The euro crisis: ten roots, but fewer solutions. Bruegel Policy Contribution 2012/17, October 2012

Full text

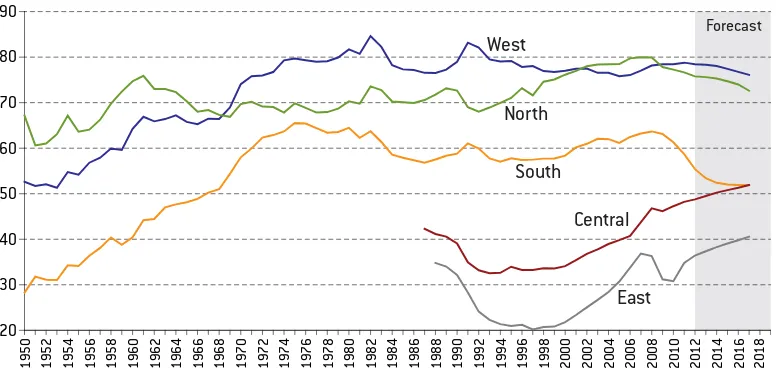

Figure

Related documents

This Policy Contribution identifies how narratives of the crisis developed since 2007, by identifying the key crisis-related topics in articles from four opinion-forming newspapers

On top of the systemic roots of the slowdown that has been visible since the 2008-09 global financial crisis, in 2014 the Russian economy was hit by two additional shocks:

123 of the EU Treaty states that “Overdraft facilities or any other type of credit facility with the European Central Bank or with the central banks of the Member States

• There are two possible responses to the Greek debt crisis: ‘Plan A’, continued official lending, for as long as needed, with possible voluntary private sector involvement, and

While the Greek case perfectly exemplifies how budgetary indiscipline in a small country can jeop- ardise financial stability in the euro area as a whole, Spain and Ireland

Altogether these measures proved that the European Central Bank was as capable as the US Federal Reserve to contain the liquidity crisis, thus reas- suring the euro area that its

In this contribution we focus on the Greek crisis and we suggest, through a model of coopetition based on game theory and conceived at a macro level, feasible

On top of the systemic roots of the slowdown that has been visible since the 2008-09 global financial crisis, in 2014 the Russian economy was hit by two additional shocks: