Institutional Investors, Dividend Policy and Firm Value—Evidence from China

Full text

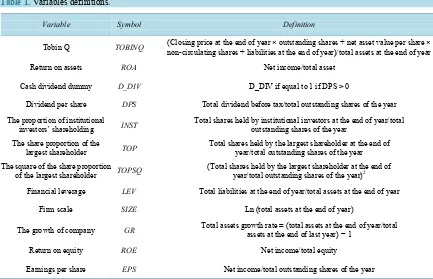

Figure

Related documents

Finally, the findings show that instructors’ modeling of balanced assessment, which includes the use of the authentic learning tasks and rubrics to engage student teachers

Volunteers OOo Code SUSE RedHat Lanedo KAKST Canonical Collabora IBM Munich SIL ALTA Bobiciel CodeThink CodeWeavers Intel.. Nou &

Also, we require our security solution to support the dynamic nature of the environment (allowing flexible user and device adition and removal), to be scal- able, to provide

At the end of each round you will be informed about the cutoff price (market price in the uniform auction treatments), about the number of units sold by each of the sellers, about

Second, regarding money-laundering arrangements that governed firmly in law number 8 of year 2010 on prevention and eradication of the crime of money laundering

(c) Discipline: If the Medical Director, after consultation with the Medical Advisor, determines in his discretion that a player in Stage One has failed to cooperate with

The quality of the knowledge construction process is evaluated through Content Analysis; and the network structures are analyzed using Social Network Analysis of the response

South Korea: This report is issued and distributed in South Korea by CIMB Securities Limited, Korea Branch ("CIMB Korea") which is licensed as a cash equity broker,