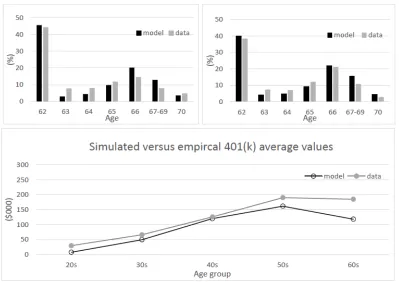

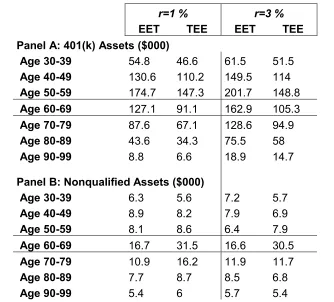

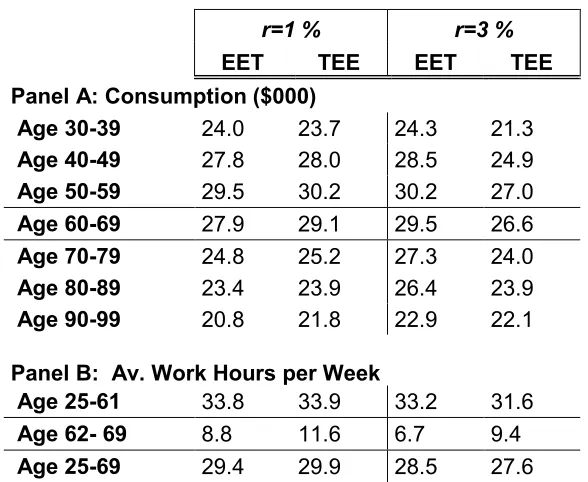

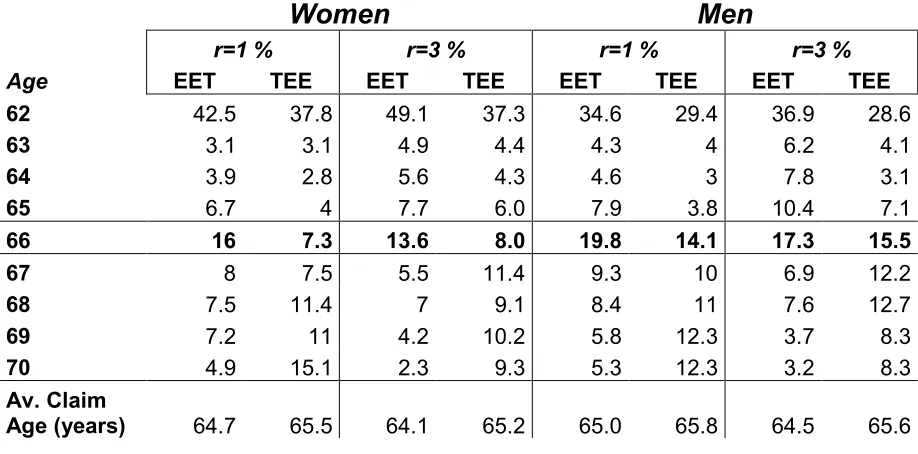

How Would 401(k) ‘Rothification’ Alter Saving, Retirement Security, and Inequality?

Full text

Figure

Related documents

The tax treatment is different from a traditional retirement savings plan, such as a 401(k) or individual retirement account (IRA), where contributions reduce taxable income

We then measured Polr3e mRNA expression levels in the various MIR knockout cells and wild-type cells by RT-qPCR with qPCR primers located inside a single exon toward the 3 ′ end of

Although we believe that the expectations reflected in such forward-looking statements are reasonable, these forward-looking statements are based on a number of assumptions

Using this model, an application task is suitably mapped on a computing resource during runtime, ensuring minimum energy consumption for a given application performance

Retirement Planning for Americans Abroad Problem: Benefitting from the significant tax

You can make an incoming tax-free rollover transfer of your account balance held in another tax qualified retirement plan (pension, profit sharing or 401(k) plan) provided the other

• Develop a personalized strategy for assets held in your Retirement Savings Plan, or for all your retirement assets, including your Cash Balance Plan and Social Security.

Assets that you have in another qualified retirement plan, such as a 401(k) or 403(b) plan, an Individual Retirement Account, or another deferred compensation plan may be rolled