Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 105 -

BLOCK DEALS AND SHARE MARKET PRICE MOVEMENT

Dr. Yagnesh M Dalvadi, Faculty

PG Department of Business Studies,Sardar Patel University, Vallabh Vidyanagar.

Rupesh.B.Darji,

Lecturer

Anand Mercantile College of Science, Management and Computer Technology, Anand.

Abstracts

A stock market typically refers to a financial market that handles the buying and selling of company stocks, derivatives and other securities. Stock markets trade company securities that are listed in the stock exchange. Block Deal is important event of stock market as shares of lakhs of rupees change the hand. We can see the information of block deal that taken place in the stock market in Business TV Channels and the daily business news paper in detail. How investors reacts such news? Does it make an strong impact on cash market share prices? This study is focuses on what are the various legal provision regarding Block Deal? What is the importance of such information? How the new investor should react to such information of block deal? How the stock market reacts in case of such block deals? This research will helpful to investors of stock markets and people in general. The said research work is analytical in nature and based on secondary data only. Purposive sample method has been used for the study.

Key Words: Block Deal, Stock Market Price Movement

Introduction

According to Securities and Exchange Board of India (SEBI) “A trade, with a minimum quantity of five lakhs shares or a minimum value of Rs.5 crore, executed through a single transaction through a separate window of the stock exchange constitutes a block deal”

The basic idea of block deal was to facilitate execution of large orders by providing separate trading window for block deals. SEBI came out with guidelines pertaining to block deals in September 2005.

Block Deals can be taken as pointers for the average investors. A block deal is carried out by Big Traders, Private Equity Firms, and Mutual Fund Houses etc. who have fat pockets and have their management all churning out information about the potential advantages of the Deal.

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 106 -

Research Methodology

Scope of Research Study

Thepresent study has undertaken to study the impact of Block deals on share price movement of listed companies of BSE. For this purpose, the share price before the proposed block deal dates have been examined of 25-1-2007, 25-04-2007, 25-07-2007 , and 25-10-2007. The said research work is analytical in nature and based on secondary data only. Purposive sample method has been used for the study.

Objective of The Study

The main objective of the study is to understand the impact of block deals on stock price movement and to suggest the investors whether he/she should purchase hold or sell the shares.

Guidelines of SEBI for Block Deal

(1) Separate trading window would be kept open for a limited period of 35 minutes from the beginning of trading hours 9.55am to 10.30 am.

(2) Orders should be placed at a price not exceeding +1% from the ruling market price or previous day’s closing price.

(3) An order should be for a minimum quantity of five lakhs shares or minimum value of Rs.5 crore.

(4) Every trade executed must result in delivery and shall not be squared off or reversed. (5) Stock exchanges should disseminate the information on block deals to the general public on

the same day after market hours. This should contain information bits like name of the scrip, name of the client, quantity of shares, traded price and so on.

Brokers need to disclose block deals transacted on BSE on a daily basis through DUS (data upload software). If it is a single trade, brokers need to inform immediately on execution of the order. They have to submit the required data on cumulative trades or multi-trades within one hour from the closure of the trading hours.

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 107 -

Block Deal and Its Impact on Share Price Movement

Block Deals and Share price movement as on 25-01-2007

Name of the company

Reporting Date

Quantity

Traded Average Price

Total Value (Rs.In crore) ICICI Bank

Ltd. 25-01-2007 385403 985.00 37.96

Bharti Airtel

Ltd. 25-01-2007 1288452 710.80 91.58

Reliance

Industry Ltd. 25-01-2007 595668 1370.00 81.6

Zee

Entertainment Ltd.

25-01-2007 457029 324.50 14.83

Sesa Goa Ltd. 25-01-2007 129589 1920.55 24.88

Table No. 1 Block deal and share price movement as on 25-01-2007

Share price movement before & after Block Deal as on 25-01-2007

Name of the company

Average Price

Share Price

1 2

Date of Block

Deal

4 5

ICICI Bank Ltd. 985.00 977.20 965.05 975.05 985.25 955.75 Bharti Airtel Ltd. 710.80 676.35 689.15 686.90 719.65 712.50 Reliance

Industry Ltd. 1370.00 1373.45 1360.85 1368.75 1369.65 1381.80 Zee

Entertainment

Ltd. 324.50 301.95 316.10 327.90 326.70 314.90 Sesa Goa Ltd. 1920.55 1679.35 1643.05 1816.05 1929.85 1946.55 Average 1062.17 1001.66 994.84 1034.93 1066.22 1062.30

Table No.2 Share price movement before and after block deal

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 108 -

The value of block deal of Bharti Airtel Ltd. was for Rs.91.58 crocres (12, 88,452) at an average price of Rs.710.80. before block deal market price of the share increased. On the date of block deal share price decreased slightly. After block deal it increased highly. In 5th trading session it was increased by 5.34% compare to initial price.

