The CARICOM

Regional Transformation Programme

for Agriculture

The Small Ruminant Meat Industry in CARICOM

Competitiveness & Industry

Development Strategies

Core Team of Consultants Singh, R.H. (Ph.D) Seepersad, G. (Ph.D) Rankine, L.B. (Ph.D)

December 2006

Department of Agricultural Economics and Extension

University of the West Indies, St. Augustine

ACKNOWLEDGEMENTS

The core team takes the opportunity to express its appreciation to all those who provided

logistical and technical support for the completion of this exercise. We firstly like to

thank the RTP Coordinator / Agricultural Advisor, Mr. Sam Lawrence as well as the

country officers for their logistical and other support in the completion of this exercise.

Field visits allowed us to verify and update the information base on small ruminants.

Small ruminant investors particularly in the case of Jamaica, Trinidad and Tobago and

Guyana provided valuable information in shaping the review of the Regional Sheep and

Goat industry. The database on small ruminants worldwide, as well as in the Caribbean,

contains significant gaps and took considerable time in their verification and validation.

Our discussion with officials in the Ministries of Agriculture in the Region proved

helpful in reconciling some of the deficiencies we encountered in the review. Technical

support was provided through the assistance of Brent Theophille, Rebecca Gookool, Jai

Rampersad and David Hanson, to which the Core Team also expresses support. To Ms.

Martha Jiminez-Spence and Ms. Indira Buchoon-Ousman, we express our sincere thanks

for their logistical organizational and communication support.

Although we tried to ensure accuracy of the database used for the review, nonetheless we

accept responsibility for any errors that may be discovered. This may be the result of the

multiple databases from which we had to access the data. The small ruminants sector in

the Caribbean is just emerging unlike countries such as Australia and systems of data

recording for this commodity have not yet entered the mainstream databases. This gap we

recommend should be addressed with urgency.

DEDICATION

We dedicate this work to the Memory of our Colleague and member of the study team, Dr

Lloyd B. Rankine. Dr Rankine passed away on October 25, 2006. He was a colleague

with whom we shared many long hours in dialogue, in the field and in the class room. His

life long endeavours and dedication reflect his passion for agriculture in the Caribbean.

Dr. Rankine was an integral part of the University of the West Indies having served the

University (both Mona and St. Augustine campuses) from 2

ndDecember 1968 to June 3,

2006 when he suffered a debilitating stroke. He served as Head of the Department of

Agricultural Economics and Extension from 1977 to 1990 and taught in the capacity of

Senior Lecturer up until 2003, when he retired. From 2003 to June 3, 2006, he lectured

part-time in the Department

Dr. Rankine also served as Director and Chairman on many Boards in Trinidad and

Tobago.

.

TABLE OF CONTENTS

LIST OF TABLES... VI LIST OF FIGURES... VII GLOSSARY OF TERMS ... IX GLOSSARY OF GOAT AND SHEEP: BREEDS AND BODY CONFORMATION ... X RECOMMENDATIONS FOR SMALL RUMINANTS INDUSTRY DEVELOPMENT... XIII

1 PROJECTPROFILE:DEVELOPMENTOFTHENUCLEUSHERD...XIII

1.1 Herd Build Up... xiii

1.2 Capital Investment ...xiv

13 Annual Farm Recurrent Cost ...xiv

1.4 Revenue...xvi

1.5 Cash Flow and Profitability...xvii

1.6 Financing ...xvii 1.7 Strategic Partnerships...xviii SECTION 1 ... 1 INTRODUCTION ... 1 1.0INTRODUCTION ... 1 SECTION 2 ... 2

MARKET ASSESSMENT: KEY ISSUES, OPPORTUNITIES AND COMPETITION... 2

2.0INTRODUCTION ... 2

2.1THECARICOMMARKETFORSMALLRUMINANTMEATS... 2

2.2THEGLOBALMARKETFORSMALLRUMINANTMEATS ... 6

2.3KEYCOMPETITIVENESSISSUES ... 7

2.4TRADEREGULATIONS ... 8

SECTION 3 ... 11

PROFILE OF THE SMALL RUMINANT INDUSTRY IN SELECTED CARICOM COUNTRIES 11 3.1INTRODUCTION ... 11

3.2JAMAICA... 11

3.3BELIZE... 15

3.4BARBADOS... 18

3.5TRINIDADANDTOBAGO ... 19

3.6ST.LUCIA... 25

3.7ST.VINCENT ... 29

3.8GUYANA ... 31

COSTS IN THE CARICOM SMALL RUMINANT INDUSTRY ... 33

4.1INTRODUCTION ... 33

4.1SHEEPPRODUCTION... 34

4.1.1 Cost of Production of Live Animals: All Models & Breeds... 35

4.1.2 Cost of Production of Meat ... 36

4.1.3 Cost of Production Differentiated by Technology... 37

4.1.4 Cost of Production Differentiated by Breeds & Breed / Technology ... 37

4.2GOATPRODUCTION ... 39

4.2.1 Cost of Production: Fattening Operations for Goats ... 40

4.2.2 Cost of Production: Goat Meat... 41

4.2.3 Cost of Production: Differentiated by Production Technology ... 42

4.3SUMMARY... 43

SECTION 5 ... 44

TRADE COMPETITIVENESS: CARICOM SMALL RUMINANT PRODUCTION... 44

5.1INTRODUCTION ... 44

5.2METHODOLOGYFORMEASURINGCOMPETITIVENESS... 45

5.2.1 Defining Market Competitiveness ... 45

5.2.2.1COST OF LOCALLY PRODUCED MEAT CARCASSES: ... 47

5.2.2.2ENTREPRENEURIAL MARGINS FOR LOCAL PRODUCTION: ... 48

5.2.2.3 CALCULATING COST OF IMPORTED MEATS: ... 49

5.3PRICECOMPETITIVENESS ... 51

5.3.1 Overview of Small Ruminants Competitiveness in the Various CARICOM Countries: Comparison among Countries ... 51

5.3.1.1 Sheep... 52

5.3.1.2 Goat... 54

5.3.2 The Influence of Technology and Breeds on Competitiveness ... 56

5.4COMPETITIVENESSBASEDONQUALITYFACTORS... 58

5.5SUMMARY... 60

SECTION 6 ... 61

PROFITABILITY OF SMALL RUMINANT FARMING... 61

6.1INTRODCTION ... 61

6.1RETURNSONINVESTMENTINPRODUCTION ... 61

6.1.1 Sheep Fattening Enterprise... 61

6.1.2 Goat Fattening Enterprise ... 63

6.2GROSSENTERPRISEINCOME:SHEEP&GOATENTERPRISES ... 64

6.3CONCLUSION... 67

SECTION 7 ... 70

INDUSTRY PERFORMANCE: THE CARICOM SMALL RUMINANT INDUSTRY ... 70

7.1INTRODUCTION ... 70

7.2SHEEPPERFORMANCE ... 70

7.2.1 Average Daily Gain ... 70

7.2.2 Average Number of Lambs per Lambing - Sheep... 72

7.2.3 Post Weaning Mortality – Sheep... 73

7.2.4 Other Key Industry Parameters – Sheep... 73

7.3GOATPERFORMANCE ... 74

7.3.1 Average Daily Gain - Goat ... 74

7.3.2 Mortality – Goat ... 75

7.3.3 Other Industry Key Parameters – Goat ... 75

7.4SUMMARY... 76

SECTION 8 ... 77

INDUSTRY DEVELOPMENT STRATEGY: THE WAY FORWARD... 77

8.0INTRODUCTION ... 77

8.1OPPORTUNITIES... 77

8.2THESTRENGTHS/ADVANTAGESOFDEVELOPINGTHESMALLRUMINANTINDUSTRY ... 79

8.3CONSTRAINTS/CHALLENGESTOTHEDEVELOPMENTOFASMALLRUMINANT INDUSTRY ... 79

8.4INDUSTRYDEVELOPMENT:CHALLENGESANDBINDINGCONSTRAINTS ... 80

8.5THEWAYFORWARD:ASTRATEGYFORTHEINDUSTRIALIZATIONOFSMALL RUMINANTPRODUCTION ... 81

8.6PROPOSEDTECHNICALSUPPORTMODELATTHEFARMLEVEL... 88

8.7PROJECTPROFILE:DEVELOPMENTOFTHENUCLEUSHERD ... 89

8.7.1 Herd Build Up... 89

8.7.2 Capital Investment ... 90

8.7.3 Annual Farm Recurrent Cost ... 91

8.7.4 Revenue ... 92

8.7.5 Cash Flow and Profitability... 93

8.7.6 Financing ... 93

8.7.7 Strategic Partnerships... 94

REFERENCES ... 95

REFERENCES ... 95

- vi -

LIST OF TABLES

Item Page No.

