1040

INSTRUCTIONS

Including Instructions for Schedules A, B,

C, D, E, F, J, and SE

NOTE: THIS BOOKLET DOES NOT CONTAIN TAX FORMS

RECOVERY REBATE CREDIT

This credit is reduced by any economic stimulus payment you received.

2008

www.irs.gov.

Get a faster refund, reduce errors, and save paper. For more information on IRS e-file, see page 5 or click on IRS e-file at

Department of the Treasury

Internal Revenue Service

www.irs.gov

IRS

makes doing your taxes faster and easier.

STANDARD DEDUCTION FOR REAL ESTATE TAXES AND DISASTER LOSSES

You may be able to increase your standard deduction by state and local real estate taxes you paid and certain disaster losses.

FIRST-TIME HOMEBUYER CREDIT

If you bought a home after April 8, 2008, you may be able to take this credit.

IRA DEDUCTION INCREASED

You and your spouse, if filing jointly, may each be able to deduct up to $5,000 ($6,000 if age 50 or older at the end of 2008).

MAILING YOUR RETURN

You may be mailing your return to a different address this year.

For details on these and other changes, see pages 6 and 7.

Dear Taxpayer,

A Message From

the Commissioner

U.S. Supreme Court Justice Oliver Wendell Holmes, Jr. notably said “Taxes

are what we pay for civilized society.” We should be proud that the vast

majority of American citizens pay their taxes honestly and of their own free

will. In an ever more complex and global world, we cannot take for granted this

cornerstone principle of our democracy.

For the IRS’s part, we owe it to all taxpayers to make the process of paying

taxes as easy as possible. IRS employees are dedicated to helping taxpayers to

quickly get their questions answered, complete their forms, pay their taxes, and

get back to their lives. From the telephone representative who answers tax law

questions, to the walk-in site employees who help low-income taxpayers, to the

technicians that design and build our website –

www.irs.gov – we are

committed to providing top quality service.

Unfortunately, there will always be some that cheat their fellow citizens by

avoiding the payment of their fair share of taxes. The IRS owes it to the

millions of you who promptly pay your taxes in full to pursue these people

through strong enforcement programs. I believe this is a basic matter of

fairness.

If you need more information about taxes, I hope you’ll visit us online at

www.irs.gov, or call us toll free at 1-800-829-1040. Your government works for

you, so please do not hesitate to contact us if you need help.

Sincerely,

Douglas H. Shulman

The IRS Mission

Provide America’s taxpayers top quality service by helping them understand and meet their tax

responsibilities and by applying the tax law with integrity and fairness to all.

Table of Contents

Contents

Page

Contents

Page

Department of the

IRS Customer Service Standards . . . 4

2008 Earned Income Credit (EIC)

Treasury

Table . . . 53

Help With Unresolved Tax Issues

Internal(Taxpayer Advocate Service) . . . 4

Refund . . . 63

Revenue Service

IRS e-file . . . 5

Amount You Owe . . . 65

What’s New . . . 6

Third Party Designee . . . 66

Filing Requirements . . . 7

Sign Your Return . . . 66

Do You Have To File? . . . 7

Assemble Your Return . . . 67

When and Where Should You File? . . . . 7

2008 Tax Table . . . 68

Where To Report Certain Items

2008 Tax Computation Worksheet . . . . 80

From 2008 Forms W-2, 1098, and

General Information . . . 81

1099 . . . 10

Refund Information . . . 84

Tax Return Page Reference . . . 12

What Is TeleTax? . . . 84

Line Instructions for Form 1040 . . . 14

Calling the IRS . . . 86

Name and Address . . . 14

Quick and Easy Access to Tax Help

Social Security Number (SSN) . . . 14

and Tax Products . . . 87

Presidential Election Campaign Fund . 14

Disclosure, Privacy Act, and Paperwork

Filing Status . . . 14

Reduction Act Notice . . . 88

Exemptions . . . 16

Order Form for Forms and Publications . 90

Income . . . 20

Major Categories of Federal Income

and Outlays For Fiscal Year 2007 . . . . 91

Adjusted Gross Income . . . 28

2008 Tax Rate Schedules . . . 92

Tax and Credits . . . 34

Index . . . 93

Other Taxes . . . 44

IRS Customer Service Standards

At the IRS, our goal is to continually improve the quality of our services. To achieve that goal, we have developed customer service standards in the following areas.

● Access to information. ● Accuracy. ● Prompt refunds. ● Canceling penalties. ● Resolving problems. ● Simpler forms.

● Easier filing and payment options.

If you would like information about the IRS standards and a report of our accomplishments, see Pub. 2183.

Help With Unresolved Tax Issues

Taxpayer Advocate Service

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS whose employees assist taxpayers who are experiencing economic harm, who are seeking help in resolving tax problems that have not been resolved through normal channels, or who believe that an IRS system or procedure is not working as it should. You may be eligible for assistance if:

●You are experiencing economic harm or significant cost (including fees for professional representation),

●You have experienced a delay of more than 30 days to resolve your tax issue, or

●You have not received a response or resolution to the problem by the date promised by the IRS.

The service is free, confidential, tailored to meet your needs, and available for businesses as well as individuals. There is at least one local taxpayer advocate in each state, the District of Columbia, and Puerto Rico. Because advocates are part of the IRS, they know the tax system and how to navigate it. If you qualify for assistance, you will receive personalized service from a knowledgeable advocate who will:

●Listen to your problem,

●Help youunderstand what needs to be done to resolve it, and

●Stay with you every step of the way until your problem is resolved.

You can contact the Taxpayer Advocate Service by:

● Calling the TAS toll-free case intake line at 1-877-777-4778 or TTY/TDD 1-800-829-4059,

● Calling or writing your local taxpayer advocate, whose address and phone number are listed in the government listings in your local telephone directory and in Pub. 1546, Taxpayer Advocate Service—Your Voice at the IRS,

● Filing Form 911, Request for Taxpayer Advocate Service Assistance (and Application for Taxpayer Assistance Order), with the Taxpayer Advocate Service, or

● Asking an IRS employee to complete Form 911 on your behalf.

To get a copy of Form 911 or learn more about the Taxpayer Advocate Service, go to www.irs.gov/advocate.

Low Income T

a

x

pay

er Clinics (LITCs)

LITCs are independent organizations that provide low income taxpayers with representation in federal tax controversies with the IRS for free or for a nominal charge. The clinics also provide tax education and outreach for taxpayers who speak English as a second language. Pub. 4134, Low Income Taxpayer Clinic List, provides information on clinics in your area. It is available at www.irs.gov or your local IRS office.Make Under $56,000?

e-file

For Free!

● Easy to use, safe, and accurate.

● File your taxes online 24 hours a day, 7 days a week (must access Free File through www.irs.gov).

● Receive your refund in as little as 10 days with Direct Deposit.

● Available in English and Spanish.

Made more than $56,000? You can still file your taxes online with e-file. Check out the IRS e-file for Individuals page on www.irs.gov for low-cost e-filing options.

Use

IRS e-file

if you don’t qualify for

Free File. There are three ways:

Use a tax professional.

