University of Warwick institutional repository: http://go.warwick.ac.uk/wrap

This paper is made available online in accordance with publisher policies. Please scroll down to view the document itself. Please refer to the repository record for this item and our policy information available from the repository home page for further information.

To see the final version of this paper please visit the publisher’s website. Access to the published version may require a subscription.

Author(s): Jan Hošek, Luboš Komárek and Martin Motl Article Title: MONETARY POLICY AND OIL PRICES Year of publication: 2010

Link to published article:

http://www2.warwick.ac.uk/fac/soc/economics/research/workingpapers/ 2010/twerp_947.pdf

MONETARY POLICY AND OIL PRICES

Jan Hošek, Luboš Komárek and Martin Motl

No 947

WARWICK ECONOMIC RESEARCH PAPERS

MONETARY POLICY AND OIL PRICES

Jan Hošek Luboš Komárek

Martin Motl

Abstract

This article discusses the relationship between monetary policy and oil prices and, in a broader sense, commodity prices. Firstly, it focuses on describing the relationship between key macroeconomic variables, gas prices and other commodity prices relative to oil prices. Subsequently, it discusses the existence of “transmission channels” through which monetary policy can be propagated to oil prices (or prices of commodities). It then provides an insight into the CNB’s forecasting process, both by looking retrospectively at the oil price outlook in the past and by analysing a transitory and a permanent shock (a rise in the oil price of USD 30/b). The simulated oil price shock is calculated from the average level of Brent oil prices in the first quarter of 2010, i.e. USD 77.50/b.

Key words: oil price, monetary policy, real interest rate, oil price shock.

JEL Classification: G12, G14, D53.

1. INTRODUCTION

The current debate among central banks is increasingly focused on the role of asset prices in the process of monetary policy decision-making and maintaining financial stability. However, most small open economies have their attention fixed not only on financial market developments (stock and bond prices and exchange rates) and property prices, but also on commodity prices, in particular prices of oil and oil products. The primary motivation for writing this article was to provide a comprehensive view of the significant role which oil has played, and still plays, in the global economic system. We will also try to quantify the threat posed to the Czech economy by a potential medium-strong oil price shock.

The relationship between monetary policy and oil prices is not a frequently addressed topic in the economic literature, especially focusing on small open economies. This is especially true as regards analysis of the Czech economy. In this paper1 we are focusing to evaluate the sensitivity of the Czech economy and monetary policy to a potential oil price shock.

This article is structured as follows. Section 2 describes the evolution of oil and oil product prices and their relation to key macroeconomic variables and prices of other commodities

Jan Hosek, Czech National Bank (jan2461.hosek@cnb.cz).

Luboš Komárek, Czech National Bank, Faculty of Economics, VŠB-TU Ostrava and The University of Finance and Admisnitration (lubos.komarek@cnb.cz)

Martin Motl, Czech National Bank and Faculty of Economics, VŠB-TU Ostrava (martin.motl@cnb.cz)

1 The opinions expressed in this paper are our own and do not necessarily reflect the official views of the CNB.

(particularly gas). Section 3 discusses the relationship between monetary policy and oil prices in the context of selecting optimal oil extraction volumes (producers) and corresponding inventory levels (oil refiners) and the effect of financial speculation (investors). Section 4 first defines the optimal central bank response to oil prices, then shows retrospectively which prices have entered the CNB’s forecasting process and provides results of a simulated positive transient and permanent oil price shock (a rise in the oil price of USD 30/b). The final section summarises and offers recommendations.

2. KEY EMPIRICAL FACTS 2.1 Oil and oil products

[image:4.595.89.496.340.496.2]Oil product prices are derived primarily from oil prices, hence the two are closely correlated. However, prices of individual oil products also depend significantly on immediate demand (e.g. in relation to the business cycle2) and have greater seasonality than oil prices. Technology can be modified (and therefore the ratios of individual distillates can be adjusted) in line with changes in the demand structure, but this is not a short-term matter. The proportions of the distillates differ according to the type of oil and refining techniques used. Table 1 summarises the approximate yields of the final products obtained from oil.

Table 1

Product yields during oil refining (in %)

Fraction Proportion Product Use

Gases 10% methane, ethane heating, cooking

propane, butane chem. industry, fuels, heating Light

distillates 35%

light petrol petrochemical industry heavy petrol motor fuels

Middle

distillates 35%

kerosene aircraft fuel diesel motor fuel (diesel) light fuel oil household heating Residual

heavy distillates

20%

heavy fuel oil fuel for power plants and ships asphalt roads, construction

petroleum coke steel production sulphur chemical industry

Source: Authors’ calculations based on IEA data.

Total proved global oil reserves amounted to 1.26 trillion barrels at the end of 2008 (see Chart 1). The largest part of the global reserves is located in the Middle East. While reserves in North America have been showing a downward trend since the late 1980s, reserves in Africa, Europe and Eurasia, and South and Central America are gradually rising, thanks mainly to the discovery of new deposits.

Chart 2 provides data on global oil production. The Middle East, with 26.2 million b/d, accounts for the largest share of the total oil extraction (84.9 million b/d in 2008). Second is Europe with 17.6 million b/d and third is North America, whose share of production is gradually declining but is still a significant 13.1 million b/d. Production in the Middle East is controlled by the OPEC oil cartel (Organization of the Petroleum Exporting Countries). OPEC coordinates the output of its member countries3 (by means of quotas) to achieve the desired market price. OPEC’s members currently control 75% of all global oil reserves and account for one-third of all global oil production and a full half of global oil exports.