Table 2.1 CARICOM Consumption of Goat and Sheep Meat (2003 & 2004) 3

Table 2.2: Per Capita Consumption of Sheep & Goat Meat : CARICOM countries- 2004

4

Table 2.3: Summary of Imports of Sheep and Goat Meats into Various CARICOM Countries in 2004

5

Table 4.1: Sheep Production Cost: Live weight Cost for Various Production Technologies (inc. 20% farmer’s margin)

34

Table 4.2 Summary: Sheep Cost of production in Various CARICOM Countries (USD)

37

Table 4.3: Goat Production Cost: Cost Differentiated by Production Technology (USD/kg live wt inc.20% profit)

39

Table 4.4 Summary: Goats Cost of Production in Various CARICOM countries

42

Table 5.1: Benchmark Data on Cost of Production of Mutton in Selected CARICOM Countries (USD/kg meat carcass basis)

48

Table 5.2: Benchmark Data on Cost of Production of Goat Meat in Selected CARICOM Countries (USD/kg meat-carcass basis)

48

Table 5.3: Items of Cost re: Importation of Sheep & Goat Meats from Australia & New Zealand

51

Table 5.4: Spread in the Cost of Small Ruminant Meat at the Wholesale Level: Local vs. Imported Meat

60

Table 6.2: Projected Annual Goat Enterprise Income Distribution Amongst Farms Surveyed (USD /farm / year): (Assumes a 50 Ewe Breeding / Fattening Operation)

ANNEX TABLES

Annex Table 4.2 Summary: Sheep Cost of production in Various CARICOM Countries (USD)

Annex Table 5.7 Production Parameters for Sheep and Goat Production in Trinidad and Tobago

Annex Table 6.1: Summary: Sheep Cost of production in Various CARICOM Countries (USD)

Annex Table 6.2: Summary: Goats Cost of Production in Various CARICOM countries

Annex Table 7.1: Sheep: Industry Performance Benchmarks Annex Table 7.2: Goat: Industry Performance Summary – Various

CARICOM Countries

Annex Table 7.3 Benchmark: Production parameters for the Barbados Black Belly and the West African sheep breeds

Annex Table 7.4: Average Daily Gain: Goat Production in various CARICOM Countries

Annex Table 7.5: Goat Industry Performance Summary – Various CARICOM Countries

LIST OF FIGURES

Item Page No.

Figure 4.1: Cost of Production per Kg Liveweight – Sheep Production in Various CARICOM Countries (2006/7 data)

36

Figure 4.2: Cost of Production per Kg Meat – Sheep Production in Various CARICOM Countries (2006/7 data)

36

Figure 4.3: Cost of Production per Kg Dressed – Sheep Production in Various CARICOM Countries; Data Sorted by Type of Breed (2006/7 data)

38

Figure 4.4: Cost of Production per Kg Dressed – Sheep Production in Various CARICOM Countries; Data Sorted by Type of Breed and Farming System (2006/7 data)

38

Figure 4.X: Cost of Production per Kg Liveweight – Goat Production in Various CARICOM Countries (2006/7 data)

41

Figure 4.X: Cost of Production per Kg Meat – Goat Production in Various CARICOM Countries (2006/7 data)

41

Figure 5.1: Typical Intermediaries and Cost Items of the Local Value Chain – Small Ruminants

46

Figure 5.2: Flow Chart Showing Major Supply Operations from Australia/New Zealand to CARICOM Market

50

Figure 5.3: Competitiveness Gap (%): Sheep Meat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass, highlighted by Country)

53

Figure 5.4: Competitiveness Gap (USD): Sheep Meat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass, highlighted by Country)

54

Figure 5.5: Competitiveness Gap (%): Goat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass)

55

Figure 5.6: Competitiveness Gap (USD): Goat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass)

55

Figure 5.7: Competitiveness Gap (%): Sheep Meat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass, highlighted by Technology)

56

Figure 5.8: Competitiveness Gap (%): Sheep Meat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass, highlighted by Major

Crosses/Breeds)

57

Figure 5.9: Competitiveness Gap (%): Goat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass, sorted by Technology)

57

Figure 5.10: Goat Production in CARICOM (Basis: Cost at Wholesale Level of Carcass, sorted by Major Crosses/Breeds)

58

Figure 5.11: Spread of Cost of Small Ruminant Meat at the Wholesale Level – Local vs. Imported Meat (2006/07)

60

Figure 6.1: Market Price for Sheep Meat (Fresh) in various CARICOM Countries (2006/07 data)

62

Figure 6.2: Returns to Investment (%) – Sheep Production in Various CARICOM Countries (2006/07 data)

63

Figure 6.3: Gross Margin Kg of Meat – Sheep Production in Various CARICOM Countries (2006/07 data)

64

Figure 6.4: Gross Margin per Head Basis – Sheep Production in Various CARICOM Countries (2006/07 data)

65

Figure 6.5: Returns to Labour, Management and Investment per Head Basis Sheep Production in Various CARICOM Countries (2006/07 data)

66

Figure 6.6: Returns to Investment (%) – Goat Production in Various CARICOM Countries (2006/07 data)

- viii -

Figure 6.7: Gross Margin per Kg Meat – Goat Production in Various CARICOM Countries (2006/07 data)

Figure 6.8: Gross Margin per Head Basis – Goat Production in Various CARICOM Countries (2006/07 data)

Figure 6.9: Gross Returns to Labour, Management and Investment per Head Basis (incl. Mortality) – Goat Meat in Various CARICOM Countries

Figure 7.1: Average Daily Gain: Sheep Production in Various CARICOM Countries (2005/06)

Figure 7.2: Average Number of Lambs per Lambing: Sheep Production in Various CARICOM Countries (2005/06)

Figure 7.3: Dress Out Performance (%): Sheep Production in Various CARICOM Countries (2005/06)

Figure 7.4: Average Daily Gain: Goat Production in Various CARICOM Countries (2005/06)

Figure 7.5: Dress Out Performance (%): Goat Production in Various CARICOM Countries (2005/06)

Figure 8.1: Proposed Small Ruminant Industry Development Strategy Figure 8.2: Proposed Nucleus Herd Model: CARICOM Level Activity: Breeding Stock Supply and technology Generation

GLOSSARY OF TERMS

BSE Bovine Spongiform Encephalopathy or Mad Cow Disease

Capretto The Italian name for tender, milk-fed kid

Caprine Goat.

Chevron Goat meat

EU European Union

FOB Free on board

Goats Capra hircus

HACCP Hazard Analysis and Critical Control Point

HS Harmonized System of Classification

HS 0204 Meat of sheep or goats, fresh, chilled or frozen HS 020410 Lamb carcasses and half carcasses, fresh or chilled HS 020421 Sheep carcasses and half carcasses, fresh or chilled HS 020422 Sheep cuts, bone in, fresh or chilled

HS 020423 Sheep cuts, boneless, fresh or chilled HS 020430 Lamb carcasses and half carcasses, frozen HS 020441 Sheep carcasses and half carcasses, frozen HS 020442 Sheep cuts, bone in, frozen

HS 020443 Sheep cuts, boneless, frozen HS 020450 Goat meat, fresh, chilled or frozen

Lamb Meat of young sheep, less than one year old

Mutton Meat of mature sheep, greater than one year old

OIE Office International des Epizooties

PM grade carcass Prime sheep carcass – lamb high in tenderness, juiciness and flavour Prime goat meat Regarded as lean, tender and juicy goat meat.

