Analysis of Volatility in Gold Prices with the Markov Regime-Switching Models

Full text

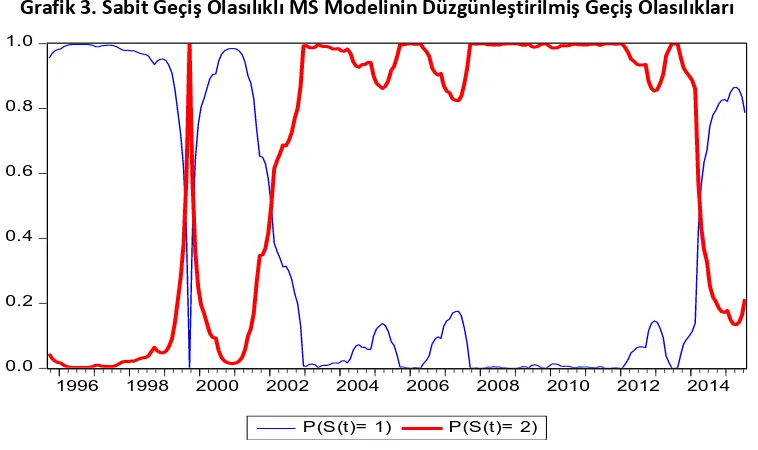

Figure

Related documents

Additional finite element modeling could be performed to estimate the maximum axial stresses generated at the notch root as a function of maximum dwell cycles for the FGOQ1 and

(If hiding or being invisible is your goal, then you probably do not want or need a LinkedIn presence.) Unless you change the settings on your public profile, it will be

On the basis of our postulates and the CPLV model, we opera- tionalize the following parameters: (1) market growth over time, (2) changes in unit costs over time, (3) the cost of

This implementation of Tripod’s [15] optimization network is described in the current research. Tripod is a “novel demand management system which incentivizes travelers in

We know from Discrete Time Finance that one can compute a fair price for an option by taking an expectation.. E Q e −

Beside reducing the energy consumption, the identified configuration also leads to a better use of some tanks, either enhancing water turnover within the tank or reducing

In this paper we develop a finger-vein image synthesis model, based on vein pattern growth from nodes to patterns, which incorporates realistic imaging

What we can observe is basically a shift from a modern world in which patterning is established through typified buildings connected to material infrastructures to a world in