Risk preference discrepancy : a prospect relativity account of the discrepancy between risk preferences in laboratory gambles and real world investments

Full text

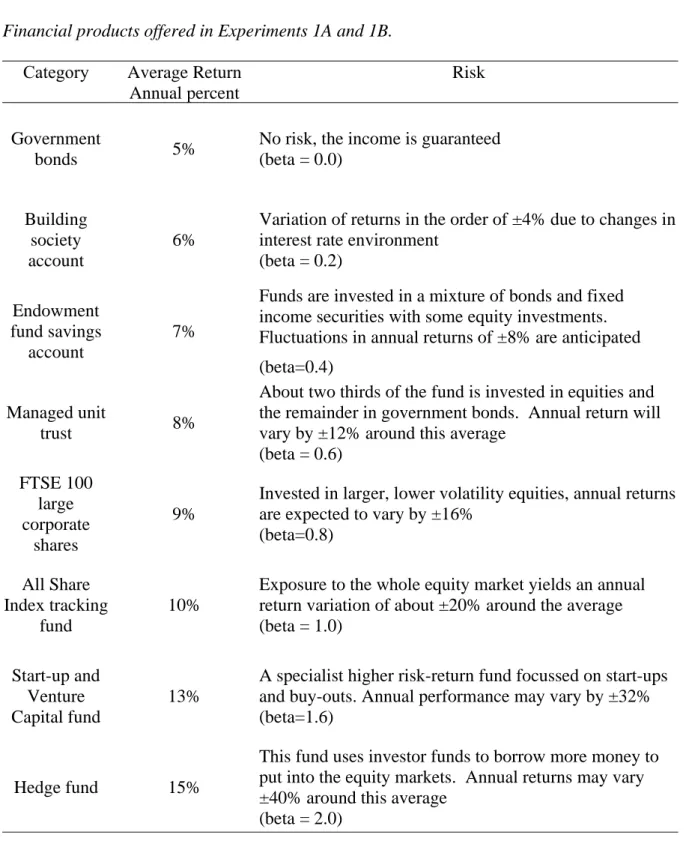

Figure

Related documents

In this presentation on the alternative fuels market, financial statistics are provided for CTL, gas- to-liquids, and biomass-to-liquids markets. Oil prices must remain in a

However, in contrast to the K&R conclusion that capital accumulation alone ac- counts for the positive shift in the distribution of output per worker, we found that either

Select the correct answer and then mark you r selection on your answer sheet...

The first Upper Waikato session was intended to introduce participants to the simulation platform, give them a chance to trade and experience the (potential) complexity of

We adapted a well-established resource-competition model to show that fluctuations in inflow concentrations of two limiting resources lead to the survival of species in clumps along

Our case-based analysis of the biotechnology industry in Belgium shows that strategic technology partner- ships between new biotechnology firms and estab- lished,

Further, estimated regression coefficients of mutual covariates in respective distress prediction models for listed and unlisted SMEs also show striking differences in their