Contents lists available at ScienceDirect

Finance Research Letters

journal homepage: www.elsevier.com/locate/frlCre

dit-implie

d forward volatility and volatility

expectations

Hans Byström

∗DepartmentofEconomics,LundUniversity,Box7082,22007Lund,Sweden

a

r

t

i

c

l

e

i

n

f

o

Articlehistory:

Received16September2015 Accepted26October2015 Availableonline31October2015 JELclassification: G1 G10 G17 G53 Keywords: CDS

Impliedvolatilitytermstructure Forwardvolatility

Forwardstartoptions

a

b

s

t

r

a

c

t

Weshowhowonecanbackoutimpliedforwardvolatilityterm struc-turesfromcreditdefaultswapspreads.Suchforwardstockvolatility termstructuresareusefulforinstanceinforwardstartoptionpricing. Wefindthetermstructuretobedownward-sloping,andthecredit market’svolatilityforecaststendtovarymoreacrosstimethanacross maturities.Long-termvolatilityexpectations,inturn,arefoundtobe lowandstablewhileshort-termexpectationsarehigherandmore volatile.Thevolatilityexpectation’smean-reversionrate,finally, in-dicatesthatthecreditmarketexpectsvolatilityshocksintheequity markettolastforseveralyears.

© 2015TheAuthors.PublishedbyElsevierInc. ThisisanopenaccessarticleundertheCCBY-NC-NDlicense (http://creativecommons.org/licenses/by-nc-nd/4.0/).

1. Introduction

WefollowByström(2013)andbackoutimpliedstockvolatilitiesfromcreditdefaultswapspreads. While Byström(2013)backsout ordinaryimplied volatilities,weinstead focusonso-calledforward volatilities,i.e.volatilitiesfortime-periodsthatstartinthefuture.Suchvolatilitiesareneededwhen pricingexoticderivativessuchasforwardstartoptions,cliquetsorforwardstarting“goldenhandcuff” employeestockoptions(Alford&Boatsman,1995;Glasserman&Wu,2011).Wethenproceedto estimat-ingvolatilityexpectations,forthefirsttime(webelieve)explicitlyestimatingthecreditmarket’s short-andlong-termequityvolatilityexpectations.

∗ Correspondingauthor.Tel:+462229478;fax:+462224118. E-mailaddress:hans.bystrom@nek.lu.se

http://dx.doi.org/10.1016/j.frl.2015.10.027

1544-6123/© 2015TheAuthors.PublishedbyElsevierInc.ThisisanopenaccessarticleundertheCCBY-NC-NDlicense (http://creativecommons.org/licenses/by-nc-nd/4.0/).

Inadditiontorepresentingthecreditmarket,ratherthantheequitymarket,thecreditdefaultswap (CDS)markethascertainfeaturesthatmakeitparticularlyusefulforthepurposeofforecastingforward volatilities.First,thematuritiesofcreditdefaultswapsaremuchlongerthanthoseofordinaryequity options.Thismakesitpossibletoforecaststockvolatilitiesstartingseveralyearsintothefuture.Second, theavailabilityofconstant-maturityCDScontractswitharangeofmaturities,n=1,2,3,… ,10years makeitpossibletobackoutforwardvolatilitiesforanycalendaryear1to10yearsintothefuture.This featuresetsthisstudy/marketapartfrompreviousstudies/marketsrelyingonbothfewerand/orchanging maturities.Third,theCDSmarkethasbecomeamaturemarketcoveringmanyregions,countriesand firms(Byström,2015).ThismakestheCDSmarketapromisingnewcandidateforanyonewhowantsto estimateimpliedforwardstockvolatilities.

Thereareseveralstudiesthatlookatthetermstructureofimpliedvolatilities.1 Inthispaperwebuild, firstandforemost,onByström(2013)backingoutimpliedstockvolatilitiesusingcreditdefaultswaps.We thenusethesevolatilitiestocalculateforwardvolatilitiesandshort-andlong-termvolatilityexpectations (inthecreditmarket)forthestocksintheDowJonesIndustrialAverage(DJIA)index.

