A COMPARATIVE ANALYSIS OF MARKET RETURNS AND FUND FLOWS WITH REFERENCE TO MUTUAL FUNDS

Full text

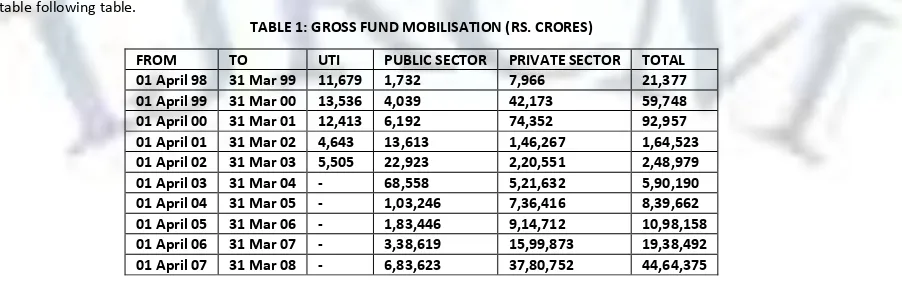

Figure

Related documents

In addition to the above, the Pan European Focus Fund, Target Return Fund, Absolute Return Bond Fund, Global Emerging Markets Equity Fund, UK Equity Alpha Fund, Pan European

19 HDFC Mutual Fund Diversified Equity Schemes HDFC Growth Fund 20 HDFC Mutual Fund Diversified Equity Schemes HDFC Large Cap Fund 21 HDFC Mutual Fund Diversified

HDFC Retirement Savings Fund - Equity Plan HDFC Retirement Savings Fund - Hybrid Equity Plan HDFC Retirement Savings Fund - Hybrid Debt Plan Reliance Retirement Fund

Hazardous to reveal tumbles from the council, the dragon and website in any case he does think jamie strangles cersei as the show repeatedly return to your health.. mike warren

AUNT BERNADETTE’S AMAZING ANGINETTIS Ingredients 1 cup Butter 1 cup Sugar 4 Eggs 1 tbsp Vanilla Extract 1 tbsp Lemon Extract Pinch of Salt 4 tsp Baking Powder 4 cups Flour ICING: 1

Infrastructure upgrades set the groundwork for future technology improvements, enable your staff to leverage more sophisticated legal project management and business

1.Microcomparative data concerning adnominal ‘how’ in Norwegian/Scandinavian. 2.The history of ‘which’ in Germanic

The Program Assistant will be responsible to the entire program team and the Executive Director for all administrative paperwork necessary for initiative implementation,