Can IT Outsourcing Enhance Firm Performance

of Banks: an Empirical Study of IT Outsourcing

Impact on Banks’ Performance

Ping Yu

Master Thesis

Master of Science in Finance and International Business

Thesis Advisor: Steen Nielsen Department of Business Studies

2010

Aarhus School of Business Aarhus University

1 Table of Contents Abstract...3 1. Introduction ...4 2. Literature Review ...10 2.1 Why IT Outsourcing? ...10

2.2 Why banks outsource IT? ...15

2.3 The Inherent Costs and Risks Related to IT Outsourcing ...16

2.4 Review of the relevant empirical evidence ...20

3. Research Framework and Hypotheses...26

3.1 How to Measure Firm Performance ...26

3.2 Performance Measurement in IS Field ...27

3.3 Hypotheses ...29

4. Research Methodology ...32

4.1 Data Collection ...32

4.2 Matched-pair Analysis ...35

4.3 Mean Comparison of the Matched Pairs ...38

4.4 Statistical Model...42

4.5 Double-differencing checking ...47

5. Research Results Discussion ...49

6. Conclusion and Future Research Discussion ...52

6.1 Conclusion...52

6.2 Limitations and Directions for Future Research ...52

2 List of Figures

Figure 1 European Market for IT Outsourcing ... 5

Figure 2 Outsourcing Contracts in Different Sectors in the Financial Industry ... 6

Figure 3 Reasons for IT Outsourcing ... 11

Figure 4 the Relationship between Business Strategy and IT Strategy ... 13

Figure 5 Reasons against IT Outsourcing ... 17

Figure 6 Research Framework of evaluating the IT effects ... 28

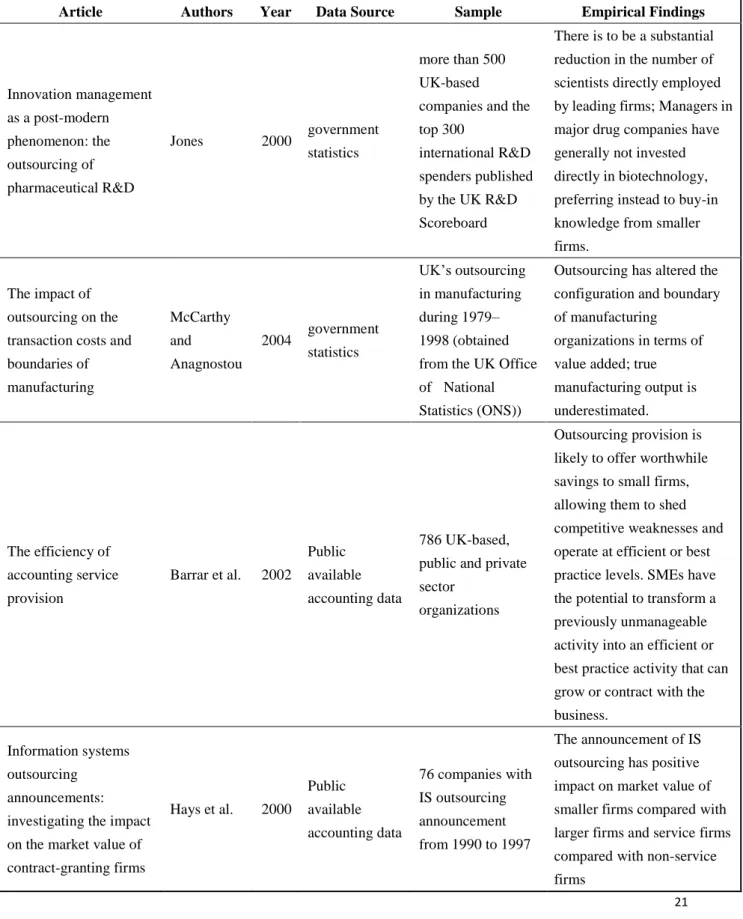

List of Tables Table 1 a short Summary of the 4 Articles Mentioned in the Study of Jiang and Qureshi (2006) ... 21

Table 2 Main Empirical Results of Former Outsourcing Studies ... 23

Table 3 Empirical Studies Related to IT Outsourcing in the Banking Industry... 25

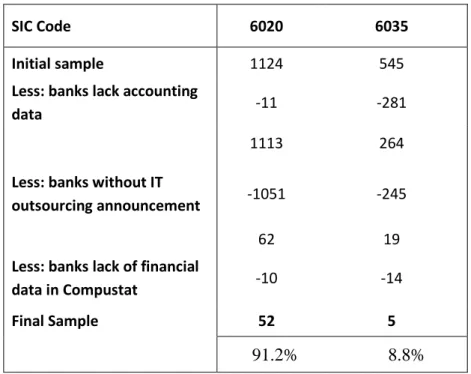

Table 4 Sample Selection Procedure ... 34

Table 5 Sample Distribution by Year ... 35

Table 6 Mean Comparison between the IT Outsourcing Group and the Matched Control Group — t-test ... 40

Table 7 Mean Comparison between the IT Outsourcing Group and the Matched Control Group -- Wilcoxon Signed-rank Test ... 41

Table 8 OLS Estimation of Regression Model ... 46

3

Abstract

IT outsourcing is a widely used business practice for organizations that are in an effort to improve firm performance and add firm value. Empirical studies show that IT outsourcing has very limited positive impact on firm performance. However, there is to date no research that has exclusively focused on IT outsourcing impact on firm performance in the banking industry, which is one of the most technology-intensive industries. This paper attempts to fill this gap by comparing the firm performance of 57 American banks that have IT outsourcing announcement with a matched control group cross-sectionallyand longitudinally before and after the IT outsourcing announcement, using accounting performance measures. The research results show that there is no significant difference in the performance measures between IT outsourcing banks and the matched non-outsourcing counterparts in the year of IT outsourcing as well as one and two years after IT outsourcing. The research results suggest that the inherent costs and risks brought by IT outsourcing exceed the positive effects so that IT outsourcing might not enhance banks’ performance. However, as a suggestion to future research, a more sophisticated performance measurement system that includes ―soft‖ measures other than only solid accounting ratios may be an optional method to measure the firm performance.

Keywords: Information Technology (IT), outsource, firm performance, banks, accounting-based measures

4

1.

Introduction

The first concept of Information Technology (IT) outsourcing can be traced back to 1962, when Ross Perot founded Electronic Data Systems (EDS). "You are good at designing and manufacturing widgets, but we are skilled with managing information technology. We will sell you the IT services that you require and you can pay us periodically with a minimum commitment of two years.‖ This is what EDS would say to a potential client (Hirschheim, Heinzl & Dibbern 2002) . The IT outsourcing deal made by Eastman Kodak with IBM in 1989 was a landmark deal which created a boom in the IT outsourcing field. On October 2, 1989, IBM announced a large contract with Eastman Kodak, under which it would build and operate a data center for Kodak. According to this agreement, IBM "will take over the work done by four Kodak centers and 300 Kodak workers will become IBM employees." In addition, "Kodak hopes to cut costs as much as 50% by turning the operation over to IBM." (Loh, Venkatraman 1992b) The huge contract between the two prominent companies had profound impact on the business world. From then on, IT outsourcing has become a strategic-level choice of firms. A considerable number of outsourcing deals have emerged as one of the most important business decisions for firms that want to improve firm performance and add firm value.

