11

/

213/74

E U R O P E A N C O M M U N I T I E S

Monetary Committee

Monetary Policy

in the Countries of the

European Economic Community

Institutions and Instruments

Supplement 1974

Denmark

Ireland

PART ONE

MONETARY POLICY IN DENMARK

Chapter One — Basic Elements of Monetary Policy

Section I — Institutional framework

1

Para I

Monetary and foreign exchange authorities

1

1. Danmarks Nationalbank

1

2.

Government Inspector of Commercial Banks and

Savings Banks

3

3. Capital Market Board

4

Para II

Structure of money and capital market

4

1. Money and capital market institutions

4

a) Commercial tanks

5

(i)

Commercial Bank Act

5

(ii) Bank lending

5

(iii) Deposits in banks

6

(iv) Foreign "business

6

b) Savings hanks

7

(i)

Savings Bank Act

7

(ii) Lending

8

(iii) Deposits

8

c) Post Office Giro

8

d) Mortgage credit institutes

9

e) Other financial institutes

11

Denmarkfs Ship Credit Fund

Industrial Finance Institute

Municipal Credit Institute

f) Insurance companies and pension funds

13

g) Supplementary (Labor Market)

13

Pension Fund and Social Pension Fund

2. The banking system and the capital market

14

3. Private nonr-bank sector’s saving habits

15

Section II - Liquidity

17

Primary money supply

Secondary liquidity

Secondary money supply

Para I

Non-tank sector,s liquid resources

19

1. Definition

19

2. Composition

19

3. Movements

19

4. Factors affecting the money supply

19

Para II

Commercial 'bank liquidity

20

1. Definition and composition

21

2. Movements

22

3. Factors affecting "bank liquidity

23

Para III Liquidity and public finance

23

Chapter Two - Instruments of monetary and foreign exchange policy

Introduction

24

Section I — Refinancing

29

Para I

Official discount rate

29

Para II

Nationalbank credit facilities available to hanks

31

Section II — Control of commercial and savings hank liquidity etc.

38

Para I

Liquidity ratios prescribed hy law

38

Para II

Solvency

39

Para III Danmarks Nationalbank’s deposit agreements with commercial

hanks and savings banks

40

Section III - Regulation of the money and capital market and of

external transactions

41

Para I

Intervention on the money and capital market

41

1

. Money market

41

2. Capital market

43

Para II

Regulation of external transactions

45

1. Foreign exchange regulations

46

a) Current payment

s

46

d) Portfolio investment

47

e) Commercial loans and credits and financial loans

48

f) Residents*accounts abroad and non—residents

1

accounts in Denmark

48

2.

Impact of international capital movements on

economic policy

49

3. Regulations governing the net foreign exchange

position of commercial hanks

49

4

* Nationalbank intervention in the forward market for

foreign exchange

51

Section IV — Direct restrictions on credit

51

Para I

General quantitative restrictions

51

1. Credit ceiling

51

2. Restrictions on local government 'borrowing

53

Para II

Selective credit regulations

53

1. Refinancing of non-profit housing projects and

construction of student dwellings

53

2.

Ship Credit Fund "bonds

53

3. Export credit scheme

53

Annexe 1

Deposit Agreements: Main Features

1965

— 1971

55

Annexe 2

Aims of Monetary and Foreign Exchange Policy

56

Annexe 3

Supervision of Local Government Borrowing

59

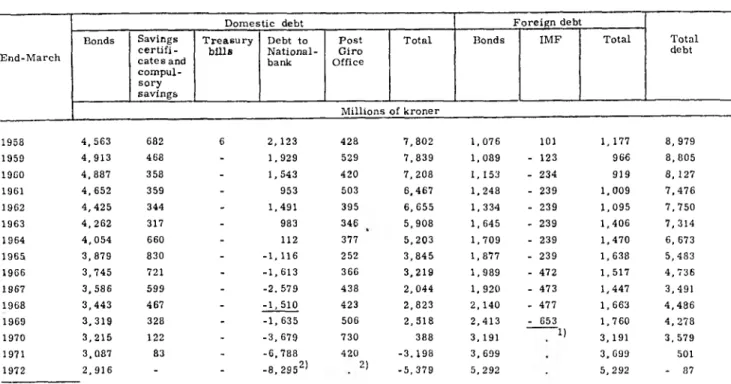

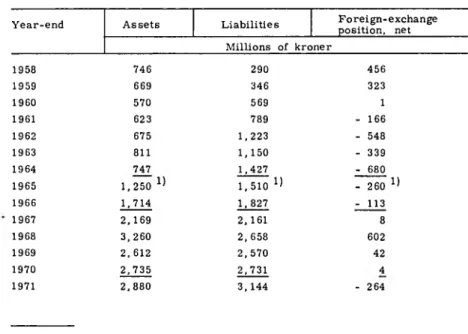

Statistical Tables

PART TWO

MONETARY POLICY IN IRELAND

Chapter One — Institutional and Structural Aspects of the Monetary

System

1

Section I — The Institutions

1

Para I

The Monetary Authority

1

Para II

Monetary and financial institutions

3

The principal institutions and their characteristics

4

1. The associated hanks

4

2.

