Internation

a

l Conferen

c

e

o

n Dynamics of Rural Transformation

in Emerg

i

ng Economies

27-28 March,

2014

Remittan

ces and

E

conomic Growth

i

n

K

en

y

a

(1

9

7

0-20

1

0

)

Kenne

d

y

Nyabuto

Ocharo

Ph

.

D

Stud

e

n

t,

Depa

rtm

e

nt

of

E

co

n

o

mi

c

T

heo

r

y,

S

c

h

o

ol

of

E

co

n

o

mi

cs

,

K

e

n

ya

t

ta U

ni

ve

r

s

i

ty, Na

ir

ob

i,

K

e

n

ya

ABSTRACT

S

t

a

ti

s

t

icss

h

o

w that re

m

ittan

c

es

to Ken

y

a h

ave

b

ee

n incr

eas

in

g ove

r th

e y

e

a

r

s.

Studie

s o

n th

e e

f

fe

ct o

f

r

e

mitt

a

n

ces

o

n

eco

n

o

m

ic

g

r

owt

hin Ken

y

a a

r

e

l

im

it

e

d

a

nd ha

v

e not in

c

lud

e

d pri

va

t

e

c

a

pit

a

l inflo

ws as

on

e o

f th

e

d

e

termin

a

nt

s

o

f

e

c

o

n

o

m

ic grow

th.

T

h

is

st

ud

y

in

ves

ti

ga

t

e

d t

h

e effe

ct

o

f remittan

ces

o

n

e

c

o

nomic

growt

h

in Ken

ya.

D

a

t

a was s

ourc

e

d

f

o

r th

e

W

o

rld B

a

nk

'

s

Afr

i

ca

n

D

e

ve

l

o

pm

e

nt

I

ndica

t

o

r

s a

nd

va

riou

s E

con

o

m

ic

S

ur

veys a

nd

S

tati

s

tical

Ab

s

tr

ac

t

s

f

o

r th

e

p

e

riod 1970

-

20 IO

. T

h

e s

tud

y

u

se

d th

e

or

din

a

r

y

l

eas

t

s

qua

r

es es

t

i

mation

t

o

d

e

t

e

rmin

e

th

e e

f

fe

ct

s

o

f remittanc

es

o

n

e

c

o

nomic

g

ro

w

th

.

Th

e s

tud

y

f

o

und th

a

t th

e

coe

ffi

c

i

e

nt

of

re

mitt

a

n

ces as a

ratio of

g

r

oss

d

o

m

es

tic product w

as

positiv

e

and

s

i

g

nifi

ca

nt

.

The Go

ve

rnm

e

nt

of

K

e

n

ya s

h

o

uld

putin pl

ace

p

o

lic

i

e

s

th

a

t

e

nc

o

ur

ag

e r

e

mittan

ces

.

1

.

INTR

ODUCTION

To overco

m

e

the high poverty

levels and improve

the standard

of living

in developing

countries

there is

needfor a s

ub

s

tantial

inflow

of external

resources

in order to fill the savings

and foreign

exchange

g

aps.

This wil

l increa

s

e

the

rate

of capital

accumu

l

ation

and

growth.

One

of these

external

resources

is

remittances.

Remittances

are not onl

y

a

s

ource

of foreign

exchange

but also

have become

the

s

econd

largestso

ur

ce o

f external

finance

for dev

e

loping

countrie

s

after foreign

direct

investment

(FDI) (World

Bank

,

2009).

R

e

mittances

have been found

to enhance

growth

through

human

capital

accumulation

and

can mitiga

t

e

p

ov

ert

y

b

y

increasing

the r

e

cipient

famil

y's

income

and

living

standards

(

Gupita

e

t

a

l.

,

2009

;

Mim a

nd Ali

,

2012

).

It is

a

r

g

u

e

d th

a

t remittances

are not onl

y

rel

a

tivel

y

s

table

than other financial

flows

but also tend t

o

increase

durin

g

periods

of economic

depre

s

sion

and natural

disa

s

ters

.

Remittances

have also been found

not have t

h

e e

ff

ec

t of erod

i

ng

the countr

y

'

s

e

x

port

competitiveness

unlike

aid flows (Yan

g,

2

006

;

Rajan

and Subra

m

a

nian

,

2006).

Remittances

can

be used

to support

the capital

account

of the balanc

e

o

f

payments (

B

o

P

),

domestic

investment,

increa

s

e

the flow of f

i

nances

during

the period

of natural

di

s

aster

s

at the

n

a

ti

o

nal

level

;

smooth

consumption

at the household

level

;

finance

development

projects

and

enhance t

h

e c

apacity

to import.

Acco

rdin

g

to Mim and Al

i

(

2

012)

the effect of remittances

o

n

the economic

growth

ofa

countr

y

can

be looke

d

a

t in three wa

y

s

:

first

,

the

y

can be

s

pe

n

t

like any other

income

and therefore

their contribution

to econo

mic

g

rowth

can be seen as the contribution

by any so

u

rce

of income.

Second

,

remittances

can

cause

n

eg

ative

effects

by recipient

hou

s

e

h

o

l

ds

spending

more

on

l

uxury

goods

and

l

eaving

little for

unprod

u

c

ti

v

e

s

a

v

ings

and investment

Iike ho

u

sing

,

land and jewelry

.