Sheep Ovis aries

Small ruminants Refers to Sheep and Goats in this study

SSOP Sanitary Standard Operating Procedures

TSE Transmissible Spongiform Encephalopathy

UK United Kingdom

USA United States of America

USD United States Dollar

- x -

GLOSSARY OF GOAT AND SHEEP

:

BREEDS

AND BODY

CONFORMATION

Boer Buck – Oaklahoma State University Pelibuey – Rancho El Tossoro (www.borregopelibuey.co m.mx/) Boer Doe – Oklahoma State University Pelibuey Ewe – www.mexico-child-link.org/birth-of-a-lamb.htm Katahdin Ram – www.palmerfarm.com/abo ut%20us.htm Katahdin Ewe – Toggenburg Buck – shamrockdairygoatfarm .com/forsale.htmlToggenburg Doe – Oklahoma State Univeristy

Saanen Doe – www.saanens.com/moonglow.asp Saanen Buck – www.saanens.com/moonglow.asp Alpine Buck – joshalivestock.com/alpine-Alpine Doe – www.kelpies.us/ovdga/2006_seni or_does_1.htm Anglo-Nubian Buck – www.aussiegoats.com/salenubia ns.htm

Barbados Black Belly Buck –

rps.uvi.edu/AES/Animal/ANS

Barbados Black Belly Ewe–

www.barkingrock.com/barba dos.htm

RECOMMENDATIONS FOR SMALL RUMINANTS INDUSTRY

DEVELOPMENT

1 PROJECT PROFILE: DEVELOPMENT OF THE NUCLEUS HERD

1.1 Herd Build Up

Each of the Nucleus farms being proposed, one for sheep and the other for goat, comprises a breeding herd of approximately 5,000 females at maturity. The Assumption is that the farms will be stocked initially with approximately 1,000 young females. The breeds of animal to comprise the herd will depend on the cross breeding programme planned. It is recommended that only high quality breeding stock should be acquired. Given the limited supply of such animals in the Caribbean, it is envisaged that the majority of the acquisition would need to be imported from extra-regional sources.

The herd build-up model is presented in Table 1.1. The model assumes that the nucleus herd stabilizes at about year 5 with a population of approximately 5,000 breeding animals. Through a well monitored programme of rigorous culling we expect that the quality of breeding stock will be continuously upgraded. Young pregnant females will be available for sale to the region commencing in about year 4 of the project. When the herd stabilizes from year 5 onwards the model projects a total of approximately 3,000 pregnant ewes will be available for sale.

- xiv -

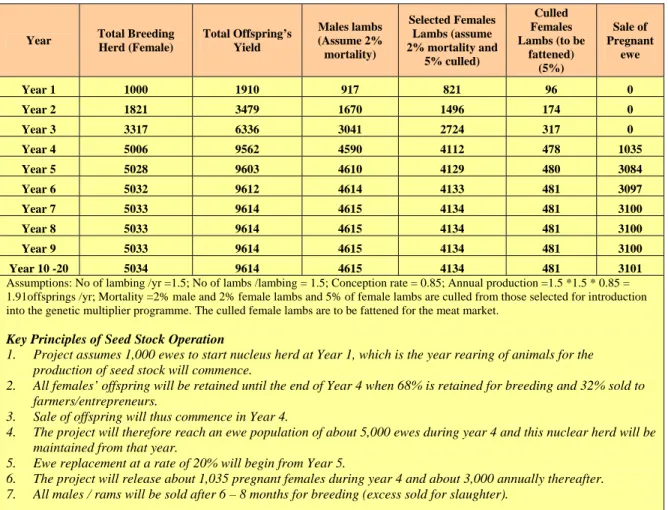

Table 1: Nucleus Herd Projection: Annual Production and Sale of Pregnant Ewes

Year Total Breeding Herd (Female) Total Offspring’s Yield Males lambs (Assume 2% mortality) Selected Females Lambs (assume 2% mortality and 5% culled) Culled Females Lambs (to be fattened) (5%) Sale of Pregnant ewe Year 1 1000 1910 917 821 96 0 Year 2 1821 3479 1670 1496 174 0 Year 3 3317 6336 3041 2724 317 0 Year 4 5006 9562 4590 4112 478 1035 Year 5 5028 9603 4610 4129 480 3084 Year 6 5032 9612 4614 4133 481 3097 Year 7 5033 9614 4615 4134 481 3100 Year 8 5033 9614 4615 4134 481 3100 Year 9 5033 9614 4615 4134 481 3100 Year 10 -20 5034 9614 4615 4134 481 3101

Assumptions: No of lambing /yr =1.5; No of lambs /lambing = 1.5; Conception rate = 0.85; Annual production =1.5 *1.5 * 0.85 = 1.91offsprings /yr; Mortality =2% male and 2% female lambs and 5% of female lambs are culled from those selected for introduction into the genetic multiplier programme. The culled female lambs are to be fattened for the meat market.

Key Principles of Seed Stock Operation

1. Project assumes 1,000 ewes to start nucleus herd at Year 1, which is the year rearing of animals for the production of seed stock will commence.

2. All females’ offspring will be retained until the end of Year 4 when 68% is retained for breeding and 32% sold to farmers/entrepreneurs.

3. Sale of offspring will thus commence in Year 4.

4. The project will therefore reach an ewe population of about 5,000 ewes during year 4 and this nuclear herd will be maintained from that year.

5. Ewe replacement at a rate of 20% will begin from Year 5.

6. The project will release about 1,035 pregnant females during year 4 and about 3,000 annually thereafter. 7. All males / rams will be sold after 6 – 8 months for breeding (excess sold for slaughter).

1.2 Capital Investment

The estimate of the approximate projected cost and returns for each of the Centralized Nucleus herd is presented here. The initial capital investment for each Nucleus Farm is estimated at approximately USD 5 million comprising the cost of breeding stock, buildings, equipment and infrastructure (such as pasture, roads and utilities) for the establishment of the farm (Table 2). The total for the two farms (sheep and goat) being proposed is thus USD 10 million.

1.3 Annual Farm Recurrent Cost

The annual operating cost for each farm is shown in Table 3. At year 5, when the herd stabilizes the total recurrent cost is estimated at approximately USD 1.7 million. Recurrent cost comprises staff cost, feed and other production input costs and administrative overheads. With respect to professional staff, we propose farm management personnel, as well as a compliment of scientists

in the relevant specialization, to ensure high quality research emanating from the Farm. We estimate an annual staff cost of approximately USD 0.4 mn.

Production cost for animals was estimated at the rate of USD 3.50 /kg live weight per annum, based on cost of production studies reported earlier. Total cost is therefore approximated on the basis of the total mass of animals on the farm in a given year.