2

For example, the share of freight transport and the consumption of diesel relative to petrol increase with growth in the global economy. Growth in oil prices relative to petrol prices is subsequently observed.

3 Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates

Chart 1

Proved global oil reserves (in billion barrels)

Chart 2

Global oil production (in million b/d)

0 200 400 600 800 1000 1200 1400

1988 1991 1994 1997 2000 2003 2006 North America Central and South America Europe, Eurasia Africa

Middle East Asia, Pacific

0 10 20 30 40 50 60 70 80 90

1965 1970 1975 1980 1985 1990 1995 2000 2005 North America Central and South America Europe, Eurasia Africa

Middle East Asia, Pacific

Note: End-2008 data.

Source: Authors’ calculations based on British Petroleum Statistical Review and Bloomberg data.

Global oil consumption is constantly rising (84.5 million b/d at the end of 2008). The Asia-Pacific region dominates in terms of both level and rate of growth, with average consumption of around 26 million b/d (see Chart 3). North America and Europe also have significant shares (23.7 million and 20 million b/d respectively). The Middle East currently has “negligible” consumption of around 6 million b/d.

Chart 3

Global oil consumption (in million b/d)

Chart 4

Growth rate of oil consumption (%)

0 10 20 30 40 50 60 70 80 90

1965 1970 1975 1980 1985 1990 1995 2000 2005 North America Central and South America Europe, Eurasia Africa

Middle East Asia, Pacific

0 150 300 450 600 750

1965 1970 1975 1980 1985 1990 1995 2000 2005 North America central south america

europe Middle East

africa asia, pacific

;

Note: Chart 3: end-2008 data; Chart 4: in %; 1965=100, global level depicted by dotted line. Source: Authors’ calculations based on British Petroleum Statistical Review and Bloomberg data.

Chart 4 illustrates oil consumption growth in the individual regions in relation to 1965. The Asia-Pacific region shows the biggest rise (almost 700%). Other significant increases (but at much lower levels) are recorded by the Middle East (570%) and Africa (450%). Consumption in North America and Europe has increased relatively little in the last 43 years (by 83% and 70% respectively). All this can be explained by rapid economic growth in regions which were originally underdeveloped and are now converging, whereas Europe and North America4, by contrast, have “learnt” from oil price shocks and have started to scale down their energy use.

4 The 1965 base year may have distorted the results, as both these regions were then at the peak of the business

The transfer of a large amount of production from advanced regions to emerging countries has also played a “distorting” role, as most of this production is highly energy intensive.

2.2 Oil price and key macroeconomic variables

Chart 5a shows the long-term evolution of the nominal and U.S.-CPI deflated real oil price.5 The real oil price at the time of the “first” and “second” oil price shocks was not surpassed until the beginning of 2005. Chart 5b illustrates the generally inverse relationship between the USD real effective exchange rate and the oil price (in USD/b).

Chart 5

Nominal and real variables and the price of oil

a) nominal and real oil price (in USD/b) b) real oil price and USD real effective exchange rate

0 20 40 60 80 100 120 140

1970Q1 1976Q2 1982Q3 1988Q4 1995Q1 2001Q2 2007Q3 Brent crude oil Brent crude oil - real (CPI)

0 10 20 30 40 50 60 70

1980Q1 1985Q3 1991Q1 1996Q3 2002Q1 2007Q3 80 85 90 95 100 105 110 115 120 125 130 135

Brent crude oil - real (in USD/b) Left axis Real effective exchange rate (USD) Right axis

Source: Authors’ calculations based on Thomson Reuters data.

Chart 6 illustrates the relationship between oil prices and key macroeconomic variables. Oil prices and CPI inflation6 in advanced (G7) countries show a clear dependence (Chart 6a) – a change in the oil price passes through to inflation almost immediately. Chart 6b illustrates signs of an inversion relationship between oil prices and economic growth over most of the period under review. This mismatch is partly due to the slower adjustment of oil prices to changes in the phase of the business cycle.

Chart 6

Relationship between oil prices and macroeconomic variables of advanced countries (G7 average)

a) real oil price and CPI inflation a) real oil price and economic growth

-100 -50 0 50 100 150 200 250

1970 1975 1980 1985 1990 1995 2000 2005 -3 0 3 6 9 12 15

Brent crude oil - real (y-o-y, in %) Left axis Inflation CPI, G7 countries (y-o-y, in %) Right axis

-240 -180 -120 -60 0 60 120 180 240

1970 1975 1980 1985 1990 1995 2000 2005 -4 -2 0 2 4 6 8

Brent crude oil - real (y-o-y, in %) Left axis Real GDP, G7 countries (y-o-y, in %) Right axis

Source: Authors’ calculations based on Thomson Reuters data.

5 The U.S.-PPI results were almost identical. 6

Chart 7 shows the relationship between real oil prices and the real interest rate. Its logic is explained by the Hotelling model, in which oil owners decide on the basis of the real interest rate whether to extract oil and sell it or not to extract it and leave it in the ground. If the oil price is rising so fast that oil in the ground guarantees higher yields than the money obtained by selling it, the owners will prefer to leave it in the ground – they will postpone production in an effort to achieve higher prices in future. This reduces current supply and increases current prices while increasing future demand and reducing future prices. In a world of certain proprietary rights and perfect information this continues until the estimated price of oil adjusted for extraction costs is rising at a rate equal to the market interest rate. If interest rates fall, other things being equal, an impulse to slow down current oil extraction and achieve higher prices will arise. This should generate a negative correlation between interest rates and oil prices. If we put together the rapid demand growth and low real interest rates seen in recent years, then rapid growth in oil prices is a logical result of the Hotelling model.