Many taxpayers rely on tax professionals to handle their returns and most tax professionals can e-file your return—you just have to be sure to ask. Also, tax professionals can charge a fee for IRS e-file. Fees can vary depending on the professional and specific services rendered, so be sure to discuss this up front. Use a computer.

You can easily electronically prepare and e-file your own tax return. To do so, you’ll need:

● A computer with Internet access, and

● IRS-approved tax preparation software available via the Internet for online use, for download from the Internet, and in retail stores for offline use. Visit www.irs.gov/efile for details.

Use a volunteer.

The VITA Program offers free tax help for low to moderate income (under $35,000) taxpayers who cannot prepare their own tax returns. The Tax Counseling for the Elderly (TCE) Program provides free tax help to people age 60 and older.

Why do more than 88 million taxpayers file their returns electronically? It’s faster, easier, accurate, and more convenient than paper filing.

Totally Safe and Secure

The IRS uses the most secure technology available to safeguard your personal information. Rest assured that when youe-file, your information will be safe.

Visit: www.irs.gov/efile for the latest information.

With e-file, taxpayers receive these benefits: ● Faster refunds...in as little as 10 days with Direct Deposit. ● Greater accuracy...a 1% or less error rate.

● Secure and confidential submission. ● Quick notification of receipt of return. ● No paper return to mail.

● File now, pay later.

You can accomplish many things electronically within www.irs.gov. The e-IRS is a gateway to the many IRS electronic options and it’s available 24 hours a day, 7 days a week. Should you choose to file a paper return, you’ll find information, resources, and all of the forms ready to download.

➜

➜ ➜

e-file!

A fast alternative to filing paper returns.

e-IRS

More than half a billion federal tax returns have been e-filed! e-file helps the environment, uses less paper, and saves taxpayer money—it costs less to process an e-filed return than a paper return.

● Save paper—help the environment. Use Free File and get these benefits:

If your 2008 adjusted gross income was $56,000 or less, you can electronically file for FREE byusing Free File at www.irs.gov!

What’s New

plan to a Roth IRA. The rollover is not Tax relief for Kansas disaster area.

Tem-What’s New for 2008

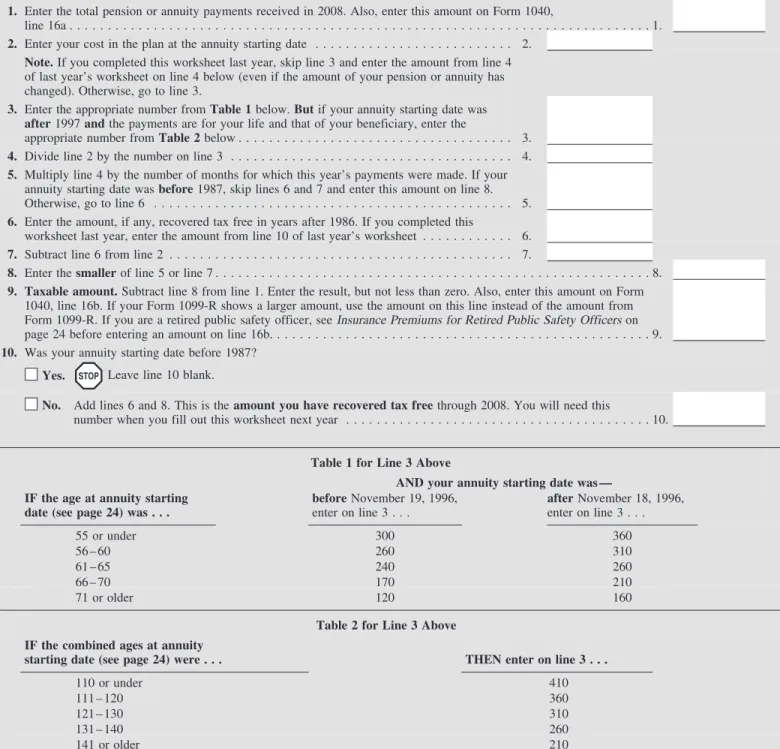

tax-free. See the instructions for lines 16a porary tax relief was enacted as a result ofand 16b for details. May 4, 2007, storms and tornadoes

affect-Economic stimulus payment. Any

eco-ing the Kansas disaster area. The tax bene-nomic stimulus payment you received is Standard mileage rates. The 2008 rate for

fits provided by this relief include not taxable for federal income tax purposes business use of your vehicle is 501⁄2 cents a

suspended limits for certain personal casu-but reduces your recovery rebate credit. mile (581⁄2 cents a mile after June 30, 2008).

alty losses and special rules for withdraw-The 2008 rate for use of your vehicle to get

Recovery rebate credit. This credit is fig- als and loans from IRAs and other qualified medical care or to move is 19 cents a mile

ured like last year’s economic stimulus retirement plans. For more details on these

(27 cents a mile after June 30, 2008).

payment, except that the amounts are based and other tax benefits related to the Kansas

on tax year 2008 instead of tax year 2007. Earned income credit (EIC). You may be disaster area, see Pub. 4492-A. The maximum credit is $600 ($1,200 if

able to take the EIC if: Tax relief for Midwestern disaster areas. married filing jointly) plus $300 for each

•

A child lived with you and you earned Temporary tax relief was enacted as a re-qualifying child. See the instructions forless than $38,646 ($41,646 if married filing sult of severe storms, tornadoes, or flood-line 70 that begin on page 61.

jointly), or ing affecting Midwestern disaster areas

Withdrawal of economic stimulus payment after May 19, 2008, and before August 1,

•

A child did not live with you and youfrom certain accounts. If your economic 2008. The tax benefits provided by this re-earned less than $12,880 ($15,880 if

mar-stimulus payment was directly deposited to lief include the following.

ried filing jointly). a tax-favored account and you withdraw

•

Suspended limits for certain personal the payment by the due date of your return The maximum AGI you can have and casualty losses and cash contributions. (including extensions), the amount with- still get the credit also has increased. You•

An additional exemption amount if drawn will not be taxed and no additional may be able to take the credit if your AGI isyou provided housing for a person dis-tax or penalty will apply. For a Coverdell less than the amount in the above list that

placed by the Midwestern storms, torna-education savings account, the withdrawal applies to you. The maximum investment

does, or flooding. can be made by the later of the above date income you can have and still get the credit

or June 1, 2009. See the instructions for has increased to $2,950. See the instruc-

•

An election to use your 2007 earned lines 15a and 15b, 21, and 59. tions for lines 64a and 64b that begin on income to figure your 2008 EIC andaddi-tional child tax credit. page 46.