Table 2: Nucleus Farms: Approximate Initial Capital Investment

Item Amount in USD Million

Animal Housing & Buildings 0.6

Pasture Establishment 0.5

Equipment 1.5

Labs 0.4

Road & Utilities 1.0

Purchase of Breeding Stock 1.0

- xvi -

Table 3: Nucleus Herd Annual Operating Cost –Each Farm (USD 1000)

Year

Total Farm Population

1/

Feed & Med Cost for Breeding Herd

2/

Fattening Cost (Male & culled

females) 3/

Total Animal Prodn Cost ( Feed, Med & Labour)

Staff + Admin

Cost4/ Annual farm Recurrent Cost Year 1 2834 191 76 267 400 667 Year 2 5161 348 138 487 400 887 Year 3 9399 634 252 886 400 1,286 Year 4 14186 957 380 1337 400 1,737 Year 5 14247 962 382 1343 400 1,743 Year 6 14260 962 382 1344 400 1,744 Year 7 14262 963 382 1345 400 1,745 Year 8 14263 963 382 1345 400 1,745 Year 9 14263 963 382 1345 400 1,745 Year 10 -20 14263 963 382 1345 400 1,745 Key Assumptions: 1/ Rams kept for 6 months while ewes are fed for 12 months

2/ USD 105 / animal / year feed etc 35kg ewe 3/ USD 75.00 / animal to 7.5 months market weight

4/ Technical Staff and Technical Assistants estimated at $252,000 plus admin = $400,000

Cost items

1. Cost per ewe for breeding USD 1,000 each.

2. Professional, technical and support will cost USD 400,000/annum

3. Males sold at 40 kg bodyweight and culled female fatteners and spent ewes at 25kg. 4. Rams budgeted to be sold at USD 3.75/kg and culled females at USD 1.50/kg. 5. Pregnant females are sold at a price of USD 700 / head.

1.4 Revenue

At year 5 when the animal population stabilizes annual revenue from animal sales is

estimated at approximately USD 2.9 million.

Revenue is based on returns from the sale of the various classes of animals as follows:

(i) Male offspring and culled female offspring that have been fattened for market up to an average age of 7 – 8 months reaching an approximate weight of 40 kg. These animals would be destined for the mutton market attracting and average price of USD 3.50 /kg liveweight

(ii) Culled spent female animals from the breeding herd. The price assumed here is USD 1.50 /kg liveweight

(iii) Select pregnant lamb offspring to be sold as high quality breeding stock. The assumed price is USD 700 / animal.

1.5 Cash Flow and Profitability

The Cash Flow projections for each farm are presented in Table 4. Operating deficits are expected for the first four years, respectively USD 0.5, 0.6, 0.8 and 0.3 million. The cumulative deficit at the end of year 4 is therefore approximately USD 2.2 million. From year five onwards a positive cash flow of USD 1.1 million is estimated.

The economic viability of this project primarily depends on the price of breeding stock. While we have suggested a price of USD 700 /animal, a policy decision could be taken with respect this price.

The profitability of investment in the Nucleus herd was estimated using two scenarios: Scenario one assumes 50% of the initial investment is provided by grant funding; and Scenario two assumes that 100% of the initial investment is provided by grant funding. The internal rate of return of the investments and the net present value based on these assumptions are as follows:

(i.) Scenario 1 - IRR = 14.5% and NPV = USD 1.946 mn (ii.) Scenario 2 – IRR = 31.5% and NPV = USD 4.45 mn

1.6 Financing

On the basis of the parameters employed in the analysis and the assumptions of the model, the revenue base of the project is inadequate to support the initial investment proposed. We suggest an investment strategy aimed at mobilizing approximately 50 % of the total investment form donor funding. For the two farms this amounts to USD 5 million. The remaining 50 % of investment and the required working capital we suggest should be mobilized through equity participation of governments and private sector in region in the project.

- xviii -

Table 4: Cash Flow: Nucleus Breeding Herd (USD 1000)

CASH OUTFLOW CASH INFLOW Year Establishment Cost Annual Staff & Admin Cost Annual Farm Prodn Cost Total Cash Outflow Total Revenue* CASH FLOW Year 0 5000 Year 1 400 267 667 141 ($526) Year 2 400 487 887 257 ($630) Year 3 400 886 1,286 468 ($818) Year 4 400 1337 1,737 1,431 ($306) Year 5 400 1343 1,743 2,907 $1,163 Year 6 400 1344 1,744 2,917 $1,172 Year 7 400 1345 1,745 2,919 $1,174 Year 8 400 1345 1,745 2,919 $1,175 Year 9 400 1345 1,745 2,919 $1,175 Year 10 -20 400 1345 1,745 2,919 $1,175

* Assume: (i) Males sold at 40 kg bodyweight and culled female fatteners and spent ewes at 25kg. (ii) Rams budgeted to be sold at USD 3.75/kg and culled females at USD 1.50/kg.

(iii)Pregnant females are sold at a price of USD 700 / head.

1.7 Strategic Partnerships

Given the developmental role of this project, we strongly urge the participation of a wide cross section of private investors as a measure to ensure that the project remains focused on maintaining commercial viability. In this regard we are of the view that among the various stakeholder groups, the current processors/ integrators in the broiler industry in CARICOM should be considered strategic investors and potential business partners since the CARICOM mutton industry could benefit from the meat handling and distribution know how and infrastructure of these entrepreneurs.

- 1 -

Section 1

INTRODUCTION

1.0 INTRODUCTION

This study is part of a larger study commissioned by the CARICOM Regional Transformation Programme for Agriculture to evaluate the international competitiveness of selected agricultural commodities. The other commodities included were, hot pepper, sweet potato, coconuts and papaya.

This Report is the final component of the overall study on the competitiveness of the Small Ruminant meat industry in CARICOM. It was preceded by a Review of the Policies in the CARICOM countries included in the study and a Market Intelligence Report on the global Small Ruminant meat industry. The Study focused on the following countries: Barbados, Belize, Jamaica, Trinidad and Tobago, St Lucia and St. Vincent.

The report is structured into eight sections. Section two summarizes the key market issues f4rom the Market Study (reported separately). Section three provides a profile of the industry in the seven CARICOM countries studied. The analysis in this report is presented in sections four to seven as follows: Section four presents the Cost of Production estimate for the sample of farms; Section five presents the results of the Competitiveness Analysis; Section six looks t profitability of Small Ruminants production; and Section seven reviews Technical performance parameters. Proposals for Industry Development are given in the final section (Section eight).

Section 2

MARKET ASSESSMENT: KEY ISSUES, OPPORTUNITIES AND

COMPETITION

2.0 INTRODUCTION

This Section of the Report presents findings from the Market Report for Small Ruminant meats. The section begins with an overview of the CARICOM and global market/competitive environment, with emphasis on the CARICOM small ruminant market as it relates to development of the Regional industry. Further examination of trade of sheep and goat meat is done within this context. A concise discussion on the main issues with respect to competitiveness in the Region is then presented, noting problematic areas within the production and supply systems in the member countries.

2.1 THE CARICOM MARKET FOR SMALL RUMINANT MEATS

As a net importer of sheep and goat meat, strategies for allowing regional producers to capitalize on existing opportunities are essential. We now review the key market features of the CARICOM market.

Market Size & Imports: Overall, the Region imports approximately 75 % of its consumption requirements of goat and sheep meat from Australia and New Zealand. In 2004, imports were valued at USD 23.3 mn with over 88 % being sheep meat. Our estimate is that the total value of the industry with respect to ONLY meat is approximately USD 30 – 40 mn. Estimated CARICOM consumption is approximately 15,000 tonnes. However, the actual levels of consumption and self sufficiency vary among countries, as well as between mutton and chevron. .

Imports of mutton and chevron into the CARICOM Region averaged 10,343 tonnes (2002/04) with 64% of the total value of imports coming from Australia and 30% from New Zealand. The USA’s market share in the Region was estimated at only just about 5% in value terms. The main import product into the Region was sheep cuts, bone in frozen (HS 020442) representing 72% of imports in value terms.

- 3 -

Jamaica is the largest importer in the Region, followed by Trinidad and Tobago. Jamaica, as do other relatively large importers (The Bahamas, Barbados) imports mostly meats of sheep while Trinidad and Tobago’s imports are mixed - about 65% sheep meat and 35% goat.

Tables 2.1 and 2.2 summarize CARICOM’s per capita consumption of goat and sheep meats. CARICOM consumption of Sheep and Goat meat in 2003/04 was about 2 kg/capita (Table 2.1). Overall the per capita consumption of sheep meat was approximately twice that of goat, 0.6 kg versus 1.4 kg / capita. Significant variation exists in the level of consumption and the type of meat preferred among countries as shown in Table 2.2.