Today IT outsourcing has become a very common way of allocating or reallocating business resources from an internal source to an external source (Parkhe 2007). Information System (IS) refers to the flow of information in an organization and between organizations, encompassing the information, the business caters, uses and stores. Information System is the combination of Information Technology (hardware, software) and its applications, which also incorporates the human aspects (Gulla, Gupta 2009). In most occasions, IS and IT are used interchangeably. IT outsourcing is a business practice that a client transfers property, responsibility or decision rights to an IT products or services vendor (Wang et al. 2008, Barthélemy, Geyer 2005). On one hand, IT Outsourcing can be regarded as a make-or-buy decision in the context of IT

5

management: should a certain IT functions be integrated into the firm or should they be acquired from the market? On the other hand, IT outsourcing is more than purchasing and consulting but a long-term relationship between contract-grantor and service provider. IT outsourcing activities include data center operations, help desk, software development, e-commerce, hosted applications (software as a service), network operations, disaster recovery services and so on. The Gartner group estimated that the worldwide IT outsourcing market grew from US$ 180.5 billion revenues in 2003 to US$ 253.1 billion in 2008 at a compound annual growth rate of 7.2% (Gonzalez, Gasco & Llopis 2006). According to the research of Deutsche Bank in 2004, the market for IT outsourcing is one of the biggest and fastest growing markets in Europe. Firms that do not consider IT to be a core competency are delegating a large portion of their IT-based activities to the market. In 2003 IT services that worth approximately EUR 45 billon were assigned externally. The market volume increases by 17% per year on average to EUR 100 billion up to 2008, as predicted by Deutsche bank (Deutsche Bank Research 2004). Figure 1 illustrates the growth of IT outsourcing market in Europe.

6

IT outsourcing is active in a wide range of industries and all kinds of business activities. Financial industry is one of the largest investors in Information Systems (IS) and Information Technologies (IT). The category of Depository and Non-depository Financial Institutions is the most IT-intensive industry in the U.S. as measured by the ratio of computer equipment and software to Value Added (Triplett, Bosworth 2002). Because of its IT-intensive business processes, IT outsourcing has developed dramatically in the past 20 years in the financial industry. Banks are pioneers in this field and still account for the lion’s share (as shown in figure 2).

Figure 2 Outsourcing Contracts in Different Sectors in the Financial Industry

Two-thirds of U.S. retail and commercial banks with assets of at least $3 billion outsource one or more business functions, according to a survey assessing IT outsourcing preferences and practices conducted by Accenture in 2003. A lot of high-profile banks such as J.P. Morgan Chase & Co., Deutsche Bank, ABN AMRO, American Express, Standard Chartered, HSBC, City Bank and Bank of America have chosen to outsource part of their business processes, IT services or applications. IT

7

outsourcing activities in the banking industry can be generalized into three categories: business process outsourcing (BPO), systems outsourcing and applications outsourcing (Gillis 2002). Business process outsourcing (BPO) indicates the labor-intensive work that does not rely heavily on technology. It could apply to procurement, accounts payable, call center, human resource, billing and collection, back-office operations and other labor-intensive functions. Systems outsourcing refers to pure technology, such as operating systems, network management, desktop management, data center management, disaster recovery and other generic aspects of technology. Applications outsourcing includes the work related to banks everyday business such as lending, taking deposits and dealing with customers. According to the survey conducted by Accenture in 2003, applications outsourcing is most widely applied by banks. Out of the banks that outsource, 75 percent reported outsourcing credit card processing and 40 percent reported outsourcing mortgage processing. The second popular category is business process outsourcing. 55 percent of respondents reported outsourcing some aspects of their human resources function (Accenture Newsroom Home 2003).

The main purpose for banks to outsource IT is to focus on their core competencies (Gupta, Gupta 1992, Lacity, Hirschheim 1994, Grover, Myun & Teng 1994, Smith, Mitra & Narasimhan 1998). Job division enables different parties to focus on what they are expert in. Banks are good at banking and IT companies are good at information technology. Banking is the core business of banks while technology is the core business of IT companies. The outside vendors are able to provide more efficient and reliable services, which lead to the economies of scale as well as the economies of scope. By outsourcing part or all of the IT functions and services to the outside vendors, banks can make use of the outside professional services and concentrate more on their core business. A Datamonitor survey (2006) revealed that banks are increasingly turning to outsourcing as the means to achieve their major business and IT goals. Reports show that, by outsourcing some or all of their IT and business operations to third-party providers, retail banking institutions can achieve greater transparency and efficiency of their infrastructure and business processes, which facilitates the achievement of their

8

strategic operational goals (Gupta, Gupta 1992, Gonzalez, Gasco & Llopis 2010). IT outsourcing gives banks the opportunities to access to world class skills, realize fast project start-up and borrow best examples in the banking industry. All of these translate into lower costs and higher quality, which increase the competitiveness of banks.

Cost reduction is another important motivation that banks choose to outsource their IT (Gupta, Gupta 1992, Lacity, Hirschheim 1994, Ang, Straub 1998). The need to reduce costs may arise from lower growth opportunities, higher debt, or falling profitability. In such cases, IT outsourcing is part of a larger cost-cutting effort for the entire company. As pointed out by John O'Connor, a partner in Accenture's Financial Services operating group, ―IT outsourcing is an excellent vehicle to help banks to rationalize redundancies, improve automation, exploit low-cost location processing and implement a variable cost structure within their finance and accounting functions‖ (Accenture Newsroom Home 2003). Other reasons for banks to outsource IT include improving corporate efficiency, increasing flexibility, providing better service and enhancing the transparency (Wang et al. 2008, Smith, Mitra & Narasimhan 1998, Kishore et al. 2003). However, besides the benefits brought by IT outsourcing, there are also some adverse effects associated with this practice. Some argue that instead of cutting cost, IT outsourcing actually brings extra costs such as vendor selection costs, legal contract costs and layoff costs (Barthélemy, Geyer 2005). Some also point out the risks followed by IT outsourcing: loss of management control, loss intelligent assets, loss of in-house IT capability, loss of innovative ability, loss of key IS employees and the risk of the default of outside venders (Smith, Mitra & Narasimhan 1998).

IT outsourcing, on one hand, cuts cost, improves performance and adds value to banks; on the other hand, also brings some additional costs and unexpected risks. Even though IT outsourcing decisions should base on precisely scientific analysis, corporate strategy and the quality and range of service, they usually end up with something more subjective (Gillis 2002). Since a lot of banks are passionate and optimistic about their decisions concerning IT outsourcing, it would be very necessary and meaningful to find

9

out if this prevailing business practice can actually enhance the performance of banks. What disappointed us is the fact that to date there are only very limited number of studies that have examined the performance and the economic implications of IT outsourcing. Instead, studies related to outsourcing determinants and drives are more popular in the IS research field. Very limited number of research has exclusively focused on the financial service industry or the banking industry. Generally speaking, two types of research methods were used to measure firm performance in former studies. One is using subjective measures that based on the data gathered from case studies, interviews or surveys (Smith, Mitra & Narasimhan 1998, Ang, Straub 1998, Loh, Venkatraman 1992a). The other is employing objective accounting performance measures that gathered from public database such as DataStream and LexisNexis Academic (Wang et al. 2008, Nicolaou 2004, Jiang, Frazier & Prater 2006). The first research method is widely used while the second research method is fairly new. However, by using audited accounting measures instead of perception-based metrics and gathering public available data from official databases instead of gathering subjective data from case studies, interviews or surveys, the second method is a more objective and reliable research method.