The

r

e

h

as

been a

g

rowing

intere

s

t

in Diaspora

remittances

by the Kenyan

Government

a

s

evidenced

in its

lo

n

g

t

e

rm development

plan

,

the Ken

y

a

Vision

2030

(Republic

o

f Kenya

,

2007).

This call

s

f

o

r an

investiga

ti

o

n int

o

the effect of remittances

o

n the economic

growth

of Ken

y

a

.

2. T

HE FLOW OF REMITTANCES

TO KENYA

25

20

~

15s:

"3

10

e

(9

0.. 0 (9 5

0

42 • Dynamics of Rural Transformation in Emerging Economies

2,000,000,000

1,600,000,000

!if

2

-

1,200,000,000<J)

8

cJJ

'E

800,000,000.,

a::

400,000,000

0

1970 1975 1980 1985 1990 1995 2000 2005 201C

Years

Fig. 1.1

:

Remittances

to Ken

y

a

(

J

970

-

2

01

0)

Da

t

a Source:

www

.

c

entra

l

bank.

g

o.ke/forex/Diaspora-

R

e

mi

t

.

a

s

p

x

For examp

l

e

,

re

m

it

tan

ces

rose f

r

o

m

U

S

$7

,

2

60

,

000

i

n 1

970

t

o

U

S$89,

099,998 in 1989,

By 2009,

remittances were US$

609

,

1

5

6

milli

o

n

(Ce

ntr

a

l B

a

nk

of Ke

n

ya,

2011)

.

The d

r

op in rate of increa

s

e in

remittances betwee

n

20

08

a

nd

2

009

co

uld be

at

tribut

e

d

to the globa

l

fi

n

ancia

l

c

ri

s

is

.

The stead

y

ri

s

e in

r

e

mittance

s

is att

r

ib

u

ted

t

o the rise of

th

e

numb

e

r

of

K

e

n

yans in

th

e Oiaspora

.

Most these remittance

s

are

fr

o

m N

o

rth America (51

%

) and E

u

ro

p

e (2

8

%).

The Ken

y

an Embassy

in Was

h

i

n

g

t

o

n

O.

C

.

i

ndi

ca

t

ed t

h

a

t

by Ju

l

y

,

2011 there were three m

i

llion

Kenyan

s

in the O

i

as

p

o

r

a a

n

d

in th

e US

A

a

l

o

n

e

,

ther

e we

r

e a

b

o

ut

400

,

000

K

e

n

yans (

R

ep

u

b

l

ic of Kenya,

2011)

.

The seco

nd r

easo

n

for t

hi

s

t

re

nd i

s t

h

e

l

o

w n

a

tur

a

li

zat

i

o

n

r

a

t

e i

n th

ese co

un

t

ri

es (USA,

Canada

,

Europe

,

Asia

,

a

nd

So

uth

Africa) w

h

e

r

e

K

e

n

ya

n

s s

ta

y. T

hir

d

l

y,

th

e passi

n

g of t

h

e new co

n

stitution

in

2010 which allowe

d

fo

r du

a

l

cit

i

ze

n

s

hip h

as

mad

e t

h

ose

K

e

n

y

a

n

s w

h

o wo

ul

d wis

h

to invest both in the

c

o

untries the

y

l

i

ve a

nd

at

h

o

m

e to increase

r

emi

tt

a

nc

es

.

Lastly

,

th

ere has bee

n

a

n

aggre

s

sive campai

g

n b

y

the Kenya Gove

r

n

m

e

nt

to i

n

vo

l

ve t

h

e

K

e

n

y

an Oi

as

p

ora

in

the developme

n

t agenda of the countr

y.

Thi

s

is

evidenced b

y

the gover

nm

ent's

ratif

i

cat

i

o

n

of

th

e amendment

to the Africa

n

Union (A

U

) Constituti

v

e

Act Article 3(q) t

h

at invites a

nd

e

n

co

u

rages

th

e f

ull p

a

rti

ci

p

ation of the African Oia

s

pora as an important

part

o

f African co

n

ti

n

e

nt

's

bu

ild

i

n

g

.

In th

e

d

o

m

es

t

ica

t

io

n

of the AU Act

,

the Kenya Government

establi

s

h

ed t

h

e I

n

ter

n

atio

n

a

l J

obs a

nd Oi

as

p

o

r

a Of

fic

e (

!JO

O)

in t

he M

i

nist

r

y of Foreign Affairs in 2007.

2

.1 Kenya's

GDP

Growth

Ken

ya's e

conomic g

r

owt

h h

as bee

n un

stab

l

e s

in

ce

in

depende

n

ce as s

h

own in Fig

.

1

.2

:

-5~~~~~~~~~~~~~~-r~~~~~~~~

1970 1975 1980 1985 1990 1995 2000 2005 201

Years

F

i

g.

l.I:

K

e

n

y

a

's

G

D

P G

r

o

wth

(197

0-2

0

1

0)

Remittances and Economic Growth in Kenya (1970-2010) • 43

K

e

n

y

a's GDP g

r

ow

th

was

h

ig

h

in

th

e fi

r

s

t t

wo

d

e

c

a

d

es

a

ft

er i

nd

e

p

e

nd

e

n

ce

i

n

1963. Th

i

s was due to

p

u

bl

ic

in

v

es

t

ment,

e

n

cou

ra

ge

m

e

n

t

of s

m

a

ll

h

o

ld

e

r

ag

ri

c

ultur

a

l

produ

ct

i

on

an

d

in

ce

n

tives

for p

r

ivate

i

n

v

es

tment.