Chart 7

Empirical relationship between real oil prices and real interest rates (Hotelling model)

0 10 20 30 40 50

1957 1962 1967 1972 1977 1982 1987 1992 1997 2002 2007

U

S

D

/b

-4 -2 0 2 4 6 8

%

Brent crude oil - real (CPI) in USD/b U.S. Real interest rate (in %)

Note: Hotelling relationship assumes negative correlation between interest rates (right-hand scale) and real oil prices.

Source: Authors’ calculations based on Thomson Reuters data.

2.3 Oil and gas

expected in the future. Besides investment in LNG infrastructure, large amounts have recently been invested in pipeline transport and unconventional gas extraction (from shale and sand). As a result, there is currently a global gas surplus and customers are trying to switch from long-term contracts indexed to oil prices to market prices. The price of gas7 on the Czech market is currently determined mainly by long-term contracts. The exact parameters of the price-setting mechanism8 for such contracts are not publicly available. However, we have found the moving average of prices of oil (both Ural and Brent) over the last twelve months to be highly successful in explaining gas prices in the Czech Republic. This tallies with the observation that on the Czech market gas prices follow oil prices with a lag of roughly six months on average. We use this dependence in our forecasting mechanism. From the point of view of retail prices, this six-month lag implies that the overall impact of energy prices is spread over a longer period, is slower and has a smaller absolute amplitude.

2.4 Oil and other commodities

Most commodity prices tend to move in the same direction as oil prices. This is confirmed by Table 2, which gives the correlation coefficients between average annual prices of oil and selected commodities since 1960. It can be seen that prices of iron ore and coal show the highest correlation with oil prices. Except for rice prices, though, all the other commodities have high correlation coefficients (> 0.8). However, if we examine the evolution of the correlation coefficients over time (between the annual averages for a five-year rolling period – data and charts available on request), we find that since 1960 they have been highly volatile and have differed across commodities. Since 2003, however, when the oil price started rising constantly, the correlation coefficients have been high. This means that the other commodity markets have also been recording steady price growth. Even so, we cannot say that oil has been affecting the other commodities or vice versa. None of the price time series for any of these commodities is stationary – not even after first differentiation in the case of coal and iron ore. Analysis of the potential dependence of individual commodity prices on oil prices (or vice versa) therefore requires cointegration tests. These, however, reveal no cointegration (and hence no long-term relationship), except for the oil-nickel pair. Therefore, we can say that (most) price co-movements of oil and the commodities under observation are a result of co-dependence on some other variable. The candidates include, for example, U.S./Fed monetary policy (see below) or the global economic cycle. These increase or decrease the demand (actual or speculative) for all commodities, which, given more or less imperfect competition on the supply side, leads to commodity price volatility. Owing to differing dynamics and the lag of commodity prices behind the business cycle, we therefore observe a dependence (albeit only apparent) between individual commodity prices and the oil price, which is expressed in Table 2 by means of Granger causality.9

7 Here we mean the wholesale price of gas. The data source is the IMF statistics on Russian gas prices at the

German border. New figures are usually available only on a quarterly basis. Retail prices are still regulated in the Czech Republic, but largely reflect wholesale prices.

8

RWE says that in setting the price of natural gas for wholesale customers it takes into account the prices of light and heavy fuel oil and black (and steam) coal (i.e. prices relatively closely related to oil prices) as well as Pribor and Libor interest rates and the EUR/USD exchange rate.

9 Granger causality does not necessarily mean that an actual causal dependence exists between two variables (in

Table 2

Relationship between the oil price and other commodity prices

Commodity

Correlation of commodity price

with oil price

Granger causality from oil prices to

commodity prices

from commodity prices to oil prices

coal 0.904 0.001 * 0.001 *

aluminium 0.803 0.836 0.095

copper 0.877 0.349 0.015 *

iron ore 0.941 0.100 0.003 *

nickel 0.830 0.011 * 0.000 *

wheat 0.858 0.031 * 0.232

rice 0.669 0.046 * 0.214

corn 0.802 0.044 * 0.258

gold 0.886 0.001 * 0.644

silver 0.819 0.010 * 0.294

Note: Granger causality test results statistically significant at the 5% level are indicated by *. Source: Authors’ calculations based on Thomson Reuters data.

It can be seen from the analysis that there is statistically significant bi-directional Granger causality between oil prices and coal and nickel prices. The causality from prices of other industrial metals to oil prices (and not vice versa) is also significant. Conversely, we observe a causality running from oil prices to prices of agricultural commodities and precious metals (and not vice versa). To obtain a more precise description of the dynamics we would have to specify a more sophisticated model. Nonetheless, based on our results we can state that an economic upswing is reflected first in rising prices of industrial metals, then in rising prices of energy, and finally in rising prices of agricultural commodities and precious metals (by this time possibly due to inflation or rising inflation expectations).

2.5 Oil price and the USD exchange rate

There is traditionally a negative correlation between the dollar exchange rate and oil prices, although the relationship between the two has undergone major changes in the past (see Chart 8). Breitenfellner and Cuaresma (2008) divide the relationship from 1950 to the present into roughly four periods according to the volatility of, and correlation between, the two variables. These periods coincide with regime shifts in oil and money markets.

The first period (1950–1970) was characterised by low oil price volatility and a strong negative correlation (-0.62). The Bretton Woods system of fixed exchange rates was in place. Other characteristics included low inflation, low interest rates and high economic growth. Oil prices were controlled by seven large international corporations that dominated oil production, refinement and distribution.

