal lending agencies are also risk averse. This is quite reasonable

1. 4. 2 Repayment and Bad Debt Problems

The increasing amount of outstanding loan lS said to be a burden to the lending agencles.

increase of outstanding loans.

Table 1. 3 shows the continuous However, from the available information provided by either government sources or by credit institutions i t is impossible to find out the true rates of

repayment as most of the information on amount recovered includes the collection of old debts and refers to both seasonal and long term credit. One can onl y summarise from Tables 1. 3 and 1.4 that the rate of recovery though improved in 1976 and 1977 is still

unsatisfactory. A very low rate of recovery of agricultural credit would certainly impede an expansion of credit (Ali , 1979) .

1.4. 3 Problems Relating to Differential Rates of Interest Differential rates of i nterest, under the socio- economic conditions of Bangladesh, seem to increase the relative income

disparity between smaller farmers and medium- large affluent farmers because the lion' s share of the credit is obtained by the latter. According to some i t affects the credit operation of the country

adversely (Ali , 1979) . The benefits accrued from obtaining credit goes to this affluent section; on the other hand the poor and small farmers are disadvantaged. This creates a socio-economic imbalance which is against the government's stated long term equity objectives.

Officials of lending agencies argue that the appropriate

[image:21.789.30.749.49.1081.2]TABLE 1. 3

EXTENT OF LOAN DISBURSEMENT, RECOVERY AND OUTSTANDING DEBTS IN THE

AGRICULTURAL SECTOR BY THE CREDIT INSTITUTIONS IN BANGLADESH

Amount Disbursed Amount Recovered Amount Outstanding

Years (in million Taka) (in million Taka) (in million Taka)

NCBsI BJSB2 IRDPI BKB2 NCBs BJSB2 IRDPI BKB2 NCB s 3 BJSB2 IRDPI BKB2

7< ' *

1971-72 96.40 11.18 n.a. 41.60 3.47 n.a. 290. 30 7.71 n.a.

1972-73 n.a. 142.50 20. 03 179.00 n.a. 67. 30 9.00 67.20 99 .90 365. 40 11.63 612 .30

1973-74 124. 30 77.40 27.65 135. 70 n.a. 84.50 20.82 119.00 114.10 358.30 6.83 671. 40

1974-75 93.00 94.10 32.16 176. 30 n.a. 92 .20 26. 00 200. 00 132.10 360. 20 6.16 717.50

1975-76 171.40 106.20 45 . 31 185.10 n.a. 121.20 35.46 274.80 267.00 345. 40 9. 15 742.10

1976-77 459. 30 113. 30 61.97 388.50 n.a. 105.20 44 .90 294.90 393 .80 353.60 17.09 903. 30

1977-78 890.60 170.50 102. 70 566.50 n.a. 140.40 n.a. n.a. 921.60 374.10 n.a. n.a.

1978-79 709. 50 198.90 n.a. 765 .00 n.a. n.a. n.a. n.a. n.a. n.a. n.a. n.a.

Note: NCBs agricultural landing started in 1973.

n. a. information not available.

* represents amount recoverable at the end of the year.

Sources: 1 GPRB , 1978b, pp. 37 , 41 .

2 Molla, 1979.

3 Bangladesh Bank, 1979.

~

TABLE 1. 4

EXTENT OF LOAN RECOVERY BY DIFFERENT CREDIT INSTITUTIONS

Institutions 1976- 77 1975- 76 1974- 75 1973- 74

BKB 46.8 45. 7 37. 8 28.4

a a

28.16: 23 . 36:

BJSB 32 .97

b 35. 78b

11. 00 16.11 11.97 7.48

IRDP 57. 9 53. 3 57.5 78. 4

c

SACP 14.63

d n .a . n.a. n.a.

24. 78

NCBs n.a . 34. 72e 81. 50e n.a.

a On principal amount.

b On interest.

c Collection as % of amount disbursed.

d Collection as % of amount fallen due for collection. e Percentage of recovery on outstanding including overdue. n.a. information not available.

Sources: Bangladesh Bank, 1978, pp.29 ,48,62 ,94. Raquib, 1977, p . 34.

institutions must find the interest rate sufficient to cover the cost

of credit including the cost of administration and a reasonable profit

margin (Ali , 1979; Gangopadhay, 1979; Choudhury, 1979; Saha, 1979).

