Bayesian Portfolio Selection in a Markov Switching Gaussian Mixture Model

Full text

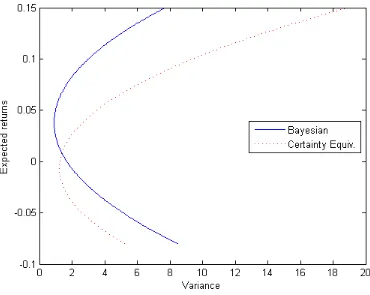

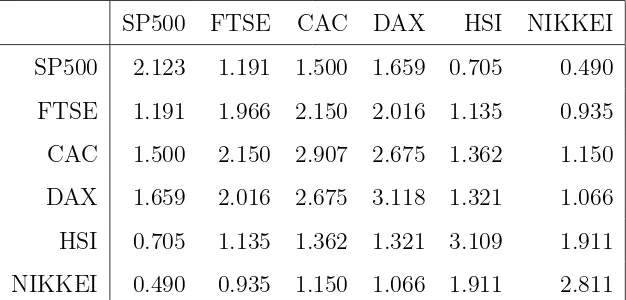

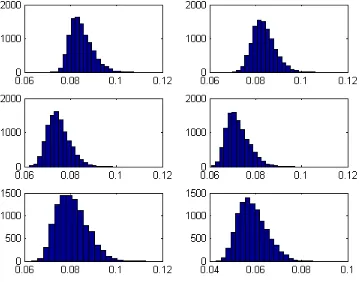

Figure

Related documents

Obtain, upon written request to the Plan Administrator, copies of documents governing the operation of the Plan, including insurance contracts, copies of the latest annual

The first measure captures the consis- tency between individual gender attitudes and couples’ general WFA to create four groups of individuals: the consistent egalitarians

Similarly, if field workers encounter anything in the network that does not match information in the record, they can notify.. Engineering so the record is changed to

Sometimes that's developing our things

During Industrial Policy Resolution 1956, Government reserved 128 items for exclusive production in the small scale sector in order to make SSI sector self-supporting and to make its

On the basis of our postulates and the CPLV model, we opera- tionalize the following parameters: (1) market growth over time, (2) changes in unit costs over time, (3) the cost of

―Powering Up: Costing Power Infrastructure Spending Needs in Sub-Saharan Africa.‖ AICD Background Paper 5, Africa Region, World Bank, Washington, DC. ―An Unsteady Course: Growth

Streetlights: A publication of the Urban Missionaries of Our Lady of Hope, August 2014 Come to.