The following period between 1971 and 1984 was one of high volatility and the negative correlation was not so strong (-0.18).10 In August 1971, President Nixon announced the discontinuation of gold convertibility of the U.S. dollar given the deteriorating U.S. balance of payments. This move resulted in a steep depreciation of the dollar against gold and other world currencies. OPEC, whose purchasing power had decreased, was slow to react to the dollar’s depreciation. Only two years later, during the Yom Kippur War (October 1973), OPEC cut its oil production and placed an embargo on oil exports to the West. The price of oil quadrupled in a year, while the dollar continued to depreciate. The next oil crisis started in autumn 1978 in the wake of the Iranian Revolution, which led to a temporary fall in oil production in the country. The subsequent growth in oil prices was boosted by a phased

10 The different correlation figure (-0.97) from our calculations for the period may be due to the use of different

decontrol of oil prices by the Carter administration. The price of oil again quadrupled in a year. At the end of the second period (1981–1984) the dollar regained strength sharply as a result of restrictive Fed monetary policy (under chairman Paul Volcker) and the price of oil fell slightly despite a decrease in oil supply due to the Iraq–Iran conflict. The strengthening dollar and economic recession in the USA probably played a stronger role.

In the third period (1985–1998) both the dollar exchange rate and the oil price were less volatile. The correlation was no longer negative (+0.44). OPEC lost its power to set prices when Saudi Arabia almost doubled its production in August 1985. This was followed by a fall in oil prices. Throughout the period OPEC was unable to take effective action to raise them. In September 1985, the Plaza Accord was signed in the United States with the aim of devaluing the dollar. This was intended to reduce the current account deficit and help the country emerge from recession. Over the following two years, coordinated central bank intervention caused a depreciation of the dollar by more than 50%. The price of oil surged temporarily in August 1990 as a consequence of the Iraqi occupation of Kuwait but subsequent declined almost uninterruptedly. This is put into context with transition-induced recession in the former Soviet Union and in Central Europe. Oil prices reached their deepest level as a result of the Asian crisis (1997–1998).

The last period (since 1999) is marked by high volatility and a renewed strong negative correlation (-0.80). Owing to low investment in the previous periods, oil producers were unable to keep pace with rising oil consumption due to rapid growth in demand in emerging (Asian) economies. Reserve extraction capacity decreased and oil prices started to rise dramatically. As non-OPEC production was already beyond its peak, the oil cartel’s price-setting power increased. Fundamentals, geopolitical risks and excess liquidity resulting from easy monetary policy caused an inflow of speculative money into the oil market. This, in turn, bolstered the growth in oil prices and caused a speculative bubble to form. This bubble burst in July 2008 and the oil price temporarily collapsed. However, thanks to the renewed market power of OPEC, the price very soon returned to the level which OPEC considers favourable for both oil producers (in terms of investment efficiency) and consumers.

Chart 8

Empirical relationship between the EUR/USD exchange rate and oil prices

a) EUR/USD exchange rate and oil price b) Moving correlation coefficient of EUR/USD exchange rate and oil price (period = 5 years)

0 20 40 60 80 100 120

1957 1963 1969 1975 1981 1987 1993 1999 2005 0,5 1,5 2,5 3,5 4,5

Brent crude oil (in USD/b) Left axis EUR/USD exchange rate (Right axis)

-1,0 -0,5 0,0 0,5 1,0

1962 1967 1972 1977 1982 1987 1992 1997 2002 2007

Note: Before 1999 “synthetic” euro; before 1979 calculated from DEM/USD. Source: Calculated using Thomson Reuters and IMF-IFS data.

to stabilise the purchasing power of their (U.S. dollar) export revenues in a situation where their imports are mostly paid for in euro. A condition for this channel to function is that oil-exporting countries must – at least partially – have the power to affect oil prices by altering supply. In fact, OPEC’s power was highly volatile in the past, but with soaring demand from China and other emerging economies and with production having peaked in most non-OPEC countries, OPEC’s significance has recently increased considerably. (ii) Local prices in non-dollar regions on the demand side – the non-dollar’s depreciation reduces oil prices in countries whose currencies have strengthened against the dollar, thereby increasing demand for oil and the oil price denominated in dollars. (iii) Investment in oil-related markets – the dollar’s depreciation reduces foreign investors’ returns on U.S. dollar-denominated financial assets, hence increasing the attractiveness of oil and other commodities as an alternative investment for foreign investors. Investment in commodities is also used by U.S. investors to hedge against domestic inflation, the risk of which increases as the dollar depreciates. (iv) Monetary policy and exchange rate regimes – the dollar’s depreciation entails an easing of monetary policy conditions in countries whose currencies are pegged to the dollar (including oil exporters and China). In turn, demand – including demand for oil products – rises in those countries.11 In such case, however, this may involve only an apparent correlation, with the USD/EUR exchange rate and the price of oil in fact being co-determined by a third variable, namely the real interest rate (if the uncovered interest parity applies). (v) Efficient currency markets – currency markets are possibly more efficient than oil market and hence anticipate developments in the real economy that affect the demand for and supply of oil.

The above-mentioned channels assume that the causality goes from the dollar exchange rate to the oil price. This is contradicted by a number of studies which also admit the opposite direction of causality, i.e. from the oil price to the dollar exchange rate, and particularly to the exchange rates of “commodity currencies” (the currencies of major global commodity-exporting countries). In the empirical part of their study, Breitenfellner and Cuaresma (2008) find that the direction of causality is unclear, but they also come to a relatively strong conclusion that the inclusion of the EUR/USD exchange rate among a model’s explanatory variables improves its ability to predict future oil prices.