2. Impliedvolatility

Impliedstockvolatilitiesaretypicallyinferredfromequityoptions.AsdescribedbyByström(2013, 2015),however,impliedstockvolatilitiescanalsobeinferredfromcreditdefaultswapsusingCDS pric-ingmodelssuchastheindustrybenchmarkCreditGradesmodel(CreditGrades,2002).InCreditGrades,a firmdefaultswhenitsassetvalue,Vt,fallsbelowitsstochasticdefaultthresholdLtD.Disthefirm’sdebt levelandLtistheglobalrecoveryrateonthefirm’sliabilities.TheCreditGradesCDSspreadforacertain maturity,T,isthen

spreadCDST =r

(

1−R)

1−P

(

0)

+erξ(

G(

T+ξ)

−G(ξ))

P

(

0)

−P(

T)

e−rT−erξ(

G(

T+ξ)

−G(ξ))

(1) wherethesurvivalprobabilityP(t)isP

(

t)

=N −At 2 + ln(

d)

At −dN −At 2 − ln(

d)

At and d= V0 LmeanD eλ2, At2=σ

2t+λ

2, G(

t)

=dz+1 2N −ln(

d)

σ

√t −zσ

√ t +d−z+1 2N −ln(

d)

σ

√t +zσ

√ t ,ξ

=λ

2σ

2, z= 1 4+ 2rσ

2.σ

istheassetvolatilityandσ

=(σ

EEt)/(Et+LmeanD)whereEtistheequityvalueandσ

Eisthestock volatility(thatwebackout).ristherisk-freeinterestrate,RistheCDS-specificrecoveryrateandLmean andλ

isthemeanandstandarddeviationoftheglobalrecoveryrate,Lt.WesetLmean=Randfollowthe recommendationsinCreditGrades(2002)choosingR=0.5andλ

=0.3.1Stein(1989)looksatthemean-revertingpropertiesofimpliedvolatility.XuandTaylor(1994)estimatesforwardvolatilities

andestimatesshort-andlong-termvolatilityexpectations.Heynenetal.(1994)testsrestrictionsontheimpliedvolatilityterm structureandCampaandChang(1995)teststheexpectationshypothesisintheimpliedvolatilitytermstructure.Mixon(2007)also testswhetherthetermstructureofimpliedvolatilitiesisconsistentwiththeexpectationshypothesisandEgelkrautetal.(2005) studiesforwardvolatilitiesandvolatilityprediction.

3. Impliedforwardvolatility

VolatilitiesimpliedbyoptionpricesorCDSspreadsareexpectationsofvolatilitiesovertime-periods startingtoday.Forcertainpurposes,such aspricingforwardstart optionsoremployee optionswith “goldenhandcuffs”,therequiredvolatilitiesareexpectedvolatilitiesacrosstime-periodsstartinginthe future.Thesevolatilitiesareknownasforwardvolatilitiesand,inoursetup,impliedforwardvolatilities (variances)fT,tforeachfutureyearT,2≤T≤10,canbecomputedattimetfromimpliedvolatilitiesyT,t (yT,t=

σ

E)withmaturitiesT,1≤T≤10,as:fT,t=Ty2T,t−

(

T−1)

y2T−1,t. (2) 4. AvolatilitytermstructuremodelInourvolatilitytermstructuremodel,whichissimilartothemodelbyXuandTaylor(1994),CDS mar-ketparticipantsformvolatilityexpectationsthatarefunctionsofthreeparameters;theshort-term ex-pectation

α

,thelong-termexpectationμ

andtherateofmeanreversion,φ

,whichdeterminesthespeed withwhichthevolatilityexpectationrevertstowardsμ

.XuandTaylor(1994)showsthattheexpected forwardvariancegT,tisalinearcombinationofα

