1 MACROECONOMIC FACTORS AND STOCK MARKET PERFORMANCE: EVIDENCE FROM

NIGERIA

CYPRIAN OKEY OKORO PhD Student

Department of Banking and Finance, Chukwuemeka Odumegwu Ojukwu University,

Igbariam Campus

+2348033403795, cy.okoro2@yahoo.com

Abstract

The study investigates the effect of selected macroeconomic factors on stock market performance in Nigeria as represented by Nigeria Stock Exchange. The study used five macroeconomic factors or variables including Gross Domestic Product, Money Supply, Interest rate, Inflation rate and exchange rate as explanatory variables while stock market performance obtained by converting All Share Index to stock returns was used as the dependent variable. The data for the study were obtained from CBN Statistical Bulletin, 2015 edition for the period spanning 1986 to 2015. The Ordinary Least Square regression technique was employed for data analysis. The results indicated that a combination of Gross Domestic Products, money supply, interest rate, inflation rate and exchange rate could not be used to predict performance of the stock market in Nigeria. The study, thus, concludes that stock prices is not a leading indicator of macroeconomic variables in Nigeria and that movements in stock prices cannot actually be explained by macroeconomic factors.The study recommended that firms should focus on improving their profitability so as to attract more investors. By so doing they would be able to maximize the value of their firms. Furthermore, future empirical investigations should focus on finding out the best macroeconomic variables that impact positively on stock market performance in Nigeria.

Keywords: Nigeria, stock markets, macroeconomic variables, All Share Index, Arbitrage Pricing Theory

INTRODUCTION

The economic development of all nations requires availability of long-term capital. The stock market is one of the financial institutions that serve as a veritable tool in the mobilization and allocation of savings among competing uses which are critical to the growth and efficiency of the economy (Alile, 1984). Through mobilization of resources the stock market promotes economic growth by providing avenue to pool large and long term capital through issuing of shares and stocks and other equities for industries in dire need of finance to expand their business. For instance, Sohail and Hussain (2009) observed that a well-organized stock market mobilizes savings and activates investment in projects, which promote economic activities in a country. This suggests that the overall development of the economy is a function of how well the stock market performs. While developed economies have fully explored the mobilization of resources through the capital market, the developing countries are yet to fully usurp the benefits of raising capital via the capital market. Thus, the development of the capital market, and apparently the stock market, provides opportunities for greater funds mobilization, improved efficiency in resource allocation and provision of relevant information for appraisal (Inanga & Emenuga, 1997). The performance of stock market can be measured using: Market Capitalization which measures stock market size; Stock Market Liquidity which measures the ability of investors to buy and sell securities easily. Others are All Share Index (ASI) which reflects the performance and condition of the stock market and Turnover Ratio which is the index of comparison for market liquidity rating and the level of transaction costs (Daferighe and Charlie, 2012)

2 prediction of stock price movements is a very challenging and important issue which the investors extensively regard in their investment decisions (Wang, Wang, Zhang & Guo, 2011).

Since, the stock market houses a large chunk of the nation’s wealth and has continued to be the major discourse of various studies since the advent of the global financial crisis, it becomes necessary to investigate the feasibility of enhancing the performance of stock markets of emerging economies through the use of monetary policies.

The macroeconomic hypotheses of stock market price movement advocates that the interactions among macroeconomic variables and the stock market prices for companies quoted on stock markets have consequential effects on both market capitalization and company’s valuations. This might make investors sceptical about the future performance of companies. As a result, the stock prices may drop in the short run as well as the long run. Therefore, Investors in the Nigerian Stock Exchange need information on the influence of macroeconomic variables on the stock market prices for companies quoted on the Stock Exchanges where they participate. Thus, for investors in Nigeria, the effect of selected macroeconomic variables/factors such as Gross Domestic Product, money supply, interest rate, inflation rate and exchange rate, on stock prices in Nigerian becomes needful.

One key problem with the Arbitrage Pricing Theory (APT) is that it could not specify the type or the number of macroeconomic factors that should be incorporated to explain stock prices. It becomes pertinent for empirical studies to be carried out to know a group of economic variables that could be managed to enhance stock market performance especially in Nigeria.