3. LINKS BETWEEN MONETARY POLICY AND THE PRICE OF OIL (COMMODITIES)

The accelerating growth in the prices of oil and other commodities which can be observed since 2003 is causing many to ask what is causing this growth. The sustained economic boom in Asia, growing demand in emerging economies, political instability (Venezuela and Nigeria; unrest in the Middle East), gradually depleting reserves of oil (commodities) and rising extraction costs are usually cited as the main reasons. However, this hypothesis is contradicted by developments over the last three years. The world economy started to slide into recession in late 2007. This situation was aggravated by the fall of Lehman Brothers on 15 September 2008 and by the onset of the global financial crisis. Meanwhile, however, the price of oil surged by almost 100% starting in late 2007. Almost all mineral and agricultural commodities then recorded rising prices. A strong correction of oil and other commodity prices occurred only in the second half of 2008. Since 2009, commodity prices have been rising sharply again. The question is what is causing these contradictory trends of strongly

rising commodity prices and an economy sliding into recession. Are demand and supply factors tied to economic growth a sufficient reason for the surge in commodity prices? If global economic growth since 2002 does not explain this surge, where should we look for its causes?

One group of economists12 believes that the recent dramatic rise in commodity prices could not have been caused solely by supply and demand for commodities including oil (as assumed by the traditional hypothesis), but that it was due largely to “cheap money”. A possible explanation can therefore be found in how monetary policy has been conducted, or rather in the real interest rate level, which is a very important factor underlying real commodity prices.

Chart 9

Real commodity prices at times of high and low real interest rates

2,30 2,35 2,40 2,45 2,50 2,55 2,60 2,65 2,70

-4,0 -2,0 0,0 2,0 4,0 6,0 8,0 10,0

U.S. real interest rate (in %)

lo

g

(

R

e

a

l

C

R

B

C

M

D

T

I

n

d

e

x

)

1981q2 - 2001q3 2001q4 - 2010q1

Source: Calculated using Bloomberg data.

Chart 9 describes the relationship between real (CPI deflated) interest rates in the USA and the Commodity Research Bureau Index13 in real terms. Commodity prices have been low at times of relatively high interest rates, i.e. tighter Fed monetary policy (shown in blue), and high at times of relatively low rates. This would suggest that interest rates have a greater impact on prices of oil and other commodities than generally assumed so far.

The current high commodity prices may therefore be a result of the Fed’s long-running easy monetary policy, which started in 2001.14 A second wave of aggressive cuts started in October 2007. The Fed lowered its key policy rate from 4.75% to only 0.25% at the end of 2008, i.e. over a period of just 14 months. On the one hand, this was a logical consequence of the situation facing the U.S. economy (i.e. the technology bubble, the terrorist attacks of 2001, the economic downturn, etc.). On the other hand the sustained easy monetary policy probably led to overall growth in asset prices, including commodity prices. Chart 10 shows the dynamic growth of real prices of individual commodity categories (i.e. industrial metals and agricultural commodities as well as the overall commodity basket), Brent crude oil prices and U.S. real interest rates. In the period of rising rates (i.e. the 1980s and 1990s), commodity prices did not record such high growth as after 2000, when interest rates were falling sharply.

12 See, for example, Frankel (2006). 13

The CBR Index describes the overall direction in commodity prices. It is a measure of price movements of 19 basic commodities. The greatest weight is assigned to oil (23%), followed by copper, corn, gold, live cattle, soybeans and natural gas (6%), cocoa, coffee, cotton, heating oil, unleaded petrol and sugar (5%) and nickel, orange juice, silver, wheat and pork (1%).

14

The different trends in the two periods are most visible in prices of agricultural commodities (non-storable, perishable) and mineral commodities (storable), i.e. oil and industrial metals.

Chart 10

Real commodity prices and real interest rates (index, 1983 Q1 = 100)

-100 0 100 200 300 400 500

1983Q1 1986Q1 1989Q1 1992Q1 1995Q1 1998Q1 2001Q1 2004Q1 2007Q1 2010Q1

U.S. real interest rate CRB Industrial Metals Index CRB Food Index CRB Commodity Index Brent crude oil

Source: Calculated using Bloomberg data.

For example, Frankel (2006) states that the effect of real interest rates on the supply of, and demand for, storable commodities can be transmitted through these channels: (i) production, (ii) inventories and (iii) financial speculation.

3.1 Production

When interest rates are low, producers leave oil in the ground instead of extracting it and storing it in tanks (see the Hotelling model, section 2.2). In this case it is virtually impossible for excess supply of storable commodities (oil, natural gas, metals) to amass. Prices then rise as new oil deliveries fail to keep pace with growth in global demand. This would mean that some cases of apparent stagnation in oil deliveries as a result of low capacity are merely an illusion – oil producers are able to keep up with rising demand, but low interest rates encourage them to keep more unextracted oil in the ground, thereby creating an impression of stagnating oil supply.15

3.2 Inventories

Low real interest rates lead to expectations of rising oil prices in the future. That prompts oil producers to increase their oil inventories, as stored oil can be sold at a higher price later on. Hence, the motivation of companies to transport their inventories to the distribution network weakens, while demand for storable commodities increases. Oil inventories are therefore held in tanks and the decision on how much oil to sell involves weighing the interest rate level against expected future growth in prices. If the rate of return on financial assets is extraordinarily low, it is better to keep oil in tanks than to sell it today and reinvest the proceeds.