A l t e r n a t i v e m i n i m u m t a x ( A M T )

•

An increased charitable standard exemption amount increased. The AMT Mailing your return. You may be mailingmileage rate for using your vehicle for vol-exemption amount is increased to $46,200 your return to a different address this year

unteer work related to the Midwestern ($69,950 if married filing jointly or a quali- because the IRS has changed the filing

lo-storms, tornadoes, or flooding. fying widow(er); $34,975 if married filing cation for several areas. If you received an

separately). envelope with your tax package, please use

•

Special rules for time and supporttests for people who were temporarily relo-it. Otherwise, see Where Do You File? on

IRA deduction expanded. You and your

cated because of the Midwestern storms, the back cover.

spouse, if filing jointly, each may be able to

tornadoes, or flooding. deduct up to $5,000 ($6,000 if age 50 or

Personal exemption and itemized

•

Special rules for withdrawals andolder at the end of the year). You may be

deduction phaseouts reduced. Taxpayers loans from IRAs and other qualified retire-able to take an IRA deduction if you were

with adjusted gross income above a certain ment plans. covered by a retirement plan and your 2008

amount may lose part of their deduction for

modified adjusted gross income (AGI) is For more details on these and other tax

personal exemptions and itemized deduc-less than $63,000 ($105,000 if married

fil-benefits related to the Midwestern disaster tions. The amount by which these

deduc-ing jointly or qualifydeduc-ing widow(er)). If areas, see Pub. 4492-B.

tions are reduced in 2008 is only 1⁄2 of the your spouse was covered by a retirement

amount of the reduction that otherwise

plan, but you were not, you may be able to would have applied in 2007. Credit for nonbusiness energy property

ex-take an IRA deduction if your 2008 modi- pired. The credit for nonbusiness energy

fied AGI is less than $169,000. See the in- Tax rate on qualified dividends and net property has expired and does not apply for structions for line 32 that begin on page 30 capital gain reduced. The 5% tax rate on 2008. Form 5695 is now used only to claim for details and exceptions. qualified dividends and net capital gain is the residential energy efficient property

credit. reduced to zero.

Standard deduction increased by real

estate taxes and net disaster losses. Your Tax on child’s investment income. Form standard deduction is increased by: 8615 is required to figure the tax for a child

•

Certain state or local real estate taxes with investment income of more thanWhat’s New for 2009

you paid, and $1,800 if the child:

Earned income credit (EIC). You may be

•

A net disaster loss attributable to a 1. Was under age 18 at the end of 2008, able to take the EIC if:federally declared disaster.

•

A child lived with you and you earned 2. Was age 18 at the end of 2008 and did

See the instructions for line 39c on page not have earned income that was more than less than $40,295 ($43,415 if married filing

34. half of the child’s support, or jointly), or

•

A child did not live with you and youFirst-time homebuyer credit. If you 3. Was a full-time student over age 18

earned less than $13,440 ($16,560 if mar-bought a main home after April 8, 2008, and under age 24 at the end of 2008 and did

ried filing jointly). and before July 1, 2009, and did not own a not have earned income that was more than

main home during the prior 3 years, you half of the child’s support. The maximum AGI you can have and

may be able to take this credit. See the in- The election to report a child’s investment still get the credit also has increased. You structions for line 69 on page 61.

income on a parent’s return and the special may be able to take the credit if your AGI is Rollovers to Roth IRAs. You can rollover rule for when a child must file Form 6251 less than the amount in the above list that distributions from an eligible retirement also now apply to the children listed above. applies to you. The maximum investment

income you can have and still get the credit the custodial parent and whose only pur- can and do claim an exemption for him or

has increased to $3,100. pose is to release a claim to exemption. her.

Limit on exclusion of gain on sale of main Credit for nonbusiness energy property. IRA deduction expanded. You may be

home. Generally, gain from the sale of You may be able to take this credit for qual-able to take an IRA deduction if you were

your main home is no longer excludable ifying energy savings items for your home covered by a retirement plan and your 2009

from income if it is allocable to periods af- placed in service in 2009. modified AGI is less than $65,000

ter 2008 where neither you nor your spouse ($109,000 if married filing jointly or

quali-(or your former spouse) used the property Personal casualty and theft loss limit. fying widow(er)). If your spouse was

cov-as a main home. See Pub. 553 for more de- Generally, a personal casualty or theft loss ered by a retirement plan, but you were not,

tails. must exceed $500 to be allowed for 2009.

you may be able to take an IRA deduction

This is in addition to the 10% of AGI limit if your 2009 modified AGI is less than Credit for plug-in electric drive motor

ve-that generally applies to the net loss.

$176,000. hicles. You may be able to take a credit if

you place a plug-in electric drive motor ve- A l t e r n a t i v e m i n i m u m t a x ( A M T )

Elective salary deferrals. The maximum hicle in service in 2009.

exemption amount decreased. The AMT amount you can defer under all plans is

exemption amount is decreased to $33,750 Qualifying child definition revised. The

generally limited to $16,500 ($11,500 if

($45,000 if married filing jointly or a quali-following changes to the definition of a

you only have SIMPLE plans; $19,500 for

fying widow(er); $22,500 if married filing qualifying child apply to years after 2008.

section 403(b) plans if you qualify for the

separately). 15-year rule). The catch-up contribution

•

Your qualifying child must belimit for individuals age 50 or older at the younger than you. Allowance of certain personal credits

end of the year is increased to $5,500 (ex-

•

A child cannot be your qualifying against the AMT. The allowance of the cept for section 401(k)(11) plans and child if he or she files a joint return, unless following personal credits against the AMT SIMPLE plans, for which this limit remains the return was filed only as a claim for re- has expired.unchanged). fund.

•

Credit for child and dependent care

•

If the parents of a child can claim the expenses. Divorced or separated parents. Anoncus-child as a qualifying noncus-child but no parent so

todial parent claiming an exemption for a

•

Credit for the elderly or the disabled.claims the child, no one else can claim the

child can no longer attach certain pages

•

Education credits.child as a qualifying child unless that

from a divorce decree or separation agree-

•

Mortgage interest credit. person’s AGI is higher than the highest

ment instead of Form 8332 if the decree or

AGI of any parent of the child.

•

Residential energy credits. agreement was executed after 2008. Thenoncustodial parent will have to attach

•

Your child is a qualifying child for•

District of Columbia first-time Form 8332 or a similar statement signed by purposes of the child tax credit only if you homebuyer credit.These rules apply to all U.S. citizens, regardless of where they live, and resident aliens.

Filing

Have you tried IRS e-file? It’s the fastest way to get your refund and it’s freeif you are eligible. Visit www.irs.gov for details.

Requirements

A child born on January 1, 1985, is con-sidered to be age 24 at the end of 2008. Do

Do You Have To File?

not use Form 8814 for such a child.When and Where

Use Chart A, B, or C to see if you must file

Should You File?

a return. U.S. citizens who lived in or had Resident aliens. These rules also apply if

File Form 1040 by April 15, 2009. If you income from a U.S. possession should see you were a resident alien. Also, you may

file after this date, you may have to pay Pub. 570. Residents of Puerto Rico can use qualify for certain tax treaty benefits. See

interest and penalties. See page 83. TeleTax topic 901 (see page 84) to see if Pub. 519 for details.

they must file. If you were serving in, or in support of,

the U.S. Armed Forces in a designated Nonresident aliens anddual-status aliens.

Even if you do not otherwise These rules also apply if you were a nonres- combat zone, qualified hazardous duty have to file a return, you should ident alien or a dual-status alien and both of area, or contingency operation, you can file

file one to get a refund of any the following apply. later. See Pub. 3 for details.

TIP

federal income tax withheld.

