Rochester Institute of Technology

RIT Scholar Works

Theses

Thesis/Dissertation Collections

1-1-2007

Immersion & iteration: Leading edge approaches

for early stage product planning

Christopher Bondy

Jack Rahill

Michael L. Povio

Follow this and additional works at:

http://scholarworks.rit.edu/theses

This Master's Project is brought to you for free and open access by the Thesis/Dissertation Collections at RIT Scholar Works. It has been accepted for inclusion in Theses by an authorized administrator of RIT Scholar Works. For more information, please contactritscholarworks@rit.edu.

Recommended Citation

Immersion

&

Iteration:

Leading

Edge Approaches for

Early

Stage

Product

Planning

"Delivering

Breakthrough

Products"Christopher

Bondy

Jack Rahill Michael L. PovioAcademic Advisor:

Robert Boehner

-Rochester Institute of Technology, College of Business

Industry

Advisors:Tony

Federico - XeroxCorporation, Corporate Officer Business

Group

Fred DeBolt

-Xerox Corporation, VP Color Line of Business

Rochester

Institute

ofTechnology

Master of Science in Product Development

Capstone Research Project

November 14, 2007

Illllllersion

& Iteration: Leading

Edge Approaches for Early Stage

Product Planning

Delivering Breakthrough Products

Signatures

Aca

d

e

mi

c A

dvi

so

r

:

Robert Boehner

Robert Boehner

Rochester Institute of Technology, College of Business

In

d

u

s

try

A

dvi

so

r

s:

Tony Federico

Tony Federico

Xerox Corporation, Corporate Officer, Business Group

Fred DeBolt

Fred DeBolt

Xerox Corporation, VP, Color Line of Business

MPD Dir

e

ct

o

r:

Mark Smith

Mark Smith

Immersion & Iteration: LeadingEdgeApproachesforEarlyStageProductPlanning (DeliveringBreakthrough Products)

Acknowledgments

Theresearchpaperbeforeyouisthefinalprojectforatwoyear endeavorinthe

pursuit of a MasterofScienceforProduct Developmentat Rochester Instituteof

Technology. Ithas been a six monthinvestmentthathas requiredthehardwork

of

balancing

family,

work and academics. Theexistenceofthis paperisdueto thesupport ofmanypeople which we wouldlike tosincerelythank.

OurFamilies: Whohave endearedthe 2years with us and wethank them for

theirunderstanding and support. Jackwouldliketoespeciallythankhiswife Gail

andtwo

daughters,

MeghanandEmmafor enduringthelong

nights andtimeawayfrom one another. Mikethankshiswife

Tracey

andkidsJacob, RyanandLindsey

fortheirmoral support. Chriswouldliketoexpresshisthanks to hiswifeGlenda and4teenagers; Kaelyn, Jacob, MariahandLucasforunderstandingthe

sacrifice andacknowledgingthevalue ofthis program.

Our Advisors: Dr. Robert Boehnerforguidingusthrough this seemingly

endless research paper. Theencouragement and motivation you gave us makes

thiseffort worthwhile. "Fromcloudsofideastogranite, prettyimpressive."

Our Companies: Xerox andDMHforgivingusthis opportunitytobetter

ourselvesineffortstogrow withthecompany.

Our Colleagues: the camaraderie oftheclass madethiscourse most enjoyable.

The

friendship

andbondsmadeherewilldefinitely

last alifetime.MPD

Faculty

andStaff: MarkSmith, Chris Fisherand all theprofessors.Youhave donean excellentjobin providingthe students ofthis course withthebest

opportunityfor learning.

Theroots ofeducation are

bitter,

butthefruitissweet. -AristotleThesis/Dissertation Author Permission Statement

Name of author:

..::To

~/J

,~;£

'/

j

v;i//

'

s

$djh

,.II

1;,e

~

h//,!./ Degree:M

S

Program:

8-dad

p,£3t/~~t?hnr&1_./r--: College: 6 N f.-,; /l/?-t?-.4)d/b

'

I understand that I must submit a print copy of my thesis or dissertation to the RIT Archives, per current RIT guidelines for the completion of my degree. I hereby grant to the Rochester institute of Technology and its agents the non-exclusive license to archive and make accessible my thesis or dissertation in whole or in part in all forms of media in perpetuity. I retain all other ownership rights to the copyright of the thesis or dissertation. I also retain the right to use in future works (such as anicles or books) all or part of this thesis or dissertation.

Print Reproduction Permission Granted:

I,

P

;)

/l-;7?q--

/,.

/'

/

,

hereby grant permission to the Rochester institute Technology to reproduce my print thesis or dissertation in whole or in pan. Any reproduction will not be for commercial use or profit.John Rahill

Signature of Author: _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Date:

Print Reproduction Permission Denied:

I. , hereby deny permission to the RlT Library of the Rochester Institute of Technology to reproduce my print thesis or dissertation in whole or in part.

Signature of Author: _ _ _ __ _ __ _ _ _ _ _ _ _ _ _ _ Date: _ _ __ _ _

Inclusion in the RIT Digital Media Library Electronic Thesis & Dissertation (ETD) Archive

I,

::z-;

~/

7 -~

/l (

'

/ /

,additionally grant to the Rochester Institute of Technology Digital Media Library (RIT DML) the non-exclusive license to archive and provide electronic access to my thesis or dissertation in whole or in pan in all forms of media in perpetuity.I understand that my work. in addition to its bibliographic record and abstract. will be available to the world-wide community of scholars and researchers through the RIT DML. I retain all other ownership rights to the copyright of the thesis or dissertation. I also retain the right to use in future works (such as articles or books) all or part of this thesis or dissertation. [am aware that the Rochester Institute of Technology does not require registration of copyright for ETDs.

I hereby certify that. if appropriate. I have obtained and attached written permission statements from the owners of each third party copyrighted matter to be included in my thesis or dissertation. I certify that the version I submitted is the same as that approved by my committee.

b3,~p'&-Immersion 8 Iteration l eadii

Executive

Summary

Developing

anddelivering

products thattruly

delight customers issurprisinglymore of a unique occurrencethan most wouldbelieve. Amongst the vastarray of

mediocre products reside afew eliteproductsthat customers

truly

seek outtoacquire beyond anythingelse offered in the marketplacethese productsare

truly

"breakthrough"

products. Breakthrough inthat theyprovide customer

benefitsthat addressthe unmet and unspokenwants and needs ofthe customer.

Breakthroughproductsdelivervalue inamannerthatexcites the customer

by

thealmost intuitivewaythese products resonate withtheirreal world requirements.

From the

developers'

perspective, breakthrough products definemarkets, steal

market share and deliver better profit marginsthan incremental productsthat

only providesustaining business results.

Uncovering

thespecific requirementsthat drive breakthroughproducts is adaunting

product planningtask intoday'sfast moving, competitive, andhigh-techglobal marketplace. Both B2C and B2Bproduct development organizations

aretaskedwithuncoveringcustomer requirementsthatwill catapulttheir firms

ahead ofthepack in a privileged position asthe marketleader.

History

suggestshowever that the path tobreakthroughproductsislesstraveled and reservedfor

onlyafew companiesthat havea uniqueway of

delivering

repeat successes.Why

is it that the traditionalproduct planning processeshave notbeen successful at

Immersion& Iteration: LeadingEdgeApproaches forEarlyStage ProductPlanning

researchproject; thorough investigationofthe obstaclesinthetraditional

product planningprocessthat hamperthe conceptualization anddevelopmentof

breakthroughproducts willbediscussed.

Thetraditionalproduct planning processisa complex process of stages and gates

thatis oftenhandicapped

by

a varieddegree ofcommitment,understandingandparticipationfromcross-functional teams thatdon'talways perceive the valueof

allthe hurdlesand processes. Therearemanycompanies who excelinthe

regimented processes ofthevariousstages and gates involved inthe traditional

productplanningprocess. Thesecompanies have successfully delivered

incrementalproducts thatmeet customer needs. These companieshave a solid

business plan with asteadycustomerbase thatdelivers sustaining business

results.