The non— associated "banks

4

3. Hire purchase finance companies

6

4. Building societies

6

5

. Assurance companies

7

6. Credit unions

7

7

. Other financial institutions

7

8.

The money and financial markets

8

Section II - Liquidity

10

Chapter Two - The objectives of monetary policy

13

Para I

General objectives and the "Policy Mix”

13

Para II

Specific monetary policy objectives

14

Chapter Three - The instruments of monetary policy

17

Section I — General purpose instruments

17

Para I

Introduction

17

Para II

Rediscounting and refinancing policy

18

Para III Solvency and liquidity ratios

20

Para IV

Changes in interest rates

22

Para V

Quantitative global restrictions on credit

24

Para II

Selective control of domestic credit

25

Annexe 1

Objectives of monetary policy in Ireland

27

Annexe 2

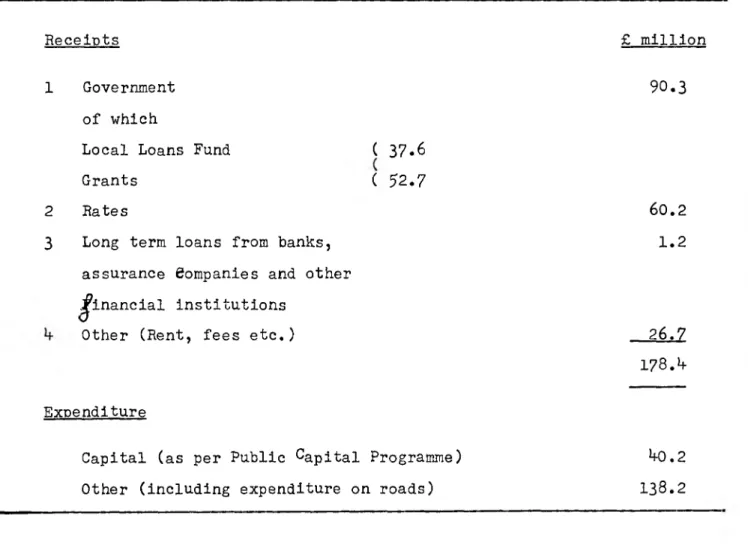

Controls exercised over Local Authorities in the

field of credit

30

PART THREE

MONETARY POLICY IN THE UNITED KINGDOM

Chapter One — Basic principles of monetary policy

Section I — Institutional framework and structural conditions

Para I

The institutional framework

1

Para II

Structural conditions

3

1.

Structure of the financial intermediaries

3

2. Banking system and capital market

7

3.

The public's habits with regard to investment

12

4.

Importance of financial transactions with foreign

countries

13

Section II — Liquidity

Para I

The liquidity of the economy

15

Para II

Bank liquidity

17

Para III Liquidity and public finances

18

1. Management of cash balances

18

2. Functions of the monetary authorities, and the

ways in which their activities affect the liquidity

of the banks and the economy

18

3. Means by which the Government raises finance

1

9

Chapter Two - Instruments of monetary policy

Development of techniques of monetary policy

22

Section I - Refinancing policy

Para I

General data

23

Para II

Refinancing

24

1. Rediscounting

24

2. Advances against securities

24

Para III Effectiveness of refinancing policy and action through

interest rates

25

Section II — Regulation of bank liquidity

Para I

Minimum reserves policy

26

1. Organisation of the system

26

Para II

Other banking ratios

31

Section III — Control of the money market and of relations with

foreign money markets

Para I

Open—market policy

32

1.

The money market

32

2. Open-market operations

34

Para II

Operations affecting short— term international capital

flows

36

Section IV - Direct action on lending

Para I

Quantitative credit control

38

Para II

Selective credit control

38

Bibliography

S u m m a r y

PART ONE

Monetary Policy Instruments in Denmark

PART TWO

Monetary Policy Instruments in Ireland

PART THREE

MONETARY POLICY INSTRUMENTS

IN

-