•

You were married to a U.S. citizen or See the back cover for filing instructions You should also file if you are eligible for resident alien at the end of 2008. and addresses. For details on using apri-the earned income credit, additional child vate delivery service, see page 8.

•

You elected to be taxed as a resident tax credit, health coverage tax credit,re-alien.

fundable credit for prior year minimum tax,

What if You Cannot File on

See Pub. 519 for details.

first-time homebuyer credit, or recovery re-

Time?

bate credit.

You can get an automatic 6-month exten-Specific rules apply to

deter-Exception for certain children under age mine if you are a resident alien, sion if, no later than the date your return is 19 or full-time students. If certain condi- CAUTION

!

nonresident alien, or dual-status due, you file Form 4868. For details, see tions apply, you can elect to include on alien. Most nonresident aliens Form 4868.your return the income of a child who was and dual-status aliens have different filing

An automatic 6-month exten-under age 19 at the end of 2008 or was a requirements and may have to file Form

sion to file does not extend the full-time student under age 24 at the end of 1040NR or Form 1040NR-EZ. Pub. 519

time to pay your tax. See Form 2008. To do so, use Form 8814. If you discusses these requirements and other in- CAUTION

!

4868. make this election, your child does not have formation to help aliens comply with U.S.

to file a return. For details, use TeleTax tax law, including tax treaty benefits and If you are a U.S. citizen or resident topic 553 (see page 84) or see Form 8814. special rules for students and scholars. alien, you may qualify for an automatic

extension of time to file without filing tional 4 months if, no later than June 15, night, FedEx 2Day, FedEx International Form 4868. You qualify if, on the due date 2009, you file Form 4868. This 4-month Priority, and FedEx International First. of your return, you meet one of the follow- extension of time to file does not extend the

•

United Parcel Service (UPS): UPSing conditions. time to pay your tax. See Form 4868. Next Day Air, UPS Next Day Air Saver,

•

You live outside the United States and UPS 2nd Day Air, UPS 2nd Day Air A.M.,Puerto Rico and your main place of busi-

Private Delivery Services

UPS Worldwide Express Plus, and UPSness or post of duty is outside the United Worldwide Express.

You can use certain private delivery serv-States and Puerto Rico.

ices designated by the IRS to meet the

•

You are in military or naval service on‘‘timely mailing as timely filing/paying’’ The private delivery service can tell you duty outside the United States and Puerto

rule for tax returns and payments. These how to get written proof of the mailing Rico.

private delivery services include only the date. This extension gives you an extra 2 following.

months to file and pay the tax, but interest

•

DHL Express (DHL): DHL Same Day will be charged from the original due datePrivate delivery services cannot Service, DHL Next Day 10:30 am, DHL

of the return on any unpaid tax. You must deliver items to P.O. boxes.

Next Day 12:00 pm, DHL Next Day 3:00

attach a statement to your return showing You must use the U.S. Postal

pm, and DHL 2nd Day Service.

that you meet the requirements. If you are CAUTION

!

Service to mail any item to an

•

Federal Express (FedEx): FedEx Pri-still unable to file your return by the end ofIRS P.O. box address. ority Overnight, FedEx Standard

Over-the 2-month period, you can get an

addi-Chart A—For Most People

AND at the end of 2008 THEN file a return if your gross IF your filing status is . . . you were* . . . income** was at least . . .

under 65 $8,950

Single

65 or older 10,300

under 65 (both spouses) $17,900

Married filing jointly*** 65 or older (one spouse) 18,950

65 or older (both spouses) 20,000

Married filing separately (see page 15) any age $3,500

under 65 $11,500

Head of household (see page 15)

65 or older 12,850

Qualifying widow(er) with dependent child under 65 $14,400

(see page 16) 65 or older 15,450

* If you were born on January 1, 1944, you are considered to be age 65 at the end of 2008.

** Gross income means all income you received in the form of money, goods, property, and services that is not exempt from tax, including any income from sources outside the United States (even if you can exclude part or all of it). Do not include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2008 or (b) one-half of your social security benefits plus your other gross income is more than $25,000 ($32,000 if married filing jointly). If (a) or (b) applies, see the instructions for lines 20a and 20b to figure the taxable part of social security benefits you must include in gross income. *** If you did not live with your spouse at the end of 2008 (or on the date your spouse died) and your gross income was at least $3,500, you must file a return regardless of your age.

Chart B—For Children and Other Dependents

(See the instructions for line 6c that begin on

page 17 to find out if someone can claim you as a dependent.)

If your parent (or someone else) can claim you as a dependent, use this chart to see if you must file a return.

In this chart, unearned income includes taxable interest, ordinary dividends, and capital gain distributions. It also includes unemployment compensation, taxable social security benefits, pensions, annuities, and distributions of unearned income from a trust. Earned income includes salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Gross income is the total of your unearned and earned income.

Single dependents. Were you either age 65 or older or blind? No. You must file a return if any of the following apply.

•

Your unearned income was over $900.•

Your earned income was over $5,450.•

Your gross income was more than the larger of —•

$900, or•

Your earned income (up to $5,150) plus $300. Yes. You must file a return if any of the following apply.•

Your unearned income was over $2,250 ($3,600 if 65 or older and blind).•

Your earned income was over $6,800 ($8,150 if 65 or older and blind).•

Your gross income was more than the larger of —•

$2,250 ($3,600 if 65 or older and blind), or•

Your earned income (up to $5,150) plus $1,650 ($3,000 if 65 or older and blind). Marrieddependents. Were you either age 65 or older or blind?No. You must file a return if any of the following apply.

•

Your unearned income was over $900.•

Your earned income was over $5,450.•

Your gross income was at least $5 and your spouse files a separate return and itemizes deductions.•

Your gross income was more than the larger of —•

$900, or•

Your earned income (up to $5,150) plus $300. Yes. You must file a return if any of the following apply.•

Your unearned income was over $1,950 ($3,000 if 65 or older and blind).•

Your earned income was over $6,500 ($7,550 if 65 or older and blind).•

Your gross income was at least $5 and your spouse files a separate return and itemizes deductions.•

Your gross income was more than the larger of —•

$1,950 ($3,000 if 65 or older and blind), or•

Your earned income (up to $5,150) plus $1,350 ($2,400 if 65 or older and blind).Chart C—Other Situations When You Must File

You must file a return if any of the four conditions below apply for 2008. 1. You owe any special taxes, including any of the following.

a. Alternative minimum tax.

b.Additional tax on a qualified plan, including an individual retirement arrangement (IRA), or other tax-favored account. But if you are filing a return only because you owe this tax, you can file Form 5329 by itself.

c. Household employment taxes. But if you are filing a return only because you owe this tax, you can file Schedule H by itself. d.Social security and Medicare tax on tips you did not report to your employer or on wages you received from an employer who did not

withhold these taxes.

e. Write-in taxes, including uncollected social security and Medicare or RRTA tax on tips you reported to your employer or on group-term life insurance and additional taxes on health savings accounts. See the instructions for line 61 on page 45. f. Recapture taxes. See the instructions for line 44, that begin on page 36, and line 61, on page 45.

