Laboratory tests with Lepidoptera to assess non-target effects of Bt maize pollen: analysis of current studies and recommendations for a standardised design

Full text

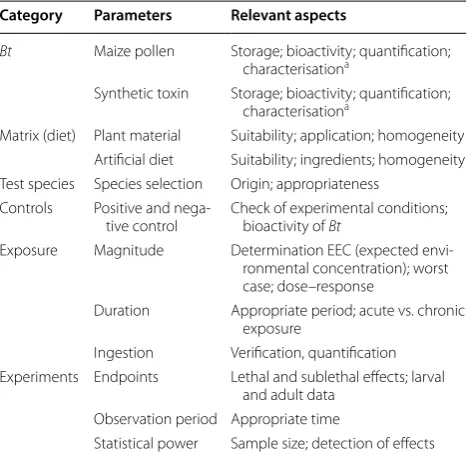

Figure

Related documents

On the other hand, strongly non-conforming subjects in the robustness treatment give more in the dictator game than others, suggesting that expected payoff maximizers in the

Uhk qukstfln fs j`kir. Ul ne thk nudakrs ine jlnsfekr thk plssfa`k jisks. Vlu jin thkn jlunt thk du`tfp`ks lb. Bfni``y, ylu wf`` nkke tl ijjlunt blr thk nudakrs thit hivk akkn

• solve basic real-life problems involving exponential growth and decay • determine the partial derivatives of functions of several variables. Continue practising solving problems

Piketty’s arguments, particularly those drawn from economic history and the data he has put together, are strong, even persuasive (see for example his estimation of two centuries

The two major interoperability standards are the Industry Foundation Classes (IFC), a common data scheme that allows interoperability across software packages (Building Smart,

monthly price series for certain items spanning the requisite time periods. The Hotel sector is notably absent from these item-level regressions.. price increases were however

It is observed that a firm’s growth rate of total employment (productive workers and supervisors combined) will follow an exponential distribution.. Our second model was an attempt

The empirical results show that, when the forehead step is small, the DNS model is better for the short term interest rate, in agree with DL’s (2006) conclusion about DNS model