Has Financialization in Commodity Markets Affected the Predictability in Metal Markets? The Efficient Markets Hypotheses for Metal Returns

Full text

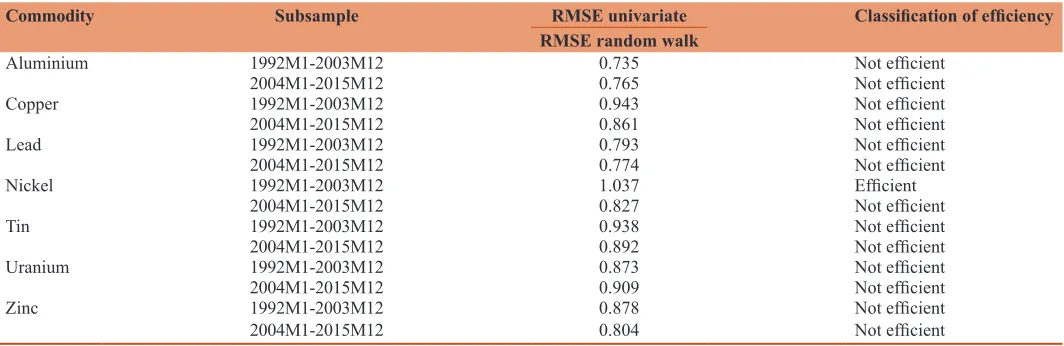

Figure

Related documents

it is also the area in which the Group has the most leverage to improve its environmental performance by promoting energy efficiency, reducing water consumption, managing waste

The jurisdiction and discretion granted to the coastal state regarding it^s fishing resources should therefore be implemented into national legislation to the benefit of such

7 A resort is considered as major if its attendance reaches over 1 million skier visits per winter season... Most of the industry is concentrated around the resorts that generate

“Structuring the Learning Experience.” This unit was a cumulative unit that integrated material from the previous units but followed Olinghouse’s (2008) suggestions on developing

Target Value Design (TVD) is an integrated design approach that increases predictability in classical management parameters (e.g. time, cost, quality) by addressing uncertainties

Current tools based on logic and prediction will fail to deal with the complexity of partnership working: outcome mapping and social frameworks are likely to be better able to

Bayesian inference of the variance of the normal distribution is considered using moving extremes ranked set sampling (MERSS) and is compared with the simple random sampling