Table 2.1 CARICOM Consumption of Goat and Sheep Meat (2003 & 2004)

Commodity Year Production

(kg) Imports (kg) Total Consumption (kg) Per Capita Consumption (kg) Goat & Sheep

2003 3,661,000 11,123,889 14,784,889 2.086 2004 3,668,000 11,287,856 14,955,856 2.111 Goat Meat 2003 2,579,535 1,948,338 4,527,873 0.639 2004 2,591,800 1,769,812 4,361,612 0.615 Sheep Meat 2003 1,081,465 9,175,551 10,257,016 1.447 2004 1,076,200 9,518,044 10,594,244 1.495

NB: 2003 excludes Antigua & Barbuda, Bahamas and Montserrat 2004 excludes Antigua & Barbuda and Bahamas

Table 2.2: Per Capita Consumption of Sheep & Goat Meat : CARICOM countries- 2004

Per capita Consumption (kg) COUNTRY

Goat &

Sheep Goat Meat Sheep Meat

Antigua & Barbuda 0.504 0.220 0.284

Bahamas 6.046 0.716 5.330 Barbados 5.666 0.136 5.530 Belize 0.073 0.024 0.048 Dominica 1.789 0.875 0.915 Grenada 1.520 0.316 1.205 Guyana 1.029 0.339 0.691 Jamaica 2.222 0.821 1.401 Montserrat 2.714 0.350 2.364

St. Kitts & Nevis 4.548 0.190 4.358

St. Lucia 5.484 0.413 5.072

St. Vincent 0.809 0.191 0.618

Suriname 0.149 0.068 0.081

Trinidad and Tobago 2.595 1.127 1.468

NB: Antigua and Barbuda based on 2005 data available. Bahamas based on 2001 data available.

Production: CARICOM per caput supply of goat and sheep meats was estimated at 2.2 kg in 2002, ranging from 0.1 kg in Belize to 6.1 kg for St Lucia1. Small Ruminant meat production has been dominated by Jamaica, which produces an average of 1,500 tonnes annually. Other significant producers include Guyana, Antigua, St Lucia, St Kitts and Nevis, Barbados, The Bahamas and Grenada. St Vincent, Trinidad and Tobago, Dominica, Suriname, Montserrat and Belize are the smallest producers in the Region. CARICOM countries also produce small quantities of breeding stock for exports. Barbados is a major exporter of the Barbados Black Belly Sheep.

Prices: An examination of the prices database shows a range of prices for small ruminant meats. Further, variation exists by species of animal, age of animal and the respective cuts. The industry’s market is further segmented by economic and socio-cultural/religious factors. Pricing in the industry is also differentiated by meat product form – fresh vs. frozen. Within the Region, freshly slaughtered small ruminant meat attracts premium prices.

1

Resident population in 2002 was estimated at 6,494,000 persons (FAOStat); tourist arrivals 4,857,107 (CTO Tourism Statistics) persons; average stop over assumed at 7 days; eqv tourist popn 1,901,000

- 5 -

We should indicate that within each of the Harmonized System (HS) custom classifaication of meat there is a range quality and / or grades are possible. For example, within the Customs Category HS 020423: Sheep Cuts Boneless (fresh or chilled) in 2004, the trade data has three CARICOM countries (Jamaica, Trinidad and Tobago and The Bahamas) making purchases from Australia at the following fob prices per tonne, repectively: USD 1,318; USD 1,615 and USD 2,756. We assume these differentials reflect differences in product quality or grade. In the same year, The Bahamas made purchases from the USA for the same HS customs category at USD 3,846 / tonne. This compares with an average price of USD 6,937 / tonne.

Similarly, frozen sheep carcasses (HS 020441) purchased in the same year (2004) from Australia showed prices of USD 712; USD 2,043; USD 2,104 and USD 2,805 per tonne. The average quoted for this category of meat in Figure 4.1 is USD 1,879 / tonne. The import of sheep and goat meat (value terms) is presented in Table 2.1.

Table 2.3: Summary of Imports of Sheep and Goat Meats into Various CARICOM Countries in 2004

CARICOM Countries Meat of Sheep (USD 1,000) Meat of Goat (USD 1,000)

Total Sheep and Goat Meat Import (USD 1,000) Antigua 229 14 243 Bahamas 3,415 - 3,415 Barbados 3,024 - 3,024 Belize 32 - 32 Dominica 43 20 64 Grenada 151 - 151 Guyana 5 - 5 Jamaica 8,448 279 8,727 Montserrat 0 - - St Kitts 299 - 299 St Lucia 957 17 974 St Vincent 27 - 27 Suriname - - -

Trinidad & Tobago 4,006 2,272 6,278

Total Imports 20,636 2,603 23,239

Data Source: Comtrade database

Market Segmentation & Preferences: While CARICOM countries have ready access to relatively cheap supplies of frozen mutton and chevron from extra-regional sources, most consumers in the Region have a strong preference for fresh mutton and chevron produced from local flocks. This, in part, is reflected by the much higher prices consumers are willing to pay for

the local meats. This distinction and preference provides the basis for the observed segmentation of the domestic market between locally produced fresh meats and frozen imports. Notwithstanding this segmentation, there is a trigger price at which imports may begin to substitute for fresh. The level of this trigger price depends on the individual’s income level, as well as cultural factors.

2.2 THE GLOBAL MARKET FOR SMALL RUMINANT MEATS

Global exports of small ruminant meat are dominated by Oceania (New Zealand and Australia) at 64% and by Europe (mostly France) at 31%. Asia and South America accounted for 6% of world trade. With respect to sheep meat, Australia and New Zealand account for 70% of the global exports or 592,159 tones, valued at USD 1.96 billion. Of this amount, New Zealand has a 56% share and Australia 44%. In the case of chevron, the combined exports from both countries are 14,680 tonnes valued at USD 34.7 mn (2003). Australia accounts for most (89 %) of the chevron exports.

Sheep flocks in Australia and New Zealand are produced for both meat (including sheep for live export) and wool2. Australia is the world's largest wool producer, accounting for about 30% of global production3. The joint product nature of the industry in both countries allows for cost sharing of production expenses between wool and meat. This gives the respective industries tremendous leverage in pricing their products and maintaining a competitive position in global trade. Countries attempting to develop a sheep industry solely for meat production would find it difficult to compete on the basis of price, making quality factors the necessary basis for developing a mutton industry.

The sheep and lamb meat industry in New Zealand is considered one of the most efficient. In addition to the joint product nature of the industry, the industry was geared for export marketing with about 50 meat export processing plants in 2004. In the case of Goat, New Zealand has consistently worked towards achieving a highly productive and efficient industry. In this regard, the country introduced the Boer Goat from South Africa in 1983 in an attempt to increase flock

2 (Source: Statistics – Tasmania Agriculture. Agricultural production., Livestock., Sheep and lambs

http://www.abs.gov.au/Ausstats/abs@.nsf/Lookup/7FE4D2922DD91969CA256C3200241770 ) 3Year Book Australia 2002., 2002., Agriculture., The wool industry

- 7 -

productivity. Today, New Zealand is the third largest exporter of goat meat (about 5%) after Australia and France. In the case of goat meat, Australia’s supply is based on both feral (wild) and domesticated species. The former provides a relatively cheap source of meat. Domesticated species include dairy goats and the genetically improved Boer goat.