Following

the traditionalproduct planningand developmentprocess withprecisionusually delivers steady businessgrowth at or slightly above

industry

growth rates.

This researchproject showsthat a solid execution ofthe traditional process can

onlyyieldwhatis referredtoas

"incremental"

product developmentat best. For

manycompanies, product development disconnectsare as fundamentalas their

inability

toconsistently followa process. Yettheproblemwithdelivering

breakthroughproducts goesbeyondthe traditionalplanningprocess. Theremust

be something more.

Why

is it that themarket leadersseemto consistentlydeliverbreakthroughproducts? Arethesemarketleaders

doing

something differentthatImm

Theansweris thatbreakthrough products require adifferent product planning

approachthan the traditionalproductplanningprocess whichis somewhat serial

in nature. Thetraditional productplanningprocess isstructured tobe more of

one-time-throughtheprocess approach,or

"pipeline"

thathas limited

commitment toiteration prototyping andusually muchtoo limited engagement

withthe target customer. Multiplestudies haveshown thatfirms are ineffective

atcapturingand

interpreting

VOC andreflectingtrue customer needsin theirnew products.

The author's conductedprimaryresearch with several north eastern companies

as well asbenchmarked several companiesthroughsecondary researchin efforts

touncover the process keysto

delivering

breakthrough products. Throughthisresearch effort and referencesfrom

industry

experts such as Cooper, Christensen,vonHippelandUlwick, this project validatedthatcompanies who deliver

breakthroughproducts engage in more elaborate activities

during

theearly stagesoftheproduct planningprocess. These companieshave much moreintimate

immersionwith the targetcustomers, and buildprototypes and iteratemore

frequently

back throughtheplanning processthroughout all stages ofdevelopment.

Companiesthat deliver breakthrough productshavean uncanny wayof

discovering

whatcustomerreallywantand need. The ability that these successfulproductdevelopment companies haveto uncoverneeds, wants and desired

outcomes isgroundedina passion for understanding,

learning

andimmersing

Immersion & Iteration .1ageProduct

Planning :

comprehensiveimmersion, these

leading

edge companies are abletobetterformulatethe total customer experience andinterpretthat experience into

specifications thatdelightthe targetcustomer.

The direct associationbetweenmore comprehensive immersion, prototypes, and

iterationprovidedthe author's withinsights to

develop

a unique productplanningprocess thatistailored specifically for breakthroughproducts. This "new"

product planningprocessfor breakthroughproductsis presented in this

research project as an alternate process approachthatcanoverlaythe traditional

productdevelopment process for productinitiatives thatarefocusedat

breakthroughvs. incrementalefforts.

Both consumerand commercial customers votewiththeirwallets

by

acquiringproducts thatintercept theirspoken and unspokenrequirements most effectively.

Theobject ofthisresearch projectisto betterunderstandthe approaches

followed

by

successful companies who consistently deliverbreakthroughproductsand synthesize thoseapproachesintoa new product planning process

modelthatcanbe better understood andfollowed

by

companieswishing toplan,Table

ofContents

Executive

Summary

vTable ofContents ix

Table ofFigures xi

Table ofTables xi

Chapter 1: Project Overview 1

Introduction 1

Problem Statement 2

ResearchObjective, Scope,

Methodology

2Value Added toKnowledge Base 3

Chapter 2: Background Research 5

Traditional Product

Planning

Process 5Phases andGates ofProduct

Planning

7Industry

Accepted Model 12HI: Traditional Product

Planning

isRarely

Done Well 13 H2: Traditional ProductPlanning

Done WellOnly

Generates IncrementalResults 19

H3: EvenifDoneWell, Traditional Product

Planning

Does Not Have the ProcessCapability

to Deliver BreakthroughProducts 23 Chapter 3:Primary

Research-Assessing

ProductPlanning

Processes 30Introduction 30

Analysis 34

VOC andMarket Input 34

ProductDefinition 36

Product Performance Compared to theCompetition 37

ProofofHI 38

ProofofH2 40

Chapter 4:

Using

Immersion toEnhance theProductPlanning

Process 43

Introduction to Immersion 43

Secondary

Research 44Hill-Rom's Riseas Bed Supplier for Acute Care Hospitals 44

Appleandthe iPhone: 47

Pratt & Whitney: 51

Steelcase: 56

3M- Lead Users 59

OnStar 63

Chapter5: Product

Planning

Approaches to Immersion 70Immersion "Pull" Approaches: 72

EthnographicStudies: 73

Ethnographic Techniques: 74

Interviewsand Surveys: 76

Immei adingEdge ApproachesforEarlyStage Product

Planning

(Deln roducts)

Table

ofContents

Continued

Lead User Engagements: 85

Immersion "Push" Approaches: 86

Virtual Reality: 87

Using

Avatarsforproduct planningpurposes: 89Alpha Labs: 90

Co-evolution: 93

Immersion Approaches Summary: 95

Chapter6: Immersionand Iterationprocess forBreakthrough

Products 97

Tradition Product

Planning

withImmersion; Phase1 a: High-levelStrategy

99Tradition Product

Planning

withImmersion-T3Pi 112

Immersion Delivers Breakthrough Products 112

Barriers in

Adopting

the Immersion Model 115Values, Processes &Resources 116

Culture 118

Lack ofCorporate Commitment 118

Lackof specific "immersionand

iteration"

skills 119

Financial Barriers 120

Time-to-Market Barriers 121

Summary

122Chapter 7: Capstone

Summary

123Chapter 8: Areas for Future Research 125

Appendix 1 : Questionnaire Resultsand Interview Notes 126

Appendix 1.1: Questionnaire 126

Appendix 1.2: InterviewResults 130

Appendix 1.3: Independent

Study

Kodak Results 131 Appendix 1.4: IndependentStudy

Xerox Results 132Appendix 1.5 Interview Notes 133

Appendix 2 Xerox Time to Market

(TTM)

Model 143Appendix 3: Kodak KECP

(1994)

Model 145Appendix 4: Kahn - Production

Planning

Essentials 2001 146Appendix 5: Academia Sources 149

Appendix 5.1: New Product Management

-Crawford & DiBenedetto 149

Appendix 5.2: Effective Innovation

-Don

Clausing

& VictorFey

149References 150

Websites 152

Immersion 8, Iteration I eadin

hrough Pi

Table

ofFigures

Figure 2.1: ModelofProduct

Planning

Pipeline 7Figure 2.2: Xerox Overviewofthe Time To Market Process 10

Figure 2.3: KodakOverview ofthe KECP Process 11

Figure 2.4: Traditional Product

Planning

Model 12Figure 2.5: APQC Performance Metrics 15

Figure 2.6:

Quality

ofExecution-Impact on Performance 16

Figure 2.7: High-Leverage Innovation Performance 18

Figure 2.8: NewProduct

Superiority

-Impacton Performance 22

Figure 2.9: VOC and Market Inputs

-ImpactonPerformance 27

Figure 3.1: VOCand Market Inputs

-Questionnaire Results 35

Figure 3.2: Product Definition- Questionnaire Results

37 Figure 3.3: Product Performance Comparedto the Competition

-Questionnaire

Results 38

Figures 3.4: Pareto ofCompanies Scores 40

Figure 3.5: CAGRvs.

Survey

Score 41Figure 3.6: CAGR vs.