T

h

e

r

e was

n

o

t

a

bl

e

d

ec

lin

e

in K

e

n

y

a

's

e

con

o

mi

c

p

e

r

fo

rm

a

n

ce

f

r

o

m th

e

1

970s to 2004 when

G

DP

g

r

o

wth was

b

e

l

ow

10

%.

Th

e wo

r

s

t

yea

r

s we

r

e

197

4

to 1

975,

1978

,

19

81

,

an

d

1990 to

1

999

,

2000-20

0

3

and 2

0

0

8

.

T

he

wo

r

s

t

p

e

r

fo

rmance

in the

s

e

y

ear

s

is e

x

plained

b

y

b

o

th

th

e

in

te

rn

a

l

a

nd

ex

t

ernal

fac

tor

s

.

Fo

r

ex

ample

,

the 1974-1990

period

wa

s

marked

by K

e

n

y

a

pur

s

uin

g

the imp

or

t

s

ub

s

tituti

o

n

(IS)

p

o

li

cy

and

th

e

tim

e

a

l

s

o

coin

c

id

e

d

w

ith

hi

g

h

o

il pri

c

e

s

which

m

a

d

e

K

e

n

y

a

's

m

a

nu

fac

turi

ng

s

ec

t

or

un

co

mp

e

titive. A

ddi

t

i

o

n

a

ll

y

,

in th

e ear

l

y

19

9

0

s,

th

e

r

e was

failur

e

b

y

th

e Gover

nm

e

n

t

t

o

s

usta

in

prudent

m

ac

r

oeco

nomic

p

o

li

c

ie

s,

th

e s

t

r

u

ct

u

ra

l

r

e

f

o

rm

s

th

a

t had

s

tart

e

d

in the 1980

s

h

a

d

s

l

owe

d

dow

n

a

n

d the

r

e

w

as t

h

e

prob

l

em of gove

rnan

ce.

In 1

99

1

,

bil

a

t

e

r

a

l

and multilat

e

r

a

l

don

o

r

s

s

u

s

p

e

n

de

d

a

id

to

K

e

n

ya

.

In 1994

-

1996

t

h

e

r

e

was

impr

ove

d

eco

n

o

mi

c

p

e

r

fo

rmanc

e

b

e

cau

se

i

n

1993 Ke

n

y

a

sta

r

ted

a major

eco

n

omic refo

rm

progra

mm

e

.

With

t

h

e ass

i

s

t

a

n

ce

o

f th

e

IM

F a

nd

t

h

e

W

or

ld

B

a

n

k

,

Ke

n

y

a

h

ad e

l

imi

n

ated

th

e

pri

ce

co

ntr

o

l

a

nd

imp

o

rt

li

ce

n

s

in

g

,

had

r

e

m

o

ved

f

o

r

eig

n

ex

chan

ge

co

ntr

o

l

s

,

h

a

d

e

mb

arke

d

on

p

r

i

v

a

ti

z

atio

n

,

h

a

d

s

t

a

rt

e

d

r

e

tr

e

nchm

e

nt

o

f th

e

ci

v

il

s

ervi

c

e

and pur

s

u

e

d

co

n

se

r

va

ti

ve

fi

s

ca

l

a

nd m

one

t

ary

p

o

l

ic

i

es

.

Ot

h

e

r

fac

t

o

r

s

that

h

av

e

h

a

d ne

g

ati

ve

ef

fects

on th

e

macr

o

ec

o

n

o

mic

p

e

r

fo

rm

a

n

ce

in

c

lud

e

th

e

a

d

ve

rs

e

wea

th

e

r c

o

nditi

o

n

s

and th

e ge

n

e

ral

e

l

ec

ti

o

n

s.

2.2 State

ment ofthe Problem

O

n

e o

f

the ai

m

s of t

h

e

K

e

n

ya

Gove

rnm

e

nt

i

s

t

o i

n

s

pi

re

eco

n

o

m

i

c

grow

th

.

H

owe

v

er

,

thi

s

is dr

i

ven

b

y

a

numbe

r

o

f factors

amo

n

g

th

e

m

ca

pit

a

l

.

Ca

p

i

t

a

l

ca

n b

e so

ur

ce

d

intern

a

ll

y

or exte

rn

a

l

l

y

.

R

em

i

t

t

a

n

ces

ca

n

be a

s

o

urce of e

x

ter

n

a

l

ca

pit

a

l

.

M

os

t

s

tudi

e

s

o

n th

e e

ff

ec

t

of re

mittanc

es

o

n

economic

growth

are

cross-co

un

try.

The effect

of re

mitt

a

n

ces

o

n th

e eco

n

o

mi

c

g

r

ow

th

of

K

e

n

y

a

h

as

n

o

t

rece

i

ve

d

t

h

e attention

it

d

es

e

r

v

e

s

.

A s

tu

dy o

n r

e

mitta

nces

a

nd p

ove

rt

y

in Ken

ya

(

Kiiru

,

2

0 I 0

)

u

se

d

a

H

o

u

se

h

o

ld

Bud

ge

t

S

u

rve

y

a

n

d did

n

o

t in

c

lud

e

eco

n

o

mic

g

r

ow

th

a

s

a d

e

p

e

ndent

v

ari

a

bl

e

but r

a

th

e

r

u

se

d p

e

r

ca

pit

a

inco

m

e

of

th

e

r

e

c

ipi

e

nt

h

o

u

se

h

o

ld

s.