3.3 Financial speculation

Low interest rates encourage speculators to shift their investment interests (capital) out of relatively risk-free short-term interest-bearing financial instruments (e.g. Treasury bills) to very risky commodity contracts, which on the other hand can generate higher returns. Therefore, rational investors (i.e. small investors, banks, pension funds and hedge funds)

15 This also applies to other storable and non-perishable commodities, i.e. how much copper to mine, how much

seeking higher returns in an environment of low interest rates – even if that means taking on a higher degree of risk – are a key factor of speculative growth in commodity prices.

All these three mechanisms can therefore foster growth in real commodity prices. The theoretical model can be summarised as follows: expansionary monetary policy temporarily lowers real interest rates (whether via a fall in nominal rates or a rise in expected inflation). This stimulates growth in commodity prices in real terms. Commodity prices can then rise until they are widely considered “overvalued”. In that situation, there is a prevailing expectation of a future decline in prices (and other costs, i.e. storage costs, transaction costs, the risk premium, etc.) that is sufficient to offset the low interest rates (and other benefits of carrying inventories – the “convenience yield”16). If we imagine the logic underlying, for example, the theory of exchange rate overshooting (see Dornbusch, 1976) and we replace the exchange rate with the price of commodities, then in the long run – when the price level adjusts to the change in money supply – the real interest rate and real commodity price should return to their initial levels.

4. PRICES OF OIL (COMMODITIES) IN THE CNB’S FORECASTING PROCESS 4.1 How should a central bank react to an oil price shock?

There is a clear consensus across the economic literature that central banks should closely monitor and analyse developments in asset markets (including oil and other commodity markets).17 However, in the case of oil prices (as opposed to, say, stock or property prices), the debate is more or less limited to their impact on the CPI, and especially the extent to which these supply shocks should be exempted. The experience of recent years suggests that making exemptions, or targeting core inflation, may be a mistake, as commodity price growth forms part of the contrary movements in relative prices and moreover reflects monetary policy settings (i.e. it is not a classic exemptible exogenous shock).

Growth in oil prices – or the second-round effects of such growth on inflation – should lead,

ceteris paribus, to an increase in the central bank’s rates. It is a negative supply shock. If

demand remained unchanged, inflation would have to rise at least temporarily. There are two fundamental problems here. First, we do not usually know whether the shock is permanent or transitory. Transitory shocks (especially those stemming from global demand) can cause input prices to rise, but their effect on consumer prices (higher prices of fuels, food, etc.) is smaller. If the shock is considered transitory, the central bank’s optimal reaction could be to raise real interest rates slightly in order to moderate demand. If the shock is permanent, it lowers the economy’s potential and, ceteris paribus, real interest rates should also rise. However, if expectations of a permanent decline in productivity reduce permanent income, consumption will fall, followed by investment. Ultimately, even temporarily reducing real interest rates in an effort to prevent an excessive drop in demand may be the optimal monetary policy reaction. The reduction can be temporary because net investment should return to its original level after some time (at a lower absolute level of capital). If we add the intertemporal aspect to the equation, the situation becomes even more complicated. A temporary reduction of real interest rates would shift part of demand from the future to the present, thereby only postponing the problems or requiring an even larger reduction of real interest rates in the future. Overall, it is apparent that the optimal monetary policy reaction to an oil price shock is hard to define within the prevailing theory, partly because a significant part of the shock may be endogenous rather than exogenous.

16 The benefit or yield associated with physically holding a commodity rather than holding a derivative linked to

the commodity.

17 For more details on this debate, see Posen (2006) and Roubini (2006), and for a discussion focusing on

The second problem is that growth in prices of oil or other commodities is not an isolated shock, so the ceteris paribus condition does not apply. On the contrary, it takes place amid significant changes in the world economy and, of course, in the Czech economy as well. The latter is undergoing structural changes that are probably raising potential growth. This is an anti-inflationary phenomenon running counter to the effects of rising prices of oil and other commodities. In addition, other significant processes are taking place in the world economy, e.g. a weakening of the U.S. dollar. In small open economies (such as the Czech Republic), this is directly causing a decline in import prices in koruna terms, which has potential first- and second-round effects on inflation. Other important effects also exist. Given the positions of the euro and dollar in Czech exports and imports, the terms of trade will improve, increasing the funds available to the domestic economy. Other effects may ensue from the decline in koruna prices of technology imported from the dollar area. This can be regarded as a positive supply shock, reducing investment costs and increasing the economy’s potential. The depreciation of the dollar should also act indirectly via its potential impacts on European exports. Economists differ significantly in their assessment of the strength of this effect. Despite all the problems with identifying the optimal monetary policy reaction, we can show how monetary policy responds to oil price shocks in the CNB’s modelling system.18

4.2 What oil price outlook enters the forecasting process?

Since the July 2006 forecast, the CNB’s forecasting system has been using the price of Brent crude oil, the outlook for which is derived from futures contracts. Brent crude oil replaced the previously used Ural crude oil. The forecast for the price of Ural crude oil was derived from the WTI crude oil price forecast published regularly by the Consensus Forecasts (CF). In addition, since April 2006, the forecasting system has also been using fuel prices, forecasts for which are derived from swap contracts on (ARA: Amsterdam–Rotterdam–Antwerp) exchanges in north-western Europe.

Oil and petrol prices are currently derived from futures contract quotations. These are determined as of the Consensus Forecasts (CF) survey date in order to ensure consistency with the other external indicators. The CF forecast is only available for the three-month and one-year horizons (meaning that developments at other time horizons have to be calculated), whereas futures contract quotations are available several years ahead at monthly frequency. The expected future evolution of oil and petrol prices calculated on the basis of such quotations is therefore better defined. Moreover, a CNB analysis has revealed that since 2004 futures contracts have predicted the future WTI oil price (the only oil price indicator contained in CF) better than the analysts’ estimates contained in the CF survey, especially at the longer horizon. Simulated forecasts of the index of import prices of energy-producing materials based on prices of various types of oil have proved that Brent crude oil has the highest explanatory power. Likewise, petrol prices on the ARA exchanges are the best available indicator for estimating retail fuel prices at filling stations in the Czech Republic.