2. You received any advance earned income credit (EIC) payments from your employer. These payments are shown in Form W-2, box 9.

3. You had net earnings from self-employment of at least $400.

4. You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes.

Where To Report Certain Items From 2008 Forms W-2, 1098, and 1099

IRS e-file takes the guesswork out of preparing your return. You may also be eligible to use Free File to file your federal income tax return. Visit www.irs.gov/efile for details.

If any federal income tax withheld is shown on these forms, include the tax withheld on Form 1040, line 62. If you itemize your deductions and any state or local income tax withheld is shown on these forms, include the tax withheld on Schedule A, line 5, unless you elect to deduct state and local general sales taxes.

Form Item and Box in Which It Should Appear Where To Report if Filing Form 1040

W-2 Wages, tips, other compensation (box 1) Form 1040, line 7

Allocated tips (box 8) See Wages, Salaries, Tips, etc. on page 20 Advance EIC payment (box 9) Form 1040, line 60

Dependent care benefits (box 10) Form 2441, Part III Adoption benefits (box 12, code T) Form 8839, line 22 Employer contributions to an Archer Form 8853, line 3

MSA (box 12, code R)

Employer contributions to a health savings account Form 8889, line 9 (box 12, code W)

W-2G Gambling winnings (box 1) Form 1040, line 21 (Schedule C or C-EZ for professional gamblers) 1098 Mortgage interest (box 1) Schedule A, line 10*

Points (box 2)

}

Refund of overpaid interest (box 3) Form 1040, line 21, but first see the instructions on Form 1098* Mortgage insurance premiums (box 4) See the instructions for Schedule A, line 13*

1098-C Contributions of motor vehicles, boats, and Schedule A, line 17 airplanes

1098-E Student loan interest (box 1) See the instructions for Form 1040, line 33, on page 33*

1098-T Qualified tuition and related expenses See the instructions for Form 1040, line 34, on page 34, or Form 1040, (box 1) line 50, on page 40, but first see the instructions on Form 1098-T* 1099-A Acquisition or abandonment of secured property See Pub. 4681

1099-B Stocks, bonds, etc. (box 2) See the instructions on Form 1099-B

Bartering (box 3) See Pub. 525

Aggregate profit or (loss) (box 11) Form 6781, line 1

1099-C Canceled debt (box 2) See Pub. 4681

1099-DIV Total ordinary dividends (box 1a) Form 1040, line 9a

Qualified dividends (box 1b) See the instructions for Form 1040, line 9b, on page 21 Total capital gain distributions (box 2a) Form 1040, line 13, or, if required, Schedule D, line 13

Unrecaptured section 1250 gain (box 2b) See the instructions for Schedule D, line 19, that begin on page D-8 Section 1202 gain (box 2c) See Exclusion of Gain on Qualified Small Business (QSB) Stock in

the instructions for Schedule D on page D-4

Collectibles (28%) gain (box 2d) See the instructions for Schedule D, line 18, on page D-7 Nondividend distributions (box 3) See the instructions for Form 1040, line 9a, on page 21 Investment expenses (box 5) Schedule A, line 23

Foreign tax paid (box 6) Form 1040, line 47, or Schedule A, line 8. But first see the instructions for line 47 on page 40.

1099-G Unemployment compensation (box 1) Form 1040, line 19. But if you repaid any unemployment compensation in 2008, see the instructions for line 19 on page 26.

State or local income tax refunds, credits, or See the instructions for Form 1040, line 10, on page 22. If box 8 on offsets (box 2) Form 1099-G is checked, see the box 8 instructions.

ATAA payments (box 5) Form 1040, line 21

Taxable grants (box 6) Form 1040, line 21 (but if you received a grant to reimburse a casualty loss to your main home due to Hurricane Katrina, Rita, or Wilma, see the Form 4684 instructions for a special rule that may apply)* Agriculture payments (box 7) See the Instructions for Schedule F or Pub. 225*

* If the item relates to an activity for which you are required to file Schedule C, C-EZ, E, or F or Form 4835, report the taxable or deductible amount allocable to the activity on that schedule or form instead.

Form Item and Box in Which It Should Appear Where To Report if Filing Form 1040

1099-INT Interest income (box 1) See the instructions for Form 1040, line 8a, on page 21 Early withdrawal penalty (box 2) Form 1040, line 30

Interest on U.S. savings bonds and Treasury See the instructions for Form 1040, line 8a, on page 21 obligations (box 3)

Investment expenses (box 5) Schedule A, line 23

Foreign tax paid (box 6) Form 1040, line 47, or Schedule A, line 8. But first see the instructions for line 47 on page 40.

Tax-exempt interest (box 8) Form 1040, line 8b Specified private activity bond interest (box 9) Form 6251, line 11

1099-LTC Long-term care and accelerated death benefits See Pub. 525 and the Instructions for Form 8853 1099-MISC Rents (box 1) See the Instructions for Schedule E*

Royalties (box 2) Schedule E, line 4 (for timber, coal, and iron ore royalties, see Pub. 544)*

Other income (box 3) Form 1040, line 21*

Nonemployee compensation (box 7) Schedule C, C-EZ, or F. But if you were not self-employed, see the instructions on Form 1099-MISC.

Excess golden parachute payments (box 13) See the instructions for Form 1040, line 61, on page 45 Other (boxes 5, 6, 8, 9, 10, and 15b) See the instructions on Form 1099-MISC

1099-OID Original issue discount (box 1)

}

See the instructions on Form 1099-OID Other periodic interest (box 2)Early withdrawal penalty (box 3) Form 1040, line 30

Original issue discount on U.S. Treasury See the instructions on Form 1099-OID obligations (box 6)

Investment expenses (box 7) Schedule A, line 23

1099-PATR Patronage dividends and other distributions from a Schedule C, C-EZ, or F or Form 4835, but first see the instructions on cooperative (boxes 1, 2, 3, and 5) Form 1099-PATR

Domestic production activities deduction (box 6) Form 8903, line 21

Credits (boxes 7, 8, and 10) See the instructions on Form 1099-PATR Patron’s AMT adjustment (box 9) Form 6251, line 27

Deduction for small refiner capital costs or Schedule C, C-EZ, or F qualified refinery property (box 10)

1099-Q Qualified education program payments See the instructions for Form 1040, line 21, on page 28

1099-R Distributions from IRAs** See the instructions for Form 1040, lines 15a and 15b, that begin on page 23

Distributions from pensions, annuities, etc. See the instructions for Form 1040, lines 16a and 16b, that begin on page 24

Capital gain (box 3) See the instructions on Form 1099-R

1099-S Gross proceeds from real estate transactions (box Form 4797, Form 6252, or Schedule D. But if the property was your 2) home, see the Instructions for Schedule D to find out if you must

report the sale or exchange. Report an exchange of like-kind property on Form 8824 even if no gross proceeds are reported on Form 1099-S.

Buyer’s part of real estate tax (box 5) See the instructions for Schedule A, line 6, on page A-5* 1099-SA Distributions from health savings accounts (HSAs) Form 8889, line 14a

Distributions from MSAs*** Form 8853

* If the item relates to an activity for which you are required to file Schedule C, C-EZ, E, or F or Form 4835, report the taxable or deductible amount allocable to the activity on that schedule or form instead.

