Optimal income tax enforcement in the presence of tax avoidance

Full text

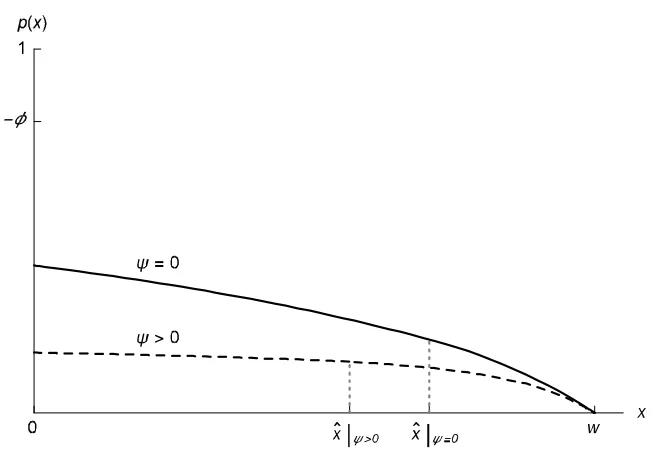

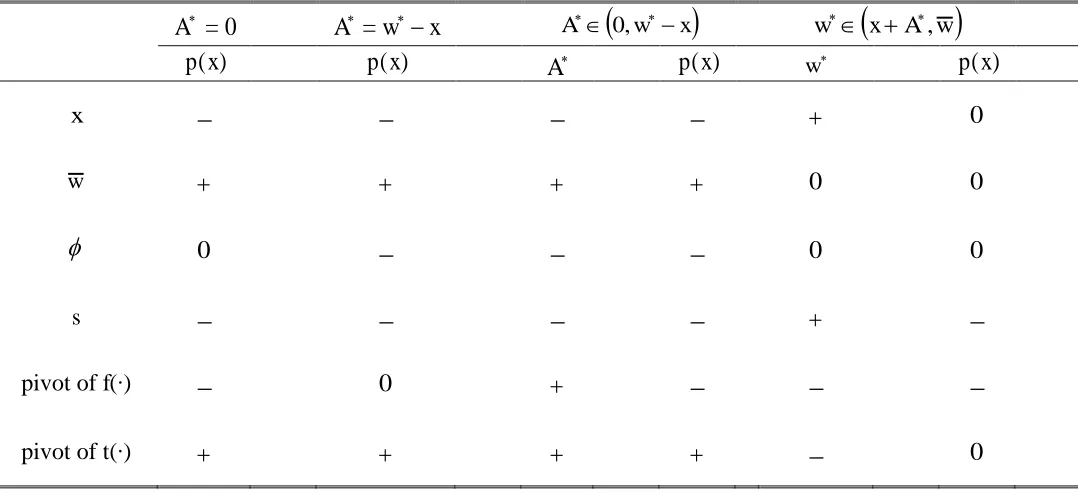

Figure

![Figure 1(a): Audit function for A*� (0, w* – x].](https://thumb-us.123doks.com/thumbv2/123dok_us/7750254.167277/15.612.169.439.92.282/figure-audit-function-w-x.webp)

![Figure 2(a): Audit function for w*� (x + A*w�, ].](https://thumb-us.123doks.com/thumbv2/123dok_us/7750254.167277/17.612.174.448.314.680/figure-audit-function-w-x-w.webp)

Related documents

For tax years beginning on or after January 1, 2004, income tax return preparers who completed 200 or more original Massachusetts Forms 1 and 1-NR-PY, including those e-filed,

Turning to the intermediary goals of ownership, pro- poor effectiveness and accountability, surely there will be chances to also contribute to these and hence to the other

[r]

CHASE High School’s athletic program is truly one of a kind and made up of incredibly hard working students, coaches, and community members who come together to give

After using restriction enzymes and ligase to insert the double-stranded cDNA into a suitable vector (Fig. 9.10d) and then transforming the vector-insert recombinants into

In: Building an Inclusionary Housing Market: Shifting the Paradigm for Housing Delivery in South Africa (Report on. the Public Hearings on Housing Finance, 31

Brand: Advertiser: Category: Campaign Period: Creative Title: Episode: Country/Language: Genre: PPL(Product Placement) Title Info Campaign Info True Beauty 74 Thailand/TH,

Contrary to the findings of Kinkeldey & Schiewe (2014), most respondents agreed that visualization of uncertainty will not devalue the perception of a