The Sarbanes-Oxley Act and Small Public Companies

Smrity Prakash Randhawa*

June 15th, 2009

ABSTRACT

This study constructs measures of costs as well as benefits of implementing Section 404 for small public companies. In this paper I provide a comprehensive measure of Section 404 costs by developing models of direct and indirect costs based on financial statement information. The results thus far indicate that implementing Section 404 of SOX was very costly for smaller public companies and therefore the non-accelerated filers that will become Section 404 compliant in the next few years need to be ready to pay a much higher cost for being public in the US. I further develop models to test the benefits of Sarbanes-Oxley. In particular, I construct tests to measure increase in quality and relevance of financial statements. The test results for earnings quality indicate that implementing Section 404 has increased the quality of earnings for small public companies.

* I would like to thank Maureen McNichols for her constant help and guidance. I would also like to thank Anat Admati, Bill Beaver, Robert Daines, George Foster, Charles Horngren, Alan Jagolinzer, Madhav Rajan, Ken Shotts and workshop participants at Stanford University for helpful comments and suggestions.

INTRODUCTION

The Sarbanes-Oxley (SOX) bill, signed into law on July 30th, 2002 is considered one of the most far-reaching reforms of American business practices since the Securities Act of 19331. The Act was passed in response to a number of major accounting scandals discovered during 2001-2002, including Enron, Tyco International and WorldCom. Even five years after the passage of the Act, there is considerable debate over whether smaller issuers2 should be subjected to Section 404 of the Act. Notably, research to date has not focused on smaller companies and therefore provides limited guidance on the costs and benefits of the act for small firms. Therefore to shed some light on this debate, I develop a comprehensive measure of costs as well as benefits of SOX, in particular Section 404 in this paper. A major aim of this paper is to construct measures of costs as well as benefits of implementing Section 404 for small public companies.

There are three different perspectives on whether smaller public companies should be subject to Section 404 of SOX. The first perspective, advanced by Small Business Advocacy and the Advisory committee on Smaller Public Companies,3 is that the costs of Section 404 compliance are too high for smaller firms and therefore these firms should be exempted4 from becoming Section 404 compliant. At a minimum it is argued that this requirement should be deferred until it can be proven that these companies can become 404 compliant in a cost-effective manner.5 This view was also expressed in the recent article by Robert Grady in the Wall Street Journal.6 The second perspective, advanced by the Public Company Accounting Oversight Board

(PCAOB), is that Section 404 is an effective way of identifying companies with internal control

1 Elisabeth Bumiller: "Bush Signs Bill Aimed at Fraud in Corporations",

The New York Times, July 31, 2002, page

A1

2 Small issuers refers to non-accelerated filers

3 http://www.sec.gov/info/smallbus/acspc/acspc-finalreport_d.pdf 4 http://www.sec.gov/info/smallbus/acspc/acspc-finalreport_d.pdf 5 http://www.sba.gov/advo/laws/comments/sec06_0427.pdf

problems and is therefore beneficial for shareholders. Therefore, it is important that all

companies should be subject to Section 404 regardless of size.7 Many pension funds have also supported this view. The third perspective is that smaller firms should be subject to Section 404 but the requirements should be made less stringent for these firms.8 For now, based on the SEC’s May 24th, 2007 filing, it seems that the SEC has accepted this view. The first group of non-accelerated filers has to become Section 404 compliant on December 15th, 20099.

In this paper, I develop measures to provide evidence on the merit of these views using the experience of smaller accelerated filers.10 In addition, this paper can help answer questions about the costs and benefits of non-accelerated filers once they become Section 404 compliant. As mentioned earlier, accounting research on direct costs of SOX to date has focused on larger companies. For example, Griffin and Lont (2006) focus on the companies that were clients of big four audit firms, while Elderidge and Keeley (2005) look at Fortune 500 companies. Most of the substantial findings about benefits of SOX like Cohen et al. (2006) again focus on bigger companies, and since they use Execucomp data, their sample is comprised of very large firms. On the other hand, as discussed in Section 2.1, studies like Doyle et al. (2005), Engel et al. (2005), Hostak et al. (2007) and Piotroski and Srinivasan (2006) have clearly demonstrated that small companies were the ones who were most affected by the Act. Therefore, it is very

important to study the costs and benefits of Sarbanes-Oxley on smaller public companies.

7 http://www.sec.gov/news/press/4-511/ayerger050106.pdf

8http://www.nytimes.com/2007/05/24/business/24regs.html?ex=1337659200&en=a7df5799e28b806b&ei=5090&pa rtner=rssuserland&emc=rss

9 http://accounting.smartpros.com/x60067.xml

10 Of course due to the new audit standard for internal control over financial reporting the costs estimates provided in this paper should be thought of as an upper bound for the costs that non-accelerated filers will have to pay. http://www.pcaobus.org/News_and_Events/News/2007/05-24.aspx

The contributions of this paper are threefold. First of all, my research provides a more

comprehensive measure of Section 404 costs by developing models of direct and indirect costs based on financial statement information. Second, this is the first paper to test the benefits of Section 404; in this paper I hypothesize that SOX will increase the quality and relevance of financial statements. Third, this paper makes two important methodological contributions to current SOX research. My study identifies an important control group for Section 404 studies, namely the non-accelerated filers, which are small public companies that have not yet adopted Section 404. My study also documents that the year of Section 404 compliance is not always 2004, as prior studies assume. I show that the year of compliance can be correctly identified by using the existing data sources.

The rest of the paper is organized as follows: Section 2 reviews the existing literature on Sarbanes-Oxley as well as other relevant literature on small businesses. Section 3 develops the hypotheses while Section 4 develops the relevant tests. Section 5 discusses the results and Section 6 concludes the paper and discusses the remaining work.

2. LITERATURE REVIEW

2.1 Sarbanes-Oxley Research11

A number of papers have tried to measure the net benefit of SOX indirectly by looking at market reactions to important events that led to the passage of SOX. The findings of these papers have varied depending on the date ranges they include in the analysis. For example, Razaee and Jain (2003) and Li et al. (2004) report that SOX is beneficial to firms while Zhang (2005) concludes that the costs of SOX surpass the benefits.

Griffin and Lont (2006), Elderidge and Keeley (2005) and Linck et al. (2007) are the first papers to look at the direct costs of SOX. Griffin and Lont (2006) have demonstrated that SOX led to an increase in audit costs for the public firms audited by “Big Four” auditors. They also show that during 2004, which they assume is the year of Section 404 compliance for all firms, the increase in audit fees is larger than that of the prior year. Similarly, Eldridge and Kealey (2005) show that the audit fees of Fortune 1000 firms significantly increased in 2004 if the firm had implemented Section 404 in that year. Linck et al. (2007) demonstrate that the cost of

maintaining corporate boards increased significantly after SOX came into effect in 2002 due to increased D&O insurance premium and director fees. Though these studies are quite relevant to this paper, a major difference is that these studies have focused on large public companies, where the magnitude of SOX costs and benefits can be less significant, while in this paper I focus on smaller businesses.

It is clear from prior research that small firms have faced high costs to remain public. Carney et al. (2005) and Engel et al. (2006) show that a number of smaller firms chose to either terminate reporting under the securities lawsor go private. Similarly, Piotroski and Srinivasan (2006) provide evidence that the passage of SOX has affected the flow of international listings in the US. They show that the firms choosing to list on the LSE Alternative Investment Market (AIM) over US markets are smaller and less profitable than the firms listed on US exchanges after SOX was passed. Also, Hostak et al. (2007) demonstrate that foreign firms that delisted their

American Depositary Receipts (ADRs) in the US were smaller than the firms that did not delist their ADRs.

