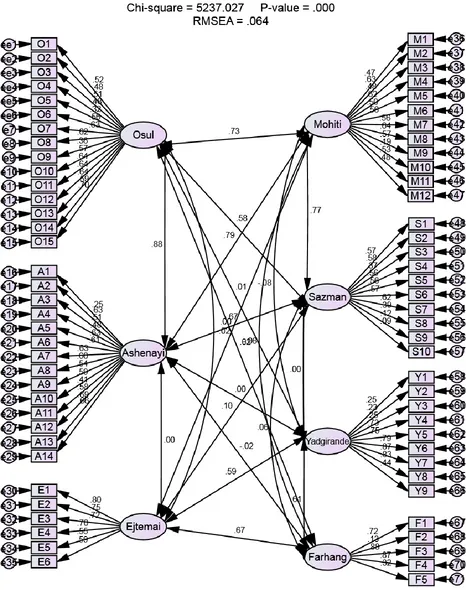

Presenting a Model in the Field of Risk Management Training in the Insurance Industry

Full text

Figure

Related documents

The main issues that emerged from the reviewed articles are grouped under seven themes which include beliefs concerning causes of pregnancy complications, beliefs

Methods: A follow-up study 5.5 years after the explosion, 330 persons aged 18 – 67 years, compared lung function, lung function decline and airway symptoms among exposed

AHS: anticonvulsant hypersensitivity syndrome; ADR: adverse drug reac- tion; AEDS: antiepileptic drugs; LP: lumber puncture; EBV: Epstein Barr virus; CMV: cytomegalovirus; HSV:

Thus, this study is designed to highlight the status of uncontrolled hypertension in patients with type 2 diabetes and determine the associated factors, which may affect the

Also, both diabetic groups there were a positive immunoreactivity of the photoreceptor inner segment, and this was also seen among control ani- mals treated with a

Pertaining to the secondary hypothesis, part 1, whether citalopram administration could raise ACTH levels in both alcohol-dependent patients and controls, no significant

exceedance, and the allowable volume of eroded bedload (AV) standard, Log(AV) = - 0.64(Q c ) – 1.52, represented both magnitude and duration of exceedance while remaining stable.

The anti- oxidant activity was performed by DPPH free radical scavenging method using ascorbic acid as standard and compound IIa, IIc and IId showed significant free