More so, empirical studies on relationships between stock market and real economic activity have given rise to mixed and conflicting conclusions. These divergences in empirical results call for further investigation on the effect of macroeconomic variables on stock market performance.

REVIEW OF RELATED LITERATURE

The stock market is the market where equity securities such as stocks, representing ownership shares in particular corporations issuing the securities, are traded (Alajekwu, Ezeabasili & Nzotta, 2013). It is a complex institution imbued with inherent mechanism through which long-term funds of the major sectors of the economy comprising households, firms, and government are mobilized, harnessed and made available to various sectors of the economy (Nyong, 1997).The stock market avail long-term capital to the listed firms by pooling funds from different investors and allow them to expand their businesses. It also offers investors alternative investment avenues to put their surplus funds as they carefully watch the performance of stock markets (Naik & Padhi, 2012).

THEORETICAL FRAMEWORK

The theoretical framework of this study anchors on the macroeconomic hypothesis school. The macroeconomic proponents posit that stock market prices can be influenced by macroeconomic factors. Two models exist to explain the relationship between macroeconomic variables and stock market prices from the macroeconomic school theoretical view. These are the Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT).The Capital Asset Pricing Model that was developed by Sharpe (1964) and Lintner (1965) investigates the effects, risk had on the expected return of an investment relative to the market portfolio. The Capital Asset Pricing Model relates the expected return of an asset to its riskiness measured by the variance of the asset’s historical rate of return relative to its asset class. The model decomposes a portfolio’s risk into systematic and specific risk. Systematic risk is the risk of holding the market portfolio. To the extent that any asset participates in such general market moves, that asset entails systematic risk. Specific risk is the risk which is unique to an individual asset. It represents the component of an asset’s return which is uncorrelated with general market moves. The CAPM assumes that any portfolio that is mean-variance-efficient and lies on the efficient frontier is also equal to the market portfolio. The implications of this, according to the authors, are that the relation between risk and expected return for any efficient portfolio must also hold for the market portfolio, if equilibrium is to be maintained in the asset market. One deficiency of CAPM is that it is designed to capture one factor at a time and hence cannot be used to examine effect of an array of macroeconomic factors in stock market performance.

3 approximately linearly related to the factor loadings or beta. In other words, the expected returns of a financial asset can be modelled as a linear function of various macroeconomic variables or theoretical market indices, where the sensitivity to change in each factor is represented by a factor– specific beta coefficient. The model-derived rate of return will then be used to price the asset correctly and the asset price should equal the expected end of period price discounted at the rate.

From the following, the researcher noted that the basic assumption of APT is that many macroeconomic factors such as Gross Domestic Product, inflation rate; Interest Rate, Exchange Rate and Money Supply are involved in the determination of risk and return relationship. Hence, the Arbitrage Pricing Theory is the theory underpinning this study.

EMPIRICAL STUDIES

Asaolu and Ogunmuyiwa (2010) examined whether changes in macroeconomic variables explain movements in stock prices in Nigeria. The macroeconomic variables included in the study were external debt, interest rate, fiscal deficit, exchange rate, foreign capital inflow, investment, industrial output. However, average share price of twenty five quoted companies in Nigeria spanning through insurance, manufacturing, banking, service companies and real estate were averaged between 1986 and 2007 to represent the dependent variable while the other variables are the exogenous variables. Various econometric analysis such as Augmented Dickey Fuller (ADF) test, Granger Causality test, Co-integration and Error Correction Method (ECM) were employed on time series data from 1986-2007 and the results revealed that a weak relationship exists between stock prices and macroeconomic variables in Nigeria and only exchange rate was found to granger-cause stock prices in the sample period. The study thus posits that stock prices is not a leading indicator of macroeconomic variables in Nigeria and that movements in stock prices cannot actually be explained by macroeconomic factors

Inyiama and Nwoha (2014) investigated the relationship between macroeconomic variables and the movement of share prices in Nigeria Brewery Industry with evidence from the Nigeria Breweries Plc. The macroeconomic variables employed are interest rate, inflation rate, exchange rate and gross domestic product and share price spanning a timeframe of 2000 to 2012. The ordinary least squares and granger causality methods were used to analyze the data. The result showed relationship between macroeconomic variables and stock prices with inflationary rate, real GDP and exchange rate indicating a positive but insignificant effect while interest rate had a negative and insignificant effect. Furthermore, macroeconomic variables explained only 13% of the variations in share price.