A few papers have also demonstrated the effect of Sarbanes-Oxley on actual business practices of firms. Cohen et al. (2006) find that accrual earnings management decreased significantly after

the passage of SOX, while real earnings management increased after the passage of the Act. In another paper, Cohen et al. (2004) find a significant decline in the ratio of incentive

compensation to salary after the passage of SOX. According to the authors, this finding was a result of firms trying to compensate the management for the additional liability imposed by SOX.

DeFond et al. (2004) find that companies voluntarily appointed financial experts to their audit committees. However, the market reacted positively to these announcements only if the financial expert was an accounting financial expert and the reaction was higher for companies that had better corporate governance. Also, Wagner and Dittmar (2006) in a recent Harvard Business Review summarize the benefits of Sarbanes-Oxley that a few companies experienced. For example, they provide evidence that Section 404 helped in strengthening the control

environment, standardizing processes, minimizing human error and exploiting convergence opportunities across different departments within the same firm. These studies along with the legislature’s belief that there are benefits to SOX lead me to hypothesize that there have been benefits from SOX. Therefore, to gain a more complete picture of the consequences of SOX, it is important to understand the cost and benefits of SOX.

2.2 Importance of Small Businesses

Prior literature has established that smaller businesses are an important driver of growth in the US economy. According to Acs and Audretsch (1987 and 1988), Baldwin and Johnson (1991) as well as Acs, Audretsch and Feldman (1994), small firms12 are an important source of

innovation in the economy. Also, according to Birch (1981) and Blackford (1991), small firms

are an important source of employment for the economy and generated almost 40% of the new jobs during 1970s and 1980s. Since innovation and job creation are two very important factors that lead to growth of any economy small businesses are an important part of the US economy. Therefore, legislation that leads to a decline in the growth of small businesses can seriously hamper the growth of the economy.

2.3 Small Businesses and Accounting Problems

Prior research has shown that reporting and control problems are greater in smaller firms. For example, Wells (2004) finds a disproportionate number of occupational frauds were committed against small businesses. Kinney and McDaniel (1989) find that firms restating earnings are normally smaller in size. Doyle et al. (2005) have shown that the firms reporting serious firm-wide control issues normally are smaller in size. As a result, establishing better internal controls as a result of Sarbanes-Oxley will improve reporting and therefore benefit the financial statement users of these firms. However, since they do not have good controls in place already establishing controls will be costly for these firms.

3. HYPOTHESIS DEVELOPMENT

Since small public companies are an important part of financial markets I focus on the effect of SOX on these companies in my dissertation. According to the report by the Advisory Committee for Smaller Public Companies, companies below 125 million USD in market capitalization form 1% of total US market capitalization and consist of 50% of total public companies. Given that the Dow Jones Wilshire 500013 index had a market capitalization of 16,683 billion USD14 as of

13 The Dow Jones Wilshire 5000 Composite Index is a broad-based stock market index more than 6,700 publicly-traded companies and is often used to represent the entire United States stock market.

November 2006, this implies that the smaller companies are worth 166 billion USD. This is a sizable amount of market capitalization in absolute terms. This absolute magnitude implies that collectively small companies form a big group with substantial market share.

It can also be argued that small companies have a different institutional structure as compared to larger companies. For example, smaller public companies are more likely to be audited by non-Big Four auditing firms, and as a result the quality of their audited reports might be lower than that of larger companies. Also, smaller companies tend to focus on one industry and technology, which makes it easier for investors who want to bet on one technology to invest in one company. Thus, if the company ceases to be public, they will have to invest in a greater number of

companies in order to create a portfolio with the same risk and return characteristics, or the exposure to a certain business and its returns might be unavailable.

In this paper, I develop measures of costs as well as benefits of SOX. I expect that the sections of SOX that are described below will have the greatest effect on costs and benefits of the Act. It is also, important to recognize that the Act has been phased in over time, as shown in Appendix B:

1. Section 302 – This section mandates that disclosure controls and procedures must be

maintained in a company and the effectiveness of their design and operation must be evaluated. This section went into effect on August 29th, 2002. It requires that all Forms 10-K and 10-Q must:

i. Contain CEO/CFO certifications under §302 (review of report, no known material misstatement or omission, no known failure to fairly present financial condition in all material respects, responsibility for disclosure controls and procedures,

internal disclosure of deficiencies in internal controls or fraud, disclosure in report of significant changes in internal controls); and

ii. Contain CEO’s/CFO’s conclusions regarding the effectiveness of the operation and design of the company’s disclosure controls and procedures.

2. Section 404– This section has 2 components:

i. Management should maintain and assess Internal Controls15 over financial reporting.

ii. Auditors have to assess whether the internal controls are effective or not. This section went into effect on November 15th, 2004 for accelerated filers, and non-accelerated filers are required to implement it by December 15th, 2007.16 (Note

accelerated filers who were not “large accelerated filers” got 45 extra days for their first 404 compliance report/audit). Section 404 is viewed as the most costly section of the SOX and has led to a lot of debate about whether the requirements of this section should be made less stringent to decrease the costs of the Act.

3. Section 409– This section has two main components:

a. Disclosure of Electronic Availability of Filings (effective Dec 15th, 2002)

15According to COSO, internal control as defined by SOX is a process, effected by an entity's board of directors, management and other personnel, designed to provide reasonable assurance regarding the reliability of financial reporting. Broader definition of internal controls can be found at COSO’s website.

16 Non-accelerated filers are defined as companies with less than 75 million in public float. Accelerated filers have more than 75 million and less than 700 million in public float. Large Accelerated filers have 700 million or more in public float. Appendix D gives a more precise description of accelerated and large accelerated filers.

b. Accelerated Filing of Periodic Reports (1st Step: Accelerated filing for accelerated filers, reducing 10K filing time to 75 days and 10Q filing time to 40 days was implemented on Dec 15th, 2003. 2nd Step: Reducing 10K filing time to 60 days for large accelerated filers was implemented on Dec 15th, 2006)

Apart from these 3 sections other important sections of the Act are Sections 201, 202, 301, 401, 402, 403, 806 and 906.

3.1 Costs of SOX

In this paper I divide the costs that companies face as a result of becoming SOX compliant into direct and indirect costs. The description of the two categories is as follows:

Direct Costs: Direct costs are the additional monetary expenses incurred as a result of becoming

SOX complaint. Audit costs are one of the major direct costs. Griffin and Lont (2006) as well as Eldridge and Kealey (2005) provide evidence that SOX, and in particular Section 404 led to a big increase in audit costs. In this paper, I compare the average increase in audit costs for accelerated versus non-accelerated filers I expect there is a fixed cost associated with procuring software, manpower etc. for becoming SOX compliant and an additional variable cost associated with monitoring the higher level of sales, so overall cost is increasing in sales. Other direct costs include the costs borne by the company to acquire and maintain internal control software,

increased employee hours to comply with SOX, increased D&O insurance premiums due to increase in liability as a result of SOX, and increased directors’ fees as a result of greater time commitment and responsibility. I reviewed a number of 10-K reports to analyze which line items would be most affected by an increase in costs due to Sarbanes-Oxley. I found that these

costs were generally included in Selling General &Administrative (SG&A) expenses17 and as a result, I design tests to detect increases in SG&A. Furthermore, I conjecture that the increase in SG&A is greater for firms that disclose a material weakness in their Section 404 reports as compared to firms that do not disclose a material weakness.18 I predict that a material weakness will substantially increase the cost of Section 404 compliance because in order to remediate these weaknesses the firm will have to establish more controls, which will require additional

documentation, software and manpower.

