Portfolio Size in Stochastic Portfolio Networks Using Digital Portfolio Theory

Full text

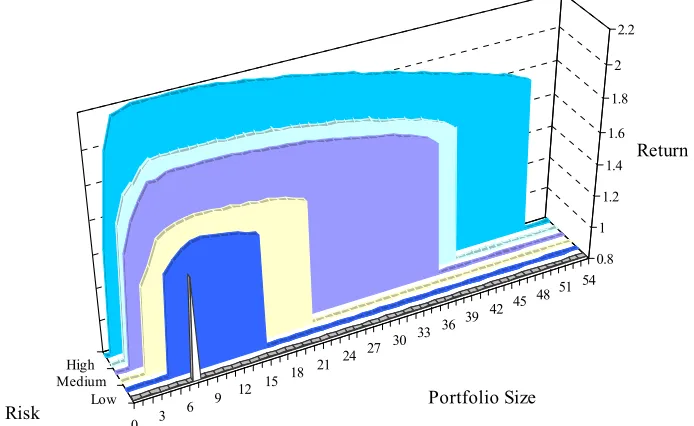

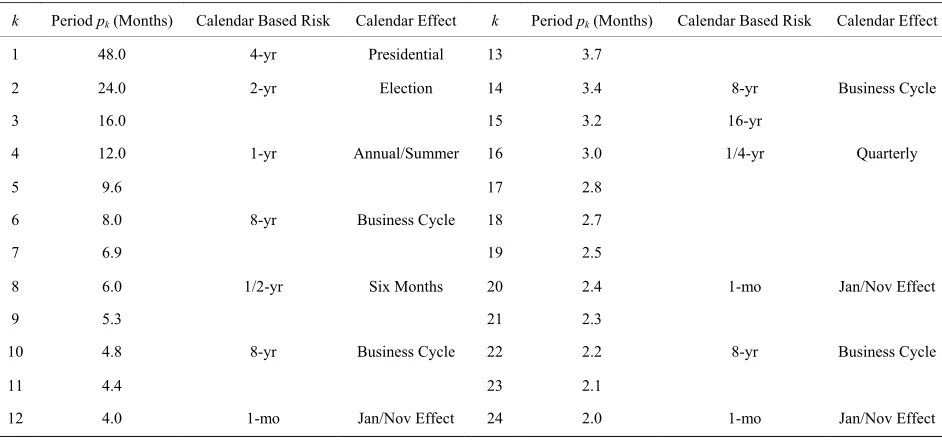

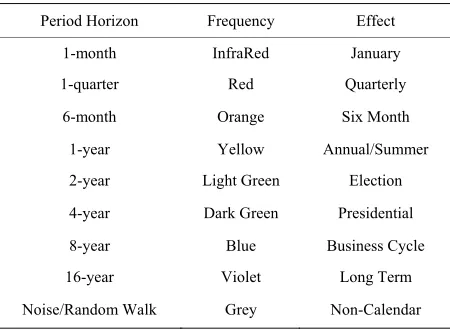

Figure

Related documents

Our extensive range of innovative high performance PVC-U windows and doors ensures our products are the preferred choice for your commercial projects.... Our UK operations in

The investment team continually monitors portfolio risk exposures using PIMCO’s proprietary models to stress test portfolios and quantify an array of security- and

Should you provide hosted solutions for email or data services please address security measures and cost comparison to a locally hosted network/data storage?. Do you have any and if

With our fully integrated practice management software, you will be able to work more efficiently, lower risk and improve client service … l egal calendaring software, contact

Cisco IOS Firewall runs on the Cisco ® integrated services router at the branch office and head office, protecting branch office resources and segmenting the network with

(c) The Minister shall formulate regulations with respect to the procedure for the employment of foreigners in the Maldives, carrying out employment by foreigners,

Tavoitteena oli tuottaa tietoa esimerkiksi siitä, mitä tarvitsee huomioida implementoinnissa, mitä CDIO:n implementointi vaatii, miten sitä on tulkittu eri organisaatioissa

Next, because many commentators argue that patent law should provide special protection to technology purchasers due to their relative lack of re- sources and sophistication, 37