Still in Nigeria, Oseni and Nwosa(2011) employed AR (k)-EGARCH (p, q) technique to examine the volatility in stock market and macroeconomic variables and used LA-VAR Granger Causality test to analyze the nexus between stock market volatility and macroeconomic variables volatility in Nigeria for the periods 1986 to 2010 using time-series data. The study used stock market volatility and volatility in macroeconomic variables such as the real GDP, inflation, and interest rate. The results of the findings revealed that there exists a bi-causal relationship between stock market volatility and real GDP volatility; and there is no causal relationship between stock market volatility and the volatility in interest rate and inflation rate. The study posits that the stock prices were not significant in explaining the inflation rate and interest rate.

Abdulkarim (2014) examined the impact of macroeconomic factors on common stock returns of the manufacturing firms listed on the Nigerian Stock Exchange using 10 firm time serial data between 1991 and 2003. The independent variables of inflation rate, interest rate, exchange rate of domestic currency and gross national income were the macroeconomic variables while stock’s average rate of return was the dependent variable. The OLS regression and correlation technique were employed to analyse the data. The results showed that none of the macroeconomic variables has significant impact on the common stock returns of the sampled firms.

4 that arbitrage profit opportunities exist in the Ghana stock market contrary to the dictates of the Efficient Market Hypothesis (EMH).

Abraham (2012) examined the relationship between the stock market and selected macroeconomic variables in Nigeria from 1985 to 2008. The All Share Index was used as a proxy for the stock market while inflation, interest and exchange rates were the macroeconomic variables selected. Employing Error Correction Model, it was found that a significant negative short run relationship exists between the stock market and the minimum rediscount rate (MRR) implying that, a decrease in the MRR, would improve the performance of the Nigerian stock market. It was also found that exchange rate stability in the long run, improves the performance of the stock market. Though the results for Treasury bill and inflation rates were not significant, the results suggests that they were negatively related to the stock market in the short run. Thus, achieving low inflation rate and keeping the TBR low could improve the performance of the Nigerian stock market. Specifically, the study concludes that, by achieving stable exchange rates and altering the MRR, monetary policy would be effective in improving the performance of the Nigerian stock market.

Owusu-Nantwi and Kuwornu (2011) investigated the relationship between macroeconomic variables and stock market returns using monthly data that spans from January 1992 to December, 2008. Macroeconomic variables used in this study are consumer price index (as a proxy for inflation), crude oil price, exchange rate and 91 day Treasury bill rate (as a proxy for interest rate). The ordinary least square estimation (OLS) model in the context of the Box-Jenkins time series methodology was used in establishing the relationship between macroeconomic variables and stock market returns. Empirical findings reveal that there is a significant relationship between stock market returns and consumer price index (inflation). On the other hand, crude oil prices, exchange rate and Treasury bill rate do not appear to have any significant effect on stock returns. Nkechukwu, Onyeagba and Okoh (2013) evaluated the effect of macroeconomic variables on stock market prices using annual time series datasets for Nigeria for the period 1980-2013. The study employed Nigerian Stock Exchange All Share Index as a proxy for stock market prices and dependent variable while gross domestic product and broad money supply served as the explanatory variables. The data were analyzed with the application of OLS regression technique. The results of the findings indicate that Nigerian stock market prices have long-run relationship with macroeconomic variables. However, GDP has significant long-run negative effect on stock prices contrary to a priori expectation that GDP has significant positive effect on stock prices. But M2 has significant long-run positive effect on stock prices, the result being consistent with a priori expectation. Again, there is unidirectional causal effect between GDP and stock prices with direction running from stock prices to GDP, whereas there is no causal effect between stock prices and broad money supply. However, in the short-run both GDP and M2 have positive but insignificant effect on stock prices in Nigeria. This result suggests that stock market in Nigeria is informational inefficient.

