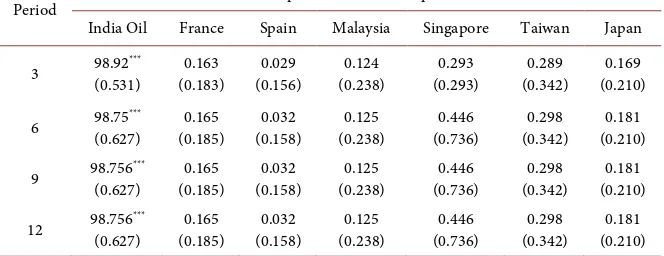

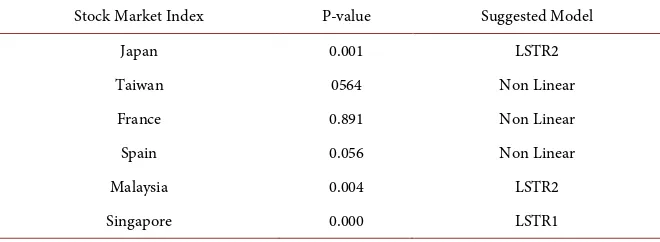

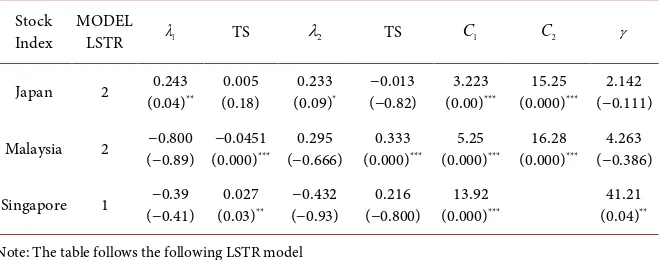

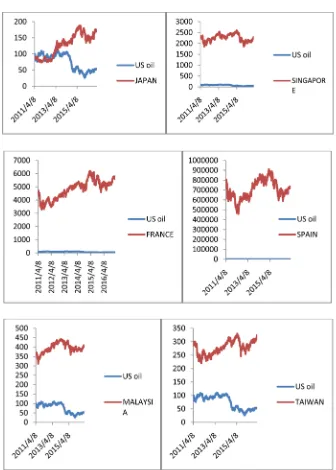

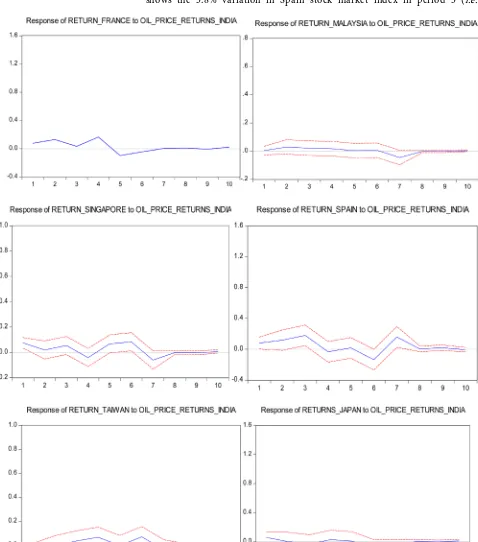

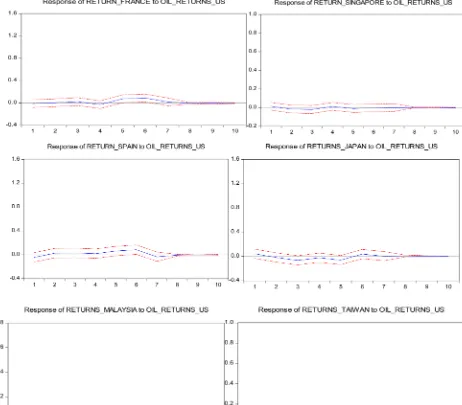

Influence of Oil Price Volatility of Developed Countries on Emerging Countries Stock Market Returns by Using Threshold Based Approach

Full text

Figure

Related documents

Where a state’s insurance market rules allow individuals to be denied coverage, as California’s do, or individuals or small groups to be charged more due to health status,

Although we found an inverse relation between participants’ HRQoL estimates (EQ-5D-5L and QoL-AD) and the severity of the AD, each participant provided HRQoL estimates for a

oxidative stress. In the present study, immunohisto- chemical data indicated that CS activated the p38 MAPK signaling pathway in the alveolar wall cells and bronchial epithelial

• Follow up with your employer each reporting period to ensure your hours are reported on a regular basis?. • Discuss your progress with

A basic task in sentiment analysis is classifying the polarity of a given text at the document, sentence, or feature/aspect level—whether the expressed opinion in

After Day, in the lighting of Moon Night wakens under a prayer to call hush to Day, time to commune. with Night, windswept under