Industry

Growth Rate 42Figure 4.1: Hill-Rom COMLinx Communication System 46

Figure 4.2: AppleiPhone 48

Figure 4.3: Steelcase PolyVision Interactive

Display

58Figure 4.4: 3MSteri-Strips 62

Figure 4.5: OnStar Console 64

Figure 5.1: Immersion Categories 71

Figure6.1: Traditional Product

Planning

Processw/Immersion Front-end 98 Figure 6.2: StrategicPlanning

coupled withImmersion & Iteration 106Figure 6.3: T3Pi Model 112

Table

ofTables

Table 2.1: PercentageofProjects in theDevelopment Portfolio 20

Table 4.1: Pratt&

Whitney

Opportunity

Scores 53Table 4.2: Ideas Generated

by

Pratt &Whitney

Team 54Table5.1: Cordis'

Angioplasty

BalloonOpportunity

Scores 83eakth

achesforEarlyStage ProductPlanning

Chapter

1:

Project Overview

Introduction

Newproductdevelopment isconsideredthe

"lifeblood"

ofanycompany,

driving

increased revenues, marketshare, andbrand recognition. Butnew competition, a

global marketplace, newtechnologiesandrapidly changing customerneedshave

created a marketplacethatmakes itdifficulttosucceed. Yetfirmsthat deliver just

onebreakthroughproduct or service can alter thefuture ofthecompany;

leading

tonewproducts, product familiesor even create a whole newindustry. A

breakthroughproductis definedas a productthatnotonly meets a customer's

unmet wantsand needs butalso delightsthe customerin awaythatcreates an

emotional connection and loyaladoption versusthe competition.

However, tryingtoproducea breakthroughproduct or service isverychallenging.

Benchmarkstudies haveshownthatahigh percentage

(30-40%)

of new productventuresfail. Themajor reasons citedfor failureare marketingor customer

related; thepoorexecution ofthe early stageintheproductplanning process,

lack ofcustomer-based ideasand the

inability

to understandthejob the customerneeds toget done.These tasks are part of atraditional productplanningprocess

thatmanycompanieshave incorporated in theirwork flow. It isthis processthat

presents a numberofproblems forcompaniesthatwishtodeliver breakthrough

[mini Iteration I eadin ining

Problem

Statement

Companies thatuse the traditionalplanning process use a varietyoftechniques

to capture customer wants and needs.These needs arecommonlyreferred toas

"Voiceofthe Customer" orVOC. The VOC produces product conceptsthatare

mapped to functionalrequirements via the

"Quality

Function Deployment"method or QFD. The product development communitythen usesthese

requirements to create a product or servicefor the customer.While this

structured process is clearlyvital forcontinued marketgrowth, it presents three

problems forfirms thatwant to

develop

breakthroughproducts.1. Thetraditional product planningprocess is rarelyexecuted well

2. Thetradition productplanningprocess when executed well oftendelivers

only incremental product improvements at best

3. Even ifdonewell, traditional productplanning does not have the process

capability todeliver breakthrough products

Research

Objective,

Scope,

Methodology

Thisresearch paper will assess the strengths and weaknesses ofthe three

traditional product planning problems stated above comparedto best-practice

industry

examples. Thefocuswill beon the early stages of process wheretheVOC's are

being

collected and interpreted. Theexamples will showthat when thetraditional product planning process isdonecorrectly, the process

typically

yieldstion: I <v geApproaches forEarlyStage ProductPlanning

existingproduct, notnecessarilya productthat isbreakthroughor onethat

ultimately delightsthe customer.

In orderto substantiatethese problems, several companiesaffiliated with the

MPDprogram will beinterviewed tounderstandtheirearlyphases ofthe

traditional productplanning process.An evaluation willbeperformedto

formulateconclusions aboutthe effectiveness oftheir approaches.

Thisresearch paperwill alsointroducesecondaryresearch examplesthat provide

evidence and validation of companiesthathave expandedthe traditionalproduct

planningprocess withnewtechniques thatdeliverbreakthrough productsthat

resonate with customers.

Finally, thisreport will analyzethe processes usedtodeliverthesebreakthrough

productsto determinetheuniquemethodologiesthesefirms have inplace. The

resultswillbesynthesized, providinginsight fortheresearch team to

develop

anew productplanningmodel. This modelwill be furthersubstantiated

by

comparing "best from

industry

consultants andbreakthroughproductexamples whose success canbeattributedto a new approachtoproduct planning

methods.

ValueAdded toKnowledge Base

Thevalue ofthis report will betoprovide additional capabilityto the traditional

lllllM

obtain and interpretthe unmet wants and needs of acustomer, resultingin

breakthrough products. To accomplish this, the research paper will...

Provide an independent studywith companies affiliated with theMPD

program, which will validate that the traditional product planningprocess

is a barrierto breakthroughproduct development.

Providea detailed model thatenables companiesto recognize and

interpret a customers unmet and unspoken needs. This model will then

feedintothe ideation phase ofthe traditional productplanningprocess.

Immi ition: Le sforEarlyStageProduct Planning

(Deli1 !

troughPro

Chapter

2:

Background

Research

Fortoday'srapidly changing marketneeds, the traditional planningprocessmay

notbegood enough. Moreneedsto be donetodeterminethe complete set of

customer requirements sincethe traditional planningprocess addressesonlythe

needs thatcustomersknowthattheyhave and can articulate. Christensen,

Anthony, Berstell, andNitterhouse

(2007)

noted that the root causethatinnovation isso failureridden isnotthat outcomes areunpredictable, butrather

that the fundamentalparadigms ofmarketingwe follow formarketsegmentation,

building

brands andunderstanding customersare broken. Thetraditionalproductplanningprocess provides a predictable methodology for stepping

througha process from concepttolaunchyetdoes not providethe tools, rigor or

emphasissurrounding thecustomer's experiencethat isessentialto

delivering

great products. Cooper

(2005)

statedthat "thetraditional processismarginal atbest."

Traditional Product

Planning

ProcessInhis book "Product

Planning

Essentials,"

Kahn

(2001)

noted product planningcanbe characterized asthetwoprocesses of product development and product

management. Product developmentrepresentsthe

"up

front" process, whereproducts are conceived, developed, produced, andtested.These activities occur

priorto aformal offering inthe marketplace (termed launch). Product

Immersion & (terai ge Appro hrough Prodi

commercialized, sustained, andeventually withdrawn. This includes launch

endeavors as well as activitiesthatoccur after launch. Within theseprocesses are

a series ofstages, phases, gates and eventsthat include explorationofnewideas,

screeningtoachieve a prioritized list of potential products, concepttesting, businesscaseanalysis, advanceddesign and development, testingtoensure

customer needs are met, and

finally

product launch.Thetremendouscost of research anddevelopmentandthe unpredictable nature

of new productdevelopment initiatives have driven most product development

companiestopursue some formof standardized approachto

developing

anddelivering

new productsto the market.Top

companiesknowthat themarketplace is abattleground thatshows no mercy to thecompaniesthatare

unableto providethevery best in products and services. Moreover, global

competitionhas increasedovertheyears makingit more difficulttodifferentiate

one's productfromthe competition. Companies arespendinglarge amountsof

theirprofit margins on research and development inefforts to comeupwiththe

next

big

thing.Companiescan no longerexpect thata new product concept going throughthe development process willbesuccessful. Theunpredictable nature of new product

development drovemanycompanies topursue some formof standardized

approachto

developing

anddelivering

new productsto themarket. A high levelof emphasis has been directedto change the simplistic,basic processes of

Immersion&Iteration: LeadingEcIl ichesfor Eai; Product

Planning

controlled process that the authors ofthispaper arecallingtheTraditional

Product

Planning

Process (T3P).Phases and Gates ofProduct

Planning

Overthepasttwodecades the traditionalproduct planningprocesshasevolved

intoaverysystematic,

highly

structured and regimented process designedtoevaluate a multitude ofinputsto theproductdefinition. Thisprocessentails

several important

"phases"

and

"gates"

thatflowin sequential ordertomanage

the development,

delivery

and refinement of new products. There isa checkpointor review after each phase where theproduct is testedagainst a set of criteria

specific to that phase.This check processistoweed-outanyproductthat willnot

beviable inthe marketplace. Thegoal istoevaluatethe

"many

ideas"

a company

haswith a set of customer requirements

sothatonlythe best,worth-whilenew

product ideasare developed

by

thecompany. Inother words, focusthe

company's scarce resources onlyon the

ideasthat havethe greatestprobability

to besuccessful in the marketplace. This

concept selection process canbethought

of as afunnel goingthrough the

Figure2.1 Model ofProduct Planning

production pipeline (Figure2.1).