Onakoya (2013) employed the Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH) and examined the contributions of stock market volatility on economic growth in Nigeria for the periods of 1980 to 2010. The variables employed were stock market volatility and volatility in the real GDP, inflation, and interest rate. The results show that Nigerian Stock market is not responsive to changes in macroeconomic factors; hence predicting stock prices and returns via changes in macroeconomic performance becomes precarious.

In Kenya, Ouma and Muriu (2014) investigated the impact of the macroeconomic variables on stock returns in Kenya during the period 2003- 2013, using the Arbitrage Pricing Theory (APT) and Capital Asset Pricing Model (CAPM) framework for monthly data. The Ordinary Least Square (OLS) technique was applied to test the validity of the model and the relative importance of different variables which may have an impact on the stock returns. The empirical analysis stated among others, that with the exception of interest rates, there exists a significant relationship between stock market returns and macroeconomic variables. According to the findings of the study, Money Supply, exchange rates and inflation affect the stock market returns in Kenya. Money supply and inflation are found to be significant determinants of the returns at Nairobi Stock Exchange. Exchange rate is, however, found to have a negative impact on stock returns, while interest rate is not important in determining long run returns in the Nairobi Stock Exchange.

Daferighe and Charlie (2012) employed a simple OLS regression technique to investigate the impact of inflation on stock market performance in Nigeria using time series data for twenty years from 1991 -2010. Inflation rate was regressed on the various stock market performance indicators including market capitalization, total value traded ratio, percentage change in All-share Index and turnover ratio. It was revealed that these measures were negatively related to inflation in convergence to a priori expectation except for TOR which showed a positive relationship.

5 including real money supply, real gross domestic product, consumer price index, real exchange rate, weighted average interest rates on loans and advances, and a dummy variable that capture the effect of the recent non-macroeconomic forces on the stock returns taking 11 September, 2001 in the US, the Iraqi war in 2003, world financial crisis in 2008 and recent political events in 2010 as the forces. The study used ARCH/ GARCH estimation models. The results of the ARCH (1) estimation showed that money supply, consumer price index, exchange rate and interest rate and the Dummy Variable have a negative role on the ASE returns while the RGDP has a positive impact.

Barakat, Elgazzar and Hanafy (2016) examined relationship between the stock market and macroeconomic factors in two emerging economies (Egypt and Tunisia) for the period from January 1998 to January 2014. The independent variables of the study are deposit rate as proxy for interest rate, CPI as proxy for inflation, local currency per US dollar as proxy for exchange rate, M2 as proxy for money supply and Market index as proxy for stock market. Results indicated that there is a causal relationship in Egypt between market index and consumer price index (CPI), exchange rate, money supply, and interest rate. The same goes for Tunisia except for CPI, which had no causal relationship with the market index. Results also revealed that the four macroeconomic factors are co-integrated with the stock market in both countries

SUMMARY OF REVIEW

This study has been anchored on Arbitrage Pricing Theory which posits that macroeconomic variables can be used to explain movement of stock prices. One key problem with the theory is that it could not specify the type or the number of macroeconomic factors that should be incorporated to explain stock prices. A plethora of empirical studies have been reviewed in this section and they have used a vast range of macroeconomic variables to examine their influence on stock prices (returns). However, while these previous studies have improved our understanding of the relationships between stock market and real economic activity, the findings from the literature have given rise to mixed and conflicting conclusions. A group of studies posit that Stock prices is not a leading indicator of macroeconomic variables and that movements in stock prices cannot actually be explained by macroeconomic factors (Asaolu & Ogunmuyiwa, 2010;Oseni & Nwosa, 2011;Onakoya, 2013;Abdulkarim, 2014 and Inyiama & Nwoha, 2014). However, Issahaku,Ustarz and Domanban (2013) noted that long periods needed to achieve adjustment can give room for arbitrage profit opportunities in the stock market contrary to the dictates of the Efficient Market Hypothesis (EMH). Despite these, another group of studies found that macroeconomic variables could have significant effect on stock market performance (Abraham, 2012; Daferighe & Charlie, 2012; El-Nader & Alraimony, 2012; Ouma &Muriu, 2014; and Barakat, Elgazzar and Hanafy, 2016). Owusu-Nantwi and Kuwornu (2011) and Nkechukwu, et al (2013) reported significant effects that conflicts with theoretical propositions. These divergences in empirical results call for further investigation on the effect of macroeconomic variables on stock market performance.