T

hi

s s

tud

y

fill

s

thi

s g

ap b

y

bein

g

c

o

untr

y

-

s

pecifi

c,

a

nd t

a

k

es e

c

o

n

o

mi

c

g

r

ow

th

as a

d

e

pe

nde

n

t va

r

ia

bl

e

a

nd

e

mpl

oys

tim

e se

r

ies

d

a

ta

.

2

.

3 Objec

ti

v

es of the Stud

y

T

he

g

e

n

e

ra

l

o

b

ject

i

v

e

of

th

is s

tud

y

was

t

o a

n

a

l

yze

th

e

r

e

l

a

ti

o

n

s

h

i

p

b

e

t

wee

n

remi

t

tances

a

nd

economic

g

r

ow

t

h in Ke

n

y

a. T

h

e s

p

e

c

i

f

ic

o

bj

ec

ti

ves

of

th

e s

tud

y we

r

e

t

o:

1.

E

x

am

in

e

th

e effec

t

s

of

r

e

m

i

tt

a

nc

es

o

n

e

c

o

n

o

mic

grow

th.

2.

Draw po

li

cy

impli

ca

ti

o

n

s

f

r

o

m th

e

r

esea

rch

f

indin

gs

.

2

.

4 Orga

nization

of the Study

T

h

e stud

y

is s

t

ruc

tur

e

d

as fo

ll

ows.

Se

ct

io

n

I i

s a

n intr

o

du

c

ti

o

n

th

a

t p

rovide

s

re

l

evan

t

i

n

for

m

a

t

io

n

a

b

out

K

e

n

ya's

Dias

p

o

r

a

re

mitt

a

n

ces

a

nd

eco

nomic

g

r

ow

th

,

durin

g

th

e

p

e

r

io

d

und

e

r

s

tud

y.

Sec

ti

o

n

II p

rese

nt

s

a

bri

e

f e

mpirica

l

li

te

r

at

ur

e

review

.

Sec

t

io

n

III

f

oc

u

ses

o

n

m

e

th

o

d

o

l

o

gy

w

h

ic

h

i

n

c

lud

e

s

t

h

e

model

s

p

ec

if

i

ca

tion,

defi

ni

t

i

o

n

an

d

m

eas

ur

e

m

e

nt

o

f

va

ri

a

bl

es

.

Sec

ti

o

n

IV pr

e

s

e

n

ts

t

h

e fin

din

g

s

of the st

u

d

y

w

hil

e

S

e

c

tion V provides

t

h

e conc

lu

s

i

o

n

a

nd p

o

li

cy

i

mpli

ca

ti

o

n

s

.

3. EM

PIRICAL

LITER

A

TURE

An

g

(2007)

in

ves

ti

ga

t

e

d

w

h

e

th

e

r

r

e

mitt

a

nc

es

h

ave s

purr

e

d

g

r

ow

th

in Ph

i

lippin

es

.

T

h

e

s

tu

dy

u

se

d

data fo

r

th

e

pe

ri

o

d 19

88-

20

0

4

a

nd

wi

th

O

L

S es

tim

a

ti

o

n

fo

und th

a

t r

e

mitt

a

nc

es

h

ave a

p

os

iti

ve

effec

t

o

n

economic

g

r

owth

.

Ba

r

ajas

e

t

a

l

.

(2

00

9)

in

ve

s

ti

ga

t

e

d

th

e

r

e

l

at

i

o

n

s

hip

b

e

t

wee

n

r

e

mi

t

t

a

n

ces

a

nd

ec

o

n

o

m

ic

growth

for

a sampl

e

of 84

r

ec

ipi

e

nt

c

o

untri

es

f

o

r th

e

p

e

ri

o

d

197

0

-

2

00

4.

Th

e

s

tud

y

ca

rr

ied

o

ut

a pa

n

el

g

row

t

h

es

ti

m

a

ti

o

n reg

r

e

s

s

i

o

n

for the fu

ll

sa

m

p

l

e

a

nd f

o

r

e

m

e

r

g

i

ng

eco

n

o

mi

es.

T

hi

s

s

t

ud

y

fo

u

nd

th

at re

m

ittance

s

have

no

impac

t

on econo

mi

c

grow

th

.

In their

w

o

r

k,

S

i

d

diqu

e

e

t

al

.

(20

1

0) i

n

ve

s

t

i

g

a

t

e

d

th

e

r

e

l

atio

n

s

hip

betwe

e

n

re

mi

ttanc

es

and

e

con

o

mic

g

r

ow

t

h for Ba

n

g

l

ades

h

,

Ind

ia a

nd

Sri La

nk

a,

f

o

r th

e

p

e

r

io

d

1

975-2

006

.

T

h

e a

u

t

h

o

r

s

e

mp

l

oye

d

a Gran

g

er

Caus

a

lity

test

un

der t

h

e

V

ec

t

o

r

A

ut

o

R

eg

r

ess

i

o

n

(

V

A

R

) f

r

a

m

ewo

rk

.

