The co-movement between exchange rates and stock prices in an emerging market

Full text

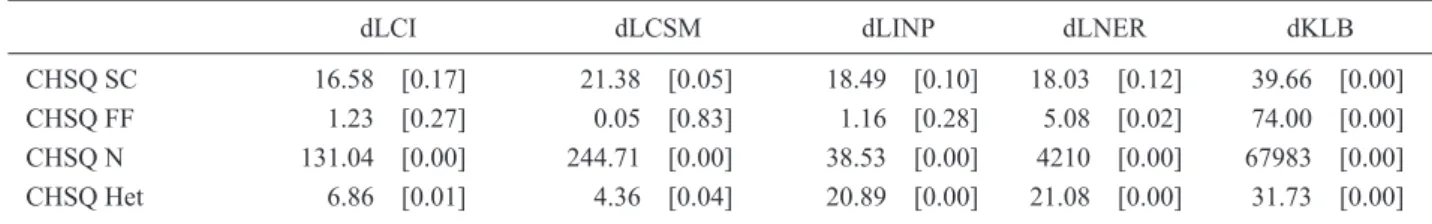

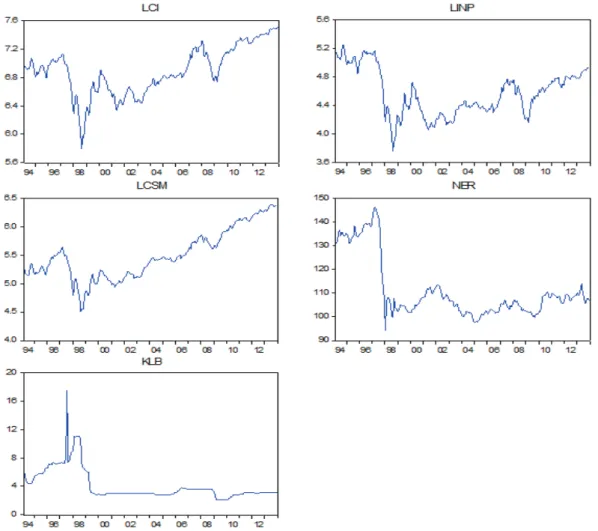

Figure

Related documents

Non-linear Granger causality test shows bi-directional causal relations between stock prices and exchange rates for nine of the countries (India, Indonesia, Korea,

The results in Table 1 indicate a stable 6 long-run relationship between exchange rates and stock prices for the UK, Japan and Switzerland, as both the F and

Phylakits, and Ravazzolo (2005) examine the long run relationship between stock prices and exchange rates and the channels through which exogenous shocks impact on these markets,

We found that there is no long-run relationship, but there is linear Granger causality from stock prices to exchange rates, in line with the portfolio approach: stock prices

This paper investigates the dynamic relationship between oil price and exchange rates of 13 selected EMBI+ countries in three different time frames utilizing VAR and generalized

This notion lends itself more to the flow oriented model, which implies that exchange rate movements should cause movements in stock prices, or that a sharp appreciation in

increase points out that oil price level and emerging markets exchange rate relation becomes. more immune to the expectations of

Employing error correction model, it was found that a significant negative short run relationship exists between the stock market and the minimum rediscounting rate (MRR)