The borrower must also find i t attractive enough to generate

additional income from investing the borrowed sum. An interest

rate is needed which will satisfy the aspirations of both the parties.

Various proposals have been suggested regarding the

revision of interest rates. The different viewpoints can be

summarised in the following ways:

sector should be lower than the general lending rate.

(ii) The rate of interest In the agricultural sector should be higher than the general lenoing rate .

(iii) The rate of interest In the agricultural sector as a whole should not only be lower than the general rate but i t should also be lower for small and marginal farmers .

(i v) A uniform lending rate in agriculture irrespective of the type of farmer .

The Two Year Plan clearly states that the lack of uniform interest rates adversely affects the incentive structure of the

farmers and creates unhealthy competition among suppliers of credit. But there is nothing fundamentally wrong with the existing interest rate structure (GPRB, 1978a, pp.142, 144) . The 'unhealthy competi tion ' as used In the Two Year Plan also has other consequences. This

results In loan overlapping which happens because of a lack of co- ordination among credit institutions {Alam and Momen, 1978).

Further problems arise from the misuse of loans. Often

\

loans are spent for purposes other than those for which the loans were given. This happens in meeting consumption expenses and

expenses for social ceremonles which weakens the repayment potential of the borrowers. Lack of loan supervlslon results in misutilization.

Such problems are common in almost all developing countries.

The demand- supply relationship is also similar in respect to

requirements based on rule of thumb in Bangladesh highly under- values the actual requirements at any prlce. Adjusting the fund with

such figures and thinking that the institutional share is significant

does not in fact get into the real solu~ion of development. This is little more than plucking a figure from the ai~ as i t has little

relevance to the farm level situation . There lS, therefore, an

urgent need for detailed micro- level studies of the manner in which formal credit institutions handle borrowers and wh~ther they are

meeting borrower' s needs. This is one such study.

1.5 Scope and Objectives of the Study

The Government of Bangladesh has committed itself in the

latest development plans to rural development and to helping the

less privileged. Part of the assistance to lower income groups lS

by providing credit on eaSler terms to smaller farmers through

formal, government controlled credit institutions. The first objective of this study is to examlne the lending policies of the

different credit institutions that do operate In the rural areas to

see whether there are significant differences between them. This will be closely rela~ed to the second objective which lS to examine

the characteristics of the borrowers of different formal credit

institutions. An obvious hypothesis, which has been tested in

other studies and is a major reason for the introduction of the Taka

1,000 illion SACP, is that credit institutions bias their lending

In favour of the larger, better off farmers. The third obJective of the study has ~herefore been set to identify and examine the

with only tacit acceptance that there are other 'hidden ' costs to

obtaining formal loans In addition to the formal rate of interest.

The central hypothesis of this study is that "other costs" in the

form of transaction costs are not only substantial but that they

have all the characteristics of fixed costs so that the average

costs of a loan decreases rapidly as the size of a loan lncreases

thus discriminating further against small farmers with modest loan

requiremen ts. The fourth objective suggests that to identify the components and analyze the nature of transaction costs is essential

for testing such a hypothesis.

1.6 Design of the Study

It was with a view to testing such hypotheses that the

author conducted a survey of the rural clients of selected credit

institutions. The survey was conducted in July, 1976 as part of the author' s responsibilities with the University Grants Commission. A total of 500 farmers were selected and interviewed from six

different districts. The credit institutions selected were the BKB, Co-operative , IRDP and Janata Bank (one of the six NCBs). The NCBs agricultural lending was not then spread throughout the country.

For this reason the Janata Bank from the NCBs was selected as i t had

an initial experimental project in Rangpur district. The SACP had

not been introduced then and the Taccavi loan is not a regular

source of agricultural finance, therefore, only the four abovementioned

credit institutions were included in the study.

Individual farmers were selected in a two stage process.

