Efficacy Assessments of Z Score and Operating Cash Flow Insolvency Predictive Models Insolvency Predictive Models

Full text

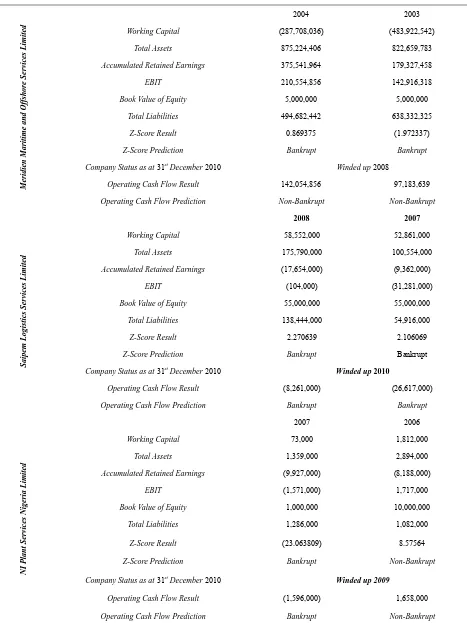

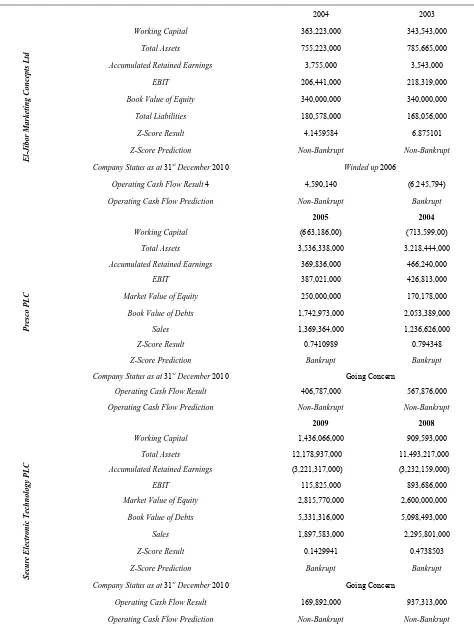

Figure

Related documents

Table (5) reports the average treatment effect over all samples of membership to CBHISs on health service utilization and income protection for all households and subset of poor

Auditor friendly Cash Flow, Cash Flow Statement, Computation of Surplus. Cash and

z Free cash flow to firm (FCFF) is cash flow from operations after investments in working capital and capital expenditure. z It represents the amount of cash available to debt

To work out the unit costs, the model starts off by creating two temporary pivot tables showing the total cost [REVISED TC] (the inlier total costs) and number of activities

High-hazard Group H occu- pancy includes, among others, the use of a building or structure, or a portion thereof, that involves the manufacturing, processing, generation or storage

[r]

Operating cash flow 2 Cash flow before dividends Operating cash flow 2 Cash flow before dividends Net capex 6.7 €bn Connection fees 0.5 €bn Net capex 4.0 €bn

Operating cash flow and free cash flow positive in the last two years – despite reorganisation (2012) and increased investment spending (2013). Decline in operating cash flow