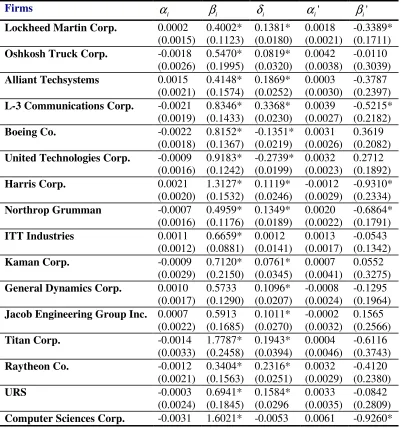

Short and Long Term Effects of September 11 on Stock Returns: Evidence from U S Defense Firms

Full text

Figure

Related documents

4. We advocate a “three pillar” approach to emerging markets: investing in a broader range of asset classes, top-down, dynamic management of risk allocation to these

1A: Skin corrosion/irritation, Hazard Category 1A Skin Corr. 1B: Skin corrosion/irritation, Hazard Category 1B

The growing industry discussion over the benefits of reshoring versus offshoring gives manufacturers an excellent starting point to conduct a Total Risk Profiling and Total Cost

drag variation with respect to angle of attack and Reynolds number, (B) coefficient of lift variation with respect to angle of attack and Reynolds number, and (C) aerodynamic

Section 3 formally analyses the security of the basic address procedure of the LISP, then using a progressive approach, it explains and for- mally verifies the refinement stages,

Chapter 20 aligns the existing Listing Rules with international standards for the mineral industry, and ensures that Mineral/Exploration Companies seeking a listing

thesis entitled “GENETIC DIVERSITY AND STABILITY ANALYSIS OF SWEETPOTATO GERMPLASM FOR LEAFY VEGETABLE” in accordance with Universiti Pertanian Malaysia Higher Degree Act 1980