First - SlX districts, namely, Rangpur, Bogra, Pabna, Myrnensingh,

Tangail and Comilla were selected keeping in Vlew the regional

variation in agricultural production. Secondly, individual

farmers were randomly selected from the lists of the loanees of

working for the Agricultural University. Two graduate students were also used. Proper care was taken to get reliable and authentic

information by pre-testing the interview schedule. The data so collected were again verified by the researcher to eliminate

inconsistencies in the information. Each interview was conducted at a single sitting and although every care was taken in obtaining factual information by asking highly specific questions, there still remains the problem of this type of survey approach - that of memory and the ability to recall events and quantities over a specified time period. Experience in Bangladesh suggests that the memories of illiterate peasants are very good and the crop year is a well-defined reference period. In addition to the survey schedule, an independent check was made with the credit institutions on the amounts of the loans applied for and received (see Appendix D.l). Where there were disparities between what the respondent said and the information given by the credit institution, these farmers were dropped from the survey. In all, thirty two farmers were excluded because of inconsistent or incomplete data. The break up of the total sample and the map showing the districts under study are shown in Appendix E.l and F.l.

1.7 Limitation of the Study

Though the data were collected from SlX different districts, the study concentrates its analysis on the institutional variation rather than spatial variation because (i) regional planning of

agricultural credit in Bangladesh is an extremely remote possibi l i ty ;

(ii) any changes in lending policies among credit institutions depend

mainly on the institutions concerned and government decisions and seems

to be less dependent on regional uniqueness; (iii) for one institution (the Janata Bank) data was collected in only one district ; and

in many agricultural statistics in Bangladesh are known to be important but preliminary tabulation (reproduced in Appendix C.l) revealed a

consistency of institutional lending patterns across districts which

suggested that ignoring district differences would not bias the

results of the study or their interpretation. It is intended to test this assertion in a subsequent analysis of the data. However, a more serlOUS problem that arises in the course of this study is that of mlsslng data. A number of variables which could influence the conclusions of the study were, unfortunately, not collected. The omitted variables such as size of family, educational attributes of the family members, the historical credit record of the borrowers did not allow the testing of certain hypotheses regarding the factors affecting the supply of institutional credit.

1.8 Outline of the Study

The study consists of SlX chapters including the introduction. Chapter 2 provides a brief description of the lending institutions

under study and the relevant government efforts relating to agricultural finance in Bangladesh. Chapter 3 examines the

characteristics of the borrowers of the different credit institutions. Chapter 4 deals with the factors influencing the supply of

institutional credit. The analysis of borrowing costs has been

done in Chapter 5 showing the extent of transaction costs and their break-up in obtaining formal agricultural credit. Finally, Chapter 6 provides the summary of overall findings of the study and possible

recommendations based on i t.

Before turning to examine the characteristics of the sample farmers, we turn in the next chapter to a brief description

of the selected le ding institutions and some recent innovations

CHAPTER 2

FORMAL AGRICULTURAL CREDIT INSTITUTIONS

2.1 Introduction

The purpose of this chapter is to discuss the varlOUS

efforts made by the Government of Bangladesh in financing agriculture. Since the liberation of Bangladesh, the government has put much

emphasis on agriculture. Substantial increases in funds have been made. In addition to the normal agricultural credit program by the Bangladesh Krishi Bank (BKE) , the Bangladesh Jatiya Samabaya Bank

(BJSB) , the Integrated Rural Development Program (IRDP) and the Nationalised Commercial Banks (NCBs) , a Special Agricultural Credit Program of Taka 1,000 million have been introduced since February, 1977. Besides , various experimental projects are being implemented to find out sound agricultural lending policies that best suit the

farmers .

As noted in the first chapter the first three lending agencies listed above dominate the formal rural lending market and

have therefore been selected for this study. In addition the Janata Bank, from the NCBs , was selected because not all NCBs had direct agricultural lending at the time of data collection. The

SACP had not been introduced then and therefore had not been included in the present study. These institutions and their lending policies

will now be described before turning to the characteristics of

farmers who actually borrowed from them. The description of the

institutions are being made in the light of the normal agricultural

2.2 Integrated Rural Development Program (IRDP)

The IRDP was launched in 1971 on a national scale for the

purpose of replicating the Comilla Approach. A major component

of the Comilla Approach was the two tier co-operative system with

primary co-operatives at the village level (KSS) and a federation

of the primary co- operatives at the Thana level (TCCA) . The basic

difference between the IRDP co-operative and the other type of

co- operative (traditional) is that the former is two tiered as

indicated above while the latter is a three tier system. From the

inception of the program the need for providing credit to the

disadvantaged groups of rural people was emphasized with a view to

stimulating agricultural production and enabling the small farmers

to get rid of the various money lending practices. In the light

of past experience in credit administration , attempts have been made

to make the credit system production- oriented and geared to the

needs and circumstances of the farmers . Thus the credit services

are integrated with the other essential services required by farmers.