2andμ

2:gT,t=

μ

2t +xT,tα

2 t −μ

2t (3) with xT,t=φ

T−1−φ

T 1−φ

, (4)assuming

φ

<1.ByminimizingthedifferencebetweenfT,tandgT,t,followingthethree-step regression-basedestimationproceduredescribedbyXuandTaylor(1994),wegetdailyα

t,μ

t andφ

ˆt estimates. ComparedtoXuandTaylor(1994)wehavetheadvantageof(i)havingconstantmaturitiesacrossthe sample,(ii)havingmaturitiesthatarecountedinyearsand(iii)eachdayhavingthesamenumberof maturities(10).5. Data

OurdatasetcontainsCDSspreads,stockpricesandleverageratiosforthefirmsintheDJIAindexfrom January1,2006toSeptember30,2010.2 ,3 TheCDSdataisavailableforconstantmaturitiesofnyearswith n=1,2,3,… ,10,andallCDScontractsareseniorUSDcontracts.Thestockpricesarealsodenominated inUSD,andasaproxyfortherisk-freeinterestrateweusetheaverageUS3monthTreasurybillrate.4 6. Results

Descriptivestatisticsonforecastedone-yeartonine-yearaheadforwardvolatilitiesispresentedin

Table1(year2startsoneyearfromnowandyear10startsnineyearsfromnowetc.).5 ,6 Thenear-term

volatilityforecastsareobviouslyhigherthanthedistant-termforecasts.Thenear-termforecastsarealso morevolatile.7 InFig.1weshowtheforwardvolatilitiesfortheaveragefirminthesampleanditisclear

2Onlynon-financialfirmsareincludedinthestudyandsincesomefirmslackavailabledataoursampleisreducedto22firms. 3Thestartdateisdictatedbydataavailability;before2006wedonotfindCDSdataforallthe(10)maturities.Theenddate,

inturn,isdictatedbytheneedforareasonablylongout-of-sampleperiodfortheforwardvolatilityforecasts(thecalendaryears 2011–2014).

4Leverageratiosaredownloadedfromtheweb-pageofA.DamodaranandtherestofthedataisdownloadedfromDatastream. 5Whileweonlyestimateone-yearforwardvolatilities,ourmethodanddataallowfortheestimationofn-year(n=2,3,…)

volatilitiesaswell.

6WeproxytheJanuary1,2011forecastwiththeSeptember30,2010forecast.

7Itshouldbenoted,though,thatalthoughthenineforwardvolatilityforecastsaremadesimultaneouslytheyareforecastsfor

differenttime-periods.Forexample,theone-yearaheadforecastsareforthecalendaryears2007to2012andthenine-yearahead forecastsareforthecalendaryears2015to2020.

Table1

Descriptivestatisticsforannualizedone-yeartonine-yearaheadcredit-implied forwardvolatilitiesaveragedacrossthe22non-financialDJIAfirmsforthe time-periodJanuary1,2006toSeptember30,2010.

Mean(%) Stdev(%) Skewness Kurtosis

Year2 41.4 5.7 –0.10 –1.22 Year3 38.8 4.6 0.41 –0.40 Year4 39.3 4.2 0.14 –1.13 Year5 38.0 3.7 0.54 –0.21 Year6 35.4 3.1 0.74 0.88 Year7 34.2 3.1 0.89 1.36 Year8 34.0 3.3 0.71 0.42 Year9 33.5 3.3 0.72 0.50 Year10 33.1 3.3 0.73 0.55

Fig.1. One-yeartonine-yearaheadcredit-impliedforwardvolatilitiesaveragedacrossthe22non-financialDJIAfirmsforthe time-periodJanuary1,2006toSeptember30,2010.

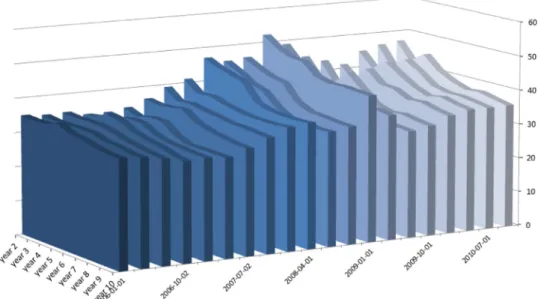

that,regardlessofhorizon,theforecastedvolatilityincreasesduringthecrisis.Fig.2showsa3D-plotof theforwardvolatilitytermstructuresampledonaquarterlybasisanditisclearnotonlythattheterm structureisdownward-slopingbutalsothatbothitslevelandslopevaryovertime.