2.3 KEY COMPETITIVENESS ISSUES

As noted earlier, regional production of goat and sheep meat meets only a small fraction of consumption demand, with the Region relying heavily on imports. Given the role that Small Ruminants could play in enhancing food security and increasing farm and rural incomes and given its appropriateness for land scarce economies, there is need for a serious thrust in propelling this industry forward. Strategies must be developed with the following key issues in mind:

a) Consumption Patterns and Preferences: An understanding of the drivers of demand in the market is critical to maintaining a strong market presence and optimizing revenues. Ethnic, cultural and religious factors are major factors influencing consumption patterns for goat and sheep meat in the Region. Fresh goat and sheep meat is consumed throughout the year with peaks associated with various celebrations and religious events such as Christmas, Eid Ul Adha and Eid Ul Fitr. In Jamaica, the consumption of goat meat is widespread in the local community and the product is being readily introduced to the tourist trade as part of the local cuisine.

b) Product Form and Carcass handling: Product marketing, proper meat handling and product presentation remain largely undeveloped in the Region. Conditions and facilities for slaughter need to be improved, and by-product utilization and value added products need to be exploited. Only a small fraction of locally produced mutton and chevron is marketed through the established supermarkets, significantly limiting consumer access to the product. Standardization and grading need to be established to fully optimize returns, and products need to be promoted to extract maximum value.

Also, laws regulating the slaughter of animals for human consumption must be updated. Generally, slaughters take place privately, without the requisite health and food safety inspections. The free range system that exists in parts of the Caribbean, together with a praedial larceny problem and the lack of certification and traceability at slaughtering, serves to further expose consumers to health and food safety risks. In addition, systems for slaughtering, meat handling and waste disposal at the public abattoirs in most countries are in dire need of upgrade and modernization. HACCP and Sanitary Standard Operating Procedures (SSOP) practices seem to be absent from such systems, while there exists a number of private abbatoris in the Region. However, not cater for handling of sheep and goats.

Although the Region is taking steps to develop its monitoring and diagnostic capabilities, the pace is slow relative to the frequency and the rate at which incidence of diseases are occurring at new locations worldwide. Unless protected, the Region is likely to suffer health, economic and social costs.

c) Packaging and Distribution: At the retail level, there is an absence of labeling which impacts on product history and traceability. Moreover, for domestic market channels, improvement in carcass cut and quality will help in promoting sheep and goat meats in more mainstream supermarkets and retail outlets.

Summary:In conclusion, the basis for a competitive CARICOM Small Ruminant Industry is the development of a quality product that maximizes value, exploits unique flavours,

freshness, wholesomeness and taste. Should CARICOM seek to transpose the level of

self-sufficiency of the Region from 25% to a much higher percentage, the industry would need to take on board these issues in its strategic plan.

2.4 TRADE REGULATIONS

The Office International des Epizooties (OIE) or the World Animal Health Organization is recognized as the international standard setting organization for promoting animal health by countries in the Region. The Competent Authority for animal health in the respective countries of

- 9 -

the Region therefore adopts the OIE guidelines, which are used in the development of animal health standards. The guidelines also provide for transparency and equivalence in trade of animals and animal products as set out by the WTO SPS Agreement. The WTO, the SPS Agreement specifies that:

a. Disease risk assessments should evaluate the likelihood of entry, establishment or spread of a disease within an importing country according to the measures which might be applied, and the associated biological and economic consequences.

b. Food safety risk assessments should evaluate the potential for adverse effects on human or animal health from the presence of pathogenic agents, additives, contaminants or toxins in foods, beverages or feedstuffs.

Unlike the regulatory environment existing in the developed countries which includes protection of the consumers, our review of the database did not locate any significant SPS regulations besides those which seek to address tariff at the border. The only exception for the Region was in the case of the Belize Agricultural Health Authority (BAHA), which approves on-farm quarantine stations prior to importation of animals. On arrival, a veterinarian inspects the animal within 24 hours of entry and then at least once weekly. Animals are quarantined for a period of 30 days4.

Belize assesses disease risk on imports of animal products to ensure that diseases and food safety risks posed by imported goods are identified and managed effectively. An import risk analysis is conducted when:

• The animal product has never been previously imported.

• The goods originate from a country or region not previously approved. • The health status of the country or region changes.

• There is new information on a particular disease.

As part of the health notification requirement, the exporting country must provide evidence that an export good does not represent a significant risk to Belize. Other Caribbean countries, generally follow guidelines reflecting those of the OIE protocols. Systematic protection and safety measures appear to be inadequately addressed.

- 11 -

Section 3

PROFILE OF THE SMALL RUMINANT INDUSTRY IN SELECTED

CARICOM COUNTRIES

3.1 INTRODUCTION

Overall, the Region imports approximately 75 % of its consumption requirements of both meats, with imports primarily from New Zealand and Australia.

The Caribbean Region however, has been a traditional producer of small ruminant meats and products. In the Region, Jamaica has the largest stock of sheep and goat at 142,000 heads, followed by Guyana estimated at 78,000 heads; Antigua 15,000; and the rest of CARICOM having animals stocks at less than 10,000 heads (FAOStat). Data on domestic production of Sheep and Goat meat in CARICOM countries are not readily available, largely on account of the fact that a significant number of animals are slaughtered at informal facilities such as backyard or roadside venues rather than in the public or other approved abattoir. The only complete database is the FAOStat, which based on our observations in Trinidad and Tobago may be underestimated.

In terms of goat meat production, the FAO data show Jamaica as CARICOM’s largest producer with 1,559 tonnes, followed by Guyana with 260 tonnes, Antigua 111 tonnes and St Kitts and Nevis 70 tonnes. Production levels for the other identified countries fall below 68 tonnes per annum. However, in the case of sheep meat, Guyana was the largest CARICOM producer with a production of 520 tonnes in 2004, followed by Barbados (92 tonnes) and St Lucia (90 tonnes).

3.2 JAMAICA

As mentioned previously, Jamaica is the largest producer of goat meat in the Region. In 2003, the country produced 466 tonnes of chevron representing just about 25% of domestic consumption. In order to supply the production deficit, the country imported 1,413 tonnes. Small ruminants can be found throughout Jamaica, with higher concentrations in the parishes of Clarendon (16.3%), St. Elizabeth (13.6%) and Westmooreland (13%).

Westmoreland

Clarendon St. Elizabeth

Animals are reared using several systems ranging from free range to intensive, and under ‘land and landless’ systems. Improved pasture normally involves the use of tanner grass and mulberry, fenced and subdivided in about 0.8 ha (2.0 ac) blocks. Animals are allowed to graze during the daylight hours, with supplement fed at night in enclosed housing. Most of the improved forages and fertilized pastures are found in Clarendon (75%), Westmooreland (50%) and St. Elizabeth (25%). Although some farms have irrigated pasture, the majority do not. For example, in Clarendon, just about 7% of the pastures are irrigated.

In some of the farms visited, there was very good quality breeding stock being used for genetic upgrade of the herd. The offspring from high quality stock may also be sold to other farmers. A selected stud service programme using various improved breeds is offered by the Ministry of Agriculture at various locations across Jamaica. In addition, a revolving buck and doe are kept in an effort to upgrade the national herd. The Ministry is also conducting experiments in artificial insemination with varying degrees of success.

Most housing for small ruminants in Jamaica is constructed very rudimentary, using recycled building materials. Proper housing and improved pastures are key pre-requisites for harnessing the genetic potential of the animals and improving performance, productivity and competitiveness.

- 13 -

Small ruminants are kept primarily for meat in Jamaica. Small amounts of leather products are also manufactured and efforts are being made towards increasing / evaluating the acceptance of cheese made from goat milk. Most of the goat and sheep meat produced in Jamaica are sold retail either for direct household consumption or for food service. Smaller amounts pass through the supermarket and meat shop channels. Market demand centers around 8 to 12 month old animals. Demand exists for both meat and certain fifth quarter parts such as the head, feet and testicles, which are used to make various delicacies in Jamaica. An estimated 40% of the small ruminants produced in Jamaica are slaughtered at the public abattoirs and 60% through various private facilities.