In Reliance industry Ltd. block deal taken place for the 5, 95,668 shares for an average price at 1370 with total value of Rs.81.6 crores. Before block deal share price declined slightly but on the date of block deal recovered. After block deal market price of the shares increased negligible amount. In 5th trading session it was traded above average share price of block deal. It was increased by Rs.11 compare to average share price of block deal.

During the study period, block deal of Zee Entertainment Ltd. taken place for 4,57,029 shares at a average price of Rs.324.50 for the total value of Rs. 14.83 crores. Before block deal share price of Zee Entertainment Ltd. was Rs.301.95. on the date of block deal it was traded on Rs.327.90. after block deal it decreased suddenly. In 5th trading session it was 13 Rs. above compare to the 1st trading session.

In Sesa Goa Ltd. block deal of 1, 29,589 shares were taken place at an average price of Rs. 1920.55 with the total value of Rs. 24.88 crores. Market price of the Sesa Goa Ltd. increased continuously. In 5th trading session market price of the share increased by around 16% which was highest gainer after block deal.

It can be observed that block deal does not affect share price in case of ICICI Ltd, and Zee Entertainment Ltd. because it was traded below the average price of block deal. There was upward movement in the share price of Bahrti Airtel Ltd., Reliance Industry Ltd. and Sesa Goa Ltd. it was traded above the average price of block deal. Overall in most of the companies it is found that there was upward trend in share price after block deal.

Block deal and share price movement as on 25-04-2007

Table no. 3 Block deal and share price movement as on 25-04-2007

Name of the company ReportingDate Quantity Traded Average Price

Total Value (Rs. In crore) ICICI Bank Ltd. 25-04-2007 892729 956.71 85.40

Bharti Airtel Ltd. 25-04-2007 160000 869.50 13.91 Hexaware Tech. Ltd. 25-04-2007 6390003 180.00 115.02

Canara Bank 25-04-2007 852900 229.50 19.57

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 109 -

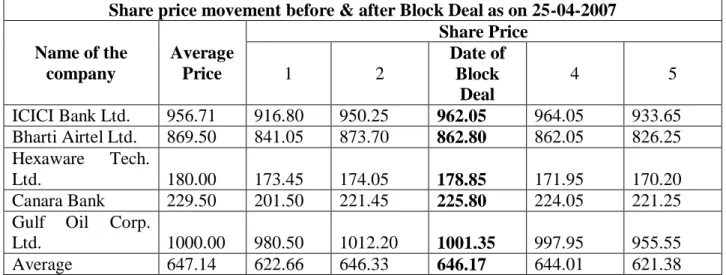

Share price movement before & after Block Deal as on 25-04-2007

Name of the company

Average Price

Share Price

1 2

Date of Block

Deal

4 5

ICICI Bank Ltd. 956.71 916.80 950.25 962.05 964.05 933.65 Bharti Airtel Ltd. 869.50 841.05 873.70 862.80 862.05 826.25 Hexaware Tech.

Ltd. 180.00 173.45 174.05 178.85 171.95 170.20

Canara Bank 229.50 201.50 221.45 225.80 224.05 221.25 Gulf Oil Corp.

Ltd. 1000.00 980.50 1012.20 1001.35 997.95 955.55 Average 647.14 622.66 646.33 646.17 644.01 621.38

Table no. 4 Block deal & share price movement as on 25-04-2007

Above Table no. 3 and 4 indicate the block deals figure on 25-04-2007 and share price movement of selected companies. During the study period, block deal of ICICI Bank taken place for 8,92,729 shares at an average price of Rs.956.71 for the total value of Rs.85.40 crores Before block deal share price of ICICI Bank was Rs.916.80 on the date of block deal market price of the shares increased. After block deal share price declined up to 933.65 on the date of block deal. The value of block deal of Bharti Airtel Ltd. was for Rs.13.91 crores (1, 60,000) at an average price of Rs.869.50. Before block deal market price of the share increased. On the date of block deal share price decreased slightly. After block deal it decreased negligible. In 5th trading session it was decreased by around 2% compare to initial price.

In Hexaware Tech. Ltd. block deal of 63, 90,003 shares were taken place at an average price of Rs.180. with the total value of Rs. 115.02 crores. Market price of the Hexaware Tech. Ltd. increased before block deal. On the date of block deal it increased slighthly. In 5th trading session market price of the share decreased by around Rs.3 compare to initial price.