This paper is mainly inspired by the research that uses objective accounting measures to assess the firm performance difference. The research that conducted by Li Wang et al. (2008) studied the firm performance after IT outsourcing announcement of 120 companies in all industries from 1993 to 2003. Their research indicated that IT outsourcing has very few positive effects on firm performance compared with the matched control group (Wang et al. 2008). However, the impact of IT outsourcing on firm performance can vary significantly across industries. Just as suggested by Li Wnag et al. (2008) as a direction of future research, ―it is also possible that the impact of IT depends on other contextual variables such as industry. With more data, future research may wish to categorize IT outsourcing initiatives and industries and study the possible differential effects of IT outsourcing‖. Although the research of Wang et al. (2008) shows very little significant difference on firm performance between the sample group

10

and the control group, there might be a completely different story when taking only the banking industry into consideration. Due to its’ information-intensive attributes, the uses of IT may have more remarkable impact on firm performance of banks. In order to find out if IT outsourcing has significant positive impact on banks’ performance, this paper focuses exclusively on the banking industry (commercial banks and saving institutions). The main purpose of this paper is to examine if IT outsourcing can actually enhance banks performance using accounting-based measures such as return on assets (ROA), return on equity (ROE), return on investment (ROI) and net interest margin (NIM). All data are gathered from Standard & Poor's Compustat database.

The rest of the paper is organized as follows. In the second section, a literature review that focuses on main IT outsourcing theories and studies is conducted. The research framework is discussed and the hypotheses are given in the third section. The fourth section is related to a research methodology including the process of data collection. The research results will be discussed in the fifth section. In the last section, some suggestions and recommendations for future research are mentioned.

2.

Literature Review

2.1

Why IT Outsourcing?

Scholars that study the determinants or drives behind IT outsourcing suggest that IT outsourcing decisions are generally motivated by expected benefits brought by IT outsourcing. A survey conducted by Capgemini Ernst & Young in 2004 listed cost cutting, strategic reasons, risk reduction and better quality as the top drivers for IT outsourcing (as shown in Figure 3). A large number of literatures have studied the reasons or drives for IT outsourcing from different angles. In general, the reasons for organizations to outsource IT can be classified into three categories: economic-related, strategic-related and technological-related.

11 Figure 3 Reasons for IT Outsourcing

Economic-related Reasons

Achieving economies of scale is one of the most commonly cited reasons for IT outsourcing that derived from economic considerations. IT outsourcing brings some clear economic advantages such as reduction in overhead expenses, elimination the soaring costs associated with hardware and software maintenance and avoiding the unexpected costs caused by the fast development of information technology (Gupta, Gupta 1992). Since the primary business of an outsourcer is to provide IT services across a large range of companies, the outsourcer are able to offer high standard services at a lower unit costs than a company who chooses to do this in-house. Therefore, IT outsourcing makes the overall cost of IS operations decrease significantly. It is easy for outsourcing companies to achieve greater economies of scale at faster pace than companies who manage IS by themselves.

The IS service providers are also able to exploit economies of scope. According to the theory of economies of scope, economies of scope are realized if it is cheaper to produce multiple products jointly than separately. Since a single service provider carries

12

out a variety of IT tasks, same hardware, software and human resources can be used to a large variety of projects (Grover, Myun & Teng 1994). Resources especially intelligent resources are used more efficiently and effectively, thus the average total cost of production decreases.

IT outsourcing also makes IT costs more predictable and structured (Clermont 1991). By arriving at a detailed fixed-price contract with service-level guaranteed, the contract-granting companies have a clear picture of the costs of the IT services that they get. The longer-term benefit is having costs aligned with the business, which allows the lines of business to understand how costs scale up and down as the business expands and shrinks.

Strategic-related Reasons

Resource-based view (RBV) is widely used to explain the reasons of outsourcing. Resource-based view considers that a firm must possess unique resources that enable it to achieve competitive advantage (Espino-Rodríguez, Padrón-Robaina 2006). Porter’s Value Chain framework provides a methodology of analyzing the competitive strength of business. Value Chain analysis suggests that business activities can be divided into two categories: the primary activities and the support activities. Primary activities are vital in value creation and product differentiation while support activities facilitate the primary activities. For most firms whose core businesses are not IT related, the IT activities are usually regarded as support activities. By outsourcing a certain types of IT activities to the outside professional providers, companies can allocate more resources to their core businesses, which can generate profit and create product differentiation (Grover, Myun & Teng 1994). IT outsourcing has been actively used by many large- and medium-sized organizations as a means to sharpen their strategic business focus and achieve competitive advantage.

The necessity to meet the fast change of market needs also urges companies to turn to the help from outside IT professionals. Organizations use IT outsourcing as an effective

13

way to respond to the changeable needs of their customers and IS users. Developing customized products that keep up with the changing tastes of customers and users may be difficult for organizations with limited indoor IT capability (Gupta, Gupta 1992). However, IT outsourcing providers are usually experienced in a certain area and have the access to advanced technologies. IT outsourcing allows outsourcing recievers to have larger degree of flexibility to meet their IT needs during designing and reengineering business process (Gonzalez, Gasco & Llopis 2010). IT outsourcing becomes an attractive alternative for organizations operating in markets that view information as a commodity.

Last but not least, IT outsourcing is an effective way to achieve the alignment of business strategy and IT, which will promote competitiveness (Grover, Myun & Teng 1994). Information systems policy is the outcome of the strategic orientations of business and its information systems. At the same time, IT drives business by way of enabling and facilitating business processes through the use of powerful IS tools. Figure 4 demonstrates the relationship among business strategy, IT strategy and IT outsourcing.

Figure 4 the Relationship between Business Strategy and IT Strategy

Short term Medium Term Long term

Technical-related Reasons

The fast progress of information technology makes IT skills obsolete rapidly and creates an IT skills shortage. IT staffs of most companies, naturally limited in size and financial constraints, cannot keep up with speedy changing in the IT fields. A single company

Business Strategy

IT Strategy

IT Outsourcing

Strategy Business Impact

Business Strategy

14

may lack the money and professional IT staffs to try a new technology, which could be a promising solution or facilitation to its business. With global resources of experienced IT professionals, IT outsourcer can provide a greater range and depth of trained personnel. With the access to a large variety of advanced software and hardware products, IT outsourcing vendors are exposed to the state-of-the-art technology (Grover, Myun & Teng 1994). Both advantages of the IT outsourcers offer outsourcing receivers the possibilities to apply the most advanced technologies at a relative low price.