** This includes distributions from Roth, SEP, and SIMPLE IRAs. *** This includes distributions from Archer and Medicare Advantage MSAs.

Check here if you, or your spouse if filing jointly, want $3 to go to this fund (see page 14) 䊳

Taxable amount (see page 26)

14

Questions about what to put on a line? Help is on the page number in the circle.

Tax Return Page Reference

24 21

FOR

REFERENCE ONLY—DO NOT FILE

21 14 14 16 17 67 14 65 14 15 19 17 18 20 21 21 22 23 23 23 23 23 24 26 26 B-1 21 23 26 28 28 29 29 29 29 29 30 30 30 33 34 34 34 29 34 16

Department of the Treasury—Internal Revenue Service

1040

U.S. Individual Income Tax Return

OMB No. 1545-0074 For the year Jan. 1–Dec. 31, 2008, or other tax year beginning , 2008, ending , 20

Last name

Your first name and initial Your social security number

(See instructions on page 14.) L A B E L H E R E

Last name Spouse’s social security number

If a joint return, spouse’s first name and initial

Use the IRS label.

Otherwise, please print or type.

Home address (number and street). If you have a P.O. box, see page 14. Apt. no.

City, town or post office, state, and ZIP code. If you have a foreign address, see page 14.

Presidential

Election Campaign 䊳

1 Single

Filing Status

2 Married filing jointly (even if only one had income) Check onlyone box.

3

Qualifying widow(er) with dependent child (see page 16)

6a Yourself. If someone can claim you as a dependent, do not check box 6a

Exemptions

b Spouse(4) if qualifying child for child tax credit (see page 17)

Dependents:

c (2) Dependent’s

social security number

(3) Dependent’s relationship to

you

(1) First name Last name

If more than four dependents, see page 17.

d Total number of exemptions claimed

7

Wages, salaries, tips, etc. Attach Form(s) W-2

7

8a 8a Taxable interest. Attach Schedule B if required

Income

8b b Tax-exempt interest. Do not include on line 8a

Attach Form(s) W-2 here. Also attach Forms W-2G and 1099-R if tax was withheld. 9a 9a Ordinary dividends. Attach Schedule B if required

10 10 Taxable refunds, credits, or offsets of state and local income taxes (see page 22)

11 11 Alimony received

12 12 Business income or (loss). Attach Schedule C or C-EZ

Enclose, but do not attach, any payment. Also, please use

Form 1040-V.

13 13 Capital gain or (loss). Attach Schedule D if required. If not required, check here 䊳

14 14 Other gains or (losses). Attach Form 4797

15a 15b

IRA distributions bTaxable amount (see page 23)

15a

16b 16a

Pensions and annuities bTaxable amount (see page 24)

16a

17 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

18 18 Farm income or (loss). Attach Schedule F

19 19 Unemployment compensation

20b

20a b

20a Social security benefits

21 21

22 Add the amounts in the far right column for lines 7 through 21. This is your total income 䊳 22

25

IRA deduction (see page 30)

23

27

33

One-half of self-employment tax. Attach Schedule SE

29

Self-employed health insurance deduction (see page 29)

34

30 26

Self-employed SEP, SIMPLE, and qualified plans

31a 27

Penalty on early withdrawal of savings

32 29

Alimony paid b Recipient’s SSN 䊳

36

Add lines 23 through 31a and 32 through 35

28

Subtract line 36 from line 22. This is your adjusted gross income 䊳

30

Adjusted

Gross

Income

37

If you did not get a W-2, see page 21.

Form

Married filing separately. Enter spouse’s SSN above and full name here. 䊳

Cat. No. 11320B

其

Label

Form1040 (2008)

IRS Use Only—Do not write or staple in this space.

Head of household (with qualifying person). (See page 15.) If the qualifying person is a child but not your dependent, enter this child’s name here. 䊳

Other income. List type and amount (see page 28)

Moving expenses. Attach Form 3903

32

26

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 88.

Boxes checked on 6a and 6b No. of children on 6c who:

Dependents on 6c not entered above Add numbers on lines above 䊳 ● lived with you ● did not live with you due to divorce or separation (see page 18)

31a

34

Student loan interest deduction (see page 33) 33

36

Checking a box below will not change your tax or refund.

Spouse You

(99)

Tuition and fees deduction. Attach Form 8917

37

4

5

23

Educator expenses (see page 28)

9b b Qualified dividends (see page 21)

24 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 or 2106-EZ 24

25 Health savings account deduction. Attach Form 8889

28

35 Domestic production activities deduction. Attach Form 8903 35

䊱

You must enter䊱

your SSN(s) above.Amount you owe. Subtract line 71 from line 61. For details on how to pay, see page 65䊳

40

Questions about what to put on a line? Help is on the page number in the circle.

Tax Return Page Reference

66 66 34 34 36 39 40 41 40 42 46 61 45 61 65 63 44 44 44 34 40 36 44 66 61 61 66 65 65 61 48 61 63 44 NEW NEW 45 NEW

Add lines 47 through 54. These are your total credits

Self-employment tax. Attach Schedule SE

Married filing jointly or Qualifying widow(er), $10,900 Head of household, $8,000

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

Add lines 62 through 70. These are your total payments 䊳

Page 2 Form 1040 (2008)

Amount from line 37 (adjusted gross income)

38 38 Check if: 39a Tax and Credits 39a Single or Married filing separately, $5,450

If your spouse itemizes on a separate return or you were a dual-status alien, see page 34 and check here䊳

b 39b

40 40

41

Subtract line 40 from line 38

41

42

If line 38 is over $119,975, or you provided housing to a Midwestern displaced individual, see page 36. Otherwise, multiply $3,500 by the total number of exemptions claimed on line 6d

42

43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter

-0-43

44 44

49

53

Credit for the elderly or the disabled. Attach Schedule R

48 47

56

Subtract line 55 from line 46. If line 55 is more than line 46, enter -0- 䊳

56

Other Taxes

57

72

Unreported social security and Medicare tax from Form:

59

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

58

60

Add lines 56 through 60. This is your total tax 䊳

Federal income tax withheld from Forms W-2 and 1099

62 62

63

2008 estimated tax payments and amount applied from 2007 return

63

Payments

64a

67

Amount paid with request for extension to file (see page 61)

66

65

Excess social security and tier 1 RRTA tax withheld (see page 61)

67

71

Credits from Form:

68

73a 73a

74 74

If line 71 is more than line 61, subtract line 61 from line 71. This is the amount you overpaid

75 75

Amount of line 72 you want refunded to you. If Form 8888 is attached, check here 䊳

Refund

76

Amount of line 72 you want applied to your 2009 estimated tax 䊳

Estimated tax penalty (see page 65)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

76

You were born before January 2, 1944, Blind.

Spouse was born before January 2, 1944, Blind.

a 2439 b 4136 59 60 68 Amount You Owe Sign Here Date Your signature Keep a copy for your records. Date Spouse’s signature. If a joint return, both must sign.

