Working beyond state pension age : the impact of income and work-family life history

Full text

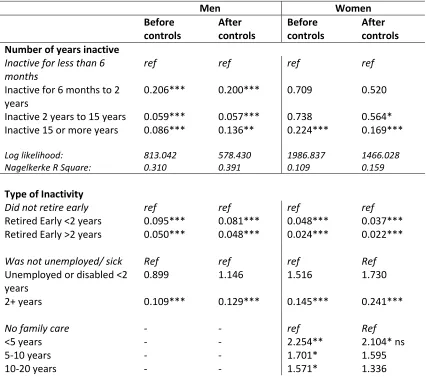

Figure

Related documents

• The objective of the American Berkshire Association is to ensure that all pork marketed in the 100% Pure Berkshire Pork Program is harvested from pigs with purebred,

Examples include reducing the state Earned Income Tax Credit from 20 percent to 6 percent of the federal credit, increasing taxes on selected types of pension income based on the age

The 2008 financial crisis has had a major impact on the international economy, bringing important lessons to the fore and changes in emerging countries’ roles

If your wife or your civil partner was born after 6 April 1950, has reached State Pension age and you reach State Pension age after 6 April 2010 (and you are not entitled to a

Technology: The project will develop capacity to access very large multivariate datasets; represent heterogeneous data types; integrate multiple GIS data sets stored in many GIS file

Accordingly, after the completion of 10-year basic education (6 years primary and 4 years secondary education), students may opt to go to technical schools

At any age, pension income from a defined benefit or defined contribution pension plan may be split with a Partner; while for those who are 65 years or older, incomes from an

The Family Building Society does not penalise those applicants who wish to work beyond state or normal retirement age, however, we do not consider earned income beyond the age of