It is possible that some of these costs are reflected in the Cost of Goods Sold (COGS)19. For example, the salary of the employee hired to oversee controls at the process level would be reflected in the process overhead and can be allocated to the given product. This discussion of direct costs suggests my first two hypotheses:

H1: Direct costs of accelerated filers increase in the year the filer became Section 404

compliant.

H2: Costs of filers increase in the year the filer finds a material weakness.

Indirect Costs:20 Indirect costs are incurred because, apart from monetary expenses, SOX

compliance requires resources such as management time and may have increased the risk aversion of the management. These resources include the time spent by executives of the

company working on compliance problems and not on the long term strategies, which can affect

17 Please refer to Appendix C where I have included excerpts from three different 10-K filings which show that Section 404 costs were mostly included in SG&A expenses.

18 According to Standard 2, an internal control deficiency exists when the design or operation of a control does not allow for the timely prevention or detection of misstatements. A material weakness is said to exist if a significant deficiency or a combination of significant deficiencies can result in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

19 I also ran regressions similar to SG&A expenses for COGS and did not find any evidence that Section 404 costs are included in COGS in this sample.

the long term as well as short term growth of the company. Cohen et al. (2004a) claim that SOX increased risk aversion in managers leading to a decrease in R&D expenditures, as well as CAPEX, and this could further affect the long term growth of the company. Also, there is some evidence that implementation of Section 404 led to cutbacks in R&D because the companies had to spend their limited funds on audits rather than on R&D21. For example, this excerpt from a newspaper article describes the experience of a small public biotech company when it

implemented Section 404:

A small public biotech company spent over $500,000 on external substantiation of internal controls. This onerous exercise forced the company to reassign laboratory researchers to perform internal control work dictated by SOX, postpone the hiring of 5 to

10 additional researchers, and delay promising research and development programs.22

In this paper, I focus on testing whether there was a decrease in Capital Expenditure and R&D Expenditures in the year the company became Section 404 compliant. The reason for this prediction is that management time, which is a limited resource, would have been diverted towards compliance with Section 404. As a result management would have less time to analyze and approve investment projects. In order to understand this argument, consider a small

company A with the following cost and benefit analysis. Before SOX:

At any given time t: NPV(Internal ControlPre-SOX) = A = Total future Benefit of implementing IC – Total Cost of implementing IC

21http://www.iht.com/articles/2006/09/20/business/sec.php

Now if management at any given time can only implement n projects in order to give required attention to all the projects and NPV(Internal ControlPre-SOX) >0, then the management might still not choose to implement internal controls if:

If NPV(IC) < NPV(n) < NPV(n-1) < … < NPV(1)

Or in words, if the NPV of internal controls is lower than that of n other projects then management will choose not to implement internal controls.

After SOX:

NPV(Internal ControlPost-SOX) = A + Benefit of being Public So, NPV(Internal ControlPost-SOX) > NPV(Internal ControlPre-SOX)

As a result the probability of implementation of Internal Controls increased after SOX and as a result the company would not undertake at least one of the projects that it would have invested in without the implementation of SOX. Also, management would need to be more involved in designing controls in case the company has a material weakness. As a result, indirect costs would also be higher.

This discussion leads to my second hypothesis:

H3: Indirect costs of accelerated filers would increase in the year the filer became

3.2 Benefits of Sarbanes-Oxley

I believe that in order to understand the benefits of Sarbanes-Oxley it is important to assess whether SOX increased the quality of financial reporting and the information content of financial statements. In this section I explain why I expect Section 404 to increase the quality of financial reporting. I also, describe how different sections of SOX in particular Sections 302, 404 and 409 increased the information content of financial statements.

I hypothesize that Sarbanes-Oxley, in particular Section 404, increased the quality of financial reporting by requiring firms to maintain and assess internal control over financial reporting. I expect that maintaining and assessing internal control over financial reporting will improve the quality of financial reporting due to increase in managerial involvement, improvement in the financial reporting process and decrease in earnings management.

First of all, I expect that Section 404 will increase in managerial involvement and responsibility in the financial reporting process.SOX has increased the involvement of managers in the financial reporting process by requiring them to maintain and assess internal controls as well as by requiring CEOs and CFOs to certify the financial statements filed with SEC. All these provisions of the Act have increased awareness about financial reporting processes23 and increased the involvement of management in the financial reporting process. Managers now certify that they are responsible for establishing and maintaining disclosure controls and procedures to provide reasonable assurance that material information relating to the issuer is made known to the investors. I expect this increase in responsibility and involvement of CEO

and CFO will increase the reliability of financial statements because it will dissuade employees lower down the hierarchy from making mistakes or committing occupational frauds.

Secondly, there is evidence that Section 404 improved the financial reporting process. The Glass Lewis study on material disclosures finds that the number of material weaknesses disclosed by companies between $75 million to $749 million in market capital that have implemented Section 404 decreased by 45% (from 699 material weakness disclosures in 2005 to 379 disclosures in 2006). On the other hand, material weakness disclosures by non-accelerated filers increased by 18% (from 573 disclosures in 2005 to 677 disclosures in 2006). The decrease in material

weakness disclosures by Section 404 compliant firms suggests that Section 404 requirements are effective in improving internal controls over financial reporting. Also, most of the material weaknesses in Section 404 compliant firms were due to systems and procedures related issues. These findings suggest tackling these issues increases the reliability of the process of financial reporting.

Lastly, I expect that SOX will lead to a decrease in earnings management. Establishing internal controls over reporting process will make sure that the information provided by the companies in financial reports is correct and will make it harder for managers to manage reported earnings in order to meet or beat analyst forecasts and as a result the quality of income would increase. For example, Cohen et al. (2006) shows that Sarbanes-Oxley led to a decrease in accrual earnings management. These reasons motivate my fourth hypothesis:

H4: Earnings quality of accelerated filers will increase after the filer becomes Section

I plan to test for increase in financial reporting quality by looking at the quality of earnings as defined in Dechow and Dichev (2002). Another way of testing financial quality would be to look at the increase in earnings persistence after Section 404 came into effect24. I further predict that SOX will increase informativeness of financial statements. There are three reasons for this prediction.

First, I expect that SOX will increase the information content of the 10-K filing. Accounting

research has shown that adverse opinions/findings under Section 302 and Section 404 are value relevant for investors. Hammersley et al. (2005) show that disclosure of a weakness under Section 302 leads to a negative price reaction and increase in trading volume on average. Similarly, Cheng et al. (2006) finds that firms announcing material weaknesses show negative cumulative abnormal returns in the 3 day period surrounding the announcement day. Also, Ashbaugh-Skaife et al. (2006) shows that the cost of capital is higher for firms reporting deficiencies in internal control.