For companies who prefer the wait-and-see policy to leading-edge technologies, IT outsourcing also takes away their worries (Gupta, Gupta 1992). It helps to minimize losses incurred if a certain technology fails to deliver on its investment. Companies can first try the services provided by the outsourcers to see if the technology can indeed enhance their core business and add profit before they decide to invest. In addition, IT outsourcing vendors also bear the burden of following the rapid technological changes, which sometimes puzzles the corporate executives (Gupta, Gupta 1992).

The development of more standard-based open IT environment makes technology more flexible and cheaper to access and manage, which to a great extent promotes the outsourcing industry and makes IT outsourcing more attractive to companies. Open source solutions are proven to be able to offer better performance, better security, more choice and more flexibility at a lower price. Because open source software is readily available from multiple vendors, customers (companies who intend to outsource) have a large degree of freedom in choosing their suppliers. Therefore, open source makes the prices of IT services and products highly competitive — to the great benefit of customers.

15

2.2

Why banks outsource IT?

Although cost saving is quoted by a lot of companies as the most important drive to outsource, strategic-related drives are most appealing to financial services companies. A survey conducted in November 2003 by Gartner shows that 21 of 39 Future Global 500 banks, brokerages and insurance companies chose focusing on core business as their top reason for outsourcing (Mearian 2003). In such an information intensive industry, IT is treated as a core competitive resource with potential use in the development of new products, markets and organizational capabilities (McLellan, Marcolin 1994). The increasing pressure for banks to deliver high quality services that can satisfy customers whenever, wherever and however they need requires banks to use a set of complex and diversified technology to run their business (O'Heney 1996). It is too difficult for banks to manage the complicated IT skills entirely in-house. IT outsourcing supports a firm's strategic initiatives by providing early and cost-effective access to emerging technologies that have the potential to change fundamentally the firm's business processes. More and more standardized open IT environments such as Linux increase the flexibility and the security of technology for financial firms. Merger and Acquisition are frequently used in the banking industry as a strategy to develop new business and cut costs. System incompatibility often makes the system integration process difficult and cause delays in operational consolidation. By outsourcing IT, banks use common outsourcing vendors and shared technology, which makes merge more easily and efficiently (McLellan, Marcolin 1994).

Being able to react quickly to the regulation requirement of risk management is another crucial reason for banks to outsource IT (Marlin 2003). Regulators are continuously increasing the standard of banking regulation, which brings high demand of detailed and timely financial data. For instance, the Basel II accord, by requiring banks to set aside a portion of their capital reserves to cover operational risk, has played a role in banks' outsourcing decisions. Basel II invites banks to seek outside expertise (Marlin 2003). Processing data in-house can consume a lot of resources and sometimes the quality of

16

the data still cannot meet the requirement of the regulation authorities. By outsourcing some of the data processing activities, banks can rely on the professional service from the experienced IT suppliers and respond more quickly and precisely to the new regulation requirement.

The need to achieve greater cost reductions also drives banks to outsource their IT. This is particularly true for banks whose financial software is mostly mainframe based, which costs somewhere between 10% and 15% of the price of the overall system (Gupta, Gupta 1992). Frequent updates and maintenance of specialized software are a major part of the services provided by the IS departments of many banks, which is not only costly but also time-consuming. Researchers have estimated that, in the financial industry, consolidation through outsourcing can reduce a bank's costs by 35% to 40% (Palvia 1995). Operational activities such as cheque processing can make up more than 30% of the banks expense base (McLellan, Marcolin 1994). IT outsourcing ensures that a bank receives higher quality and better on-time delivery at lower price. IT service giant companies such as IBM, EDC and Unisys can make a very good use of their resources; hence help the companies with IT outsourcing to realize both economics of scale and economics of scope. An innovative view in the banking industry is that computing power is a utility, much like electricity and water and banks are buying on volume (Marlin 2003). The underlying meaning is that a bank can buy computing power more cheaply than it can manufacture itself. Just as pointed by Michael Sztejnberg, the managing director of JPMorgan Chase & Co, "Although the bank has huge scale in itself, IBM's scale is an order of magnitude larger, which translates into economic benefits."

2.3

The Inherent Costs and Risks Related to IT Outsourcing

IT outsourcing is a two-edged sword. Besides the benefits that contract-granting companies can get from IT outsourcing, there are also some inherent costs and risks.

17

Firms mainly hesitate to outsource because they fear to lose direct control. Moreover, worries are related to the fact that confidential information is processed outside the firm as well as the risks and costs related to the migration process. Figure 5 demonstrates the four top reasons against IT outsourcing according to a survey conducted by Capgemini Ernst & Young in 2004. Scholars as well as practitioners have had extensive discussions over what negative effects could be brought by IT outsourcing to organizations. To conclude all the opinions presented by former research, the adverse impacts of IT outsourcing are divided into three categories: managerial-related, economic-related and security-related.

Figure 5 Reasons against IT Outsourcing

Managerial perspectives

When IT systems are outsourced, the outsourcers carry out part or all of the IT management. This means contract-granting companies have lost full control over both the quality of software and the timetable of a project (Grover, Myun & Teng 1994). According to agency theory, when an agent performs a task for a principal, the latter always faces the risk that the agent might not carry out the task as the interest of the

18

principal. In the case of IT outsourcing, each party in the relationship has their own profit motive and interest, their goals are not congruent. The principal cannot monitor the actions of the agent perfectly and without cost (Bahli, Rivard 2003).

Another risk that management may face is referred as the lock-in risk (Gorla, Mei 2010). A lock-in situation often results from specific investments that were made by the supplier when the contract was first signed. At contract renewal time, if no other supplier is ready to make specific investments, the client does not have other alternatives but continue its relationship with the current supplier. The supplier can then increase its fees, because of this lack of alternatives. The lock-in situation may also occur in an industry where there are only a small number of suppliers. Since companies who have outsourced their IT have invested a great deal of time and effort and do not retain in-house competencies any more, they will have a huge loss if the contract fails (Bahli, Rivard 2003).

Other frequently cited management-related risks include that IT outsourcing can cause the transfer of layoff of IT staff; the contract-granting part may lose the technical knowledge and capability; external service provider is less sensitive to the client’s culture and tradition (Parkhe 2007, Gonzalez, Gasco & Llopis 2006, Gillis 2002, Gonzalez, Gasco & Llopis 2010, Cheon, Grover & Teng 1995).

Economic perspectives

Despite for the economic benefits, IT outsourcing also adds additional costs. Transaction cost theory (TCT) is one of the most frequently referred theories that analyze the added costs of IT outsourcing. In IT outsourcing activities, transaction costs refer to the effort, time and costs incurred in creating, negotiating, monitoring and enforcing a service contract between buyers and IT outsourcers (Ang, Straub 1998). First of all, the time and effort putting in finding the most suitable and trustworthy outsourcer are the start of the added costs. With any outsourced service, the expense of selecting a service provider can cost from 0.2 percent to 2 percent in addition to the

19

annual cost of the deal (Overby 2003). When the outsourcer is selected, additional time is required to communicate and negotiate with the service provider. All kinds of formal and informal meetings, clause negotiation and contract verification make the added costs even higher. Since most of IT service companies are operating in different locations from the service receiver, the costs of coordination and monitoring also increase (Grover, Myun & Teng 1994). Some scholars also refer to the agency theory to explain the additional costs brought by IT outsourcing. The agent costs are the sum of the monitoring costs, the bonding costs and the residual loss of the principal (Cheon, Grover & Teng 1995).