Preparer’s SSN or PTIN Date

Preparer’s

signature Check ifself-employed

Paid Preparer’s

Use Only Firm’s name (oryours if self-employed), address, and ZIP code

EIN Phone no.

䊳

䊳

䊳

Your occupationTax (see page 36). Check if any tax is from: b

Direct deposit? See page 63 and fill in 73b, 73c, and 73d, or Form 8888. Routing number Account number c Checking Savings a Form(s) 8814 Form 4972 b d 䊳 䊳 71 54

Child tax credit (see page 42). Attach Form 8901 if required

57

58

Additional taxes:

72

䊳

Retirement savings contributions credit. Attach Form 8880

Credits from Form:

52

Additional child tax credit. Attach Form 8812

65 66 Standard Deduction for— Joint return? See page 15.

Daytime phone number

( )

Earned income credit (EIC)

Credit for child and dependent care expenses. Attach Form 2441

45 46

Alternative minimum tax (see page 39). Attach Form 6251

Add lines 44 and 45 䊳

Foreign tax credit. Attach Form 1116 if required

50 If you have a qualifying child, attach Schedule EIC. 45 46 64a Spouse’s occupation ( ) Form 1040(2008) ●People who checked any box on line 39a, 39b, or 39c or who can be claimed as a dependent, see page 34. ●All others: Designee’s name 䊳

Do you want to allow another person to discuss this return with the IRS (see page 66)?

Third Party

Designee Phone

no. 䊳 ( )

Yes. Complete the following. No

Personal identification

number (PIN) 䊳

54

Education credits. Attach Form 8863

55 a 8396 b 8839 51 61 61 Type: c 8801 Total boxes checked 䊳

兵

其

51 49 53 48 47 52 50 c 5695 Other credits from Form: a 3800 b 8801 c69 First-time homebuyer credit. Attach Form 5405

64b

a 4137 b 8919

55

70 Recovery rebate credit (see worksheet on pages 62 and 63)

b Nontaxable combat pay election

69 70

Check if standard deduction includes real estate taxes or disaster loss (see page 34) 䊳

c 39c

a AEIC payments b Household employment taxes. Attach Schedule H

d 8885

Form 1040 — Line 1

IRS e-file takes the guesswork out of preparing your return. You may also

Line

be eligible to use Free File to file your federal income tax return. Visitwww.irs.gov/efile for details.

Instructions for

Form 1040

Section references are to the Internal Revenue Code.•

Your spouse is filing a separate return.Foreign Address

Name and Address

Enter the information in the followingor-der: City, province or state, and country. Follow the country’s practice for entering

Use the Peel-Off Label

Presidential Election

the postal code. Do not abbreviate the Using your peel-off name and address label country name.

Campaign Fund

on the back of this booklet will speed the processing of your return. It also prevents

This fund helps pay for Presidential elec-common errors that can delay refunds or

Death of a Taxpayer

tion campaigns. The fund reduces candi-result in unnecessary notices. Put the labeldates’ dependence on large contributions on your return after you have finished it. See page 82.

from individuals and groups and places Cross out any incorrect information and

candidates on an equal financial footing in print the correct information. Add any

missing items, such as your apartment the general election. If you want $3 to go to

number.

Social Security

this fund, check the box. If you are filing ajoint return, your spouse can also have $3 go to the fund. If you check a box, your tax

Number (SSN)

Address Change

or refund will not change. An incorrect or missing SSN can increase

If the address on your peel-off label is not your tax or reduce your refund. To apply your current address, cross out your old for an SSN, fill in Form SS-5 and return it, address and print your new address. If you along with the appropriate evidence

docu-plan to move after filing your return, use ments, to the Social Security Administra-

Filing Status

Form 8822 to notify the IRS of your new tion (SSA). You can get Form SS-5 onlineaddress. at www.socialsecurity.gov, from your local Check only the filing status that applies to

you. The ones that will usually give you the SSA office, or by calling the SSA at

lowest tax are listed last. 1-800-772-1213. It usually takes about 2

Name Change

weeks to get an SSN once the SSA has all

•

Married filing separately. If you changed your name because of mar- the evidence and information it needs.•

Single. riage, divorce, etc., be sure to report the Check that your SSN on your Forms•

Head of household. change to your local Social Security Ad- W-2 and 1099 agrees with your socialse-ministration office before filing your re- curity card. If not, see page 81 for more

•

Married filing jointly or qualifyingturn. This prevents delays in processing details. widow(er) with dependent child.

your return and issuing refunds. It also

safeguards your future social security bene-

IRS Individual Taxpayer

More than one filing status can fits. See page 81 for more details. If you

Identification Numbers

apply to you. Choose the one received a peel-off label, cross out your

(ITINs) for Aliens

that will give you the lowestformer name and print your new name.

TIP

tax. If you are a nonresident or resident alien

and you do not have and are not eligible to

What if You Do Not Have a

get an SSN, you must apply for an ITIN.Label?

For details on how to do so, see Form W-7Line 1

and its instructions. It usually takes about Print or type the information in the spaces

4-6 weeks to get an ITIN.

Single

provided. If you are married filing a

sepa-rate return, enter your spouse’s name on If you already have an ITIN, enter it You can check the box on line 1 if any of line 3 instead of below your name. wherever your SSN is requested on your

the following was true on December 31, tax return.

2008. Note. An ITIN is for tax use only. It does

If you filed a joint return for

•

You were never married. not entitle you to social security benefits or2007 and you are filing a joint

•

You were legally separated, according change your employment or immigrationreturn for 2008 with the same

TIP

status under U.S. law. to your state law, under a decree of divorce

spouse, be sure to enter your

or separate maintenance. names and SSNs in the same order as on

Nonresident Alien Spouse

your 2007 return.

•

You were widowed beforeIf your spouse is a nonresident alien, he or January 1, 2008, and did not remarry before she must have either an SSN or an ITIN if: the end of 2008. But if you have a

depen-P.O. Box

•

You file a joint return, dent child, you may be able to use the qual-ifying widow(er) filing status. See the Enter your box number only if your post•

You file a separate return and claim anForm 1040 — Lines 2 Through 4 You may be able to file as head If the child is not your dependent, enter

Line 2

of household if you had a child the child’s name on line 4. If you do not living with you and you lived enter the name, it will take us longer toMarried Filing Jointly

TIP

apart from your spouse during process your return. the last 6 months of 2008. See Married

You can check the box on line 2 if any of

persons who live apart on this page.

the following apply. Dependent. To find out if someone is your

dependent, see the instructions for line 6c

•

You were married at the end of 2008,that begin on page 17. even if you did not live with your spouse at

the end of 2008.

Line 4

Exception to time lived with you.

Tempo-•

Your spouse died in 2008 and you did rary absences by you or the other person forHead of Household

not remarry in 2008. special circumstances, such as school,

va-•

You were married at the end of 2008, Special rules may apply for cation, business, medical care, military and your spouse died in 2009 before filing a people who had to relocate be- service, or detention in a juvenile facility,2008 return.