The R& D in Jamaica is primarily done by two institutions: (1) The Ministry of Agriculture and (2) CARDI. Research being done includes:

(i) Artificial insemination (ii) Improved forages - mulberry

(iii) Cross Breeding and Breed Evaluation / improved crosses for quality and meat content

(iv) Screw Worm eradication

1

Picture Source: Mocho Goat Development Project: Recovery of Mined-out Bauxite Lands for Goat Production

A joint project of IICA, the Jamaica Bauxite Institute (JBI) and the Jamaica Aluminum Company (JAMALCO)

http://www.agroinfo.org/caribbean/iicacarc/jamaica/mochonew.htm

Picture Source: Mocho Goat Development Project: Recovery of Mined-out Bauxite Lands for Goat Production

A joint project of IICA, the Jamaica Bauxite Institute (JBI) and the Jamaica Aluminum Company (JAMALCO)

http://www.agroinfo.org/caribbean/iicacarc/jamaica/mochonew.htm

Picture source :

http://www.agroinfo.org/caribbean/iicacarc/jamaic a/Mochofacts.pdf

Goats: Common sight in the streets of Jamaica Picture source: http://www.jamaicans.com/gallery/lindalowesphot os/Goats_3?full=1 Picture source : http://www.jamaicans.com/gallery/lindalowesphot os/Goats_3?full=1

Goats grazing in unimproved pastures

- 15 - Northern Belize Cayo District

3.3 BELIZE

Small ruminant production in Belize is largely focused on sheep production. In 2004, sheep and goat meat production for Belize were estimated at 13 and 1 tonne, respectively. This level of production is locally consumed, channeled via butchers and processors who sell directly to consumers. The most common sheep breed reared is the Barbados Black Belly. However, production reports show a poor meat to bone ratio for Barbados Black Belly reared.

The Boer goat is currently being promoted for upgrading local stock (which includes crosses of the Anglo Nubian and local breeds), with respect to meat production The Cayo District and Northern Belize have suitable conditions for sheep production and are thus targeted. The five major problems identified by small ruminant farmers in Belize (CARDI 2003) were predatory animals, poor pastures, internal parasites, poor breeding stock, and marketing.

In light of this, the Belizean authorities have initiated several improvement and development strategies; among these are the introduction of better quality forage (mulberry) and the development of protein banks, possible use of artificial insemination, and the introduction and cross-breeding of higher quality stock (Barbados Black Belly and Pelebuey). Belize also has a large citrus industry which may also possess some potential for linkages with the small ruminant industry.

Refer to pictures: Small Ruminants – Jamaica.

- 17 -

Small Ruminants: Central Farm Experimental Station, Belize

Picture 7: Pregnant cross-bred Goat Picture 8: Small Ruminant Housing Picture 3: Body conformation of Boar

Goat Buck for breeding

Picture 4: Pregnant Purebred Doe body conformation

Picture 6: Two Cross-bred Offspring’s - Goat Picture 5: Weaned upgraded cross-bred offsprings

3.4 BARBADOS

Sheep are the preferred small ruminant livestock in Barbados. The goats on the island are largely resident at the Government’s breeding and research facility. A range of production systems are utilized, ranging from intensive to an extensive, landless system. Production technology generally comprises of a semi-intensive management system for ewes, and an intensive system for fatteners. Fatteners may comprise of both male and female sheep. In the semi-intensive systems, ewes are grazed and supplement fed on return to the housing on evenings. Although the Government provided a ready market for weaned males, farmers generally retained the stock for fattening. These production systems are usually not labour-intensive, and only one labourer may be kept full-time.

Animal nutrition is generally based on farm feed formulations using spent grains. Wheat middling, cotton seed, ground corn, molasses, soybean meal, and hull are common ingredients used. These formulations range in price from Bds $0.40 - $0.45/kg (Bds $0.18 - $0.20 /lb) compared to Bds $0.70 - $0.73/kg (Bds$ 0.32 - $ 0.33/lb) for commercial mixtures. Supplements are fed at a rate if about 0.4 kg (1 lb) per ewe. The market weight at slaughter for the Barbados Black Belly is recommended at about 40 – 45 kg.

An estimated 60% of Barbados sheep production is slaughtered in backyard abattoirs. Alternatively, the Government of Barbados oversees the operations of the Southern Meats abattoir, which accounts for about 40% of slaughters, which is equal to on average 60 sheep per

- 19 -

week. Generally, only sheep destined for supermarkets are slaughtered at the Southern Meats abattoir. The major channel for fresh meat is via butchers, with a small proportion of direct sales by farmers. The principal areas for concern in the production and supply of meat include:

a. Farmer education: re. slaughtering under hygienic conditions b. Health risk potential of private/ backyard slaughtering

c. Risk of contamination posed by meat portions prepared in unhygienic manner d. Monitoring of slaughter practice at supermarkets and backyard operators.

3.5 TRINIDAD AND TOBAGO

Small ruminants can be found throughout Trinidad and Tobago. Higher concentrations are found in Tobago, Wallerfield, Carlsen Field and Princes Town. An estimated 87% of farmers are located on owned or leased lands, and about 13% are based on landless systems. Production technology ranges from free range to intensive, under ‘land and landless’ systems. Improved pasture normally involves the use of tanner and elephant grasses, as well as some leucaena and

gliricidia. Northeast (Caura Valley, Maloney, Wallerfield Vega de Oropuche South (Moruga, Princes Town Tabaquite)

The breed of sheep most commonly grown in Trinidad and Tobago is the Barbados Black Belly, followed by the West African and various crosses of these two breeds. Katahdin, Persian Blackhead, Virgin Island White are relatively small in numbers. Increasingly, growers are using the Dorper and crosses thereof to enhance body conformation and weight gain of the Barbados Black Belly and the West African. Breeding ewes and good quality, pure line genetic stock are difficult to locate and the rate at which the parental and F1 stock are reaching the meat market have been a cause for concern, especially in Tobago.

The improved breeds of goats commonly grown are the Saanen, Anglo Nubian, Toggenburg, Alpine, Boer and crosses thereof as well as the well adapted ‘Scrub /local’ goats. The mixed hybrids and crosses of these comprise an estimated 50% of the population, while scrub goats

comprise the rest. Pure line goats comprise less than 15% of the goat population. A few farms visited as well as the Blenheim Project in Tobago had very good quality breeding stocks, used for genetic upgrade for their herd. Offsprings from superior breeding quality may be sold to other farmers. A selected stud service programme using various improved breeds is offered by the Ministry of Agriculture at various locations across Trinidad and Tobago in an effort to upgrade the national herd and the Artificial Insemination tests in small ruminants have been described as promising.

Animals are allowed to graze during the daylight hours in semi-intensive system, and supplement feed are fed on return to the housing area. Various on-farm feed formulations may be used, normally comprising of various types of agro-processing by-products or factory waste such as spent brewers grain, citrus pulp and coconut meal. Factory-formulated feeds are also used, however, these are generally more expensive than the on-farm formulated feeds. Mineral Lick is used as nutritional supplement.

Most housing for small ruminants in Trinidad and Tobago is constructed very rudimentary, using recycled building materials. Proper housing and improved pastures remains key pre-requisites for harnessing the genetic potential of the animals and improving performance, productivity and competitiveness in Trinidad and Tobago.

Most of the goat and sheep produced are sold on the hoof to butchers. Butchers then slaughter animals, reselling the meat directly to consumers. Only very small amounts of fresh meat are sold through the supermarket and meat shop channels. Demand is for both meat and certain ‘fifth

- 21 -

quarter’ parts such as the head, liver, feet and intestines. Both meat and fifth quarter parts are considered a delicacy in Trinidad and Tobago. No goat or sheep meat goes into further processing. Although a few public abattoirs exist in various municipalities, an estimated 90% of the small ruminants produced in Trinidad and Tobago are slaughtered at various private facilities and roadside stalls.