Chart 11 compares the actual prices of Ural and Brent crude oils in USD/b with the individual forecasts entering the CNB’s forecasting process (thin black lines). As Chart 11 shows, the oil prices entered into the forecasting process were lower than the actual subsequent prices in the vast majority of cases. This confirms the hypothesis that the oil prices gathered in the CF, or stemming from market outlooks, are backward-looking. However, this is linked with the fact that prices were rising significantly over most of the period under review. It can also be seen that, with the exception of the recent past, the outlooks are not good at capturing either the direction of movement or turning points.

18 However, the modelling system largely ignores the long-term impacts of oil price changes on the supply side

Chart 11

Actual oil prices and their CF and market outlook paths (in USD/b)

15 35 55 75 95 115 135 155

I/01 I/02 I/03 I/04 I/05 I/06 I/07 I/08 I/09 I/10 I/11 Ural crude oil Brent crude oil Oil price outlook path

Source: Authors’ calculations based on Consensus Forecasts and Thomson Reuters data.

4.3 Impact of an oil price shock on the external and domestic economy

The impact of an oil price shock (i.e. a step increase of USD 30/b) was estimated for the Czech economy using a model19 (g3) in two basic variants – a transitory one-year increase and a permanent increase. The impact on the euro area economy, which is used here to demonstrate an exogenous environment, was consistently calculated by simulation of the NIGEM model. Tables 3 and 4 contain the expected paths of the exogenous variables, while Charts 12 and 13 show the g3 model outputs in the form of the path of the endogenous variables according to the baseline scenario and the deviation induced by the oil price shock.

4.3.1 Transitory one-year oil price shock (+ USD 30/b)

[image:16.595.128.465.91.297.2]An oil price increase of USD 30/b was reflected fastest in a rise in external interest rates and a decline in external GDP (see Table 3). Except for a lag in Q1, external PPI inflation also rose simultaneously. The price shock faded fastest in the case of external interest rates, which after rising in response to the price shock fell sharply in 2011 Q1 and continued declining steadily thereafter. The decline in external GDP slowed in the following quarter. The slowest adjustment was observed for PPI inflation, which started to slow in 2011 Q3.

Table 3

External developments according to the NIGEM model – one-year oil price shock of USD 30/b

I/10 II/10 III/10 IV/10 I/11 II/11 III/11 IV/11 I/12 II/12 III/12 IV/12

Ext. GDP - -0.08 -0.11 -0.15 -0.22 -0.08 -0.03 0.03 0.13 0.12 0.14 0.14

Ext. PPI - -0.16 0.13 0.36 0.54 1.03 0.66 0.28 -0.05 -0.51 -0.54 -0.48

3M Euribor - 0.45 0.68 0.79 0.05 -0.16 -0.23 -0.25 -0.26 -0.25 -0.24 -0.22

Note: Values express changes compared to baseline; external GDP and PPI (y-o-y in p.p.). Source: Simulations in NIGEM model.

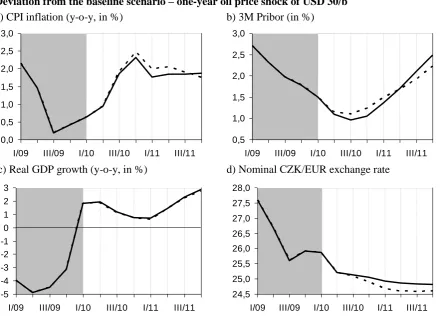

The effects of the transitory one-year oil price shock on the Czech economy are described in Chart 12. A transitory increase in oil prices generates higher inflation pressures (see Chart 12a) via growth in import prices and domestic regulated energy prices. The implied domestic interest rate path (see Chart 12b) is thus shifted slightly upwards in order to counteract the expected inflationary pressures (via a decline in domestic real economic activity). GDP declined slightly (by 0.1 percentage point) in Q2, but returned to its initial level after a year.

19

The largest deviation is observed for the nominal CZK/EUR exchange rate (see Chart 12d). The koruna appreciates strongly against the euro in Q3, owing mainly to growth in external PPI inflation and also to a slight transient rise in external interest rates (which started to fall sharply in 2011 Q1) relative to domestic rates.

Chart 12

Deviation from the baseline scenario – one-year oil price shock of USD 30/b

a) CPI inflation (y-o-y, in %) b) 3M Pribor (in %)

0,0 0,5 1,0 1,5 2,0 2,5 3,0

I/09 III/09 I/10 III/10 I/11 III/11

0,5 1,0 1,5 2,0 2,5 3,0

I/09 III/09 I/10 III/10 I/11 III/11

c) Real GDP growth (y-o-y, in %) d) Nominal CZK/EUR exchange rate

-5 -4 -3 -2 -1 0 1 2 3

I/09 III/09 I/10 III/10 I/11 III/11

24,5 25,0 25,5 26,0 26,5 27,0 27,5 28,0

I/09 III/09 I/10 III/10 I/11 III/11

Note: Baseline scenario – solid line; deviation from baseline scenario – dashed line. Source: Simulations in g3 model.