Managing the actual offshore relationship is also a major additional cost (Overby 2003). There is a significant amount of work in invoicing, auditing, ensuring cost centers are charged correctly, and making sure time is properly recorded. Other hidden economic costs include exit or switch costs, license or patent charge from the IT provider and re-negotiation costs (Grover, Myun & Teng 1994, McLellan, Marcolin 1994, Bahli, Rivard 2005).

Security perspectives

IT outsourcing is inevitably more or less companied by data management outsourcing and data processing outsourcing. When some IT operations of an organization are contracted out, the external service provider may effectively become an ―insider‖, handling sensitive and important information for the organization. On one hand, the service receivers are facing the hazard of losing data due to the operation mistake of the vendors such as system crash or hardware break. On the other hand, the service receivers are also in danger of the disclosure of commercial secrets since the data is stored at the vendors’ place (Gritzalis et al. 2007).

Information security is extraordinarily crucial to banks. Preservation and protection of the security and confidentiality of customer information is a prerequisite for the stability and reputation of the bank. Risks such as service providers acquiring knowledge of the

20

banking system and misusing it for other benefits, are always there. Relying too much on the third party can lead to leakage of confidential information of clients. Such leakage can result in severe damage to the bank’s whole operation and management.

2.4

Review of the relevant empirical evidence

Empirical Research Concerning General Outsourcing

Jiang and Qureshi (2006) study the outsourcing research from 1990 to 2003. As discussed in their article, in the last decade, most academic studies have focused on understanding outsourcing decision determinants and outsourcing process control while the results of outsourcing have not yet been well confirmed by existing research (Jiang, Qureshi 2006). They also generalize that, when researchers measure the financial results of outsourcing, they rely only on managers’ estimates other than tangible metrics such as public available accounting data. Generally speaking, two assessing methodologies have been applied to measure the outcomes of outsourcing. One focuses on the assessment of how well the perceived objectives are satisfied after outsourcing. Survey, case study and interviews are the main methods used to gather data (Lacity, Hirschheim 1994, Weeks, Feeny 2008). The other methodology conducts performance based analysis using public available financial data such as stock price (Hayes, Hunton & Reck 2000, Oh, Gallivan & Kim 2006) and financial accounting data (Wang et al. 2008, Jiang, Qureshi 2006). However, most available studies concerning the results of outsourcing rely upon perceived metrics rather than direct measures, which are likely to be influenced by subjective perceptions (Jiang, Qureshi 2006). The interviewees usually only think about their own fields or departments instead of taking the whole picture of the firm into consideration. Studies that based on objective financial data are very limited. The study of Jiang and Qureshi (2006) reveal that only four out of 168 articles used the hard evidence –public available data rather than self-reported data to analyze

21

the results of outsourcing. Table 1 presents a short summary of the four articles mentioned in the study of Jiang and Qureshi (2006).

Table 1 a Short Summary of the 4 Articles Mentioned in the Study of Jiang and Qureshi (2006)

Article Authors Year Data Source Sample Empirical Findings

Innovation management as a post-modern phenomenon: the outsourcing of pharmaceutical R&D Jones 2000 government statistics more than 500 UK-based

companies and the top 300 international R&D spenders published by the UK R&D Scoreboard There is to be a substantial reduction in the number of scientists directly employed by leading firms; Managers in major drug companies have generally not invested directly in biotechnology, preferring instead to buy-in knowledge from smaller firms.

The impact of outsourcing on the transaction costs and boundaries of manufacturing McCarthy and Anagnostou 2004 government statistics UK’s outsourcing in manufacturing during 1979– 1998 (obtained from the UK Office of National Statistics (ONS))

Outsourcing has altered the configuration and boundary of manufacturing

organizations in terms of value added; true manufacturing output is underestimated. The efficiency of accounting service provision Barrar et al. 2002 Public available accounting data 786 UK-based, public and private sector

organizations

Outsourcing provision is likely to offer worthwhile savings to small firms, allowing them to shed competitive weaknesses and operate at efficient or best practice levels. SMEs have the potential to transform a previously unmanageable activity into an efficient or best practice activity that can grow or contract with the business.

Information systems outsourcing

announcements: investigating the impact on the market value of contract-granting firms Hays et al. 2000 Public available accounting data 76 companies with IS outsourcing announcement from 1990 to 1997 The announcement of IS outsourcing has positive impact on market value of smaller firms compared with larger firms and service firms compared with non-service firms

22

To address the research gap, Jiang et al. (2006) later conduct an empirical study to provide a more objective evaluation of outsourcing impact using public available accounting data. They study 51 publicly traded firms that outsourced parts of their operations between 1990 and 2002 and find out that firms with outsourcing announcement have significantly higher SG&A/Sales ratio (selling, general and administrative expenses/ total sales), exp/sales ratio (operating expense/ total sales) and PPE (property, plant and equipment ) turnover (sales/fixed asset). However, no significant difference was found in assets turnover (sales/assets), ROA and net profit margin. They conclude that outsourcing can improve a firm’s cost-efficiency but not its productivity and profitability. This research is regarded as the first one that empirically tests the relation between the outsourcing decision and the firm’s financial performance (Jiang, Frazier & Prater 2006).

Empirical Research Focusing on IT Outsourcing

Gonzalez et al (2006) conduct a literature review focused on IT outsourcing articles published in journals that enjoy high prestige in the IS area between 1988 and 2005. Their research find that the studies of outsourcing determinants and reasons why firms choose to outsource are the most frequently studied topics in the IS field (Gonzalez, Gasco & Llopis 2006). Surprisingly, the studies concerning the outcomes of IT outsourcing are not very well developed.

The study of Wang et al. (2008) develops a conceptual framework to examine the impact of IT outsourcing on firm performance. They study a sample of 120 companies with IT outsourcing announcement from 1993 to 2003. Their research suggest that IT outsourcing firms have significantly higher SGAS (selling, general and advertising expenses / net sales) and significant lower ROA compared with the non-outsourcing counterparts in year t+1 (one year after IT outsourcing) but there is no significant difference in ROA, ROE, ROI and other measures in the rest of the years (Wang et al. 2008). Table 2 generalizes the main results of the empirical studies of Jiang et al. (2006)

23

and Wang et al. (2008). Symbol ―+‖ means significantly positive effect, symbol ―-‖ means significantly negative effect and symbol ―N‖ means no significant difference.

Table 2 Main Empirical Results of Former Outsourcing Studies

Author Year Performance Measures Empirical

Finding

Jiang et al. 2006

SG&A/sales +

Op exp/sales +

assets turnover(sales/assets) N

PPE turnover(= sales/PPE) +

employee productivity (= sales/number of employees) N

ROA N

net profit margin N

Wang et al. 2008

ROA -

ROE N

ROI N

SALES (net sales /)total assets N SALEEMP (net sales /number of employees) N SGAS(selling, general and advertising expenses / net sales) - DEPS(depreciation expenses/net sales) N OPIBDS(operating income before depreciation net sales) N

* Symbol ―+‖ means significantly positive effect, symbol ―-‖ means significantly negative effect and symbol ―N‖ means no significant difference.