Secondly, SOX has increased the timeliness of the information provided in information statements. Information is provided in a more timely manner to investors in the 10-K reports. While adopting accelerated reporting in 2002, the SEC stated that they expected that periodic reports filed under the Exchange Act contain valuable information for investors, and expressed concern that an undue delay in making available the periodic report information may cause the information to be less valuable. As a result, accelerating the filing of 10-Ks is a way of making these reports more valuable to investors. Bryant-Kutcher et al. (2005) shows that firms that met

24 Testing if ERC increased after implementation of Section 404 would be one of the methods of measuring increased investor confidence in earnings quality.

the shortened deadline were able to provide higher quality information in a more timely manner. Their measure of quality was absolute discretionary accruals measured using Jones modified model25. So, if firms are providing better quality information in a timely manner because of Section 409, it should increase the value of the information to the market.

Lastly, as discussed before, SOX increased the quality of financial statements. I expect that higher quality financial statements are more informative. I plan to measure this benefit by investor response during 10-K filing dates. A preliminary model for measuring this benefit is developed in this paper.

H5: Informativeness of financial statements of accelerated filers will increase after the

filer becomes Section 404 compliant.

4. EMPIRICAL MODELS FOR TESTING HYPOTHESES

4.1 Measuring Costs of Section 404 Compliance

4.1.1 Direct Costs

There are two primary tests in this paper to measure the direct costs of Sarbanes-Oxley. The first test looks at the increase in SG&A expenses when the firm becomes Section 404 compliant while the second examines the increase in audit costs when the firm becomes Section 404 compliant.

4.1.1.1 SG&A Cost

The model for SG&A costs is as follows:

where for each firm i and year t, Sales = Revenue (Compustat: Data 12)

Decrease_Dummy = Indicator equal to 1 if the sales decreased in this year

Audit = Audit Fees + Audit Related Fees (Audit Analytics: Audit_Fees and Audit_Related_Fees) SOX1 = Indicator equal to 1 if the firm became Section 404 compliant in year t (Audit Analytics: First year with SOX 404 Internal Report)

SOX2 = Indicator equal to 1 if the firm became Section 404 compliant in year t-1 (Audit Analytics: Second year with SOX 404 Internal Report)

SOX3 = Indicator equal to 1 if the firm became Section 404 compliant in year t-2 (Audit Analytics: Second year with SOX 404 Internal Report)

MW = Indicator equal to 1 if the firm reveals a material weakness in Internal Control in the Section 302/404 report (Audit Analytics: IC_IS_EFFECTIVE)

This test is based on the model of SG&A costs proposed by Anderson et al. (2003) who show that SG&A costs are sticky. Specifically they show that SG&A costs increase more when revenues increase than they decrease when revenues decrease by the same amount. The reason for this finding is that managers might delay the reductions to committed resources until they are more certain that demand has declined permanently and as a result, a decrease in revenues is not accompanied by a decrease in costs. In this model, the coefficient on SOX1 represents the increase in SG&A expenses incurred in becoming Section 404 compliant. Similarly, the

) 1 ( * 3 * 2 * 1 3 2 1 ) ln( _ ) ln( ) ln( _ ) ln( ) ln( ) ln( , , , 12 , , 11 , , 10 , 9 , 8 , 7 , 6 1 , , 5 1 , 2 , 1 , 4 2 , 1 , 3 , 1 , , 2 1 , , 1 1 , , t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t j t i t i MW SOX MW SOX MW SOX MW SOX SOX SOX Audit Audit Dummy Decrease Sales Sales Sales Sales Dummy Decrease Sales Sales Sales Sales SGA SGA ε β β β β β β β β β β β β β β + + + + + + + + + × + + × + + + = − − − − − − − − −

coefficient on SOX2 represents the increase in SG&A expenses incurred by filers during the second year of becoming Section 404 compliant, while the audit variable is a control for the increase in auditing costs.

Hypothesis 1 predicts that the coefficient on SOX1 should be positive. If a component of costs when firms became 404 compliant is fixed and will not recur in the following year, then the coefficient on SOX2 will be negative. Since auditing takes place after the end of the financial year, it is likely that costs of Section 404 costs are carried into the year after the firm becomes 404 compliant. Also, based on hypothesis 2, if the increase in SG&A is greater for firms that disclose a material weakness in their Section 404 reports as compared to firms that do not disclose material weaknesses, then the coefficient on MW*SOX1 should be positive.

4.1.1.2 Audit Cost

The second test is for an increase in Audit costs when the firm becomes Section 404 compliant.

where for each firm i and year t,

Audit = Audit Fees + Audit Related Fees (Audit Analytics: Audit_Fees and Audit_Related_Fees) Sales = Revenue (Compustat: Data 12)

Decrease_Dummy = Indicator equal to 1 if the sales decreased in this year

SOX1 = Indicator equal to 1 if the firm became Section 404 compliant in year t (Audit Analytics: First year with SOX 404 Internal Report)

) 2 ( * 3 * 2 * 1 3 2 1 _ ) ln( ) ln( _ ) ln( ) ln( ) ln( , , , 11 , , 10 , , 9 , 8 , 7 , 6 , 5 1 , 2 , 1 , 4 2 , 1 , 3 , 1 , , 2 1 , , 1 1 , , t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t j t i t i MW SOX MW SOX MW SOX MW SOX SOX SOX Dummy Decrease Sales Sales Sales Sales Dummy Decrease Sales Sales Sales Sales Audit Audit ε β β β β β β β β β β β β β + + + + + + + + × + + × + + + = − − − − − − − −

SOX2 = Indicator equal to 1 if the firm became Section 404 compliant in year t-1 (Audit Analytics: Second year with SOX 404 Internal Report)

SOX3 = Indicator equal to 1 if the firm became Section 404 compliant in year t-2 (Audit Analytics: Second year with SOX 404 Internal Report)

MW = Indicator equal to 1 if the firm reveals a material weakness in Internal Control in the Section 302/404 report (Audit Analytics: IC_IS_EFFECTIVE)

This test is similar to the test for SG&A costs. In this model the coefficient on SOX1 represents the increase in Audit costs incurred as a result of becoming Section 404 compliant. Similarly, SOX2 denotes the increase in Audit Costs incurred by filers during the second year of becoming Section 404 compliant. The coefficient on MW*SOX1 corresponds to additional increase in audit costs for companies that disclose a material weakness in their Section 404 reports. Based on Hypothesis 1, the coefficient on SOX1 should be positive. If a component of audit costs in the year firms became 404 compliant is fixed and will not recur in the next year then, the coefficient on SOX2 should be negative. Also, the coefficient on MW*SOX1 should be positive if the audit costs of companies that disclose material weakness is higher based on hypothesis 2.

4.1.2 Indirect Costs

In order to measure the indirect costs of Sarbanes-Oxley, I plan to test whether a firm decreased investment in a year in which it becomes Section 404 compliant. I test for this by looking at changes in capital expenditures and R&D expenditures separately. All these expenditures are important for the future growth of the company and a decrease in them due to diversion of management time can negatively affect the future growth of the company.