In Canara Bank block deal taken place for the 8, 52,900 share for an average price at 229.50 with total value of Rs.19.57 crores. Before block deal share price increased continuously. On the date of block deal it increased slighthly. After block deal market price of the shares declined with negligible amount. In 5th trading session it was traded below average share price of block deal. It was decreased by Rs.8 compare to average share price of block deal.

During the study period, block deal of Gulf oil Corp. Ltd. taken place for 50,000 shares at an average price of Rs.1000 for the total value of Rs. 5 crores. Before block deal share price of Gulf oil Corp. Ltd. Was Rs.980.50. on the date of block deal it was traded on Rs.1001.35. After block deal it decreased suddenly. In 5th trading session it was decreased highly compare to the 1st trading session. It was decreased by around 2.75%.

It can be seen that block deal does not affect the share price of any selected companies. In all the companies it is easily found that after block deal the market price of shares traded below the average price of block deal.

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 110 -

Name of the company Reporting

Date

Quantity

Traded Average Price

Total Value (Rs. In crore) Bellary Steel Ltd. 25-07-2007 5559721 2.96 1.64

Tata Steel Ltd. 25-07-2007 377800 735.00 27.76

ICICI Bank Ltd. 25-07-2007 117750 974.25 11.47

Bharti Airtel Ltd. 25-07-2007 165000 970.00 16.00 Reliance Communication Ltd. 25-07-2007 751424 572.40 43.01

Table no. 5 Block deal & share price movement as on 25-07-2007

Share price movement before & after Block Deal as on 25-07-2007

Name of the company

Average Price

Share Price

1 2

Date of Block

Deal

4 5

Bellary Steel Ltd. 2.96 2.69 2.82 2.96 3.10 3.25

Tata Steel Ltd. 735.00 715.25 721.00 721.10 709.50 651.60 ICICI Bank Ltd. 974.25 985.15 970.05 969.30 959.45 914.25 Bharti Airtel Ltd. 970.00 922.95 940.95 932.15 946.80 925.25 Reliance

Communication Ltd.

572.40 583.60 583.60 577.55 567.25 569.50

Average 650.92 641.93 643.68 640.61 637.22 612.77

Table no. 6 Share price movement before and after Block Deal as on

25-07-2007

Given Table no. 5 and 6 shows the block deals figure on 25-07-2007 and share price movement of selected companies. During the study period, block deal of Bellary Steel Ltd. taken place for 55, 59,721 shares at an average price of Rs.2.96 for the total value of Rs.1.64 crores. Before block deal share price of Bellary Steel Ltd. Was Rs.2.69. On the date of block deal it was traded on Rs.2.96. After block deal it increased continuously. In 5th trading session it was 0.56 paisa above compare to the 1st trading session.

In Tata Steel Ltd. block deal of 3, 77,800 shares were taken place at an average price of Rs. 735 with the total value of Rs. 27.76 crores. Market price of the Tata Steel Ltd. Increased continuously up to block deal. After block deal it was decreased highly. In 5th trading session market price of the share decreased by around 9% which was highest looser after block deal. During the study period, block deal of ICICI Bank taken place for 1, 17,750 shares at an average price of Rs.974.25 for the total value of Rs.11.47 crores. Before block deal share price of ICICI Bank was Rs.985.15 but due to block deal share price declined up to highly. It was declined by Rs.16 on the date of block deal. Afterwards it observed that it was continuously decreased but in last 5th trading session it declined by 7.2% compare to initial share price.

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 111 -

share price decreased slightly. After block deal it increased slightly. In 5th trading session it was increased by Rs.3 compare to initial price.

In Reliance communication Ltd. block deal taken place for the 7, 51,424 shares for an average price at 572.40 with total value of Rs.43.01 crores. Before block deal share price traded at a same price. On the date of block deal it decreased slightly. After block deal market price of the shares increased negligible amount. In 5th trading session it was traded below average share price of block deal. It was decreased by Rs.3 compare to average share price of block deal.

It can be observed that block deal does not affect share price in case of ICICI Ltd, and Zee Entertainment Ltd. because it was traded below the average price of block deal. There were upward movement in the share price of Bahrti Airtel Ltd., Reliance Industry Ltd. and Sesa Goa Ltd. it was traded above the average price of block deal. Overall in most of the companies it is found that there was upward trend in share price after block deal.