T

h

ey fo

und th

a

t th

e

r

e was

n

o cau

s

al

ln

g,

=

ao

+a

1R

M/

+a

21n

FD

I

/

+a

3In

P

I

/

+

a

41nI

B

B

/

+a

s

ln

G/

+a

61

nFD

/

+a

7In

M

S/

+

a

g

ln

N

X/

+

a

91

n

He

/

+

c

/

(3.

1

)

44 • Dynamics of Rural Transformation inEmerging Economies

betwee

n

re

m

itta

nc

es

a

nd

eco

n

o

mi

c g

r

ow

th in

S

ri L

a

n

ka

,

a

nd th

a

t r

e

mi

t

tan

ces

di

d not lea

d

to economic

g

ro

w

th in Banglades

h

.

Fayassa and Nsia

h

(2

010

)

in th

e

ir

i

n

v

e

s

ti

g

ation

of

th

e

a

gg

r

ega

te impa

c

t

of

r

emitta

n

ces o

n

eco

n

omic

growt

h

of

1

8 La

t

i

n

A

meri

ca

n c

o

untri

es

within the n

eo

cla

ss

i

ca

l

g

r

ow

th

f

ram

ework

u

si

n

g the

p

a

n

e

l

da

t

a for

the period 1980

-

2005

,

f

o

und th

a

t r

e

mitt

a

n

ces

h

ave

a p

osi

ti

v

e

a

nd

sta

ti

s

ti

ca

ll

y

significant

effect on the

g

rowth of Lati

n

A

m

e

ri

ca

n

co

un

tries

.

A 10 p

e

r

ce

nt in

crease in re

mit

ta

n

ces

of a typica

l

Latin America

econo

m

y

r

esu

lt

e

d in

a

b

o

ut 0

.

15 percent increa

s

e in th

e

av

e

ra

g

e p

e

r

ca

pita in

co

me

.

Kii

r

u (20

1

0) i

n

ves

t

ig

at

e

d th

e i

mp

ac

t

of

r

e

mi

tt

anc

es o

n p

o

v

e

r

ty a

nd

the de

t

e

rmin

a

n

ts

of remittances at

the ho

u

seho

ld l

evel

in K

e

n

ya

.

T

h

e

author u

se

d H

o

u

se

h

o

ld Bud

ge

t

S

u

rvey

d

a

ta

2

00

5

/

2006

and found that

remittances

h

ave

h

ad a

p

os

iti

ve

imp

act o

n h

o

u

se

h

o

ld

co

n

s

umpti

o

n.

K

ii

r

u

'

s st

ud

y cons

i

dered remittances

as com

pr

is

in

g of

d

o

m

es

ti

c a

nd intern

a

ti

o

nal

r

e

m

i

ttan

ces.

T

hi

s s

tud

y

c

o

n

s

id

e

r

s

int

er

n

a

ti

o

n

a

l

r

emitta

n

ces

and its impac

t

on t

h

e economic g

r

ow

th

.

Mim and A

l

i (20

1

2)

in

vestiga

ted th

e g

r

ow

th

effec

t

s of

r

e

m

i

t

ta

n

ces a

nd th

e chan

n

els t

h

rough which

they ma

y

affect eco

n

o

mi

c

g

r

ow

th in M

E

NA

c

ountri

es

o

f A

l

g

eria

, Egy

pt

,

Djib

o

uti

,

Ira

n

,

J

o

r

dan

,

We

s

t

Bank and Gaza

,

a

nd Y

e

m

e

n

.

T

h

ey

u

s

ed pan

e

l d

ata for

th

e

p

e

ri

o

d

1

9

80-

20

0

9

.

Usi

n

g

th

e S

y

stem

Generalized Method of

M

o

m

en

t

s

,

t

h

ey

f

o

und

t

h

a

t r

e

mitt

a

n

ces

h

a

d

a

p

os

it

ive a

nd

stat

i

s

t

ical

l

y

si

g

nificant

coefficient

,

lead

in

g

t

o t

h

e co

n

c

lu

s

i

o

n

t

h

a

t r

e

mitt

a

n

ces

p

os

iti

vely a

nd

s

i

g

n

ifica

ntl

y affect econo

mi

c gro

w

th

in MENA co

un

tr

i

es

.

A s

tud

y o

n th

e

impact

of

r

e

mittanc

es

o

n

e

c

o

n

o

mi

c grow

th in

Sub

-

Sa

h

ara

n

Af

r

ica

cou

n

tries by

I

Kec

hi

a

nd An

ayo

chuk

w

u

(2

01

3)

t

a

r

ge

t

e

d thr

ee co

untri

es

of

N

ige

r

ia

,

Ghana and South

Africa

.

The study use

d t

ime

-

se

ri

es

d

ata fo

r th

e pe

ri

o

d 1

9

80

-2

01

0

t

o dete

rmi

ne t

h

e effect

o

f remittance

s

o

n economic growt

h

. They a

l

so con

du

cte

d

a G

r

a

n

ge

r

Ca

u

sa

lit

y test to

d

etermi

n

e the directi

o

n

o

f cau

s

alit

y

between the two var

i

a

bl

es. T

h

e s

tud

y

f

o

und th

a

t w

o

rk

e

r

s

'

r

e

mit

ta

n

c

e

s

h

a

d

i

mp

ac

t

ed posit

i

vely

on the

e

conomic

g

rowt

h

of t

h

e t

hr

ee co

untr

ies

,

wi

th th

e g

r

ea

t

es

t impact

fe

lt

i

n

So

u

t

h

Afr

i

ca fol

l

owed b

y

Ghana

a

nd then Niger

i

a.