4.1.2.1 Research and Development Expenses

Additional models are used to examine Research & Development expenses and Capital Expenditure. The model for Research and Development Expenses is as follows:

where for every firm i, in given year t and industry j:

RD = Research and Development expense (Data 46: Compustat)

V/P = Measure of growth opportunities, ratio of the value of firm and the market value of equity, similar to Tobin’s Q

V= (1-αr) BVE + α (1+r) OI -α r*Div where r=12% and α= (ω/ (1+ω-r)) where BVE is the Book Value of Equity, OI is operating income and Div is dividend paid

P = Market Value of Equity

Lev = Leverage, Book Value of Total Debt/Total Assets ((Data 9 +Data 34)/ (Data 9 + Data 34 + Data 60): Compustat)

Size = log of total assets in beginning of the year (lag (Data 6): Compustat) Cash= Cash and Short term investments (Data 1: Compustat)

SOX1 = Indicator equal to 1 if the firm became Section 404 compliant in year t (Audit Analytics: First year with SOX 404 Internal Report)

SOX2 = Indicator equal to 1 if the firm became Section 404 compliant in year t-1 (Audit Analytics: Second year with SOX 404 Internal Report)

SOX3 = Indicator equal to 1 if the firm became Section 404 compliant in year t-2 (Audit Analytics: Second year with SOX 404 Internal Report)

MW = Indicator equal to 1 if the firm reveals a material weakness in Internal Control in the Section 302/404 report (Audit Analytics: IC_IS_EFFECTIVE)

RD = Research and Development expense (Data 46: Compustat)

)

3

(

*

3

*

2

*

1

3

2

1

&

, , , 12 , , 11 , , 10 , 9 , 8 , 7 , 6 1 , 5 , 4 , 3 , 2 , 1 , t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t i t j t iMW

SOX

MW

SOX

MW

SOX

MW

SOX

SOX

SOX

RD

Size

Cash

Lev

VP

D

R

ε

β

β

β

β

β

β

β

β

β

β

β

β

β

β

+

+

+

+

+

+

+

+

+

+

+

+

+

+

=

−This model measures the change in R&D in the year a firm becomes Section 404 compliant. V/P26 is a measure of growth opportunities where the value of the firm is calculated using Ohlson (1995) framework, which assumes that price is equal to discounted expected dividends, clean-surplus relation hold and abnormal earnings follow an auto-regressive process and have a

persistence parameter equal to ω. This measure of book value of equity includes book value of equity, earnings and dividends and as a result takes into account intangible assets and hence is a better measure of the value of existing assets I use V/P as a variable in this model instead of Tobin’s Q because I anticipate that the value of a firm calculated using Ohlson (1995)

framework takes the value of unrecognized intangible assets into account. As a result V/P would be a better predictor of R&D expenditure which, in effect, is an expenditure on an unrecognized intangible asset. Please refer to the description of model 3 in section 4.1.2.1 for a detailed discussion of V/P.

Other control variables like cash level, leverage and size are included because prior studies such as Hall (1992), Hall and Reenen(1999), Himmelberg and Petersen (1994) and Hubbard (1998) have shown that these are important controls.27 In this model the coefficient on SOX1 represents the change in R&D expenditure as a result of becoming Section 404 compliant. The coefficient on MW*SOX1 corresponds to additional change in R&D expenditure incurred by companies that disclose a material weakness in their internal control report.

Hypothesis 3 predicts that the coefficient on SOX1 should be negative. Similarly, it can be assumed that it will harder for firms with material weaknesses to become 404 compliant and as a

26 V/P was used in Richardson (2006).

27 Note I did not include operating income, which is one of the common variables used in R&D regressions, into the equation because V/P is composed of operating income.

result their R&D expenditure could decrease even more in the year they become Section 404 compliant as predicted by Hypothesis 2.

I also consider the interaction of SOX with cash because, as discussed earlier, there is evidence that some firms had to cut back on R&D expenditures due to cash constraints. As a result I would expect that the cash constraint would become even more important in the year in which the firm becomes Section 404 compliant, and therefore the coefficient on this term would be positive.

4.1.2.2 Capital Expenditure

I also run separate tests for capital expenditures. The model used to test Capital Expenditure is as follows:

where for every firm i, in given year t and industry j: CAPEX = Capital Expenditure (Data 128: Compustat)

Inv_Q = Inverse of Tobin’s Q = (Book Value of Assets/Market Value of Assets), it’s a measure of growth opportunities of a firm ((Data 25 * Data 99 + Data 6 – Data 60)/Data 6: Compustat) CF = Cash from operations (Data 308: Compustat)

In this model Inv_Q controls for the growth opportunities available to the firm28. Tobin (1969) and Hayashi (1982) show that under certain conditions Tobin’s Q captures all investment opportunities. I include cash flows in the model because Fazzari, Hubbard and Bruce (1988) show that cash flow controls for financing constraints in the model. I also control for leverage in this model because firms with high leverage might have debt covenants, which might restrict

28 McNichols and Stubben use inverse of Tobin’s Q because the distribution of the reciprocal is less skewed leading to more desirable properties for the regression analysis.

) 4 ( * 3 * 2 * 1 3 2 1 _ , , , 10 , , 9 , , 8 , 7 , 6 , 5 , 4 , 3 1 , 2 , 1 , t i t i t i t i t i t i t i t i t i t i t i t i t i t i t j t i MW SOX MW SOX MW SOX MW SOX SOX SOX CF CAPEX Q Inv CAPEX

ε

β

β

β

β

β

β

β

β

β

β

β

β

+ + + + + + + + + + + + = −them from investing in some projects, and as a result I would expect that capital expenditure would decrease with increase in leverage. In this model the coefficient on SOX1 represents the change in capital expenditure as a result of becoming Section 404 compliant. The coefficient on MW*SOX1 corresponds to additional change in capital expenditure incurred by companies that disclose a material weakness in their internal control report.

Hypothesis 3 predicts that the coefficient on SOX1 should be negative. Similarly, it can be expected that it will be harder for firms with material weaknesses to become Section 404 compliant and as a result their capital expenditure could decrease even more in the year they become Section 404 compliant. On the other hand it is possible that becoming Section 404 compliant reduces the cost of capital for these firms because now their earnings are of higher quality and also, because there is more information about firms in the financial statement, which reduces information asymmetry. As a result these firms would be able to undertake more capital expenditure projects. In this case I would expect that the coefficient on SOX1 would be positive. 4. 2 Measuring Benefits of SOX

4.2.1 Earnings Quality

The measure of accounting quality in this paper is the accrual quality from the modified Dechow and Dichev (2002) model discussed in McNichols (2002). The model which will be estimated for each 2 digit SIC code based on quarterly data is as follows29:

29 Dhaliwal et al. (2007) have used the model in quarterly specification with a seasonality factor

) 5 ( , 3 1 , , 6 , , 5 , , 4 1 , , 3 , , 2 1 , , 1 , t i n n i j n t i j t i j t i j t i j t i j j t i QTR PPE Sales CFO CFO CFO WC

ε

β

β

β

β

β

β

β

+ + + Δ + + + + = Δ∑

= + −Where for every firm i, quarter t and industry j

ΔWC= Changes in working capital accounts CFO= Cash from operations

ΔSales= Changes in sales

PPE= Property, plant and equipment

QTR = Indicator variable equal to 1 if the fiscal quarter equal to n

This model is similar to the quarterly model presented in Dhaliwal et al. (2007). According to this model the quality of accruals depends on how closely the accruals are related to the past, present and future cash flow realizations. The error term from the model represents the earnings quality of the firm. The further it is from zero, the lower is the quality.