Overall it was found that in most of the companies there was downward trend in market price of shares due to block deal for the selected companies. It was traded below the average price of block deal. Only Bellary Steel Ltd. was traded in positive after block deal

Block Deals and Share price movement as on 25-10-2007

Name of the company Reporting Date Quantity

Traded Average Price

Total Value (Rs. In crore) Reliance Energy Ltd. 25-10-2007 332961 1680 55.93

Reliance Industry Infra. Ltd. 25-10-2007 330358 2664 88.00 Tata Steel Ltd. 25-10-2007 1194712 978.75 113.81 Bharti Airtel Ltd. 25-10-2007 534618 1010.8 54.03

HDFC Bank 25-10-2007 892110 1475 131.59

Table no. 7 Block Deal & share price movement as on 25-10-2007

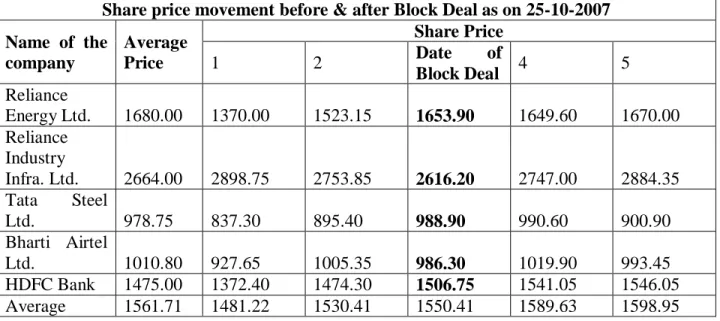

Share price movement before & after Block Deal as on 25-10-2007

Name of the company

Average Price

Share Price

1 2 Date of

Block Deal 4 5

Reliance

Energy Ltd. 1680.00 1370.00 1523.15 1653.90 1649.60 1670.00 Reliance

Industry

Infra. Ltd. 2664.00 2898.75 2753.85 2616.20 2747.00 2884.35 Tata Steel

Ltd. 978.75 837.30 895.40 988.90 990.60 900.90

Bharti Airtel

Ltd. 1010.80 927.65 1005.35 986.30 1019.90 993.45 HDFC Bank 1475.00 1372.40 1474.30 1506.75 1541.05 1546.05 Average 1561.71 1481.22 1530.41 1550.41 1589.63 1598.95

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 112 -

In given Table no. 7 & 8 indicate the block deals figure on 25-10-2007 and share price movement of selected companies. During the study period, block deal of Reliance Energy Ltd. taken place for 3,32,961 shares at an average price of Rs.1680 for the total value of Rs.55.93 crores. Before block deal share price of Reliance Energy Ltd. was increased highly. On the date of block deal it was increased continuously. After block deal share price increased up to 1670. It was increased around 18% compare to initial price.

In Reliance industry infra. Ltd. block deal of 3, 30,358 shares were taken place at an average price of Rs. 2664. With the total value of Rs.88 crores. Market price of the Reliance industry infra. Ltd. decreased highly. On the date of block deal it decreased by around 10% compare to initial price. In 5th trading session market price of the share decreased by around Rs.14 compare to initial price.

In Tata Steel Ltd. block deal taken place for the 11, 94,712 shares for an average price at 978.75 with total value of Rs.113.81 crores. Before block deal share price increased continuously. On the date of block deal it was increased by around 10.40%. After block deal market price of the shares increased with negligible amount. In 5th trading session it was traded below average share price of block deal. It was decreased by Rs.78 compare to average share price of block deal. The value of block deal of Bharti Airtel Ltd. was for Rs.54.03 crores (5, 34,618) at an average price of Rs.1010.80. Before block deal market price of the share increased around 8.5%. On the date of block deal share price decreased slightly. After block deal it was suddenly increased. In 5th trading session it was increased by around 7.12% compare to initial price.

During the study period, block deal of HDFC Bank taken place for 8, 92,110 shares at a average price of Rs.1475 for the total value of Rs.131.59 crores. Before block deal share price of HDFC Bank was Rs.1372.40. on the date of block deal it was traded for Rs.1506.75. After block deal it increased suddenly. In 5th trading session it was increased highly compare to the 1st trading session. It was increased by around 12.68%.

Overall in Reliance Energy Ltd. & HDFC Ltd. the share price traded above the average price of the block deal but in Reliance Industry Ltd., Tata Steel Ltd. and Bharti Airtel Ltd. the market price of the shares traded below the average price of block deal.