Provision for other inputs of production, such as , fertilizers ,

seeds, irrigation, improved farm implements , insecticides etc. is

sought to be made together with credit. Training farmers in the

improved farm practices of cultivation and extension services have

been emphasized.

Providing credit to small and medium farmers and the poorer

rural women lS categorically emphasized under the IRDP . A survey

on the IRDP in the Comilla district indicates that 78 per cent of

the members In the agricultural societies have land holding below

The proportion of members having no agricultural land holdings is

very small. Thus the dominance of small farmers is well represented.

The specific objectives of the IRDP are as follows :

(a) To create an institutional infrastructure

for the effective utilization of available

resources.

(b) To organize farmers into cohesive disciplined

groups for planned activities initially

aimed at agricultural development.

(c) To channel institutional credit facilities

offered and supervised by Thana Central

Co-operatives.

(d) To build capital through the mobilization

of thrift savings deposits and the sale of

co-operative shares.

(e) To facilitate innovation and promote adoption

of innovations in agriculture by individual

members through co-operatives by intensive agriculture extension services.

(f) To develop local leadership through

participation in training programs organized

by the TCCA and group activities in the

village.

(g) To facilitate equitable income distribution

by making credit facilities and agricultural

inputs available to small and medium farmers;

(h) to experiment for development in other areas , such as warehousing , marketing, processing, education, health and housing

etc.

2.2. 1 Lending Procedure for Short-Term Loans at IRDP The individual members of the FCS apply to the FCS using the specific loan from STI (short- term loan application form) two months before justifying the amount required for specific purposes . The two months margin is required, acco~ding to them, for ensuring procurement and timely delivery of the loan. The FCS prepares

a Production Plan on the basis of the stated demand of the individual applicant with the necessary papers and legal documents. The loan application (Production Plan) is considered and scrutinized by the Loan Sub- Committee of the TCCA. The various forms required in the process of the loan are called ST1, ST2 , ST3 , ST4 (all short-term

loan forms) . After final approval of the loan at the IRDP (district level) , information is sent to Sonali Bank Head Office (one of the NCBs which provides funds to IRDP) notifying that credit has been

approved for each TCCA and the terms of the repayment.

Once loans to borrowing members have been finally

sanctioned and just before cash and kind components related to these loans are disbursed, the FCS manager makes the member sign a

(vii) the guarantee securlng the repayment of the loan; and (viii)

a deed of hypothecation of the standing crop financed by the loan.

The deed clearly shows the plot number, acreage, location etc. This

deed of hypothecation must stipulate that the loan is to be repaid

with the proceeds of the crops and that the borrower binds himself

not to sell the crops grown on these plots without the consent of

FCS. The terms of this deed must be written on a legal form and

be consistent with the prevailing laws of the country.

For the loans received, an individual FCS member lS now

required to pay interest and serVlce charges combined at 17.5 per

cent per annum (interest 12. 5 per cent and service charge 5.0 per

cent) . The break up of the interest structure is shown below:

Parties Involved

(a) INTEREST

Sonali Bank TCCA

FCS (Commission)

FCS Manager (Commission)

(b) SERVICE CHARGE

(to pay salary of inspectors and village accountants)

Share of Interest (%)

Sub-Total

Total

7.5 2.0 2.0 1. 0 12.5

5.0 17.5

2. 3 Co-operatives

The co-operative credit structure In Bangladesh comprises

a three tier system which consists of: (i) the Bangladesh Jatiya

Sarnabaya Bank, BJSB (Apex Co-operative Bank) at the national level;

i

(iii) over 4 ,000 Union Co- operative Multipurpose Societies (UCMPS) at the primary level; and (iv) sixteen Co-operative Land Mortgage Banks also at the primary level (Ahmed, 1980) . The co-operative agencies have a widespread network for dispensing credit throughout the country.

