Trading anonymity and order anticipation

Full text

Figure

Related documents

For a sample of Euronext-Paris stocks, we document a buy-sell asymmetry in order submission strategies: informed traders use more price aggressive (market) buy orders before

KEYWORDS: Algorithmic trading, high frequency trading, limit order book, order flow imbalance, electronic liquidity provision, market

(2014) is used, which combines the three main types of order book events: order insertions, cancellations and trades (market orders).. This makes it perfectly repro- ducible by the

We analyze some order book of stocks traded in Jakarta Stock Exchange and see interesting properties there by looking at the balance of the order book.. We also build a model based

Buy orders submitted into the Central Order Book with a buy price higher or equal to the sell Order with the lowest price (crossing prices), will be matched into one or more trades

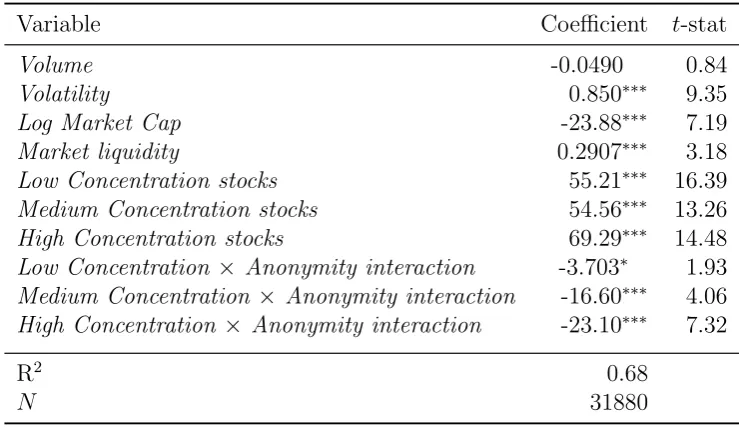

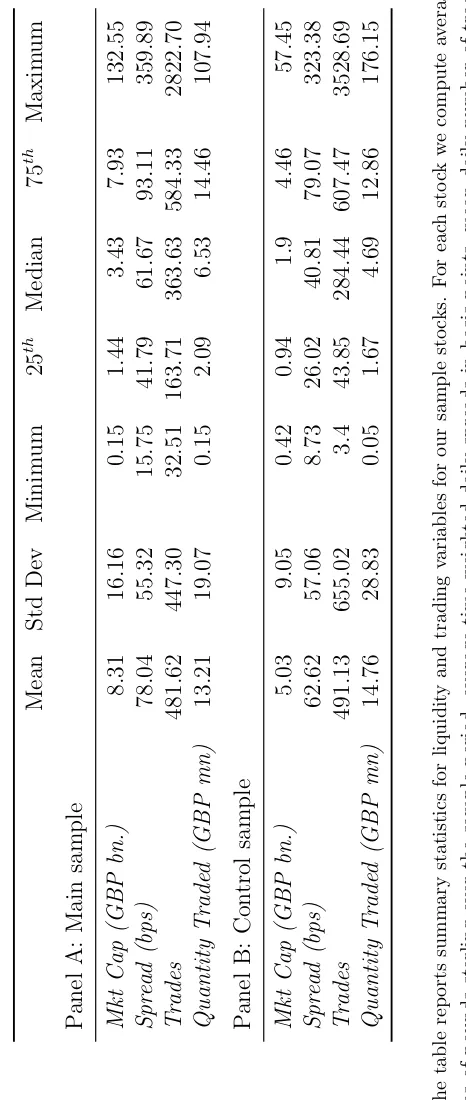

In order to select and characterise sample stocks, their risk and liquidity are evaluated through a set of empirical measures such as the volatility of daily close returns,

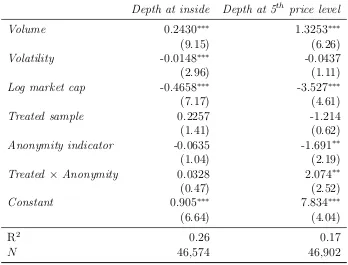

When the trading desire in a stock increases, and traders become more anxious to fill their trades, they are more likely to trade deeper in the limit order book and the

In order to select and characterise sample stocks, their risk and liquidity are evaluated through a set of empirical measures such as the volatility of daily close returns,