In conclusion, previous research shows very little significant difference in firm performance measures of ROA, ROE, ROI and net profit margin between IT outsourcing firms and the non-outsourcing counterparts. The only significantly positive effects lie in the cost efficiency metrics such as the ratio of SG&A to sales and Operating Expense to sales.

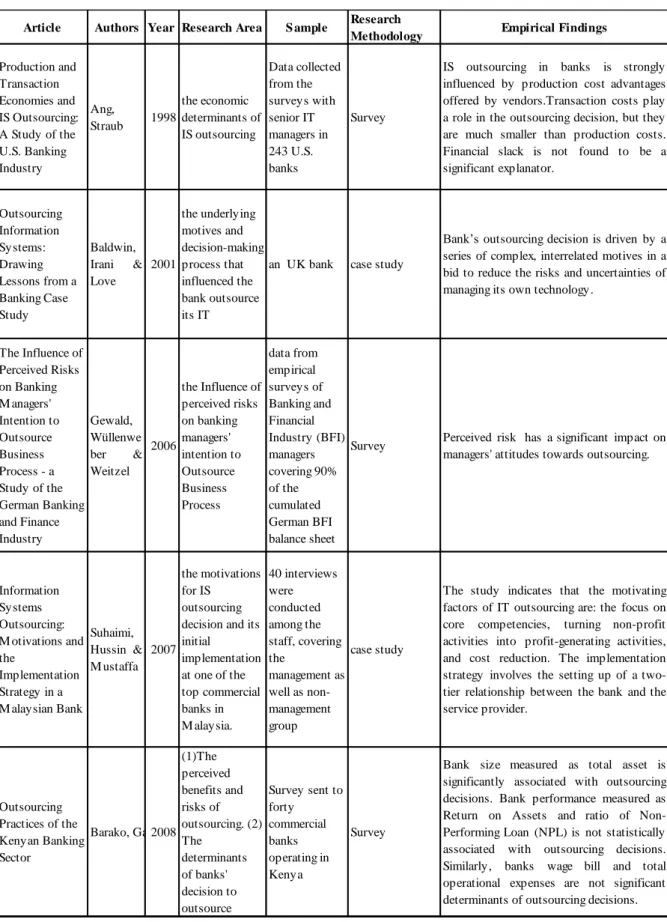

24 Empirical Research Focusing on IT Outsourcing in the Banking Industry

Similar studies focusing exclusively on the IT outsourcing impact in the banking industry are even fewer. Articles were searched from 1990 to 2010 in ELIN, a journal portal of Aarhus School of Business, Aarhus University, which has access to the most popular literature search engines such as Business Source Premier, ProQuest, ScienceDirect, etc. A combination of words ―IT‖, ―outsourcing‖ and ―bank‖ or ―Information System‖, ―outsourcing‖ and ―bank‖, or ―IT‖, ―outsource‖ and ―bank‖ or ―Information System‖, ―outsource‖ and ―bank‖ were applied to search for the related subjects. The search yields 280 results. Among these results, only five articles study the IT outsourcing practice in the banking industry using empirical study method. Table 3 summarizes these five articles (Ang, Straub 1998, Baldwin, Irani & Love 2001, Gewald, Wüllenweber & Weitzel 2006, Suhaimi, Hussin & Mustaffa 2007, Barako, Gatere 2008).

As shown in Table 3, the existing empirical studies concerning IT outsourcing in the banking industry focus mainly on the determinants (drives) and the risks of IT outsourcing. The research methodologies are either case study or survey. None of these studies examines the IT outsourcing impact on firm level performance. In addition, the data used in the five studies are all subjective data gathered from surveys or interviews. None of them applied public available accounting data into their research. Therefore, this paper will be the first that studies the IT outsourcing impact on firm performance in the banking industry using audited and public available accounting data.

25 Table 3 Empirical Studies Related to IT Outsourcing in the Banking Industry

From 1990 to 2010 Article Authors Year Research Area S ample Research

Methodology Empirical Findings Production and Transaction Economies and IS Outsourcing: A Study of the U.S. Banking Industry Ang, Straub 1998 the economic determinants of IS outsourcing Data collected from the surveys with senior IT managers in 243 U.S. banks Survey

IS outsourcing in banks is strongly influenced by production cost advantages offered by vendors.Transaction costs play a role in the outsourcing decision, but they are much smaller than production costs. Financial slack is not found to be a significant explanator. Outsourcing Information Systems: Drawing Lessons from a Banking Case Study Baldwin, Irani & Love 2001 the underlying motives and decision-making process that influenced the bank outsource its IT

an UK bank case study

Bank’s outsourcing decision is driven by a series of complex, interrelated motives in a bid to reduce the risks and uncertainties of managing its own technology.

The Influence of Perceived Risks on Banking M anagers' Intention to Outsource Business Process - a Study of the German Banking and Finance Industry Gewald, Wüllenwe ber & Weitzel 2006 the Influence of perceived risks on banking managers' intention to Outsource Business Process data from empirical surveys of Banking and Financial Industry (BFI) managers covering 90% of the cumulated German BFI balance sheet

Survey Perceived risk has a significant impact on

managers' attitudes towards outsourcing.

Information Systems Outsourcing: M otivations and the Implementation Strategy in a M alaysian Bank Suhaimi, Hussin & M ustaffa 2007 the motivations for IS outsourcing decision and its initial implementation at one of the top commercial banks in M alaysia. 40 interviews were conducted among the staff, covering the management as well as non-management group case study

The study indicates that the motivating factors of IT outsourcing are: the focus on core competencies, turning non-profit activities into profit-generating activities, and cost reduction. The implementation strategy involves the setting up of a two-tier relationship between the bank and the service provider. Outsourcing Practices of the Kenyan Banking Sector Barako, Gatere 2008 (1)The perceived benefits and risks of outsourcing. (2) The determinants of banks' decision to outsource Survey sent to forty commercial banks operating in Kenya Survey

Bank size measured as total asset is significantly associated with outsourcing decisions. Bank performance measured as Return on Assets and ratio of Non-Performing Loan (NPL) is not statistically associated with outsourcing decisions. Similarly, banks wage bill and total operational expenses are not significant determinants of outsourcing decisions.

26

3.

Research Framework and Hypotheses

3.1

How to Measure Firm Performance

Before the general research framework is introduced, one question has to be answered: how should firm performance be measured? Since performance measurement system plays a key role in developing strategic plans, evaluating the achievement of organizational objectives and compensating managers, scholars as well as practitioners have paid considerable interest in performance measurement. One of the most frequently used classifications divides firm performance measures into two broad categories: financial and non-financial (Benson, Buckley & Hall 1988).