The individual member of this type of co- operative (known as Krishak Sarnabaya Sarnily, KSS at the village level) receive loans from the Central Co- operative Banks. Membership of the Central Co-operative Bank was restricted to co-operati ve societies only (no individual could be a member of CCB) . At the primary level there were UCMPS and KSS. These KSSs were federated into TCCAs.

The di fferent types of co- operatives (for farmers , fishermen and other rural producers) were formed at government

initiative mainly for the purpose of providing institutional credit and other servi ces needed by the people of respective occupations at minimal cost. The government officials who organized the

co- operatives initially wi th the help of the rural power structure enlisted all classes of people including those who were comparatively well off and influential in the respective groups , as members of

these co-operatives. Ultimately; i t so happened that co-operative societies were dominated by the people who had a vested interest

(Molla, 1979) . The overall supervision and control of the

co-operatives , however, were vested under law with the Registrar of Co- operative Societies or his authorized representatives , i .e .,

government official who had always shown a leniency towards the people belonging to the rural power structure. Therefore, the

system were generally pre- empted by the influential members who were also the big defaulters.

2. 3. 1 Lending Procedures of the Central Co-operative Bank Loans, under the terms and condition of this institution,

are advanced to only the members of the KSS . The members are required to submit a Production plan justifying the credit needs.

No loans are granted to a member unless the applicant' s name appears In t11e specific forms (called A, Al form for dealing with short-term loan) . The Central Co-operative Bank charges nlne per cent per annum from the KSS and KSS charges 12 per cent per annum from the

individual KSS members on both short and medium term loans. Interest lS payable on a yearly basis.

The loan is supposed to be repaid after the explry of the loan period without fail with interest. An additional interest at the rate of three per cent lS charged for failure to repay the loan on the due date . Loan is issued to the members on execution of a registered mortgage karbarnama and on submission of the completed and signed tamsuk form (a form which shows full particulars of the borrower indicating the loan amount, the rate of interest to be paid, and the terms and conditions of the loan) . The borrower

having signed the tamsuk form guarantees the authority that he shall be bound to accept any decision given according to by-law if he does not utilize the loan properly and if he fails to repay the loan.

2.4 Bangladesh Krishi Bank (BKE)

long-term loans. The bank has a network of branches widely

distributed allover the country. In 1971 i t had only 75 branches and by the end of 1978 this number increased to 197. Besides, 61 small rural branches have been opened during the last six years so as to make the bank' s credit facilities available to the fanners at their door steps.

The short-term loans are advanced for financing the cost of raising crops while the medium- term loans are given for the

purchase of agricultural implements , draft animals , bullock/buffalo carts, dairy , poultry, pond fishery etc. Long-term loans are

given for purposes such as the development of orchards/fruit gardens , inland fisheries , the acquisition of farm machinery , construction of warehouses etc.

The bank provides loans to any person or company who satisfies the bank that the loan being taken shall be spent on agriculture or on the development of agriculture or agricultural

products or on cottage industry in the rural areas or on the storage, warehousing or marketing or processing of agricultural products.

Loan applications for amounts below Taka 100 are not admitted by the bank. The bank charges interest at 11 per cent for short- term

loans (except for tea and jute finance for which the interest rate is 10. 5 per cent) and at 10.5 per cent for medium and long-term loans.

mortgage. Short- term loans , besides being advanced on the mortgage

of property, can also be sanctioned:

(i) against personal surety up to Taka 1,000;

(ii) on unconditional guarantee of a scheduled

bank or by drawing , accepting , dis

-(i i i)

counting, buying and selling or rediscounting

bills of exchange and promissory notes

bearing t wo or more valid signatures , one

of which should be that of a scheduled bank

or any corporation approved by the government;

and

against the hypothecation of sugarcane, paddy

and tea crops.

The total amount to be granted shall not exceed the value of security

given by the individual loanee.

Application for loans are entitled on prescribed forms .

There is a separate form for loans up to Taka 1,000 secured by

surety, hypothecation of crops and a separate form for loans

secured by mortgage, assignment, etc. The applicants are not

required to pay for a loan amounting up to Taka 1 ,000 but over

this amount application fees are payable, depending upon the size

of the loan. Various kinds of documents are required for

supporting the contents of the loan application.

2.5 Nationalised Commercial Banks (NCBs)

The CBs played an insignificant role in respect of

agricultural credit in Bangladesh until the early seventies. Since

the country) to induce NCBs into the field of agricultural finance.