4.3.2 Permanent oil price shock (+ USD 30/b)

[image:17.595.76.520.150.466.2]For all the selected exogenous variables, the difference between the permanent and transitory oil price shocks is reflected mainly in a sharp deviation from the baseline scenario in 2010 (see Table 4). The return to the baseline scenario values is then very slow in 2011. The price shock was again reflected fastest in external interest rates and GDP. PPI inflation again responded with a lag of one quarter. The GDP decline started to slow in 2011 Q2. External interest rates also started to fall moderately in this period. The interest rate path changed later than in the case of the one-year price shock, while external interest rates remained relatively high until the end of 2011. As in the previous variant, the price shock abates most slowly in the case of external PPI inflation, which does not start to decline until the start of 2011 Q3.

Table 4

External developments according to the NIGEM model – permanent oil price shock of USD 30/b

I/10 II/10 III/10 IV/10 I/11 II/11 III/11 IV/11 I/12 II/12 III/12 IV/12

Ext. GDP - -0.15 -0.30 -0.43 -0.57 -0.54 -0.50 -0.46 -0.41 -0.37 -0.33 -0.30 Ext. PPI - -0.10 0.24 0.50 0.72 1.01 0.84 0.71 0.60 0.51 0.42 0.35 3M Euribor - 0.52 0.76 0.86 0.88 0.87 0.84 0.79 0.74 0.69 0.64 0.59 Note: Values express changes compared to baseline; external GDP and PPI (y-o-y in p.p.).

The impact of the permanent oil price shock on the endogenous variables is demonstrated in Chart 13. As regards CPI inflation (see Chart 13a), domestic interest rates (see Chart 13b) and annual real GDP growth (see Chart 13c), the observed variables followed a similar pattern as in the case of the transient shock, the only difference being a stronger and longer-term response this time. The only major change is seen for the nominal CZK/EUR rate (see Chart 13d) – the koruna responds by depreciating for a short time and then converging towards the euro exchange rate. By the end of 2011, the koruna is again appreciating modestly against the euro. This different pattern (the koruna oscillating around the euro exchange rate) compared to the previous variant is due mainly to two contrary factors: higher growth and a gradual decline in external interest rates (depreciation of the koruna) and growth in external PPI inflation, which exerts appreciation pressure on the koruna. In the end, these two effects cancel each other out – the effect of higher external interest rates prevails in the first phase up to the end of 2011 and is subsequently outweighed by the effect of higher external PPI inflation and renewed appreciation of the koruna.

Chart 13

Deviation from the baseline scenario – permanent oil price shock of USD 30/b

a) CPI inflation (y-o-y, in %) b) 3M Pribor (in %)

0,0 0,5 1,0 1,5 2,0 2,5 3,0

I/09 III/09 I/10 III/10 I/11 III/11

0,5 1,0 1,5 2,0 2,5 3,0

I/09 III/09 I/10 III/10 I/11 III/11

c) Real GDP growth (y-o-y, in %) d) Nominal CZK/EUR exchange rate

-5 -4 -3 -2 -1 0 1 2 3

I/09 III/09 I/10 III/10 I/11 III/11

24,5 25,0 25,5 26,0 26,5 27,0 27,5 28,0

I/09 III/09 I/10 III/10 I/11 III/11

Note: Baseline scenario – solid line; deviation from baseline scenario – dashed line. Source: Simulations in g3 model.

4.4 The oil price in the CNB’s forecasting model

domestic currency. The share of the effect of oil prices on the real marginal costs of the import sector is calibrated at 5%. An assessment of predictive powers reveals that the extended model better predicts the endogenous model variables at times of high oil price volatility. It does not provide worse prediction results at times of stable oil prices. For this reason, the extended model is used as a satellite version of the core prediction model in situations of increased volatility of oil prices in world markets.

5. SUMMARY

As regards the evolution of oil and commodity prices going forward, risks can currently be identified mainly in the gradual modest recovery of the world economy and the expected renewed growth in demand. Another potential risk is the excess money that has been pumped into the world economy as part of stimulation measures introduced during the crisis. In the event of a late or insufficient exit from the current expansionary monetary policy, the “spare” funds (those not corresponding to the needs of the real economy) might be moved into oil and other commodities via purchases of derivatives. In such case, it would not be possible to view the subsequent price growth – exceeding central banks’ inflation targets – as a supply shock. Hence, the absence of a corresponding monetary policy reaction would not be justified, as monetary policy itself would be the originator of a price shock.

REFERENCES

ANDRLE, M.; HLÉDIK, T.; KAMENÍK, O.; VLČEK, J. 2009. Implementing the New Structural Model of the Czech National Bank, CNB WP 2/2009. Czech National Bank, September 2009.

BREITENFELLNER, A.; CUARESMA, J. C. 2008. Crude Oil Prices and the USD/EUR Exchange Rate, Monetary Policy & the Economy. Oesterreichische Nationalbank, Issue 4, pp. 102–121.

DORNBUSCH, R. 1976. Expectations and Exchange Rate Dynamics, Journal of Political Economy 84, pp. 1161–1176.

FRAIT, J.; KOMÁREK, L. 2007. Monetary Policy and Asset Prices: What Role for Central Banks in New EU Member States? Prague Economic Papers. 2007/1.

FRANKEL, J. A. 2006. The Effect of Monetary Policy on Real Commodity Prices, NBER WP 12713, December 2006.

HAMILTON, J. D. 2009. Causes and Consequences of the Oil Shock of 2007–08, Brookings Papers on Economic Activity, Spring 2009.

POSEN, A. 2006. Why Central Banks Should Not Burst Bubbles, International Finance, 9(1), pp. 109–124.

RADEMAEKERS K.; SLINGENBERG A.; MORSY, S. 2008. Review and Analysis of EU Wholesale Energy Markets, European Commission, December 2008.