(Graphicfrom Applied MarketingScienceInc.)

Product Definition

Target Technology Needs Design Identification Assessment Assessment Specification Concept

Development

'

Ideation Concept Concept [nine Screening Testing

Design&

Engineering Feature Prototype

Trade-On*

Evaluation

Go toMarket

Immersion& Iteration: I,e iduct Planning

Top

performingcompaniesclearly documenttheir traditional productplanningprocessto provide a common systematic pathfrom concept tolaunchsuchthat

all parties involvedhavespecific roles, responsibilities anddeliverables.

Therearemanyforms ofthe traditional product planningprocess. Textbooks

such asEffective Innovation

by Clausing

&Fey

(2004)

and NewProductManagement

by

Crawford &DiBenedetto(2005)

statethe process flowfromstart tofinishwhile describing, indetail, whateach phase consists of. A high

levelsummary ofthemajor phases is offeredbelow.

Phase 1

-Product Concept/ Definition /

Strategy

Phase 2

-Concept Generation

Phase 3

-Concept Selection / Evaluation

Phase 4

-Product Development / Robustness

Phase 5

-Technology

Transfer / LaunchMost companiestakea traditionalproductplanning process and modify itto fit

their culture,

industry

and workflow.They

alsotailor thesortingrequirements tomatchthe type of producttheyareproducingalongwithaddingtheirown

best-practices. Allthistailoring is doneto increasethe likelihood of

launching

asuccessful product. Infact, some firms believethat theirunique and customized

processes providethem a competitive advantage. All thesemodifications lead to

numerous variations ofthe process,making the"traditional product planning

process"

dingEdge ApproachesforEarlyStage Product Planning (Deli'\

process mayvary significantlyfrom companyto company, overallmostfollowa

similar phase gate approach thatbrings a concepttolaunch.

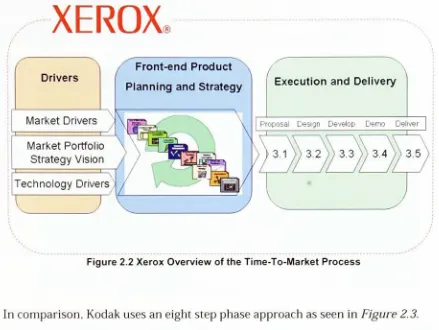

Two formal processes we reviewedtogain insighton the detailsofT3Pwere

Xerox's Time To Market

(TTM)

andKodak's KECP. Sincethescope ofthispaperisfocused onthe gathering andinterpretationofVoice ofthe Customer

(VOC)

onlythefirstthreephases are reviewedin detail.

Xeroxuses asix-step phase approach withthefirstphase

being

front-endproductplanningand strategy {Figure2.2). InthisphaseXeroxputs alot of effortin

reviewingeleven

key

factorsthat definethe boundariesoftheproduct/servicebeforea project proposal isreleased. FromthereVOC'saretranslatedto

engineeringrequirements viathewidelyused

Quality

Function Deployment(QFD)

method. QFD, alsoknownastheHouse ofQuality

(HOQ)

tiesproduct/servicedesign decisions

directly

tocustomer wants andneeds, i.e. theVoiceoftheCustomer (VOC). Atthispointtheproductflowsthroughdesign,

development, anddemonstrationtolaunch. Amoredetailed viewoftheXerox

[mm

XEROX.

Drivers

larket Drivers

Front-end Product

Planning and Strategy

Market Portfolio

Strategy Vision

Technology Drivers I

Execution and Delivery

Proposal Design Develop Demo Deliver ~

3.1

))

3.2 )) 3.3 )) 3.4 3.5Figure2.2 XeroxOverview oftheTime-To-Market Process

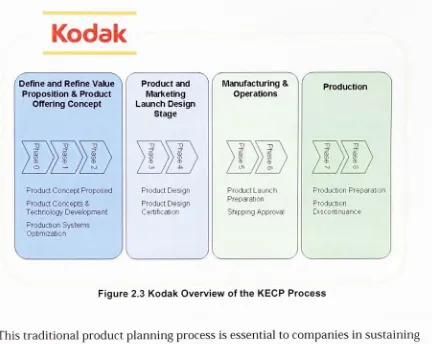

In comparison, Kodak uses aneightstep phase approach as seen inFigure2.3.

Instead of

having

onephase, likeXerox, Kodak hasthree phases inthefront-endbeforethe productdesign starts. Kodakalsohas more phasereviews inthe

deliver/launch phase. Amore detailedviewofthe Kodak KECP processis

provided in Appendix 3.

Clearly, howthecompanyviews theimportanceofa particularstep withinthe

[image:23.559.58.497.66.396.2]lachesforEarlyStage ProductPlanning

ltrough Prodi

Kodak

DefineandRefine Value Proposition& Product

OfferingConcept

Product Concept Proposed

Product Concepts & TechnologyDevelopment

Production Systems Optimization

Productand

Marketing

LaunchDesign Stage

Product Design

Product Design Certification

Manufacturing& Operations

Product Launch Preparation

ShippingApproval

Production

Production Preparation

[image:24.559.73.505.62.406.2]Producton Discontinuance

Figure 2.3 Kodak Overviewofthe KECP Process

This traditionalproductplanning processis essentialto companiesinsustaining

current product butit hassomeinherent flawswhenit comestoproducing a

breakthroughproduct. This ispartly because theinformationusedtocreate the

breakthroughproduct comesfromthecustomer. Thepoint is, accordingto

Ulwick (2002), customersshould notbetrustedto comeupwith solutions.

They

are nottheexpertswhen it comesto the innovationprocess. Theproblems

associated withthetraditionalproduct planningprocess will bediscussed in

Immersion & Iteration: I i Proclui I Planning

Industry

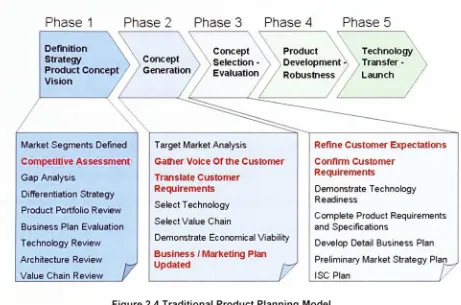

Accepted ModelA synthesizedviewofthe traditionalproduct planningmodel {Figure2.4),

incorporatestheconcepts ofXerox, Kodak, McGrath, Crawford &DiBenedetto,

Kahn,

Clausing

and Frey. The focusof our project will beon components ofthefirstthree phases, mostnotably competitive assessment,gatheringVOC,

translationofVOC intocustomer requirements, businessand marketing plans,

and refiningandconfirming customer expectations.

Phase 1 Phase 2 Phase 3 Phase 4 Phase 5

Definition Concept Product Technology

Strategy \ \ Concept \ \selection- \ \Development

-> >Transfer Product Concept /

Generation/

/ EvaluationVision

Market Segments Defined

Competitive Assessment

GapAnalysis

DifferentiationStrategy

Product Portfolio Review

Business Plan Evaluation

Technology Review

Architecture Review

Value Chain Review ]/

Target Market Analysis

Gather Voice Of the Customer

Translate Customer Requirements

SelectTechnology

Select Value Chain

Demonstrate EconomicalViability

Business /MarketingPlan Updated

F

Refine Customer Expectations

Confirm Customer Requirements

DemonstrateTechnology Readiness

Complete Product Requirements

andSpecifications

Develop Detail Business Plan

PreliminaryMarketStrategyPlan

ISC Plan

Figure2.4 Traditional ProductPlanning Model

Inthe next section we will discussthree

key

hypotheses the traditionalplanningprocess presentsfor firms involved innew product development. These

hypotheseswill beused inconjunction with data fromthe American

Productivity

and

Quality

Center(APQC)

andindustry

consultant Robert Cooper. The APQC [image:25.559.58.519.257.562.2]Immi I Leading Product Planning

(Deli1

inthe productdevelopmentprocess. These activitiesinclude; theVOC and

market inputs, product superiority, product developmentportfolios, working

with customersthroughout the development process, andworking with

lead-users.