R

e

mi

t

t

a

n

ces we

r

e fo

un

d to g

r

a

n

ge

r

ca

u

se eco

n

omic grow

th

i

n

So

u

t

h

Afr

i

ca and Ghana

,

whereas economic growt

h

was fo

und t

o gra

n

ge

r

ca

u

se

r

e

mit

ta

nc

es

i

n N

i

g

er

ia.

3.

1 O

ve

r

v

i

ew o

f Literatur

e

M

os

t

s

tudie

s

on remittances

and econo

mi

c growt

h

a

r

e c

r

oss

-

co

un

try

.

More so

,

t

h

ese

s

tudie

s

ha

v

e taken

remittance

s

inde

p

e

nd

e

nt

of ot

h

e

r

fore

i

g

n

pr

ivate ca

pit

a

l

in

f

lo

ws (

An

g

,

2

0

07

;

Ba

r

ajas

e

t

01

.,

2009

;

Siddique

,

2010

;

a

nd

Fay

i

ssa a

nd N

s

i

a

h

,

2

010

)

,

ye

t

re

mitt

a

nc

es

co

uld b

e co

n

si

d

e

r

ed

a specia

l

t

y

pe of

pri

v

at

e

capital inf

l

ow

s

(Baraja

s

e

t

01

.,

2009)

.

T

hi

s s

tud

y

i

s

different

in that it is cou

n

tr

y

-

spec

i

fic

an

d

focuses on the eff

e

ct

s o

f r

e

mittance

s

o

n

e

con

o

mic growt

h in

c

ludin

g var

i

o

u

s co

mp

o

n

e

nt

s of

pr

iva

t

e ca

pi

ta

l

i

n

f

l

ows as

ind

epende

n

t variables

.

4.

METH

ODO

L

O

GY

4.

1

Mo

d

e

l

S

p

e

cification

T

h

e o

bjective of

thi

s

st

ud

y wa

s

to dete

r

m

in

e t

h

e effec

t

of re

m

itta

n

ces

o

n

e

co

n

omic

g

r

ow

th

.

Thi

s

w

as

a

chi

ev

ed thr

o

u

g

h Ord

in

ary Lea

s

t Sq

u

ares es

t

imat

i

on.

The O

r

di

n

ary Lea

s

t Square

s es

timati

o

n

includ

e

d

o

th

e

r det

er

minants

o

f eco

n

omic growt

h

.

These

v

ariables were selected on the ba

s

i

s t

h

a

t the

y

ha

ve

be

e

n

identified in the

li

tera

tur

e as dete

rmin

a

n

ts

of eco

n

om

i

c

g

r

owt

h

.

T

h

e v

ari

a

bl

es

in

c

l

uded we

r

e fo

r

ei

g

n

dire

c

t in

ves

tment

(FD

I

)

,

portf

o

lio

invest

m

ent

(P

I

)

,

cross-bo

r

der

inte

r

bank b

o

rr

o

win

g

(188)

,

human

ca

pital (H

C),

macroeco

n

omic

s

tability

(MS)

,

tra

d

e o

p

en

n

ess

(NX)

,

fi

n

a

n

cia

l

d

e

v

e

lopm

e

nt

(

F

O

)

and

gov

ernm

e

nt e

x

p

e

ndit

u

re (G)

.

Thu

s

the eff

e

ct of re

mi

tta

n

ces on

e

co

n

o

mi

c growth was ca

p

t

ur

e

d

by r

un

ning a

n

ordinar

y

l

ea

s

t

s

quares

es

timati

o

n

o

f the followi

n

g

equation

:

w

h

e

r

e

a

's a

r

e

param

e

t

e

r

s,

InRM

,

ln

g,

InFOI

,

InPI

,

In

1

8B

,

ln

G

,

I

n FO

,

InMS

,

InN

X a

nd InH

C a

nd

Remittances and Economic Growth inKenya (1970-2010) • 45

ratio

of GDP

,

lo

g

of portfolio investment as a ra

t

io of GDP

,

log of cro

ss

-border

interbank borrowin

g

as a

ratioo

fGDP

,

lo

g

of government expenditure as a ratio of GDP

,

log offinanci

a

l

d

e

v

e

l

o

pm

e

nt a

s

a ratio

of

GD

P

,

l

og

of macroeconomic

stabi

l

ity

,

log o

f

trade openne

s

s a

s

a r

a

ti

o of

GDP

a

nd l

og o

f human capit

a

l

,

and

e

,

w

a

s w

hite noi

se.

In addition to the use of the trad

i

t

i

ona

l

ordinary

least

s

quares regre

ss

ion

es

timation

,

the

s

tud

y

emp

l

oye

d another time-series technique

,

i

mpu

l

se re

s

pon

s

e function and

v

ariance d

e

c

o

mp

os

iti

o

n

(

to

g

eth

e

r

cal

l

e

d

'

innovation

accountin

g'

)

to anal

y

se the dynamic relati

o

n

s

hip

b

e

t

w

een remitt

a

n

c

e

s

and

e

c

o

n

o

m

ic

g

row

th

.