METHODOLOGY

The study adopted an expost facto research design. The study is expost facto because the data is based on historical information obtainable from the official records of the stock exchange. The data were obtained from secondary sources. The data were generated from the CBN Statistical Bulletin, 2015 edition. The model was specified on Arbitrage Pricing Theory which assumes that multiples of macroeconomic variables combine to explain stock market performance. Thus, the present study which models stock market performance as a function of five macroeconomic variables seem as very instrumental to Nigerian economy. The model is shown as below:

SMP = f(GDP, MS, INTR, INFLR, EXR) (1)

This can be rewritten in equation form as follows:

SMP = α0 + β1LnGDP + β2LnMS + β3LnINTR + β4INFLR + β5LnEXR +µ (2)

Where

Β1-5 is the sensitivity of each of the macroeconomic variables to stock returns, and µ is the disturbance

term. Ln means the natural logarithm of the variable.

SMP = stock market performance represented by annual values of the All Share Index (ASI) in the Nigerian stock market. ASI is the broad market indicator of the stock market and measures the overall performance of the stock market. This index is computed by the Nigerian Stock Exchange. The ASI is converted into stock market returns using the formula below:

Rmt= Ln(Pt / Pt-1)*100 (3)

Where: Rmt represents yearly market return for period t, Ptand Pt-1denote market prices for period t and period

6 the data into continuously compounded rates. This practice is common rather than using discrete compounding (Simons & Laryea, 2015).

LnGDP = Gross Domestic Product as a proxy for economic growth. It is expected that a growing economy will enhance the performance of stock market.

LnMS = represents the broad money supply in the Nigerian economy. The Appriori expectation is that an increase in money supply will increase the liquidity in the economy resulting in an increase in the

purchasing power of the citizenry. This means that more money will be available not just for consumption but also for investment. Hence, a positive relationship is expected.

LnINTR = is the 91-Day Treasury bill rate used as proxy for interest rate since Treasury bill serves as the opportunity cost of holding shares and as a benchmark for measuring interest rate. It is expected that high interest rate regimes lead to high cost of borrowing and hence a reduction in economic activity, thereby affecting corporate profit, future cash flow of business and dividend. Therefore interest rates are expected to be negatively related to market returns either through the inflationary or discount factor effect (Mukherjee and Naka, 1995).

LnEXR = is the exchange rate of the Naira per US dollar. A fall in the Nigerian currency is likely to affect the economy negatively. In an economy which is import driven, a depreciation of the local currency will drive pricing upward which will make it difficult for people to save for investment. Hence, a negative effect is hypothesised between exchange rate and stock performance.

LnINFLR= is the inflation rate which is derived from the consumer price index. In times of inflation, prices are always unstable and rising. Income is therefore devoted for consumption purposes. Savings and investment will therefore be negatively affected. Based on the above argument, the expected effect will be negative.

The OLS regression technique was used to analyse the data employed in the study. The variables were tested for normality and multicolinearity using descriptive statistics and correlation matrix.

RESULTS AND INTERPRETATION

The OLS regression is performed in this section and used to address the objectives of the study. At first, the descriptive statistics presented on Table 1 is used to explain the normality of the variables; Table 2 has correlation matrix used to determine presence of multicolinearity in the model. Then the result on Table 3 is the model estimation that addressed both the main and specific objectives of the study.

