Determinants of capital structure for retailing firms on the JSE

Full text

Figure

Related documents

Although man- datory disclosure obviously is superior to voluntary disclosure given the in- formation about product risks that firms have — since such information is valuable

This thesis utilizes the Apache Storm real time processing engine enhanced with a Kalman Filter to provide estimation of an aircraft’s location.. This approach provides an

If this product contains ingredients with exposure limits, personal, workplace atmosphere or biological monitoring may be required to determine the effectiveness of the ventilation

The PA-A6 is a series of single-width, single-port, ATM port adapters for the Cisco 7200 series router, Cisco 7200VXR series router, Cisco 7301 router, Cisco 7401ASR routers, Cisco

Findings from this study showed that following propofol induction, low dose suxamethonium (0.1 mg/kg) significantly improved grades of overall laryngeal mask

Few graduate programs appropriately educate environmental health personnel in the basic environmental health issues: the issues that underlie and create our pollution and

Labelling could be required through a provincial regulation, or possibly through local permitting (e.g. generalized use of CEAs and EnerGuide labelling as a means for local

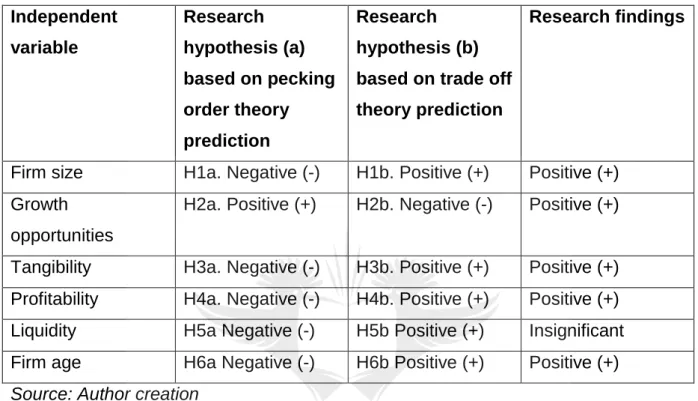

This study used 202 Pakistani companies and analyzed eight years data for the annual periods of 2006 to 2013 and investigated the leverage composition of firms and the determinants