I also, calculate the model estimated for each 2 digit SIC code based on quarterly data while allowing the coefficients to take different values in case they have a loss in the given year. In that case the estimation equation looks like:

Where for every firm i, quarter t and industry j

Loss = Indicator variable equal to 1 if the Earnings before extraordinary items in a given quarter is less than 0. ) 6 ( * * * , 3 1 , , 9 , , 8 , , 7 , 1 , , 6 , , , 5 , , 4 , 1 , , 3 1 , , 2 , , 1 , t i n n i j n t i j t i j t i t i j t i t i j t i j t i t i j t i j t i j j t i QTR PPE Sales Loss CFO Loss CFO CFO Loss CFO CFO Loss WC

ε

β

β

β

β

β

β

β

β

β

β

+ + + Δ + + + + + + + = Δ∑

= + − −My measure of earnings quality is the standard deviation of residuals before and after company becomes Section 404 compliant30. The effect of SOX on earnings quality would be measured by the following model which is based on Dhaliwal et al. (2007):

where for every firm i in industry j, Quality = Earnings quality

BigFour = Indicator equal to 1 in year t if the auditor was Big Four in all the quarters Average Size = Average of total assets across all quarters

OpCycle = average of log(Operating Cycle) across all quarters Int = Average of R&D investment across all quarters

σ(CFO) = Standard deviation of cash from operations across all quarters

σ(Sales) = Standard deviation of sales across all quarters

Loss = Indicator equal to 1 if number of quarters of loss is greater than quarters of profit SOX = Indicator equal to 1 after the company becomes Section 404 compliant

MW = Indicator equal to 1 if the company disclosed a material weakness

In this model, the coefficient on SOX1 represents the increase in earnings quality as a result of becoming Section 404 compliant. The coefficient on MW*SOX1 corresponds to the change in earning quality of companies that disclose a material weakness in their internal control report. Hypothesis 4 predicts that the coefficient on SOX1 should be negative. However it is not clear how the earnings quality would change for a firm that discloses material weakness though it is

30 I require a company to have information for at least 4 quarters before and after becoming Section 404 compliant to calculate the standard deviation. I repeated the analysis by increasing the requirement to 5 and 6 quarters and the results were comparable to the results presented in this paper.

) 7 ( * * ) ( ) ( , 11 10 9 8 7 6 5 4 3 2 1 0 t i i i i i i i i i i i i i i i SOX MW SOX MW MW SOX Loss Sales CFO Int OpCycle AvgSize BigFour Quality

ε

α

α

α

α

α

σ

α

σ

α

α

α

α

α

α

+ + + + + + + + + + + + + =clear that earnings quality would increase for these firms once their internal controls become effective.

This model includes controls for operating cycle, standard deviation of cash flow, standard deviation of sales following Dechow and Dichev (2002), and controls for investment in

intangibles because Francis, Lafond, Olsson and Schipper (2004) find that increased investment in intangibles decreases earnings quality.

4.2.2 Informativeness of Financial Statements

In order to test whether informativeness of financial statements increases after SOX, I will examine the relation between the stock price response around the 10-K filing date and variables related to SOX. Specifically I will test the following model:

) 8 ( 404 302 5 6 4 3 2 1 0 it i it it it it it

it NT MW ICD Section AccFiling Section

ER =β +β +β +β +β +β +β +ε

where for every firm i, in given year t:

ER = 2-day mean standardized signed/unsigned excess return measured using Sharpe and Lintner model around the 10-K filing day

NT = 1 if there is a prior Form NT-10K filing for the same period

MW = Indicator equal to 1 if the firm reveals a material weakness in Internal Control in the Section 302/404 report (Audit Analytics: IC_IS_EFFECTIVE)

ICD= Indicator equal to 1 if the firm reveals a internal control deficiency in Internal Control in the Section 302/404 report (Audit Analytics: SIG_DEFICIENCY)

Section302 = Indicator variable equal to 1 if the filing is after August 29th, 2002 and as a result was Section 302 compliant

AccFiling = Indicator variable equal to 1 if the filing was an accelerated filing after December 15th, 2003

Section404 = Indicator variable equal to 1 if the filing was made by Section 404 compliant firm (Audit Analytics: Year with SOX 404 Internal Report)

In this model, the dependent variable ER is similar to Beaver (1968) U-Statistic and it captures the unusual price movement in the filing period. The coefficient on Section302 captures the increase in 10-K informativeness as a result of Section 302 compliance. Similarly, the

coefficient on AccFiling reflects the increase in 10-K informativeness due to accelerated filing and the coefficient on Section404 captures the increase in informativeness because of Section 404 compliance. This model assumes that investors believe that all the information in the filing is relevant for firm valuation and hence respond to this information.

Even though I have presented this model for 10-K filings, similar analyses can be done for earnings announcements because I expect that annual/quarterly earnings might be announced earlier because of acceleration of financial statement filing dates. Also, increase in quality of earnings will increase the informativeness of earnings disclosure.

5. SAMPLE AND RESULTS

5.1 Sample:

In this study I use 2 different samples to understand the effect of Sarbanes-Oxley on small public companies. First I use the data from Audit Analytics and Compustat of companies that are section 404 compliant and divide it into 3 different categories, namely small, medium and large filers based on asset size in the year of SOX compliance. There are 753 companies with assets between 1 million and 150 million USD in 2007 in this sample. Also, there are 1701 companies between 150 million to 1 billion USD and 1381 companies above 1 billion USD in assets. Then I run regressions individually on every group, to find if there is a different effect of SOX between these groups. One disadvantage of using data only from accelerated filers is that it is hard to control for macro-economic factors, in particular for the cost studies. Therefore I use a second

dataset where using Audit Analytics, I match the 753 companies with assets between 1 million and 150 million USD in 2007 which are Section 404 compliant with 1000 companies between 1 million to 150 million USD in assets during 2007 which are not Section 404 compliant.

An important advantage of the second sample is that I exploit the definition of accelerated and non-accelerated filers, to control for other macro-economic factors in the study. Since

accelerated and non-accelerated filers differ on the dimension of public float,31 there are non-accelerated filers that match an non-accelerated filer on all dimensions other than public float. These non-accelerated filers provide a good control group for this study because by matching smaller accelerated filers with non-accelerated filers based on industry and size, I can control for industry-related and macro-economic factors affecting firms in the period they implemented SOX.

I choose companies based on total asset size because the size of a company is a better indicator of its resources compared to market value of equity, and thus the difficulty it might encounter in complying with Section 404. I chose the limit of 150 million because given the cost range of 900 thousand to 2.5 million, as estimated by the Advisory Committee for Smaller Public

Companies, for becoming compliant;32 SOX costs would have been a more significant financial burden for these companies. I collected a matching sample of 428 firms that are accelerated filers after combining data from Audit Analytics and Compustat.

Table 2 Panel A explains the sample derivation for the second dataset in detail. I determine the first year of Section 404 compliance by the financial year in which the first Section 404 report is

31 Public float is the number of freely traded shares in the hands of the public. Float is calculated as Shares

Outstanding minus Shares Owned by Insiders, 5% Owners, and Rule 144 Shares. Accelerated filers have public float between 75-700 million while non-accelerated filers have public float less than 75 million.

filed by the accelerated filer. This methodology differs from the previous literature which assumes that all filers become Section 404 compliant in financial year 2004. As Table 2 panel C shows, almost 42% of the first year of the compliance would have been misclassified for small firms if I had assumed that all the accelerated filers became compliant in 2004, similarly 31% and 26% of the first year of compliance for medium and large firms would have been

misclassified. Also, in case of the matched sample almost 33% of first year of compliance would have been misclassified.

I match each accelerated filer with a non-accelerated filer with the same 3 digit SIC code and the closest asset size. The mean (median) difference in asset size between accelerated filers and non-accelerated filers is 27.85 million (1.4 million) and the mean (median) difference in market value of equity is almost 135 million (100 million) in the year of compliance. The mean market capital for non-accelerated filers is 43 million and for accelerated filers is 178 million. I obtained

SG&A, sales and investment from Compustat. The data on audit fees and audit related fees was obtained from Audit Analytics. Table 1 provides the description and source for all the variables used in the analysis.