Financial performance measures are based on the available accounting information; data are derived from balance sheet and income statement. The financial performance measures usually use tangible financial indicators such as profit, sale and cash, which is a traditional way of measuring firm performance. There are several advantages of using accounting-based corporate performance measurement. First, the data are audited and public available, which verifies data reliability and qualification. Second, the methods used to create accounting information are well-defined, widely understood and generally accepted (Reilly, Campbell 1990). Third, the measurement results are intuitive and easy to compare. Research shows that there is a clear relationship between firm performance and financial results of company (Kristensen, Westlund 2004). Therefore, performance measurement system based on financial accounting measures is a good way of measuring firm performance.

Since the early 1990s, the non-financial measures are receiving more and more attention. Academics suggest that traditional performance measurement systems do not provide a full understanding of the influences on firm performance. Nowadays the increasing dynamic and competitive business environment demands across-the-board measurement

27

systems which provide the company with a complete ―map‖ of different aspects influencing the results of companies.

3.2

Performance Measurement in the IS Field

Dehning and Richardson (2002) review the archival studies that use accounting or market measures of firm performance to assess the relationship between information technology investments and firm performance. Although their paper does not focus exclusively on the field of IT outsourcing (which is of course part of IT investment), their research framework is referred by a lot of IS research including the research related to IT outsourcing. The research framework of Dehning and Richardson (2002) can be formulized into the following formula:

(

)

Performance

f IT

The above formula shows that there is a certain functional relationship between IT and firm performance. IT has a direct or indirect effect on business processes, which together determine the overall performance of the firm.

Research that concentrates on the relation between IT and firm performance can be generalized into three categories. The first category focuses on a direct link between IT and overall firm performance. Researchers in this group usually measure firm performance using market measures or accounting measures. Market performance measures include event studies (short-window abnormal stock returns), market valuation of common equity and Tobin's q. Accounting performance measures include ratios such as return on assets (ROA), return on equity (ROE), return on investment (ROI) and gross profit margin (GMP). The second category describes the relation between IT and business process performance. Business process performance measures include inventory turnover, customer service, quality, efficiency, turnover ratios, etc.

28

The third category studies how the combination of these performance measures determines the overall firm performance interactively.

The research of Dehning and Richardson (2002) developed the fourth method of assessing the link between IT and performance, which is named as Contextual Factors in their framework. The Contextual Factors refer to related firm or industry attributes that can influence firm performance such as firm size, industry index, financial health of the firm, growth options and IT intensity. Below the research framework figure from the paper of Dehning and Richardson (2002) is quoted to summarize the research frameworks that were used by former researchers.

Figure 6 Research Framework of Evaluating the IT Effects (Dehning, Richardson 2002)

*The the circles with number inside in figure 6 indicate the different paths that IT could influence performance

29

3.3

Hypotheses

As discussed in section 3.2, there are up to date four types of methodology that focus on different aspects of IT effects to business. Our research chooses to focus on the direct relationship between IT and overall firm performance. Accounting ratios are used as the measurements of firm performance. In the context of measuring IT impact on firm value, firm-level financial ratios such as return on assets (ROA), return on investment (ROI) and return on equity (ROE) have been extensively used by prior studies (Wang et al. 2008, Ang, Straub 1998, Nicolaou 2004, Jiang, Frazier & Prater 2006, Hayes, Hunton & Reck 2000, Karr 2005). Banks have some of the same performance measures as traditional firms such as ROA, ROI and ROE, but the industry specific factors also lead them to other unique measurements. One industry specific measure is net interest margin. Net interest margin is a percentage difference between interest income produced by a bank's earning assets (loans and investments) and its major expense-interest paid to its depositors. The net difference between interest earned and interest paid is a key measure of banks’ profitability. Net interest margin measures the difference between the yield on earning assets and the rate paid of funds (Juras, Hinson 2008). The measure is similar to the gross profit margin percentage used in other industries.

To sum up, this paper develops an industry-specific performance measurement system that is especially for evaluating the performance of banks. The performance measures included in the measurement system are: return on assets (ROA), return on equity (ROE), return on investment (ROI) and net interest margin (NIM). The detailed explanation of each measure is discussed in the following section. The definitions of the measures are abstracted from the Compustat database (Standard & Poor's 2009).

Return on Assets (ROA)

ROA is calculated as income before extraordinary Items, divided by total assets, multiplied by 100. Generally speaking, ROA represents a total picture of the

30

profitability of a firm. ROA gives a quick indication of whether the business is earning profit on each dollar invested. A rising ROA across periods is generally favorable. ROA for different industries can vary substantially. Compared with other industries, the banking industry has relatively lower ROA, which ranges from 0.60% to 1.50% (Standard & Poor's 2009).

As companies outsource part or all of its IT services to more experienced IT vendors, they can focus more on their core business, which can generate more profit. At the same time, IT outsourcing enables the outsourcing receiver to realize economies of scale and scope, which will help to cut operational costs. Therefore, it is rational to hypothesize that banks with IT outsourcing activities have higher profitability compared with their non-outsourcing counterparts, which should be shown on the numerical value of ROA.

H1: IT outsourcing banks will have higher ROA than their non-outsourcing counterparts will.

Return on Equity (ROE)

ROE is calculated as income before extraordinary items, divided by common equity, multiplied by 100. ROE represents the earnings that return for each dollar of average shareholder equity in the company. Equity normally constitutes only a small portion of banking assets, so ROE is usually much higher than ROA, ranging from 10% to 25% (Standard & Poor's 2009). ROE is the ultimate measure of success in meeting shareholder requirements. This shareholder value-oriented measure provides a summary level picture of if a bank is contributing to or detracting from shareholder value (Karr 2005).

One of the advantages of IT outsourcing is that it brings the cutting-edge technology to outsourcing receiver at a relatively low price. In such an information-intense industry as the banking industry, emerging technology is usually accompanied with business process change, which will lead to value creation. In addition, other benefits brought by

31

IT outsourcing such us cost deduction and risk control can also contribute to shareholder value. All in all, it can be assumed that banks with IT outsourcing activities contribute more to shareholder value compared with their non-outsourcing counterparts.

H2: IT outsourcing banks will have higher ROE than their non-outsourcing counterparts will.

Return on Investment (ROI)

ROI is calculated as income before extraordinary items, divided by total invested capital, multiplied by 100. Total invested capital is the sum of total long-term debt, preferred stock, minority interest and total common equity. ROI measures how effectively a firm uses its capital to generate profit.

It is undeniable that IT outsourcing is an investment activity. ROI measures the monetary benefit of the investment. According to all the strategic-related, economic-related and technology-related advantages that discussed in the ―literature review‖ part, the assumption that IT outsourcing banks will have higher ROI compared with their counterparts comes naturally.

H3: IT outsourcing banks will have higher ROI than their non-outsourcing counterparts will.

Net Interest Margin (NIM)

Net Interest Margin (NIM) is calculated as the tax-equivalent net interest income divided by average earning assets for a period. This yields the net percentage (after interest expense) that a bank is earning on its assets. The measure is similar to the gross profit margin percentage in other industries. With many businesses, gross margin is a function of the organization’s sales mix. With banks, loan and deposit rates vary by categories and overall loan and deposit rates may vary based on a product mix. As a broad guideline for commercial banks, a NIM of less than 3% is generally considered

32

low, while a NIM greater than 5% is regarded high (Standard & Poor's 2009). NIM is affected by the business mix and the size of the bank. Small retail banks, credit card banks and consumer lenders tend to have a higher NIM than larger wholesale banks, international banks and thrifts. At the end of 2008, the FDIC (Federal Deposit Insurance Corporation) reported the annual average NIM for commercial banks at 3.23% and for savings banks (thrifts) at 2.77% (Standard & Poor's 2009).