Ba

s

ed on the above

,

a Vector Autoregress

i

on

(V AR) i

n

corporating the

g

rowth m

o

del o

f

the form

3.2

was

built

:

k

V,

=

A

o

+

L

A

i

V

,-i

+

£,1=1

(3.2)

W

h

e

re V

t=

(log of economic

g

rowth

,

log of remitta

n

ce

s

a

s a

r

a

ti

o o

f GDP

,

l

og o

f f

o

r

e

i

g

n dir

ec

t

invest

m

e

nt as

a

rat

i

o ofGDP

,

log of portfo

l

io i

n

ve

s

tment a

s

a ratio of

G

DP

,

l

og of c

r

oss

-b

o

rd

e

r

interbank

borrow

in

g

a

s

a ratio of GDP

,

lo

g

of financial

development

a

s

a r

a

ti

o of G

DP

,

l

og of gove

rnm

e

nt

expe

nditure a

s

a ratio of GDP

,

lo

g

of huma

n

capital and lo

g o

f macro

e

c

o

n

o

mic

s

t

a

bilit

y),

e

,

=

err

o

r

terms

for the var

i

able

s

inc

l

uded and AI to Ak a

r

e

nin

e by n

i

ne matrices

o

f coefficient

s

a

nd A

o

is an

identity

m

a

tri

x

.

4

.

2

Definition a

nd

Measurement

of Va

ri

a

bl

es

4

.

2

.

1 Eco

n

o

mi

c G

r

owt

h

Theave

r

ag

e annual

g

r

o

wth rate of rea

l

gross dome

s

t

i

c pr

o

duct in perc

e

ntag

e.

4

.

2.2

Remittance

Perso

n

a

ltransfers and compen

s

ation

of employee

s.

Persona

l

transfer

s

c

o

n

s

i

s

t of

a

ll curr

e

nt tran

s

f

e

r

s

in

cash o

r in kind

made

or received

by r

e

sident

hou

se

hold

s

to

o

r from

non-re

s

id

e

nt

hou

s

eh

o

ld

s.

C

ompe

n

sa

tion

o

f

e

mplo

y

e

es

refer to the income

o

f bord

e

r

,

s

e

aso

n

a

l

,

a

nd

o

th

e

r

s

h

o

rt-term

wo

rk

e

r

s w

h

o

are

e

mpl

oye

d in an

e

conom

y w

her

e

the

y

ar

e

not re

s

id

e

nt and

o

f r

es

ident

s

e

mpl

oye

d

b

y

n

o

n-r

es

id

e

n

t

entities.

It

w

a

s

m

e

a

s

ured as

a

rati

o

of gro

ss

dome

s

tic product

4

.2.3

Foreign Di

r

ect I

n

ves

t

me

n

t

An

inves

tment t

o

acquire

a

la

s

tin

g

mana

g

ement

(

normall

y

10 p

e

r

ce

nt

of vo

tin

g s

t

oc

k

)

in a bu

s

in

ess

o

pera

t

i

n

g

in K

e

n

y

a by no- Ken

y

an investor

s.

It wa

s

mea

s

ur

e

d a

s

a p

e

r

ce

nt

age o

f

g

r

oss

d

o

m

es

ti

c

pr

o

duct.

4.2

.

4

Portfolio I

n

vestme

n

t

Portfolio

e

qu

i

t

y

flo

ws

(th

e

purcha

se

of s

tock

s

b

y

a f

o

rei

g

n

E

nt

e

rpri

se)

a

nd p

o

rtf

o

li

o

b

o

nd

f

l

ows

(

thepurc

h

ase o

f bond

s

i

ss

u

e

d b

y

a d

o

me

s

tic enterprise

o

r

g

ov

e

rnm

e

nt b

y

a fo

r

e

i

g

n

e

r

).

It

was

m

eas

ur

e

d

as

a perce

nt

age o

f

g

ros

s

dome

s

tic product.

4

.

2

.

5 C

r

os

s-border

Interbank

Bor

r

owi

n

g

Loanst

h

a

t

we

re

g

iven b

y

f

o

rei

g

n banks to dome

s

tic bank

s.

Thi

s s

tud

y

u

se

d n

e

t

ex

t

e

rn

a

l d

e

b

t (

pri

vate) as

a proxyfo

r cr

oss

-bord

e

r int

e

rba

n

k b

o

rrowing

.

Thi

s

wa

s

m

eas

ur

e

d a

s a

rati

o of g

ro

ss

d

o

m

es

tic pr

o

duct.

U

.

6

Human Capi

t

al

46. Dynamics of Rural Transformation in Emerging Economies

4.2.

7

Macroeconomic

Stability

A

m

easu

r

e of

m

ac

r

o

e

co

n

o

mic

p

e

rformanc

e

of the countr

y

. Inflation measur

e

d in p

ercen

ta

ge te

r

ms was

u

se

d t

o

captur

e

thi

s.

T

r

a

de

o

p

e

nn

ess

is the measure of the volume of trade between Kenya and the re

s

t

of

th

e w

orld.

It

was

m

e

a

s

ur

e

d

as

the

s

um of e

x

port

s

and import

s

as a percentage of gross domestic produ

c

t

.

F

in

a

ncial d

ev

e

l

opment

mea

s

ured the development

of the financial markets.

It

w

a

s

captur

e

d b

y

th

e

l

eve

l

o

f

g

r

oss

d

o

m

es

tic capital formation as a ratio of gross domestic product

.

Public

ex

penditure m

eas

ur

e

d the government

'

s

participation

in developm

e

nt

pr

ocess

.