The major diseases in small ruminants in Trinidad and Tobago include foot rot, pregnancy toxemia and pneumonia. Incidence of these generally increases during the wet season.

With respect to R&D, the national research agenda has focused on: (i) Growth performance / response to mineral lick (ii) Oestrus stimulation

(iii) Feeding trials (concentrates vs. forages; various protein sources; various feed – forage/concentrate mixes)

(iv) Multiplication: Number of offspring from different goat and sheep breed crosses (v) Identification of puberty among different breeds and crosses.

Breeding Stock – Tobago

Picture 13: Boer Goat Buck Picture 14: Cross-bred Buck Picture 11: Breeding Rams Picture 12: Breeding Rams Picture 9: Breeding Rams Picture 10: Breeding Rams

- 23 -

Technology Transfer – Blenheim Sheep Project, Tobago

Picture 15: Internal Feeding Rack Picture 16: Internal Feeding Rack

Picture 17: Slatted Floors Picture 18: Drinking Water Trough

Technology – Small Ruminant Housing Models, Tobago

Picture 25: External Feeding Rack Picture 26: External hoof bath with Copper Sulphate

Picture 23: Open housing design – ground level. Concrete floor has bagasse bedding base

Picture 24: Simple housing design Note: concrete foundation and sloping base Picture 21: Raised housing model facilitate

dung storage and collection

Picture 22: Raised housing, slatted floor design allows dung to fall through

- 25 -

3.6 ST. LUCIA

Increasing focus is being placed on small ruminant meat in St Lucia. The production is still at a subsistence level, representing a source of additional household income. Animals are reared using semi intensive and free range (‘tie out’) systems. Pastures are rainfed; comprising of unimproved forages. There is a general scarcity of fodder in dry season. Indigenous forage is generally of poor nutritional quality. Pasture irrigation is available on the government livestock station at Vieux Fort.

Most of the small ruminants produced in St Lucia are concentrated in Vieux-Fort, Micoud and Babonneau. St Lucian farmers rear different breeds and crosses of small ruminants. Among the sheep breeds, the Barbados Black Belly is most common, followed by the Virgin Island White and a “Local” or creole breed. The Anglo-Nubian is the most common goat breed, followed by “local” crosses. More recently, Boer goats were introduced for their meatier characteristics. The Boer was introduced from Martinique.

Babonneau

Vieux-Fort

Vieux Fort recorded a small ruminant population of 1,400 Barbados Black Belly, 800 Virgin Island White and 400 local sheep. Further, this region had 800 Anglo Nubians, 100 “Local” and 40 Boer goats in 2004/5. In Micoud, 1,000 Barbados Black Belly, 800 Virgin Island White, and 300 local sheep were reported, in addition to 600 Anglo Nubians and 200 “Local” goats. Babonneau recorded 1000 Barbados Black Belly, 400 Virgin Island White and 100 local sheep; 800 Anglo Nubians and 600 “Local” goats. The genetic stock of sheep and goats found on some farms as well as the government station were of high quality. However, adequate numbers of good quality stock for expansion were not available, posing a significant limitation to growth of the industry.

Technology support is provided by the Extension Staff of the Ministry of Agriculture.Extension programmes includes animal health and breeding. Farmers in the VIEUX FORT area have formed themselves into a small ruminant producers association. Farmers can access limited market information and intelligence at the St. Lucia Marketing Board and the Marketing Unit of the Ministry of Agriculture. At present, no proper abattoir facility exists in St. Lucia. Most of the animals are butchered using on-farm arrangements. The fresh mutton and chevron entering the supermarkets were sold as specialized cuts RTC / RTS. Others sell their meat as half carcasses, specialized cuts and a smaller amount as whole and half carcass.

Small ruminant production in St. Lucia is limited most by internal parasites and attacks from stray dogs. The latter was highlighted as being serious in the Vieux Fort region.

- 27 -

Breeds and Breeding Stock – St Lucia

Picture 27: Mixed Breed Buck Picture 28: Virgin Island White Rams

Picture 29: Boer Goat Picture 30: Virgin Island White Flock

Picture 31: Barbados Black Belly ewe and lambs

Technology (Feeding System, Boar Goat Breeding Stock) – St Lucia

Picture 34: Hanging feeding trough

Picture 37: Boer goat used for upgrading local breeds

Picture 38: Skins being dried Picture 33: Goat housing

Picture 36: Enclosed pasture and cut and carry supplemental feeding Picture 35: Enclosed pasture and cut and

- 29 -

3.7 ST. VINCENT

The small ruminant industry has been identified as an important agricultural sub sector in need of greater emphasis. Over the years, production has been largely done in small farmer production units ranging from 1 – 12 animals using the ‘ let-go’ and “tie out’ systems. Production is utilized as food and a source of additional household income. When pastures are used, grazing forages comprise indigenous species of shrubs and herbs grown under rainfed conditions. The availability of forage is significantly reduced in the dry season.

St. Vincent farmers rear different breeds and crosses of small ruminants. Among the sheep breeds, the Barbados Black Belly and “mixed” are most common. Minor sheep breeds include Virgin Island White, Black Head Persian and Kathadin. “Mixed” goats are most common, although pure line Anglo-Nubian, Boer and Toggenburg are also found on some farms. The genetic stock of sheep and goats found on some farms as well as the government station were of reasonably high quality. However, adequate numbers of good quality stock for herd development and growth is a major limiting factor to industry expansion. Animal breeding stock is obtained from the government animal farm as well as certain farmers.

The Statistical Unit of the Ministry of Agriculture collects, analyzes and disseminates information on production and export. Farmers can access limited market information and intelligence at the Marketing Unit of the Ministry of Agriculture. The government’s veterinary officers provide extension, animal health and inspection support. All of the small ruminant meat produced in St Vincent is consumed locally. Most farmers sell directly to the consumers. Previously, Trinidad and Tobago was an important market for live meat animals from St. Vincent. However, with shortages in domestic supply, exports have been discontinued.

Orange Hill

Breeding Stock – St Vincent

Picture 44: Fattener Picture 39: Virgin Island White and Barbados

Black Belly

Picture 40: Virgin Island White and Barbados Black Belly

Picture 42: Boer goat crossbreds Picture 41: Pregnant ewe

- 31 -

3.8 GUYANA

The major ruminant producing areas in Guyana are located in the East and West Berbice regions as well as the Lethem area. In East Berbice, Fort Wellington and Rose Hall are noted as principal producing sectors. There is an observed preference for rearing of sheep over goat.

Production systems are largely extensive / free ranging units, in proximity to the sea wall and back dam areas. The smaller herds comprise of some

seventy-five heads of animals. Larger units comprise up to three hundred heads, with about 50 – 80 breeding ewes. Herdsmen accompany animals in the free range system. Breeds include the Barbados Black Belly, the Wiltshire Horn and some mixed/non-descript.

Meat produced is consumed locally, accounting for most of domestic consumption. A review of trade data shows that both imports and exports are negligible. The small ruminant meat is generally consumed fresh.

The New Guyana Marketing Corporation (NGMC) has been making efforts at market facilitation, more so from the Lethem area. The NGMC started a service of purchasing animals directly from farmers in this area in order to expand market opportunities and facilitate expansion in production. However, the programme was not sustained due to problems with pricing and supply shortages.

The government veterinary officers assist in animal health treatment and education/technology transfer. In previous years, CARDI promoted an expansion programme in the Berbice area which lead to higher populations of the Barbados Black Belly sheep in that area. Currently, some R&D is being undertaken by the National Agricultural Research Institution (NARI). Major focal areas

East & West Berbice (Mara)

included breeding and selection, pen design and construction, and improvement of local breeding stock.

Common production problems include Helminthes, pneumonia, foot rot and attacks from predators (e.g. stray dogs, anaconda and alligators). In addition, there is a need for greater development of abattoirs in decentralized areas to replace the system of backyard slaughtering. Inland transport to market can be prohibitive, especially from Lethem.