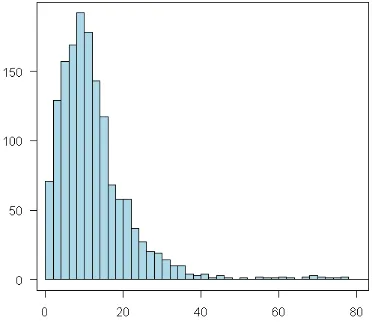

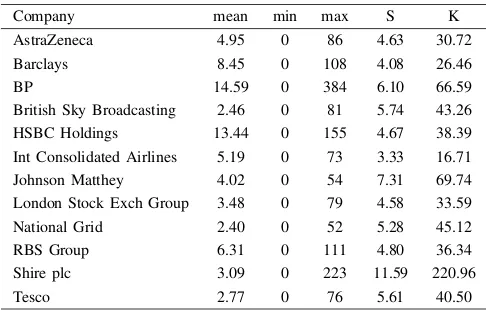

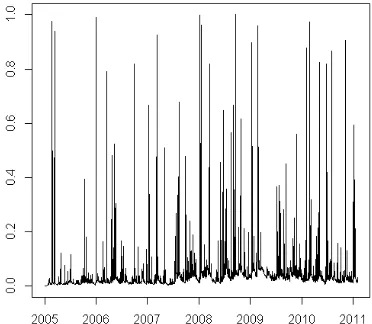

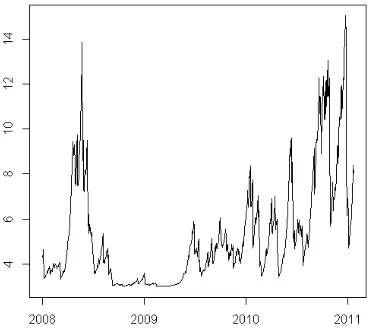

Stock Volatility Modelling with Augmented GARCH Model with Jumps

Full text

Figure

Related documents

If Posthorn Corporation accounts for its investment in Stamp Company at fair value through other comprehensive income, what entry will the company make to record the revaluation of

Recently, a research company (RavenPack International, S.L.) has developed means for quantifying news stories; and our goal was to search for a model based on news sentiment

The integration features the creation of a sophisticated damage indicator: mode shape’ continuous wavelet transform-singular value decomposition component (MWSC).The

Then, I use the calibrated model to study the e ff ects of competition on domestic welfare and on the optimal domestic R&D subsidy, assuming that the foreign government is not

Dapat disimpulkan maka terbukti bahwa variabel penerapan model pembelajaran kooperatif tipe STAD mempunyai korelasi yang positif dan signifikan terhadap hasil

Key words: food industry, enterprises, Russian and foreign ownership, revenue, assets, dynamics, variance analysis Сравнительный анализ показателей

In tort actions, a judgment for prejudgment interest awarded pursuant to this subsection should bear interest at a per annum interest rate equal to the intended Federal Funds Rate,