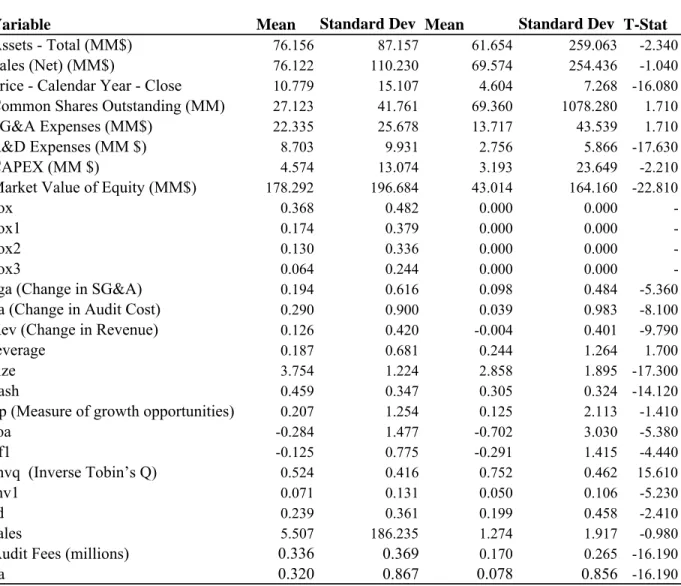

Table 3 panel A presents the descriptive statistics for small firms, medium and large firms. According to this table the average small, medium and large companies have 84 million, 430 million and 7 billion in sales and 88 million, 496 million, 19 billion in assets respectively. The mean market value of equity for these firms is 195 million, 608 million, 9.6 billion respectively. Also, small firms pay 370 thousand in audit fees while medium and large firms pay 690 thousand and 3.4 million respectively.

According to the descriptive statistics in Table 3 Panel B for the matched sample, the average accelerated filer in the sample has 81.1 million in assets and 98.1 million in sales while the average non-accelerated filer has 108.9 million in assets and 143.5 million in sales. The average market value of equity of the accelerated filer is 193 million and on average the audit fee of these filers is 380 thousand while non-accelerated filers have market value of equity of 58.4 million and pay 210 thousand in audit fees.

In both the samples, I deleted all the observations for the year in which the companies went through merger, acquisition or any accounting change33. In order to examine the data for outliers, I compared Pearson and Spearman correlation between all the variables and found they were consistent.

Also, in order to make sure that filers were not actively choosing to stay below 75 USD million in market float in the matched sample, I looked at the distribution of market float of firms not filing Section 404 reports, which is presented in Appendix D and I found that the distribution seems pretty continuous and there does not seem to be any discontinuity around 75 million dollar mark. In further analysis not presented in this paper, I also, looked at differences in patterns of repurchase of stocks by the non-accelerated and accelerated filers and did not find any difference that would suggest that the non-accelerated filers are actively trying to maintain their status. Table 4 presents the descriptive statistics of material weakness disclosures by the small, medium and large firms. According to the data more than 32% of all the small firms had a material weakness disclosure, while 30% of the medium firms and 17% of the large firms disclosed a material weakness. Also, almost 10 to 20% of the firms with material weakness discovered the

33 It is really important to delete observations from these years otherwise these observations can lead to incorrect findings. For example, when I looked at COGS regressions with these observations, it seemed that those costs were also increasing but once I deleted those observations then all the coefficients became insignificant.

weakness before the first year of Section 404 filing. This implies that Section 404 auditing is actually a very important step in analyzing internal controls of the firm.

5.2 Results

5.2.1 Direct Costs

Tables 5 and 6 present the estimation results for the direct costs. Table 5 Panel A presents the results from estimating model 1 with industry fixed effects for SG&A expenses for all 3 groups. Consistent with Hypothesis 1, the coefficient on SOX1 is positive and significant. The

coefficient on SOX1 around 0.055 for small firms and is statistically significant at 0.01 level, while it is around 0.006 for medium firms and -0.008 large firms. This implies that Section 404 was costlier to implement for small firms compared to medium or large firms. Also, the finding for large firms implies that they in general had internal controls in place before they underwent Section 40434 auditing under SOX.

After taking into account the increase in audit fees and all the other variables, the coefficient of SOX1 for small filers is 0.052, which implies that there is a 5.2% increase in SG&A in the year the accelerated filers became Section 404 compliant and the coefficient on SOX2 is significant which implies there an increase in SG&A in the second year of Section 404 compliance as well. This implies that we need to control for macro-economic effects in order to find the actual increase in SG&A costs due to Section 404 for small filer. Also, the coefficient on MW is not statistically significant, which implies that just disclosing material weakness does not increase SG&A for a firm. In addition, the coefficient on MW*SOX1 is around 2% and is marginally significant at 0.10 level, implying companies with material weaknesses might have paid more in

34 It should be noted that companies are required to maintain internal control over financial reporting under the Foreign Corrupt Practices Act of 1977.

the year of Section 404 compliance than companies with no deficiencies but this paper does not enough evidence to support this finding. Similarly, MW*SOX2 is positive and statistically significant at 0.01 level implying that firms that disclosed material weakness in the second year of Section 404 incurred additional expenses.

Table 5 Panel B presents the results for model 1 with year and fixed effects for the matched sample. According to this table, increase in cost for small firms was around 5% of SG&A for small firms in first year of Section 404 implementation and there was no increase in costs in the second year of Section 404 implementation. This implies that the increase in second year of Section 404 that was found in Panel A was due to macro-economic factors. According to this table the actual increase in costs of small filers due to Section 404 after accounting for auditing costs is around 3.94%. Because SG&A expenses average around 31 million dollars, this implies average Section 404 compliance cost is approximately 1.2 million dollars every year.

Table 6 Panel A presents the estimation results for model 2 with industry fixed effects for auditing costs of small, medium and large filers. The coefficient on SOX1 small filers is 0.51 and is statistically significant at 0.01 level. This indicates that there is an increase of at least 51% in auditing costs in the first year in which the small filer became Section 404 compliant.

Similarly the coefficient for medium and large filers is 0.48 and 0.36 respectively. This implies that increase in auditing costs for the small firms due to implementation of Section 404 was much greater than the larger firms. Also, the coefficient on SOX2 is negative and statistically significant at 0.01 level. The coefficient on SOX2 indicates almost a 19% decrease in auditing costs in the second year for small filers with no material weakness in internal controls while there was a 22% decrease in audit costs for both medium and large filers.

The coefficient on MW is positive and statistically insignificant at 0.01 level. This implies that firms disclosing a material weakness might have higher costs but there is not enough evidence to support this in our data. In addition, the coefficient on SOX1*MW is 0.30 and on SOX2*MW is 0.28 for small firms and they are statistically significant. This implies that firms disclosing a material weakness in the first year or second year of Section 404 compliance incur additional auditing costs. These findings indicate that audit costs increased by almost 150 thousand for small filers when they became Section 404 compliant if they do not have any material weakness. Also, the coefficient of MW in the first year indicates that the firm’s auditing costs increase by an additional 100 thousand dollars if they have a material weakness in the first or second year of Section 404 compliance. Also, the findings in Panel B support the findings in Panel A of the table.