Focusing

onthesekey

areaswill provide insight intohowcompaniesgather VOC needs, definerequirements, andinteract with customers. Thereport

will provide examples of eachproblem, validatethe exampleswith

benchmarking

data, and summarizeits

key

findings.HI: Traditional Product

Planning

isRarely

Done WellFor nearlytwo decades companies haverelied onthe traditionalproduct

planningprocess, using traditionalVOC/QFD methodologytoguide new product

innovation. Yet, new productfailure rates are stillhigh andbreakthrough

innovationsare still rare. Thissectionwilldiscuss Cooper'sviewonthe execution

of"recommendedbest approachestoproductplanning, inputfromNeal

(2002)

onthe areasthathave beenproblematic forthemarket research phase ofproduct planning, and data fromtheBooz-Allen-HamiltonGlobal Innovation

1000survey thatshows companiesspend lessonR&D,yet out-pace their

industriesacross a wide-range of performancemetrics.

Cooper

(2005)

showed thatfor everyseven new product ideas, aboutfour enterdevelopment, 1.5 is launchedand onlyone succeeds. Ofthe initiativesthat do

succeed, onlya fewaretruly innovative. The analysis will showthat firms are

ineffective at capturingand

interpreting

customerrequirementsand reflectingImmersion & Iteration: LeadingEdge Appro lucl Planning

Cooperalso investigatedwhysome businessesare betterat new product

developmentthanothers. Cooper

(2005)

usesthe term "best todescribe firms thatconsistentlywin the waron productinnovation.The names of

thesefirmswill soundfamiliar: companies such as Proctor& Gamble, 3M, Apple,

GE, Johnson &Johnson, and Kraft Foods. Those firms not viewedas winners are

firmsthat introduceextensions or incremental improvements ofexisting

products, where profit and growthfrominnovation are smallerthan

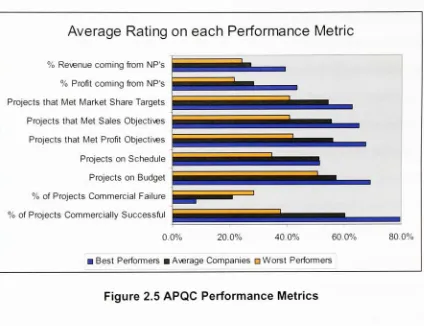

breakthrough products. Throughthe APQC studies, best performing businesses

were selected basedon theirperformance on metrics

including

successrate,failurerate, on time, onschedule, etc. (Figure 2.5), forprojectsthat enteredthe

development phase.

Thetop 20%offirms (for eachmetric) were definedas the "bestperformer,"

the

bottom 20% were definedasthe"worst and those inthe middle of

the pack weredefinedas

"average."

Considerthe percent offirmsmeeting profit,

sales and market share objectives. Thefactthat the average valuesfor all three

ining

Average

Rating

on each Performance Metric% Revenue coming from NP's

% Profit comingfrom NP's

Projectsthat Met MarketShare Targets

Projectsthat MetSales Objectives

Projectsthat Met Profit Objectives

Projects onSchedule

Projects on Budget

% ofProjects Commercial Failure

% ofProjects Commercially Successful

0.0% 20.0% 40.0% 60.0% 80.0%

Best Performers Average Companies ?Worst Performers

Figure 2.5 APQC Performance Metrics

Nextconsiderthedistributionoftheresults: thetop performers achieved a 50%

increaseinperformance over theworst performers. Alsonote thegap between

bestand worst performersforpercent of profitfromnew products (43.6%vs

21.6%). Thesegaps suggest thatmany businesseshavea

long

waytogo to beconsideredbestperformers.

Forall metrics, the best performers scorehigherthanthe worst.

By

comparingbesttoworst, firmscan

identify

bestpracticesas abasis forbenchmarking

studies. We used Cooper's benchmark data tohighlightproblems with the

traditional productplanning processand as a benchmark for ourinterviews.

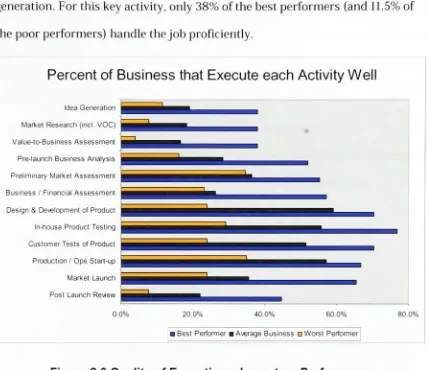

Cooper (2005) noted thatwhile productdevelopmentis often thoughtof as a

[image:28.559.71.495.55.381.2]Immersion& Iteration: LeadingEdge Approache Product Planning

frequently

kill products.The data in Figure 2.6 from Cooper's(2005)

bookonProduct

Leadership

showsthat only 19%of average businessesexcel atideageneration. Forthis

key

activity, only 38% ofthebest performers (and 11.5% ofthe poor performers) handlethejobproficiently.

Percent of

Business

thatExecute

eachActivity

WellIdea Generation

MarketResearch (incl.VOC)

Value-to-Business Assessment

Pre-launch Business Analysis

PreliminaryMarket Assessment

Business/ FinancialAssessment

Design & DevelopmentofProduct

In-house ProductTesting

Customer TestsofProduct

Production/OpsStart-up

MarketLaunch

PostLaunchReview

0.0% 20.0% 40.0% 60.0% 80.0%

[image:29.559.61.489.118.488.2]IBestPerformer Average Business?WorstPerformer

Figure 2.6

Quality

of Execution - Impacton Performance

The dataalsoshowsthatonly18.3%oftheaverage businessesexecute the market

research/VOC planning stagesofthe productdevelopment process properly. On

topofthat only 37.9%ofthe bestperformers executethis phase well.

By

contrast,the technical work on theseprojects has muchhigherratings. Thethreebest

activitiesaretechnicaldevelopment, in-houseproducttesting, and production

start-up.

Clearly

the frontend ofthe projectisexecuted more poorlythan thewhile 42.3%ofthe back-end activities are well executed. Allthreeofthe top rated

activities occurintheback-end oftheprocess,whilethe threeworst, Idea

Generation, MarketResearch, andValue-to-Business, occurinthe front-endpart

oftheprocess where products are defined.Also, Cooperreferenced Crawford

(1979), who hasundertaken perhapsthe mostthoroughreviewof new product

failurerates, as saying35% of new productsfail

largely

duetopoor execution inthe planningstage.

Neal

(2002)

noted therewere twokey

areasthathave beenproblematic forthemarket research phase oftraditionalproduct planning:

1.

Marketing

researchispoorlyfunded, where somecompanies considerspendingon market research anexpense, not an investment inrisk

reduction.

2. Companies aretoo oftenrushedtoget new products outthataretheresult

of poorplanning orweakstrategies.