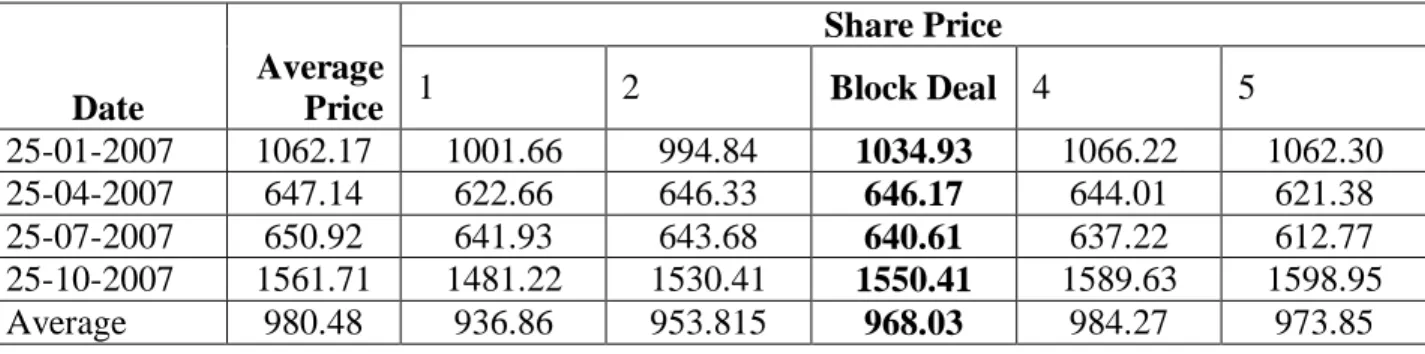

Block Deal and Average share price movement

Date

Average Price

Share Price

1 2 Block Deal 4 5

25-01-2007 1062.17 1001.66 994.84 1034.93 1066.22 1062.30 25-04-2007 647.14 622.66 646.33 646.17 644.01 621.38 25-07-2007 650.92 641.93 643.68 640.61 637.22 612.77 25-10-2007 1561.71 1481.22 1530.41 1550.41 1589.63 1598.95 Average 980.48 936.86 953.815 968.03 984.27 973.85

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 113 -

Block Deal and average share price movement

0 200 400 600 800 1000 1200 1400 1600 1800

1 2 Block Deal 4 5

Days

S

ha

re

pri

c

e

(

s

0

25-01-2007

25-04-2007

25-07-2007

25-10-2007

Graph no. 1 Block Deal & Average Share Price Movement

Table no.9 and graph no. 1 shows the block deal and average share price movement on 25-01-2007. It is observed that before block deal average share price declined but on the date of block deal it increased highly. It was increased by 4.03%. After block deal average share price raised speedily. It was increased by Rs.28. it was traded near average price of block deal.

On 25-04-2007 it was observed that the average share price declined before block deal. On the date of block deal there was no changed in average share price. After block deal average share price decreased slightly and in last trading session it was decreased by 3.84%. on last trading session average share price traded below the average price of block deal.

On 25-07-2007 it was found that the average share price increased slightly before the date of block deal but on the date of block deal decreased slightly. After the date of block deal average share price declined by 4.35%. in last trading session average share price traded below the average price of block deal.

On 25-10-2007 it can be seen that before block deal average share price increased continuously. On the date of block deal it increased very speedily. After block deal it was increased highly. It was increased by Rs.48 in last trading session. In last trading session it was traded above the average share price of block deal.

Limitations of the Study:

Following are the limitations of the study

1. Only five companies has selected for the study. 2. This study is of one year only.

Sri Krishna International Research & Educational Consortium http://www.skirec.com

- 114 -

Conclusion

It is found from the study that block deal does not affect share price movement in a great way even if the transaction of block deal is in large or small amount. Average share price movement during the study period was nearly the value price of block deals and that to less than the deal price. Therefore, investors should not take block deals as a means of decision making for purchase, sell or hold of particular stock and should relay on fundamentals and other market sentiments. Investors should ignore data of block deals as majority shares are traded below the deals price. Investors should not expect positive movement of share price due to block deals.

Reference

Kishore Ravi M, “Management Accounting & Financial Analysis”, Third Edition, Taxmann Allied Services (p) Ltd.

Peter S. Rose, Texas A&M, “Money and Capitals Markets Financial Institution & Global Market Place”, Ninth Edition.

Holmes P and Worn M W (2001) “Foreign Investment, Regulation and Price Volatility in Southeast Asian Stock Market” Emerging Markets Review Vol.2 No. 4 pp. 371-286.

Sakriya D, “Sebi & Securities Market In India”, Anmol Publications Pvt Ltd. Securities Analysis,The Institute of Chartered Financial Analysts of India.

Kim W and Wei S J (2002) “Offshore Investment Funds: Monsters in Emerging Markets? Journal of International Economics, Vol 56 No.1, pp.77-79.

NEWS PAPERS

Business Standard, Ahmedabad Edition. The Economic Times, Ahmedabad Edition. The Financial Express, Baroda Edition