Table 1: Descriptive Statistics

Mean Std. Deviation N

SMP 4.7909 .29583 30

LnGDP 8.6174 1.96363 30

LnMS 6.8157 2.16312 30

LnINTR 2.9192 .20144 30

LnINFLR 2.6871 .77151 30

LnEXR 3.8211 1.36544 30

Source: SPSS output from researchers computation.

The result of Table 1 shows that mean stock market return (performance) is 4.79 with standard deviation of 0.29. The mean of LnGDP, LnMS, LnINTR, LnINFLR and LnEXR show that the mean are larger than their respective standard deviations. This suggests that the variables have normal distribution and thus have relative predictability. It also suggests that there may not be an outlier in the series capable of distorting the result.

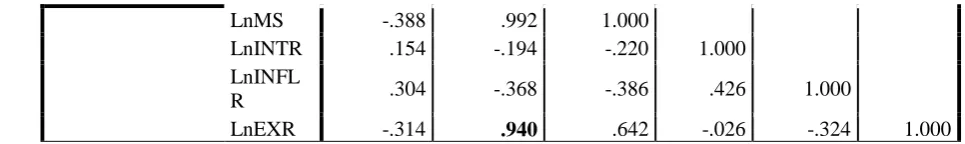

Table 2: Correlation Matrix for test of multicolinearity of the model

SMP LnGDP LnMS LnINTR LnINFLR LnEXR

Pearson Correlation SMP 1.000

7

LnMS -.388 .992 1.000

LnINTR .154 -.194 -.220 1.000

LnINFL

R .304 -.368 -.386 .426 1.000

LnEXR -.314 .940 .642 -.026 -.324 1.000

Source: SPSS output from researchers computation.

Having shown that the variables have normal distribution and hence suitable for parametric statistical test, it is also good to determine the suitability of the model of the study. The test of presence of multicolinearity is examined using the Correlation Matrix on Table 2 above. Presence of correlation coefficients above 0.7 between the explanatory variables connotes colinearity, and the presence of more than one colinearity suggests multicolinearity in the model. The result shows that only correlation coefficient of LnGDP and LnEXR are above 0.07 that is 0.94. Thus, we conclude that there is no multicolinearity in the model. This implies that the result of the model is robust and reliable.

This test of autocorrelation using Durbin Watson statistics is presented on Table 3 below. The result is 1.626 which is approximately equal to 2. Since the result is 2, we conclude that there is no autocorrelation in the model. This also indicates that the variables are well behaved and none of the variables will distort the result of the study.

Table 3: Model estimation

Model Unstandardized Coefficients Standardized Coefficients

t Sig.

B Std. Error Beta

1

(Constant) 4.787 1.067 4.486 .000

LnGDP .326 .207 2.167 1.574 .129

LnMS -.412 .205 -3.009 -2.003 .057

LnINTR -.218 .340 -.149 -.641 .528

LnINFLR .069 .078 .180 .879 .388

LnEXR .117 .135 .540 .863 .397

Coefficient of Determination (R2) = 0.278

Adjusted R2 = 0.127

F-statistics = 1.848 F.Prob. = .142

Durbin Watson = 1.626

Dependent Variable: SMP; Predictors: (Constant), LnEXR, LnINTR, LnINFLR, LnGDP, LnMS Source: SPSS output from researchers computation.

The model estimation is presented on Table 3 above. The result is used to address both the main objective and the specific objectives of the study. The main objective is addressed using result of the coefficient of determination (R2) and F-statistics. The result of the R2, 0.278 which indicate that about 28% of changes in

the dependent variable (stock market performance) is explained by changes in the explanatory variables (macroeconomic indicators such as GDP, MS, INTR, INFL and EXR). The results indicate about 72% of factors that determine stock market performance is not captured by these macroeconomic indicators. However, the F-statistics result is 1.848 with probability value of 0.142. Since the F-probability is greater than 0.05, this indicate that the result is not statistically significant. Thus, we conclude that macroeconomic indicators are not statistically significant determinants of stock market performance in Nigeria.