Conventionalwisdom oftenviews R&D as a predictableblack boxthat

automaticallytranslatesideasinto successful new products. Suchwisdom also

holdsthat strategiesthatfocuson

increasing

R&Dspends willlikely

maintaininnovativegrowth. Evidence contrarytothese notions is thestudies conducted

by

Booz-Allen-Hamilton

(2006)

on theGlobal Innovative 1000 firms. Thesecompanies might not

develop

thehighest number of products or services, buttheyconsistentlyreapthe greatest financial returnfrom every dollar theyinvest

Immersion & Iteration I > (Deli\

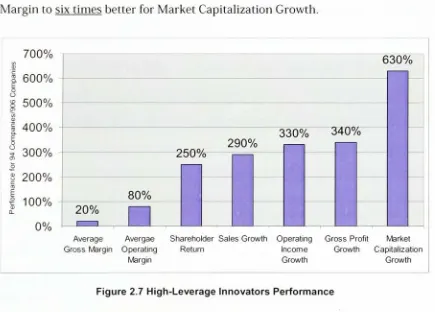

1. Lessthan 10 %of companies arehigh leverageinnovators

Only

94 ofthe Global Innovation 1000companies achievedsignificantlybetterperformance per R&D dollarover a sustained

five-yearperiod

These innovatorsspend (as a percentage ofsales) about 44%of what theother

906 Global Innovation 1000 members spend onR&D. Buttheyconsistently

outperformthe median intheir

industry

forsuch variables as salesgrowth, grossmargin percentage,gross profit growth, operating marginpercentage, operating

incomegrowth, totalshareholder return, and market capitalization growth as

showin Figure2. 7below. These results rangefrom 20% betterin AverageGross

Margin tosix times better forMarketCapitalization Growth.

700%

600%

500%

400%

300%

200%

100%

0%

630%

250%

290%

330% 340%

80%

20%

i i

Average Avergae Shareholder Sales Growth Operating Gross Profit Market Gross Margin Operating Return Income Growth Capitalization

Margin Growth Growth

[image:31.559.56.491.347.659.2]LeadingEdgi tchesforEarlyStage ProductPlanning Products)

These high-leverage innovatorsand companies with thebest overall performance

distinguishthemselvesnot

by

the moneytheyspend, butby

the capabilities theydemonstrate in ideation, projectselection, developmentand commercialization.

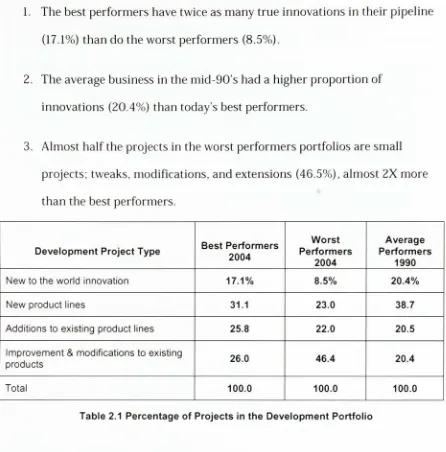

H2: Traditional Product

Planning

Done WellOnly

Generates IncrementalResults

Companieshave

difficulty

executingthe traditionalproductplanningprocess, aspreviouslynoted.

During

the mid-90's, growth wascomingthroughchangestoexisting products, wherethe demands and rewardsforincremental improvement

spurred companiestofocus on current products. Cooper

(2007)

statedthat ifproduct innovationwereeasy, halfthecompanies intheU.S. and Europewould

be

incredibly

wealthyand others would notbedoing

so well. Coopers datashowedthat the bestcompanies see 47.6%of annual sales and 49% of annual

profits coming from new productdevelopment. Nationally,U.S. companies spend

about 4.9%of sales onR&D, anumber thathas not changedfor decades. What

havechanged are sales revenues returns fromthese investments. New product

revenueshave dropped from 32.6% in 1990to 28.0% in 2004.

Themajor reasonforthis

drop

in revenueisthe failureofmany firmstoinvest inbreakthroughprojects.

Why

is this? Cooper(2007)

noted the majorissuewasinvestment

by

projecttype. Thedatashowedthat thebest performingcompanieshave higher value projectsin theirdevelopmentpipelines, and a muchbettermix

1. The bestperformershave twiceasmany true innovations intheir pipeline

(17.1%)

thando theworst performers (8.5%).2. Theaverage business in the mid-90'shada higherproportion of

innovations

(20.4%)

than today's bestperformers.3. Almost halfthe projects in the worst performers portfolios are small

projects; tweaks, modifications, and extensions (46.5%), almost 2X more

than the best performers.

Development Project Type Best Performers 2004

Worst

Performers

2004

Average

Performers

1990

Newto theworldinnovation 17.1% 8.5% 20.4%

Newproduct lines 31.1 23.0 38.7

Additions toexisting productlines 25.8 22.0 20.5

Improvement&modificationstoexisting

products 26.0 46.4 20.4

Total 100.0 100.0 100.0

Table2.1 PercentageofProjects inthe Development Portfolio

Whatarethe causesfor thisportfolio shift inthe past15 years? Cooper's

(2005)

studiesidentified established roadblocks such asreducingtime-to-market, urgent

customer request andmaking thequarter-by-quarter. However, the biggest

roadblock wasthe lack ofbreakthrough, innovative, creative,game-changing

ideas inthe

firms'

pipeline.

Eveniftheseroadblocks are removed, whyare companies

investing

along theselinesof projecttype? Cooper

(2005)

statedthat "me too" [image:33.559.49.495.58.510.2]Immersion&Iteration: LeadingEdge Approaches for

EarlyStage Product Planning (Deln

ratherthan theexception ofmanyfirms' new productefforts, andtoooften,

companies assumethatproductfeatures and

functionality

arethesame ascustomerbenefits, when infacttheymay beoflittlevalue to thecustomer. The

threemost common scenarios associated with poor performance are:

1. Copycatprojectsthatyieldboring, undifferentiated products

2. Extensions, modifications, and minor improvementsthat is easyand often

urgentlyneededto

keep

the product line"fresh."

3. Technology-driven projects, wherethe technicalcommunity decideswhat

the customer wants

(technology

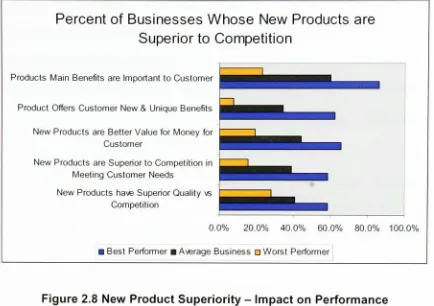

push)In Figure2.8, Cooper's

(2005)

datashowsthateventhe bestcompanies whofollowthe traditionalproduct planning process are superiorinmeeting customer

needsonly58%ofthe time

-on average a 40-42%failure rate.

The

key

data points showedthatwhile 60% oftheaverage performer's mainbenefits areimportant to thecustomer, only 34.3%ofthe average performers

offer new and uniquebenefits, 38.8%oftheaverage performers are superior to

thecompetition in meetingcustomerneeds, and 40.6%oftheaverage performers

have superiorqualitythantheircompetition. The numbersforthe average

Iinnn

Percent

ofBusinesses Whose

NewProducts

areSuperior

toCompetition

Products Main Benefitsare Importantto Customer

Product Offers CustomerNew& Unique Benefits

New Products are BetterValue forMoneyfor Customer

New Products areSuperiortoCompetition in

MeetingCustomer Needs

New ProductshaveSuperiorQualityvs

Competition

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

[image:35.559.56.490.65.371.2]Best Performer Average Business ?Worst Performer

Figure 2.8 New Product

Superiority

- Impacton Performance

As a result of

investing

thisway,firms arespending R&D moneytoproduceprojectsthat are not capturing intendedmarket share (poorproduct

performance). This is a

bankruptcy

scenario, where firms havemadethe same level ofR&D spendingforwell over ten years, fora lowerreturn oninvestment,resultingin incrementalprojects thatjustaren't

delivering

value tocustomers.Thereare two major reasonswhythe traditional planning model producesthe

results shown above. First, the model focuses on short termincrementalproduct

improvementsbecause thatiswhat company's want and it is whattheirstrategies

tell them to do

-it is built intothe firms'

corporate culture. Investment

by

projecttype

directly

ties intothe shortterm quarter-by-quartergrowthWall Streetage ProductPlanning

describe

-theirknowledge isrelevantonlyto the current productstheyhavein

their shop. Thisone-two punchis aself-reinforcing

loop

thatwillnotbreakunless firm's have thewherewithal and couragetorecognize that a problem exists.

