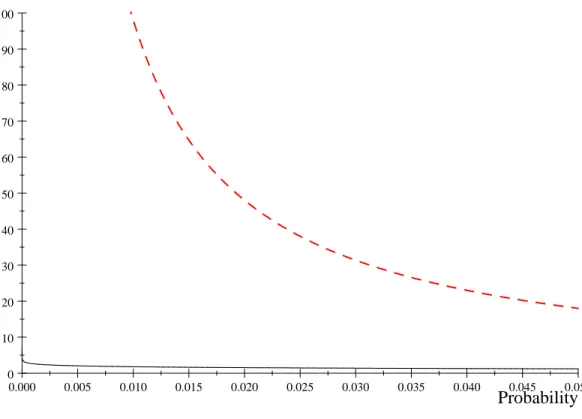

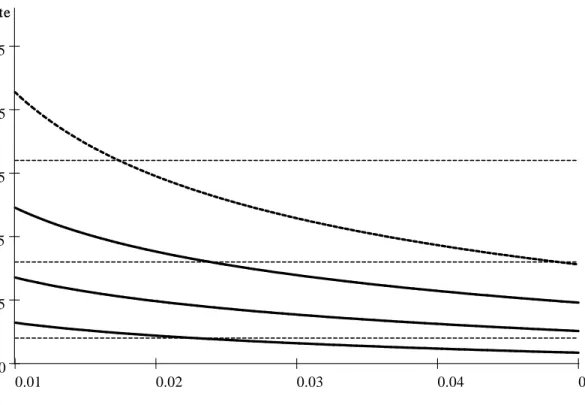

Why Do People Pay Taxes? Prospect Theory Versus Expected Utility Theory

Full text

Figure

Related documents

HELLP , hemolysis, elevated liver enzymes and low platelets; HUS , hemolytic uremic syndrome; NR , not reported; TTP , thrombotic thrombocytopenic purpura. a Present in case of

Based on a complaint investigation survey, completed September 20, 2012, and a follow-up survey completed November 14, 2012, the Centers for Medicare and Medicaid Services (CMS)

imagination but online and at scale – and illegal lenders will look just like licensed lenders Once illegal lending market becomes established, it is very difficult to tackle.

Our main interest is on extreme value theory based modes: we consider the unconditional GPD, the GARCH models, the conditional GPD, the historical simulation, filtered historical

Behaviorists also view the therapeutic relationship as nonspecific, and the techniques of behavior therapy as specific. 9) for example, claims that his method of reciprocal

This also provides support for the ability of international development organisations such as the World Bank to influence financial reporting regulation beyond the adoption of IFRS

For powerful use of metrics to exist, a fundamental belief in the value of hard measures in relation to people matters is as essential as the core skills and the systems

Key Words: Economic Development of India, Micro, Small and Medium Enterprises, Funding needs of MSMEs, Future of MSMEs, Unorganized