The coefficients of regression showed that Gross Domestic Product (LnGDP = 0.326.), inflation rate (LnINFLR = 0.069), and exchange rate (LnEXR = 0.117) have positive effect on stock market performance while money supply (LnMS = -0.412) and interest rate (LnINTR = -0.218) had negative effect on stock market performance. The result of the t-statistics showed probability values greater than 0.05 level of significance for all the explanatory variables. This means that all the variables (LnGDP, LnMS, LnINFL, LnINTR and LNEXR) do not have significant effect on stock market performance in Nigeria.

CONCLUSION AND IMPLICATION OF FINDINGS

8 inflation rate and exchange rate could not be used to predict performance of the stock market in Nigeria. This study have, thus, joined Asaolu and Ogunmuyiwa (2010), Oseni and Nwosa (2011), Onakoya (2013), Abdulkarim (2014), and Inyiama and Nwoha (2014), to posit that stock prices is not a leading indicator of macroeconomic variables in Nigeria and that movements in stock prices cannot actually be explained by macroeconomic factors. It, thus, means that Arbitrage Portfolio Theory does not hold in Nigeria Stock Exchange. This is an indication that Nigerian stock market is not efficient. By this position one would expect that arbitraging cannot be a profitable investment strategy.

The implication of this conclusion is that stock market prices cannot easily be predicted from movements of macroeconomic factors like GDP, inflation, interest rate, exchange rate and money supply. Thus, it will be difficult to use monetary policies to plan and forecast macroeconomic indicators that will enhance stock market activities. By extension, it will be unsound for investors to rely on the announcement of macroeconomic variables in deciding whether or not to invest or not to invest since stock price changes are not influenced by macroeconomic indicators.

RECOMMENDATIONS

1. One of the recommendations posed by this study is that firms should focus on improving their profitability performance so as to attract more investors. By so doing they would be able to maximize the value of their firms.

2. Future empirical investigations should focus on finding out the best macroeconomic variables that impact positively on stock market prices in Nigeria.

REFERENCES

Abdulkarim, G. (2014). Impact of macroeconomic factors on common stock returns: A study of listed manufacturing firms in Nigeria. European Journal of Business and Management, 6(13), 140 – 150. Retrieved from http://www.iiste.org/Journals/index.php/EJBM/article/viewFile/12699/12974. Abraham, T. W. (2012). Stock market reaction to selected macroeconomic variables in the Nigerian

economy. CBN Journal of Applied Statistics, 2(1), 61 – 70. Retrieved from

https://www.cbn.gov.ng/OUT/2012/PUBLICATIONS/REPORTS/STD/STOCK%20MARKET%20 REACTION%20TO%20SELECTED%20MACROECONOMIC%20VARIABLES.PDF.

Alajekwu, U. B., Ezeabasili, V. N. & Nzotta, S. M. (2013). Trade openness, stock market development and economic growth of Nigeria: Empirical evidence. Research Journal of Finance and Accounting, 4(3), 120 – 127.

Aldin, M., Dehnavi, D. & Entezari, S. (2012). Evaluating the employment of technical indicators in predicting stock price index variations using artificial neural networks: A Case Study of Tehran Stock Exchange. International Journal of Business and Management, 7 (15), 36 - 49.

Alile, H. I.(1984). The Nigerian Stock Exchange: Historical perspective, operations and contributions to economic development. Central Bank of Nigeria Bullion, Silver Jubilee Edition 2, 65-69.

Asaolu, Y. O. & Ogunmuyiwa, M. S. (2010). An econometric analysis of the impact of macroeconomic variables on stock market movement in Nigeria. Asian Journal of Business Management 3(1), 72-78. Retrieved from http://maxwellsci.com/print/ajbm/v3-72-72-78.pdf.