It

was ca

ptured

b

y t

h

e gove

rnm

e

nt

'

s

e

x

p

e

nditur

e

on

g

oods and services as a ratio of

g

ros

s

dome

s

ti

c

pr

o

du

c

t

.

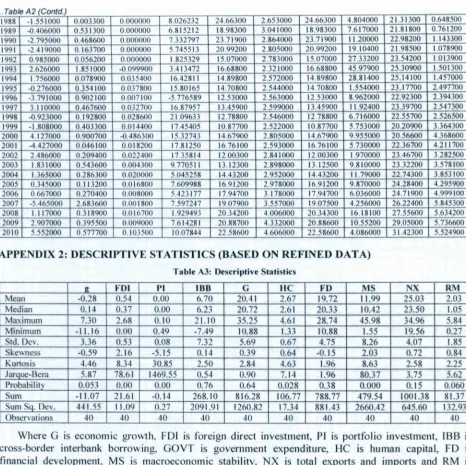

5.

FINDINGS

5.1 Effect of Re

m

i

tt

a

n

ces o

n

Eco

nomi

c G

r

owt

h

V

a

ri

a

ti

o

n

s

in th

e

independent variable

s s

ho

w

n in Appendix 5

,

Table A8 below j

o

intl

y ex

pl

a

in

a

b

o

ut 8

2

p

e

rc

e

nt

o

f th

e va

riation

s

in

ec

on

o

mic

g

rowt

h

.

An adjusted R2

of more than 0.5 indic

a

t

es

th

a

t th

e

m

o

d

e

l

h

as a goo

d fit and

c

an e

x

plain the variations

in the economic

growth. The F-

s

t

a

ti

s

ti

c

i

s 57

.0

34 a

nd i

s

s

t

a

ti

s

ti

ca

ll

y s

i

g

nific

a

nt at I perc

e

nt level

.

The

s

tandard error of the re

g

res

s

ion

of

0.0 II i

s s

m

a

ll

,

m

ea

nin

g

t

h

a

t th

e

m

o

d

e

l

was w

ell fittin

g.

Th

e

remainin

g

18 per cent of the

v

ariation

s

in

eco

n

o

mi

c grow

th

co

u

l

d b

e

ex

pl

a

in

ed

b

y o

th

e

r f

a

ct

o

r

s s

uch

as

bett

e

r maintenance of rul

e

of la

w

,

impr

ove

m

e

nt

in t

h

e

t

e

rm

s of t

r

ade

,

p

o

li

t

i

ca

l

f

r

ee

d

o

m

,

li

fe

e

x

p

e

ct

a

n

cy

and lo

w

er f

e

rtilit

y

.

T

h

e

r

eg

r

ess

i

o

n re

s

ult

s

in Table A8 App

e

ndix 5 show that the coeffici

e

nt

of

l

og of

r

e

mi

tta

n

ce

s

as a

r

atio of G

DP i

s

0

.

1

5

1 and i

s s

tati

s

ticall

y s

i

g

nificant

.

The r

e

sult indicat

e

s that a 10 p

e

r

ce

nt ri

se

in

t

h

e

r

a

t

io

of re

mitt

a

n

ces

t

o

GDP will l

e

ad to an increa

s

e of economic growth by 1.5 perc

e

nt

.

Th

e

re

s

ult

co

ntr

a

di

c

t

s

th

e

findin

gs of

Bar

a

ja

s

e

t

a

l

.

(

2

009) and Siddique

e

t al

.

(2010) in the ca

s

e

o

f Indi

a

and Ban

g

lad

es

h.

H

oweve

r

,

th

e

r

es

ult

s

upp

o

rt

s

th

e

findin

gs

of Fa

y

i

ss

a and N

s

iah (2010) for Latin

A

m

e

ri

c

an

co

untr

ies a

nd

S

iddi

q

u

e

e

t

a

l

.

(2

010

)

f

o

r

S

ri L

a

nka.

Thu

s

the a

ss

ertion that r

e

mittanc

es

ma

y

b

e

u

se

d f

o

r

co

n

s

p

icuo

u

s

co

n

s

umpt

io

n

r

a

th

e

r th

a

n f

o

r the a

c

cumulation

of producti

v

e a

s

sets

(

Rahman

e

t

a

l.

,

20

06

)

m

ay

n

o

t b

e

t

r

u

e

fo

r K

e

n

ya s

in

ce

thi

s s

tud

y

h

as s

hown th

a

t r

e

mittances a

s

a ratio

o

f GDP ha

ve a

p

os

iti

ve a

nd

s

i

g

n

if

i

ca

n

t

coe

f

f

i

c

i

e

nt

.

To com

pl

e

m

e

nt

th

e

r

eg

r

ess

ion r

es

ult

s

,

a

n impul

se

re

s

pon

s

e anal

ys

i

s w

a

s

d

o

n

e

t

o

tr

ace

th

e

p

a

th

of a

sh

ock

i

n

r

e

mi

t

t

a

n

ces o

n

eco

n

o

mi

c g

r

o

wth

.

Th

e

re

s

ult is

s

hown in fi

g

ur

e

4

.

1:

2 3 4 5 6 7 8

.20

.15

.10

OJ .05 0>

'

"

C .00

OJ

u

Q; o,

·.05

-.10

-.15

-.20

I'"

//

~

"'-...

_-9 10

Period