Beforea patient with chronic illnesscan bemade healthy,theyfirstmust

recognizethey haveproblem.

Unless afirm can create breakthroughideas, the trendinthe datashown

by

Cooperwill continuebecausetheorganization will not havebreakthrough

projects towork on (no ideas, noprojects, and no senior management support).

It takes immersiontocome up with gamechanging ideas.

H3: Even ifDone

Well,

Traditional ProductPlanning

Does Not Have theProcess

Capability

to DeliverBreakthrough ProductsConfusion can permeatetheproduct developmentprocess becausethe

difficulty

in understanding customer's needsis often acostlyand inexact process. Even

when customers knowwhat theywant, they cannot communicateor transferthat

knowledgeclearly or completely. Consequently, the customer offers requirements

in alanguage that is familiar tothem; unfortunately, that

"language" is not

particularlyharmonized withthe creation ofbreakthroughproducts.

Additionally, companies continuetodefine "requirements" as any kindof

customerinput; wants, needs, benefits, solutions, ideas, desires, demands,

specifications, etc. Ifyouwant to

develop

breakthrough products,following

thelinn

traditional process doesnot have the processcapability tocollectthe typeof

requirementsthat create breakthrough products, and costs offailure in the

traditional process arehigh. Ulwick

(2005)

noted that newproduct failures costmorethan $100 billion dollars toUScorporations a year.

There isadditional proofthat the traditionalproductplanning processitselfdoes

nothavethe process capabilityto producebreakthrough products, and thatfine

tuning

itwon't work either. Thomke and von Hippel (2002, pg6) stated thatproduct development "is oftendifficult becausethe needed information (whatthe

customerwants) resides with thecustomer and the solution orinformation (how

tosatisfythose needs) lies withthe manufacturer. Traditionally, theonus has

beenwiththemanufacturerto collectthe needed informationthrough various

means,

including

market research and informationgatheredfromthe field. Theprocess can be costly and

time-consuming

becausecustomer needs are oftencomplex, subtle, andfastchanging. Frequently, customers don't

fully

understandtheir needs untilthey tryout prototypesto explore whatdoes, anddoesn't

Thetraditionalproductdevelopment process can be a

long

drawn-out churn oftrial and errorbetweenthe product manufacturer and the customer. Sometimes

the manufacturerdevelopsa prototype based oninformation from thecustomer

thatdoesnot produce breakthroughconcepts. Thecustomer and manufacturer

iterate backforth between flaws, softwarebugs and corrections.

Following

thetraditional model, this cycle repeats itselfuntilthecustomer issatisfied often

luct Plain

shorten the cycle?What is missingin theplanningprocessbetween a company

that deliversgood products and one thatdeliversbreakthroughproducts?

One factorstands out above all others inthe traditionalproductplanning

process; ironically, it istheinputs fromthe customerthat is not reliableas the

sole source for breakthroughproduct development. Whencompanies gather

customer requirementstheydo notknowwhat typesofinputsthey needto

obtainfrom the customer. Norcanthecustomer describethe

"unexpected"

or

"delight"

featuresthat make a product greatbecausethe customer's reference

pointis theperformance ofthecurrent product.Yetthere are new approaches

thathave been developed thatcould expedite theproduct developmentprocess.

Thomke and vonHippel created a customer-as-innovator approach wherethe

manufacturer or productdevelopersuppliesthe customer withtoolssothat the

customer candesign and

develop

theapplication-specific part ofthe product ontheirown. This does not eliminatethe needtodeterminehow theproduct should

work; rather itmakes product developmentbetter and faster fortwo reasons.

First, firms canbypassthe expensive and painfulmistake-prone processto

understandthe customer needsin detail. Second, thetrial-and-error cycles that

unavoidablyoccur

during

productdevelopment can move muchfaster becausethe iterationswill beperformed solely

by

the customer. Butdeveloping

the righttool kit for customersis

hardly

a simple matter.Specifically, toolkits must provide fourimportant capabilities. First theymust

1mm ation I eadini

kthiough

whatdoesand doesn'twork.This issimilar tocomputer simulation where

customerscan

try

outdifferentscenarios withouthaving

to manufacture theproduct. Second, tool kitsmust be user-friendly suchthat customers do not

needto undergo extensive

training

in ordertousethe tool kit. Third, thekitsmust contain useful components and modules thathave beenpre-tested and

debugged in order tosave customers from re-inventingthe wheel. Lastly, these

kitsmust contain information aboutthecapabilities andlimitations ofthe

process toensurethe customer's designwillbe somethingthe supplier can

produce. Thereisalsohard data thatsupportsthelack of processcapability in the

current product developmentprocess.

Cooper

(2005)

noted that there arefive marketing best practices identified intheirAPQC

benchmarking

study, as shown inFigure2.9Cooper's datashowsthatfor the "average business" only 11.4%useMarket Research, 17.3% study

Buyers'

Behaviorand only 26.3% maintainthecustomer

learning

experiencebeyondthe initialVOCeffort. A closerlookatthe datashows only 15.4%ofthe

worstperformers workcloselywithcustomer's,

hardly

12.0%work withlead orinnovative customers, and0%of worst performers define productsfrom market

research.

Cooper (2005, pg 179) notedthe major reason forthese poor grades wasthe

failure

by

firms to "adopt astrongmarket orientation in product innovation, anunwillingnessto undertake theneeded marketassessment, and

leaving

thecustomersout oftheproduct developmentspell disaster. It'slike abroken record:

throuel

roachesfi : Product

Planning

markets, and marketlaunch; and inadequateresourcesdevoted to marketing

activities are common weaknessesfoundinvirtuallyevery studyofwhynew

products fail."

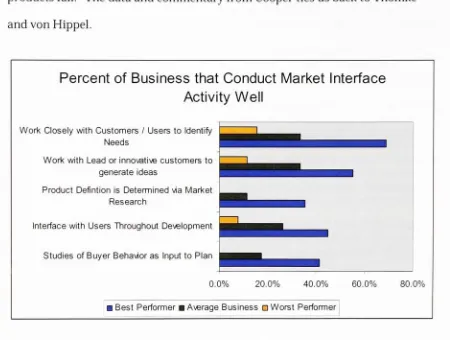

Thedataandcommentary from CoopertiesusbacktoThomke

and vonHippel.

Percent

of Business thatConduct

Market InterfaceActivity

WellWork Closelywith Customers/Users to Identify

Needs

Work with Leadorinnovativecustomersto

generate ideas

Product Defintionis Determinedvia Market

Research

Interfacewith Users Throughout Development

Studies ofBuyer Behavioras Inputto Plan

IBest Performer Average Business ?Worst Performer

[image:40.559.62.512.130.470.2]0.0% 20.0% 40.0% 60.0% 80.0%

Figure 2.9 VOC and Market inputs- Impacton Performance

The Cooper input showsfewproductdevelopersworkcloselywithcustomers,

and Thomke re-affirmsthat the traditional productdevelopment is a

long

andcostlyprocess oftrial and error. Also, fewcompanies workwithleaduser because

thetool kitneeded to

develop

new products requirescomplicated, robustengineeringpractices. Lastly, oftheworstperformers

-nobodydefines a

productthrough market research. How can you builda successful new product

Inn u

want to affordthe time and expensetodeliver breakthrough products, in factthe

traditional processtells themnotto.

Market research as a

key

tool tohelp

define the product throughoutthedevelopment cycle maybeacostly, lengthy,and iterativeprocess, butcontinued

customer contact isessential for breakthroughproduct development inthe

market.