Since auditing costs are less than 2% of the total SG&A expenses, the estimates of 51% increase in auditing costs explains only 1.02 % increase in SG&A expenses. Therefore a large portion of the increase in SG&A expenses can be attributed to non-auditing costs incurred within the firm due to Section 404. My findings are slightly lower than the 2 to 3 million dollar estimate of Section 404 costs noted by Grady (2007). However, given the average market capital of the small companies is less than 200 million, the fact that SOX related costs might not be a onetime expense but a recurring expense might be a big cause of concern for these companies35.

5.2.2. Indirect Costs

Table 7 Panel A presents the results from the R&D model with fixed industry effects for small, medium and large filers. The findings in Table 7 indicate that R&D expenses for small filers

35 Note that more years of data is needed to analyze how the costs for Section 404 implementation decreased for the small companies.

declined in the year of SOX compliance and are significant at 0.01 level, consistent with my predictions. The coefficient of SOX1 for medium filer is negative and not statistically

significant while the coefficient for large filer is positive and not statistically significant. This implies that the indirect cost of Section 404 was higher for small filers compared to large filers. The average ratio of R&D expenses to Total Assets is around 11% and coefficients on SOX1 is around -0.1 which implies that R&D declined around 1% of total assets in the year of Section 404 compliance. This finding is supported by the matched sample results in Panel B of table 7 though after taking into macro-economic factors this decrease seems to be around 0.5% of total assets. Prior research by Griliches (1981), Pakes (1985), Jaffe (1986) and Salinger (1984) finds that R&D expenditures are an important driver of future growth. Consequently, a decrease in R&D can adversely affect the future growth of a firm and its value36. This is in line with the discussion that companies that faced constraints because of Section 404 costs reduced on R&D expenditures.

Even though this result can be explained by lack of managerial attention, there are several alternative explanations for this finding. For example, earnings management to meet earnings target can explain this finding since prior research like Bushee (1998) has shown that managers can cut R&D to meet earnings target. From the earlier results in this paper we know that SG&A increased in the year the small firms became Section 404 compliant therefore it is possible that management cut their R&D budget in order to meet earnings targets.

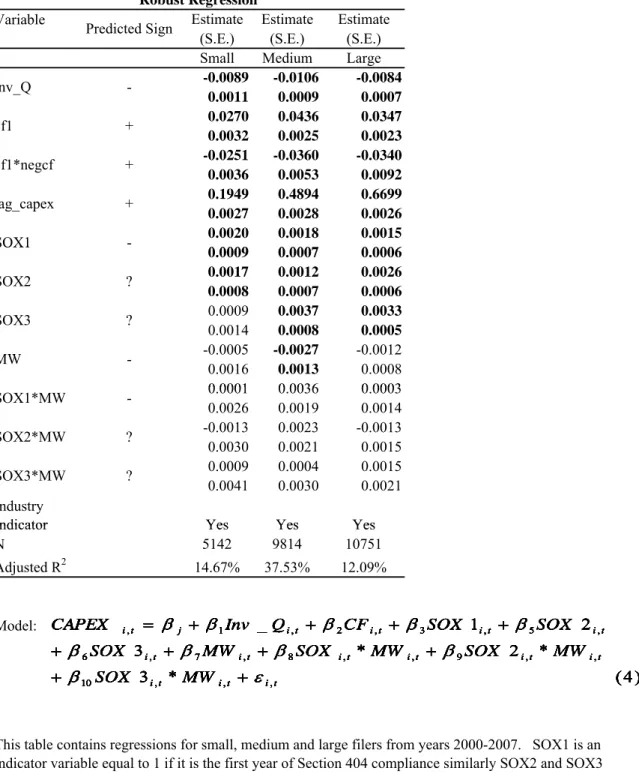

Table 8 Panel A presents the estimated results for the capital expenditure model for small, medium and large filers. The findings for this model imply that capital expenditure increased

36 Also, in further analysis the coefficient of the interaction of cash with SOX was found to be positive implying that change in cash became a bigger constraint for these companies when they become Section 404 compliant.

once the companies became Section 404 compliant. The coefficients of SOX1 and SOX2 for CAPEX are positive and statistically significant for all filers indicating an increase in CAPEX in the first and second year of Section 404 compliance. The coefficient on SOX1 ranges between 0.001 and 0.002 for small to large filers and the coefficient is between 0.012 and 0.026 for SOX2 for small to large filers, also the coefficients are statistically significant at 0.01 level. This

implies that capital expenditure increased by 2 to 3% in the first year of Section 404

implementation for all filers. There was a similar increase in capital expenditure in the second year. This is not consistent with hypothesis 3 but is consistent with the discussion that cost of equity might have reduced for these companies as a result of Section 404 compliance due to increase in earnings quality37. The findings in Panel A for small filers are supported by similar findings in Panel B for the matched sample of filers. These findings need to be explored further, because I believe that cost of equity would decrease only after the firm complies with Section 404 and as a result the increase in capital expenditure in first year of Section 404 compliance cannot be attributed to reduced cost of equity.

5.2.3 Earnings Quality38

Table 9 presents the descriptive statistics of the earnings quality variables. The mean of standard deviation of residuals of the sample is 0.101 and 0.099 for small filers while it is around 0.047 for large filers. This implies that earnings quality of firms decrease with decrease in size. This result is expected because different size firms are probably in different stages of product life cycle and as a result they focus on different aspects of business to maximize shareholder value.

37 We know from Francis, Lafond, Olsson and Schipper (2004) that cost of equity for a firm with high accrual quality is lower than a firm with low accrual quality.

38 There are only 324 companies in the final sample for earnings quality because the other 61 companies were missing cash flow data.

Also, it is interesting to note that the probability of being audited by a Big Four auditor increases with increase in firm size. The correlation matrix indicates that there is a decrease in standard deviation of residuals or an increase in earnings quality for all firms after Section 404 came into effect. Also, according to the results of regression of earnings quality in Table 10 it seems that earnings quality increased after the firms became Section 404 compliant. The coefficient of SOX is around -0.02 for small filers and is statistically significant at 0.01 level, which implies almost a 20% decrease in standard deviation based on the mean of 0.10 for the sample. This finding is in line with hypothesis 439. Also, there seems to be an increase in earnings quality for medium and large filers as implied by coefficients around -0.012 and -0.008 respectively, all coefficients are statistically significant at 0.01 level. Also, small filers have the highest increase in absolute quality but the relative improvement in quality for medium filers (16%) and large (17%) filers is pretty similar to small filers.

5.3 Sensitivity Analysis and Additional Tests

I repeated the analysis in this paper by matching the non-accelerated sample based on market value of equity instead of asset size and found similar results. I have also looked at the changes regressions for investment instead of levels regression and my findings were consistent with the findings in this paper. All the results presented in this paper, except the earnings quality

regressions, are based on robust regression analysis40. According to Huber (1981) and Rousseeuw and Leroy (1986) robust regression is robust with respect to outliers and does not assume normality of errors. This regression comprises of three steps. In the first step the algorithm selects an initial estimate of coefficients based on Ordinary Least Squares (OLS). In

39 I also, repeated this analysis on firm level and found similar results. 40 M-method is used in the results.

second step residual and associated weight from previous iteration is calculated. In the third step the algorithm solves for the new weighted least square estimate. The second and third steps are repeated till the estimated coefficients converge. The coefficients from the model can be interpreted in the same way as OLS estimates.

I also ran regressions for change in SG&A, auditing costs and investment while allowing for cross-sectional correlation and the results remained unchanged.