Interest margins are key factors to the profitability of banks and are some of the most scrutinized figures in the banking industry. The interest margins are considered through two main measures: Net Interest Margin (NIM) and Net Interest Spread (NIS). They are similar numbers that both reflect the difference between asset yield and cost of funds. In this paper only NIM was taken into consideration. A higher NIM indicates higher profitability. If IT outsourcing can add value to banks, it will improve its NIM as well. In other words, banks that pursue IT outsourcing should have higher NIM compared with the matched banks without IT outsourcing.

H4: IT outsourcing banks will have higher NIM than their non-outsourcing counterparts will.

4.

Research Methodology

4.1

Data Collection

Since commercial banks and saving institutions are the two most common types in the banking industry, the paper only focuses on the commercial and saving banks in America. Savings institutions, also called thrift institutions, are banks that serve a local community. They take the deposits of local residents and lend the money back in the form of consumer loans, mortgages and small business loans (Heffernan 2005). Savings institutions include savings and loan institutions, savings banks and credit unions.

33

Commercial banks provide the widest variety of wholesale and retail banking services such as trust services, trade financing, savings accounts, checking services, consumer loans, commercial and industrial (C&I) loans, and credit cards (Heffernan 2005). According to the classification principle of Standard Industrial Classification (abbreviated as SIC), banks with SIC code of 6020 (Commercial Banks) and 6035 (Savings Institutions, Federally Chartered) were first selected from Compustat database. As IT outsourcing activities became prevalent after the famous outsourcing deal between Kodak and IBM in 1989, the start date of data collection was set up as 1 January, 1990. Firm performance two years after IT outsourcing announcement was examined. Considering the financial crisis started in 2007, in order to eliminate the influences other than IT outsourcing as much as possible, the end date of data collection was set as 31 December, 2006. Thus the latest date of two years after IT outsourcing announcement is 31 December, 2008. The Searching yielded 1124 banks with SIC code of 6020 and 545 banks with SIC code of 6035. Among these banks, some were missing the necessary accounting data such as total assets and the capital of common stock. After getting rid of the banks with missing data, it yielded 1113 banks with SIC code of 6020 and 264 banks with SIC code of 6035, the total number is 1377.

For all the 1377 banks, each bank was checked for the IT outsourcing announcement from 1 January, 1990 to 31 December, 2006. IT outsourcing initiatives were identified by examining firms’ public announcement of an IT outsourcing contract or agreement from the LexisNexis academic database. A key word search method is employed. Each bank’s name combined with the terms ―IT outsourcing‖ or ―IT outsource‖ or ―Information System outsourcing‖ or ―Information System outsource‖ were checked for related news. After the checking, banks without IT outsourcing announcement were exempted from the list. As IT outsourcing might influence firm performance in the coming years, for the banks with more than one IT outsourcing announcements, only the latest traceable announcement was recorded. By doing so, firm performance can be isolated from the impact of the IT outsourcing activities that happened before the latest one. The search yielded a sample of 81 banks, among which 62 were with SIC code

34

6020 and 19 were with SIC code 6035. Each of the 81 banks was then checked for the availability of financial data (ROA, ROE, ROI, NIM, TA and MB) in Compustat database using their GVKEY. GVKEY is a unique permanent number assigned by Compustat, which can be used to identify a Compustat record in different updates if name or other identifying information changes. The Bank and Thrift dataset in Compustat database provides a special tool to check the ratio report of financial service companies and institutions. All the financial ratios in this paper were derived directly from Compustat. The data checking in Compustat filtered another 24 banks, which were lack of one or more financial data in the consecutive years. The final dataset contains 57 banks. 52 of them are with SIC code 6020 and 5 of them are with SIC code 6035. Table 4 summarizes the whole sample collection process. Table 5 demonstrates the sample distribution by year.

Table 4 Sample selection procedure

SIC Code 6020 6035

Initial sample 1124 545

Less: banks lack accounting

data -11 -281

1113 264

Less: banks without IT

outsourcing announcement -1051 -245

62 19

Less: banks lack of financial

data in Compustat -10 -14

Final Sample 52 5

35 Table 5 Sample Distribution by Year

Year of Outsourcing Number percentage

1994 3 5.26% 1996 2 3.51% 1997 4 7.02% 1998 5 8.77% 1999 3 5.26% 2000 1 1.75% 2001 2 3.51% 2002 7 12.28% 2003 7 12.28% 2004 13 22.81% 2005 7 12.28% 2006 3 5.26% 57 100.00%

4.2

Matched-pair Analysis

In order to evaluate whether a firm performs unusually better or worse after a certain event, the expected performance in the absence of the event must be specified. In other words, a benchmark should be provided, which sample firms can be compared with. Matched-pair analysis is a frequently used method for setting up a benchmark. To provide a benchmark for the performance of the sample banks and to control for potential industry- and economy-wide influences, a matched control group should be set up. It is reasonable to assume that firms in the same industry and of similar size are subject to similar economic and competitive factors. The research of Barber and Lyon (1996) provides a guidance of creating a control group. After evaluated the methods used in event studies that employ accounting-based measures of operating performance, they summarize that the best matching procedure in event studies is matching by

36

industry, firm size and pre-event performance (Barber, Lyon 1996). This matching procedure would yield better-specified tests than matching only on industry or industry and firm size.

First of all, industry-matching assumes that some of the cross-sectional variation in operating performance can be explained by an industry benchmark. For instance, if a certain industry has experienced unusual growth in ROA during the sample period, it might be reasonable to expect that the sample firms in the same industry to experience a similar growth in ROA as well. Barber and Lyon (2006) introduced two methods of industry-matching: two-digit SIC code matching and four-digit SIC code matching. As already mentioned before, this paper studies commercial banks with SIC code of 6020 and savings institutions with SIC code of 6035. Thus the four-digit SIC code industry-matching requirement is met. A sample bank with a SIC code of 6020 is only matched with a control bank that also has a SIC code of 6020. The same goes for banks with a SIC code of 6035.

The second matching condition is size-matching. Size-matching indicates that each company in the control group should be of similar size as its counterpart in the sample group. This implicitly assumes that operating performance varies by firm size. In the research of Barber and Lyon (1996), firm size is measured as the book value of assets. The Contextual Factors framework of Dehning and Richardson (2002) that mentioned before also pointed out that related firm or industry attributes such as firm size can influence firm performance. Book value is an accurate measure of valuation for non-fast-growing companies. However, considering the special characters in the banking industry such as quick growth and high frequency of merger and acquisition, book value may not be the best measurement for firm size. For this reason, total assets (TA) are used as the firm size measurement. Firms with similar total assets in the year before the IT outsourcing announcement are paired. To do this, banks with the same SIC code were first sorted according to its TA and then the bank with the TA that is closest to the bank with IT outsourcing announcement was chosen. The next step was to