Our

key

summaryofthe problemsfacing

the traditionalproduct developmentprocess arethe following:

1. Overthe last 15yearscompanies arespending thesameamount of sales on

R&D

(4.9%)

fora smaller return ontheirinvestment.2. Thetraditional productdevelopment processfocuseson incremental

resultsdriven

by

theneed forshortterm profits (WallStreeteffect).3. The lack ofbreakthrough, game-changing ideas inthefirm's product

development pipeline. It is herethat the team will provide a new model,

applying immersionthat isused as an input to the traditionalproduct

development processto

help

generate breakthroughproducts.Inthe next section we will discussinterviews withlocal firmssuch asXerox,

Kodak, Corning, DirectMail

Holding

andJohnsonand Johnsonthatvalidate theproblems with the traditionalproduct process. This willbe followed, in

pproachesfor Earl Product Planning

secondarycase research of

highly

innovative companiesthat haveappliedthisChapter

3:

Primary

Research

-Assessing

Product

Planning

Processes

Introduction

Inorder tovalidate

Coopers'

claims stated earlierthe researchteam performed

interviewswith localcompanies affiliated withthe MPDprogram. Thetarget

interviewees were people whose roles and responsibilities involvedcollectingand

interpreting

VOC's.Aquestionnaire was created tospecificallyfocus onthree

key

areas in the productdevelopment process: "voice ofthe customer /market inputs", "product

definition", and "productperformance against competitive

products."

Thequestions in "voiceofthecustomer /market

inputs"

section aredirectedat

howwell companies obtain customers needsthroughclose interactionwiththe

customer, work withinnovativeusers, marketing actions,marketstudies,

customer tests, fieldtrials and studies of customer

buying

behavior.The questionsin "productdefinition" section are pointed at

defining

the targetmarket, the concept, benefits, features, specs, requirements andpositioningof

the product earlyinthe developmentcycle. Also howwellcompanies ensure

Imnii lachesforEarlyStage ProductPlanning

Thequestionsinthelastsection "productperformance againstcompetitive

are todefinetheproductsabilitytomeetthe customersneeds andhow

itcompares to thecompetition and its'

unique customer value.

Focusing

the study onthesethreekey

areas will provide a close insight into howthe localcompanies gatherVOC'sand definerequirements forproductstomeet

thoseneeds. In addition, itwill also enable a second validation ofthe data Cooper

collected.Thequestionnaire was supplied inadvanceto the intervieweestoallow

sometime todigest theinformation. Then

during

thecourse oftheinterviewthequestionnaire was completed.

Additionally

as part of a separateindependentstudy theauthors puttogether anelectronicsurveywiththesame questions and sentit outto alargergroup within

KodakandXerox forcomparison. Therange of peoplesurveyed was also

increasedto includenotjust marketingpeople butproject managers and

engineers.The decisionwasto includethisinformation in thisresearch paper to

bettersupport thestudy.

Therewere atotal of34 respondentsforboththesurveyand theinterview

questionnaire withthe majority ofthem

being

in the market area.Thecompanies interviewed are asfollows:

f

f"YRNTNCr

Corning

Incorporated isanAmerican manufacturerofglass, ceramics and related materials, primarily for industrial and scientific

Immersion <V Itei

employsabout 25,000 people worldwide with annual revenue as of2006 of$5.17

billion.

dEfth

Direct Mail Holding, LLC(DMH)

is afull servicedirect mailcompanythat mails over 1.5 billion piecesannuallythroughservingthe

fundraising, financial, healthcare, publishingand consumer products markets.

Direct Mail Holdingsis a companythatwasbuilt through acquisition. Itincludes

Alaniz LLC in Iowa, Focus DirectinTexas,Mail America inVirginia,

International DataManagement inOhio, andCreative

Mailing

andMarketing

inOklahoma and California, Diamondback Direct in Maryland and Shanghai, China.

The privately heldcompany's revenues now exceed $140 millionannuallyand it

employs morethan 1200people.

y Space Systems Division

(SSD)

is aleader in remote sensing,V ITT

command and controlsystems, satellitecommunications, tactical

warning/attack assessment,and space launchservices. Headquarteredin

Rochester, NewYork, SSD provides commercial and government customer'shigh

performance, bestvalue remotesensingproducts and services. Thebusiness

leverages corporate resources and employs over 2,600people worldwide.

%[

g>\f\2*Jkjr Eastman KodakCompany

is an American multinationalpublic companywhich producesphotographic materials and equipment.

Long

known for itswide range of photographicfilm products, Kodak hasfocused in

recent years onthreeprimary markets: digital photography, healthimaging, and

Immersion &Iteration lachesforEarlyStageProductPlanning

51,100

(2005)

and istheworld's foremostimaging

innovatorwith sales of$10.7billionin 2006.

t_ . _.. , , _ . Ortho Clinical Diagnostics isaJohnson & Ortho-Clinical Diagnostics &

aMHtHOlmfoWttOM company _ -

,__-i i i r

Johnsoncompany.

They

arealeading

provider olhigh-value diagnosticproducts and services forthe global health care community.

Ortho Clinical Diagnosticscorporate offices are in Raritan, NewJersey, while

theirmain research

facility

is in Rochester,NewYork.Thebusiness hastwomajor segments: Transfusion Medicinewhichis involved inscreening human

blood, and ClinicalLaboratories, whichdoes avariety of chemicaltesting.

.^_. . Sensis Corporation is a global provider ofsensors,

flSensis

informationprocessingand simulation andmodelingthat

advancehuman security,safety andhealth. TheSyracuse, NYbased company has

offices acrosstheworld, andtechnology deployed in morethan25 countries

acrossfivecontinents, theprivately-held companyoffers innovativesolutionsfor

airdefense, airtraffic control, airline and airport operationsmanagement, and

dataintegrationanddistribution.

V I

,IJf^Y

Xerox Corporation is aglobaldocument managementcompany, which manufacturesand sells a range of color printers,

black-and-white printers,multifunction systems, photo copiers, digitalproductionprinting

presses, and relatedconsultingservices and supplies. Xerox is headquartered in

[mini .i.l eaditij pproaiIn (Delh

around Rochester, NewYorkemploying-53,700

(2006)

withan annual revenueof$15.9 billion USD

(2006)

Analysis

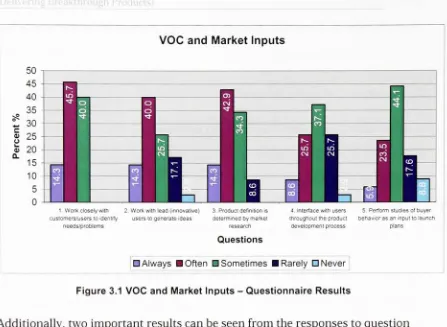

Thedata from thequestionnaire hasbeen tabulated anddisplayed in graphical

form below. Acopy ofthequestionnaire and all theinterviewnotes can be found

in Appendix1ofthisreport.

VOC and Market Input

The data in Figure3.1shows thatall scores arevery low

(<15%)

forthe'always'

category. This indicatesthat the current processesthecompanies areperforming

are not

being

carried out efficiently. Thisresult issurprisingsincethe companiessurveyed have been using theirproduct planningprocess foralmosttwo decades.

Onewould expecttheiranswers toberated much higher.For example, question

#1, workingcloselywithcustomersto

identify

needs and problems is rated 45.7%for" often"

and 40.0%for "sometimes."

Acompany striving to bea best

performer should havethe highest percentagesinthe

"always"

category, not

"often"

or

"sometimes."

This performance would beunacceptable ifthiswere a

tageProduii Manning (Deli

VOC and Market Inputs

gj

t

1

1

1 Work closelywith 2 Workwithlead(innovative) 3.Producl definitionis customers/userstoidentify userstogenerateideas determinedbymarket

needs/problems research

Questions

4 Interfacewith users 5 Performstudiesofbuyer throughout the product behavior asaninputto launch

development process plans

I Always Often ? Sometimes Rarely ? Never

Figure 3.1 VOC and Market Inputs- Questionnaire Results

Additionally, two importantresults canbeseen fromthe responsesto question

four,