The CBs were asked to set up separate sections/ divisions in their

Head Offices as well as Regional Offices with proper personnel to

deal with agricultural credit. The banks were free to go in for

providing credit to the agriculturists either directly or through

any intermediaries like the co-operatives. The banks , however,

showed a preference primarily for the indirect approach as they

considered i t to be safer and easier. One of the NCBs (Sonali

Bank) took up IRDP- Co-operatives for retai ling its credit with TCCAS

at the receiving end and KSS at the delivery end. Another NCB

(Janata Bank) took to project financing and also direct financing

of individual farmers , while other NCBs were still hesitant. This

lS the main reason for which respondents of the NCBs carne particularly

from the Janata Bank in the present study.

2. 5.1 Lending Procedures of the Janata Bank

As a first step for selecting the area to be covered,

indirect contacts are made by the bank personnel. Having selected

the area, investigations are again made indirectly through village

key-men to assess individual applicants who asked for loans as a

check to verify the contents of the loan application.

are granted:

Crop loans

(a) on guarantee, pronote, letter of guarantee

from the local acceptable farmers

(identification from Agricultural Extension

Officers or Union Council's Chairman),

i i

I

I

!

i

(b) On mortgage, pronote, registered mortgage of

land, hypothecation of crops.

The documents , such as mortgage deeds, as provided in the

loan application are examined and drafted by the bank's lawyers.

All these costs of documents including lawyer' s fees are paid by

the loanee. The rate of interest on short- term loans was 10.5 per

cent per annum. Crop loans are repayable immediately after

harvesting/marketing of the produce. For crop loans indirect

information through village keymen and directly through personal

inspection are made to ensure proper use of the loan and its

repayment. Reminders in advance of 15 days are given for repayment.

Personal contacts are directly made before issuing reminders.

Repayment schedules are revised to suit the needs of the borrower

in the case of genuine crop failure but on proper inspection by the

bank personnel.

To complete the picture of formal credit we look at some

of the most recent developments, in particular the Special

Agricultural Credit Program and the Rural Finance Experimental Project.

2.6 Special Agricultural Credit Program (SACP)

Under the normal agricultural credit program the small and

marginal farmers have been historically neglected and landless

farmers , a significant portion of the rural population, had virtually

no accommodation in institutional credit. A very small portion of

the total institutional lending would go to small farmers . Security

orientation was such that only medium-large and affluent farmers ased

I

with a vlew to providing credit facilities to the poorer

section of the rural poor a Special Agricultural Credit Program of

Taka 1,000 million was undertaken in February 1977. The program

involved the Bangladesh Krishi Bank and the six nationalised

commercial banks. The decision to initiate the program came from

top- level policy makers in the Government of Bangladesh, and to some

degree, the program was imposed on reluctant bank officials

(Bangladesh Bank, 1978, p . 7) .

However, the loan procedure under the program has been

simplified to a great extent. Owner cultivators, tenants and share

croppers are all eligible to get loans in this program provided that

they are in bona fide possession of land under cultivation simply

by signing an application form and a crop hypothecation deed in the

prescribed form (without any stamp duty) . The farmers are required

to produce up to date rent receipts and parcha (similar to title

deed) from the revenue department to prove they are bona fide .

Loans to share croppers are extended against hypothecation

of crops and one or two personal sureties preferably the owner of

land or ward member, chairman of the union councilor any of the

persons acceptable to the bank in the absence of the owner of the

land. Provision was also made for group loans and such loans are

secured by crop hypothecation and additionally by group surety bonds

to be executed by the individual farmers belonging to the group.

It was decided that for the supply of inputs like fertilizer, seeds

etc. credit would be provided in kind. Provision was made that no

loan should be given to a borrower whose land exceeds a maxlmum

amount and per acre amount. In order to avoid duplication and to

maintain effective co-ordination in credit disbursement, a Lp.ad

Bank System was introduced designating one commercial bank to act

as Lead Bank for each district. The Lead Bank, in consultation

with the district committee , will designate the unions to different

bank branches so that no union is served by more than one branch

bank.

In order to minimise the non- interest cost of borrowing,

provisions were made under the program so that any farmer living

at a distance of four miles or more from the bank branch can get

loan money closer to horne from booths opened by the mobile units of

the branch at convenient places within the union.

interest was 11. 0 per cent compounded annually.