TIP

cause of the Midwestern count as time lived in the home. Also seestorms, tornadoes, or flooding. Kidnapped child on page 19, if applicable. For federal tax purposes, a marriage

For details, see Pub. 4492-B.

means only a legal union between a man If the person for whom you kept up a

and a woman as husband and wife. A hus- This filing status is for unmarried indi- home was born or died in 2008, you can band and wife filing jointly report their viduals who provide a home for certain still file as head of household as long as the combined income and deduct their com- other persons. (Some married persons who home was that person’s main home for the bined allowable expenses on one return. live apart are considered unmarried. See part of the year he or she was alive. They can file a joint return even if only one Married persons who live apart on this

had income or if they did not live together page. If you are married to a nonresident Keeping up a home. To find out what is all year. However, both persons must sign alien, you may also be considered unmar- included in the cost of keeping up a home, the return. Once you file a joint return, you ried. See Nonresident alien spouse on page see Pub. 501.

cannot choose to file separate returns for 16.) You can check the box on line 4 only if

If you used payments you received that year after the due date of the return. you were unmarried or legally separated

under Temporary Assistance for Needy (according to your state law) under a decree

Joint and several tax liability. If you file a Families (TANF) or other public assistance of divorce or separate maintenance at the

joint return, both you and your spouse are programs to pay part of the cost of keeping

end of 2008 and either Test 1 or Test 2

generally responsible for the tax and any up your home, you cannot count them as

below applies.

interest or penalties due on the return. This money you paid. However, you must

in-means that if one spouse does not pay the Test 1. You paid over half the cost of keep- clude them in the total cost of keeping up tax due, the other may have to. However, ing up a home that was the main home for your home to figure if you paid over half see Innocent Spouse Relief on page 81. all of 2008 of your parent whom you can the cost.

claim as a dependent, except under a multi-Nonresident aliens anddual-status aliens.

Married persons who live apart. Even if ple support agreement (see page 19). Your

Generally, a husband and wife cannot file a you were not divorced or legally separated

parent did not have to live with you. joint return if either spouse is a nonresident

at the end of 2008, you are considered un-alien at any time during the year. However,

Test 2. You paid over half the cost of keep- married if all of the following apply. if you were a nonresident alien or a

ing up a home in which you lived and in

•

You lived apart from your spouse for dual-status alien and were married to a U.S.which one of the following also lived for the last 6 months of 2008. Temporary ab-citizen or resident alien at the end of 2008, more than half of the year (if half or less,

sences for special circumstances, such as you may elect to be treated as a resident see Exception to time lived with you on this

for business, medical care, school, or mili-alien and file a joint return. See Pub. 519 page).

tary service, count as time lived in the for details.

home. 1. Any person whom you can claim as a

dependent. But do not include:

•

You file a separate return from your spouse.a. Your qualifying child (as defined in

Line 3

•

You paid over half the cost of keepingStep 1 on page 17) whom you claim as your

up your home for 2008.

Married Filing Separately

dependent based on the rule for Children ofdivorced or separated parents that begins

•

Your home was the main home of If you are married and file a separate return,on page 18, your child, stepchild, or foster child for

you will usually pay more tax than if you

more than half of 2008 (if half or less, see b. Any person who is your dependent

use another filing status for which you

Exception to time lived with you above). only because he or she lived with you for

qualify. Also, if you file a separate return,

all of 2008, or

•

You can claim this child as yourde-you cannot take the student loan interest

pendent or could claim the child except that deduction, the tuition and fees deduction, c. Any person you claimed as a

depen-the child’s odepen-ther parent can claim him or the education credits, or the earned income dent under a multiple support agreement.

her under the rule for Children of divorced credit. You also cannot take the standard See page 19.

or separated parents that begins on page 18. deduction if your spouse itemizes deduc- 2. Your unmarried qualifying child who

tions. is not your dependent. Adopted child. An adopted child is

al-ways treated as your own child. An adopted Generally, you report only your own 3. Your married qualifying child who is

child includes a child lawfully placed with income, exemptions, deductions, and cred- not your dependent only because you can

you for legal adoption. its. Different rules apply to people in com- be claimed as a dependent on someone

munity property states. See page 20. else’s 2008 return. Foster child. A foster child is any child

Be sure to enter your spouse’s SSN or 4. Your child who is neither your depen- placed with you by an authorized place-ITIN on Form 1040 unless your spouse dent nor your qualifying child because of ment agency or by judgment, decree, or does not have and is not required to have an the rule for Children of divorced or sepa- other order of any court of competent

Form 1040 — Lines 5 Through 6b

Nonresident alien spouse. You are consid- If your spouse died in 2008, you cannot

ered unmarried for head of household filing file as qualifying widow(er) with depen-

Exemptions

status if your spouse was a nonresident dent child. Instead, see the instructions foralien at any time during the year and you do line 2 on page 15. You usually can deduct $3,500 on line 42

not choose to treat him or her as a resident for each exemption you can take. You may

Adopted child. An adopted child is always

alien. To claim head of household filing also be able to take an additional exemption

treated as your own child. An adopted child

status, you must also meet Test 1 or Test 2 amount on line 42 if you provided housing

includes a child lawfully placed with you

on page 15. to a person displaced by the Midwestern

for legal adoption. storms, tornadoes, or flooding.

Dependent. To find out if someone is your dependent, see the instructions for line 6c

Line 5

that begin on page 17.

Line 6b

Qualifying Widow(er) With

Exception to time lived with you.

Tempo-Spouse

Dependent Child

rary absences by you or the child for specialCheck the box on line 6b if either of the circumstances, such as school, vacation,

Special rules may apply for

following applies. business, medical care, military service, or

people who had to relocate

be-detention in a juvenile facility, count as

cause of the Midwestern 1. Your filing status is married filing

TIP

time lived in the home. Also see Kidnapped

storms, tornadoes, or flooding. jointly and your spouse cannot be claimed

child on page 19, if applicable.

For details, see Pub. 4492-B. as a dependent on another person’s return.

You can check the box on line 5 and use A child is considered to have lived with 2. You were married at the end of 2008, joint return tax rates for 2008 if all of the you for all of 2008 if the child was born or your filing status is married filing sepa-following apply. died in 2008 and your home was the child’s rately or head of household, and both of the

home for the entire time he or she was

•

Your spouse died in 2006 or 2007 and following apply.alive.

you did not remarry before the end of 2008. a. Your spouse had no income and is not

•

You have a child or stepchild whom Keeping up a home. To find out what is filing a return. you claim as a dependent. This does not included in the cost of keeping up a home,b. Your spouse cannot be claimed as a

include a foster child. see Pub. 501.

dependent on another person’s return.

•

This child lived in your home for all of If you used payments you received 2008. If the child did not live with you forunder Temporary Assistance for Needy

the required time, see Exception to time Families (TANF) or other public assistance If your filing status is head of household lived with you on this page. programs to pay part of the cost of keeping and you check the box on line 6b, enter the name of your spouse on the dotted line next

•

You paid over half the cost of keeping up your home, you cannot count them asto line 6b. Also, enter your spouse’s social

up your home. money you paid. However, you must

in-security number in the space provided at

•

You could have filed a joint return clude them in the total cost of keeping upthe top of your return. with your spouse the year he or she died, your home to figure if you paid over half