Barakat, M. R., Elgazzar, S. H. & Hanafy, K. M. (2016). Impact of macroeconomic variables on stock markets: Evidence from emerging markets. International Journal of Economics and Finance, 8(1), 195 – 207. Retrieved

fromhttp://www.ccsenet.org/journal/index.php/ijef/article/download/54784/30012. Daferighe, E. E. & Charlie, S. S. (2012). The impact of inflation on stock market performance in

Nigeria.American Journal of Social and Management Sciences, 3(2): 76-82. doi:10.5251/ajsms.2012.3.2.76.82. Retrieved from

9 El-Nader, H. M. & Alraimony, A. D. (2012). The impact of macroeconomic factors on Amman stock

market returns. International Journal of Economics and Finance, 4(12), 202 – 213. doi:10.5539/ijef.v4n12p202. Retrieved from

http://ccsenet.org/journal/index.php/ijef/article/viewFile/22094/14461.

Inanga, I. L. & Emenuga, C. (1997). Institutional, traditional and asset pricing characteristics of the Nigerian Stock Exchange, African Economic Research Consortium Research paper 60 March 1997. Inyiama, O. I. &Nwoha, C. (2014).Macroeconomic variables and share price movements in Nigeria

brewery industry: Evidence from Nigerian Breweries plc. European Journal of Accounting Auditing and Finance Research, 2(5), 19-32. Retrieved from

http://www.eajournals.org/wp- content/uploads/Macroeconomic-Variables-and-Share-Price-Movements-in-Nigeria-Brewery-Industry1.pdf.

Issahaku, H., Ustarz, Y. &Domanban, P. B. (2013). Macroeconomic variables and stock market returns in Ghana: Any causal link? Asian Economic and Financial Review, 2013, 3(8), 1044-1062. Retrieved from http://www.aessweb.com/pdf-files/aefr%203(8),%201044-1062.pdf.

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47(1), 13 - 37.

Nkechukwu, G., Onyeagba, J. & Okoh, J. (2013). Macroeconomic variables and stock market prices in Nigeria: A cointegration and vector error correction model tests. International Journal of Science and Research, 4(6), 717 – 724. Retrieved from http://www.ijsr.net/archive/v4i6/SUB155162.pdf. Nyong, M. O. (1997). Capital market development and long-run economic growth: Theory,evidence and

analysis, First Bank Review, December: 13-38.

Onakoya, A. B. (2013). Stock market volatility and economic growth in Nigeria (1980-2010). International Review of Management and Business Research, 2(1), 201 - 209. Retrieved from http://irmbrjournal.com/papers/1367573041.pdf.

Oseni, I. O. & Nwosa, P. I. (2011). Stock market volatility and macroeconomic variables volatility in Nigeria: An Exponential GARCH Approach. Journal of Economics and Sustainable Development, 2(10), 28 – 42. Retrieved from

http://www.iiste.org/Journals/index.php/JEDS/article/download/791/694.

Ouma, N. W. &Muriu, P. (2014). The impact of macroeconomic variables on stock market returns in Kenya. International Journal of Business and Commerce, 3(11), 1-31. Retrieved from

http://www.ijbcnet.com/3-11/IJBC-14-31001.pdf.

Owusu-Nantwi, V. & Kuwornu, J. K. M. (2011). Analyzing the effect of macroeconomic variables on stock market returns: Evidence from Ghana. Journal of Economics and International Finance, 3(11), 605-615. Retrieved from http://www.academicjournals.org/journal/JEIF/article-full-text-pdf/D41BE5F5772.

Ross, S. A. (1976). The arbitrage theory of capital asset pricing. Journal of Economic Theory, 13, 341-360. Sharpe, W. F. (1964). Capital Asset Prices: A theory of market equilibrium underconditions of risk.

Journal of Finance, 19(3), 425 - 442.

Simons, D. & Laryea, S. A. (2015). Testing the efficiency of selected African stock markets. Retrieved on 20th October, 2016 from

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.467.7105&rep=rep1&type=pdf. Sohail, N. & Hussain, Z. (2009). Long-run and short-run relationship between macroeconomic variables

and stock prices in Pakistan, the case of Lahore stock exchange. Pakistan Economic and Social Review, 47(2), 183-198.

Wang, J., Wang, J., Zhang, Z., and Guo, S. (2011). Forecasting stock indices with Back propagation neural network. Expert Systems with Applications, 37 7056–7064.