The rate of

We turn finally to a somewhat longer discussion of the

Rural Finance Experimental Project (RFEP) because some of its

concerns are closely allied to this study.

2. 7 Rural Finance Experimental Project (RFEP)

The Rural Finance Experimental Project has been undertaken

Slnce November, 1978 for a two year period to be implemented by all

the six nationalised commercial banks , the Krishi Bank, the Samabaya

Bank and the IRDP co-operatives In some 80 selected outlets

throughout the country under eight different models (Bangladesh Bank

Annual Report, 1979) . The basic hypothesis being tested by the

project is that flexible interest rates, efficient administration,

effective supervision and organizational innovations would make i t

provlslon of savings incentives of the target groups of small and

marginal farmers.

The variables of the Rural Finance Experimental Project are as follows (Church and Adams, 1979, pp. 142-4) :

(1) Interest rates on loans - Rates of 12 per

cent, 18 per cent, 24 per cent, 30 per

cent and 36 per cent will be tested. The objectives are to assess the impact of

interest rates on: (a) whether loans

actually reach the target groups, that is , are not absorbed by large farmers ;

(b) the demand for institutional credit;

(c) costs and returns from credit use; and (d) the banks financial viability.

(2) Interest rates on savlngs: Options being tested are 11 per cent, 12 per cent, 13

per cent, 14 per cent and 15 per cent.

Objectives are to test the impact of interest

rates in generating rural savings,

particularly among the rural poor.

(3) Collateral/security requirements - A range of options exists including: (a) no security except promise to pay; (b) investigation of credit worthiness; (c) Production Plan

analysis; (d) close supervision; (e) crop or

other lines; and (f) co-signers etc .

or leniency of security requirements with

regard to the number of target groups reached

and repayment.

(4) Borrowers Selection; loan approval - Options

include: (a) any person claiming to be an

eligible small farmer; (b) any person

certified by some designated official; (c)

persons confirmed through pre lending surveys;

(d) persons with a technically, economically

feasible production plan; and (e) local level

vs higher level delegation of loan approval

authority. The objectives are to test the

relationship between the intensity of borrower

evaluation and the level of loan approval

upon the number of target groups reached and

the subsequent use of funds and loan

recovery. This is particularly relevant for

the present study as i t attempted to find

out answers to this.

(5) Forms and Procedures - Various options exist,

from a verbal understanding documented by

the lender records to detailed systems of loan

evaluation and analysis. The objectives are

to test the effects of various levels of

simplification on: (a) attracting small

farmers to institutional lending sources; (b)

timeliness and costs of loan processing and

(6) Loan disbursement methods - Options include cash,

in-kind or a mix of these. The objective lS to test the effectiveness of the form of

disbursement on directing credit use to the

intended purposes, and on loan recovery.

(7) Loan Supervision; technical advice; and loan

collection methods - Options range from not providing any technical advice to the provision

of various levels of advice/supervision by loan

officers and/or other government agents . The

objective is to measure the relative

effectiveness of various methods in terms of increased production and loan repayment

compared to the costs of supervlslon .

(8) Loan purposes - Options include small farm

production only; small rural enterprises:

productive purposes only or production and consumption. The objectives are to compare the effectiveness in terms of benefits to the

rural poor; to observe the consequences of providing or not providing consumption credit .

(9) Handling of delinquencies - Options include

persuasion by various level officials, penalty

fees, withholding of future credit etc. The objective is to determine the cost and

(10) Personnel policies/incentives - Options include various commission and incentive schemes,

promotion etc. for achieving program

objectives. The objective is to determine the costs and effectiveness of various personnel

policies and incentives on program effectiveness. (11) Training - Options include varlOUS amounts and

intensities of training/non- formal education for local bank officials , local lenders and

borrowers. The objective is to ascertain the

effect on credit extension, use and collection. (12) Nature and location of institutions/outlets

-Options include commercial banks , the

Agriculture Bank, Co- operative Bank , Integrated Rural Development Program; branch outlets , field agents , mobile units , full or part time village offices. The objectives are to identify the institutional characteristics which contribute to or inhibit farmer acceptance of credit,

lending and collection to target groups, and the timeliness of delivery.