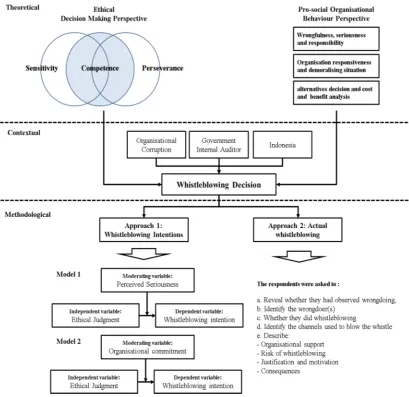

Whistle blowing decisions in responding to organisational corruption in government internal audit units in Indonesia

Full text

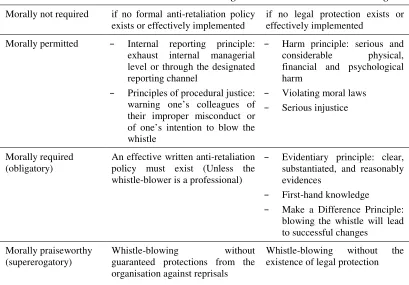

Figure

Outline

Related documents

PART I: HISTORY, IDEAS, VALUES CHAPTER 1: A HISTORY OF TRADITIONAL ASTROLOGY IN A FEW PAGES We astrologers like to talk about the antiquity of what we do, but many people don’t

Wenn die Ziffer IT mit einem kleinen Bindebogen versehen, iiber oder unter drei Noten gesetzt wird, so wird diese Gruppe als eine Triole bezeichnet, und die drei Noten werden im

SHLD 16-bit address The contents of register L are stored into the memory location specified by the 16-bit address in the operand and the contents of H register are stored into

A) The definition should allow the researcher to obtain all the information needed to address the management decision problem. B) The definition should guide the researcher

Mechanisms and instruments that promote responsible investment in agriculture and food systems are indispensable to achieve higher productivity, inclusive growth, poverty reduction

Similarities in the development of the crises include: (1) the formation and bursting of an asset price bubble, which caused debt levels to expand too much and then subsequently

Mohnish Pabrai, in his new book The Dhandho Investor, gives examples of the use of the Kelly Criterion for investment situations..

Figure 2.1 shows the values derived from the first column of Table 10.2, split by Charities Tax Repayments (excluding corporate Gift Aid and Tax Credits), corporate Gift Aid and