Progressivity of personal income tax in Croatia: decomposition of tax base and rate effects

Full text

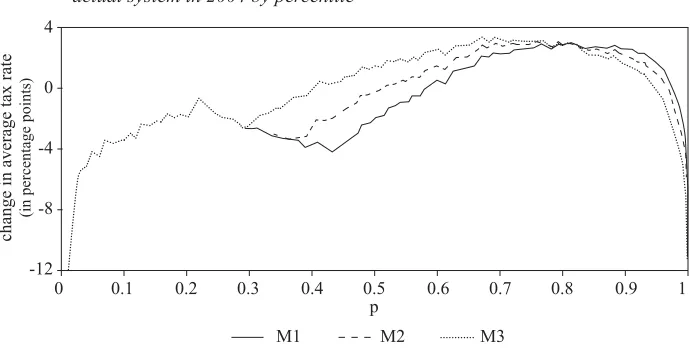

Figure

Related documents

In order to further understand the impacts of each condition on power and Type I error rates at time and school levels, (a) Figure 2 to Figure 5 depicted the effects of time- level

Unlike solutions that requires multiple software to be included in a stack to satisfy all of the business requirements, Pega’s unified Build for Change platform can

Available in six different colours, the eco-leather notebooks are offered in a variety of stylish and contemporary apple themed covers.. Eco-leather notebooks 740 Golden

provide a tool to generate such ICC profiles based on display characteristics (luminance, contrast ratio, calibration only to GSDF or also to be perceptually linear in

Asset Description Asset Data tabs move through project flow defining the data points and documents necessary to track and monitor project activity and to report up to

The results suggest that, although product market competition marginally increases the impact of firm size on financial leverage, firm size remains relevant for

Since market capitalization, exchange rate, inflation was found out to be strong variables significant in the determination of trends of share prices, suffice to

Co-sponsored by the Hudson River Waterfront Conservancy of NJ, Inc., and Stevens Institute of Technology’s Davidson Laboratory/Center for Maritime Systems, the Waterfront Conference