Sovereign credit risk in a hidden Markov regime-switching framework. Part 1: Methodology

15

0

0

Full text

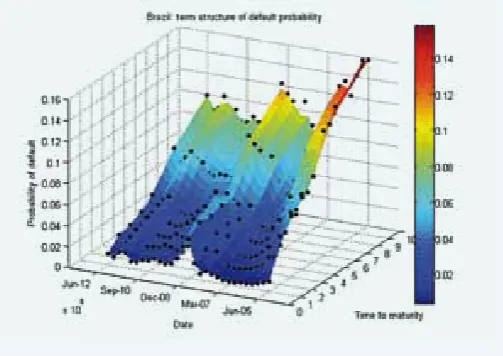

Figure

Related documents