Thefinancialcrisismakesitdifficulttoevaluatetheaccuracyofvolatilityforecastsandinthispaperwe thereforechooseadifferentpath.InFigs.3–4wepresentsnapshotsfromthesetofforecastsinFig.1.We limittheforecaststothoseforwardvolatilityforecaststhataredonethefirsttradingdayeachcalendar yearfrom2006to2011.Theresultingforwardvolatilityforecastsforthecalendaryears2007to2014are plottedbothinFig.3,withthedependentvariablebeingtheyear,

τ

,fortheforecast,andinFig.4,with thedependentvariableinsteadbeingtheyear,t,whentheforecastismade.Inanidealworld,wherethemarketalwayspredictsfuturevolatilitiescorrectly,thesevencurvesin

Fig.3shouldoverlap.Inreality,theforecastsdifferfromeachother,however;thecreditmarket over-estimatedtheforwardvolatilityfortheyearsafterthecrisisandunder-estimateditforthecrisisyears. ThecurvesinFig.4,inturn,shouldbehorizontalifthemarkethadperfectforesight.Instead,theactual

Fig.2. The(average)credit-impliedforwardvolatilitytermstructuresampledonaquarterlybasisoverthetime-periodJanuary1, 2006toSeptember30,2010.

Fig.3. Credit-impliedforwardvolatilityforecastsmadethefirsttradingdayinJanuaryeachyearfrom2006to2011.Thevariable onthex-axisistheyear,τ,fortheforecast(thecalendaryears2007to2014).

forecastsdemonstrateanupward-slopingpatternwheretheforecastoftheforwardvolatilityincreases overtimeregardlessoftheyear,

τ

,fortheforecast.Ingeneral,theforecastvariationissmalleramongthe variousτ

thanamongthevarioust;i.e.thecreditmarket’sequityvolatilityforecaststendtovarymore acrosstimethanacrossmaturities.Fig.4. Credit-impliedforwardvolatilityforecastsforthecalendaryears2007to2014.Thevariableonthex-axisistheyear,t,when theforecastismade(thefirsttradingdayinJanuaryeachyearfrom2006to2011).

Fig.5. Short-andlong-termvolatilityexpectations(αandμ)averagedacrossthe22non-financialDJIAfirmsforthetime-period January1,2006toSeptember30,2010.

Themodel-impliedshort-andlong-termvolatilityexpectations

α

andμ

arepresentedinFig.5(mean valuestogetherwith25%-and75%-percentiles).Thecreditmarket’slong-termexpectationsarequite stablearound30%whiletheshort-termexpectationsfluctuatebetween40and75%.Theaveragevolatility expectationmean-reversionrateφ

isfoundtobe0.9andvariesbetweenaround0.8in2006and0.95in 2010;i.e.,a“half-life” of3–13yearswithanaverageof7years(0.97≈0.5).4. Conclusion

Inthispaperweshowhowonecanbackout impliedforwardstockvolatilitiesfromCDSspreads andthenusethesevolatilitiestoestimateshort-andlong-termvolatilityexpectations.Wefindthe for-wardvolatilitytermstructuretobedownward-sloping,andthecreditmarket’svolatilityforecaststend tovarymoreacrosstimethanacrossmaturities.Thecreditmarket’slong-termvolatilityexpectationfor thestocksintheDJIAindexisaround30%whiletheshort-termexpectationfluctuatesbetween40and 75%.Meanwhile,theaveragemean-reversionrateinthevolatilityexpectationcorrespondstoa“half-life” ofaround7years.I.e.,volatilityshocksintheequitymarketareexpectedtolastforlong.Webelievethis tobethefirstattemptatestimatingthecreditmarket’sshort-andlong-termexpectationsaboutfuture stockvolatility.

Acknowledgment

Financial assistancefromTheMarianneandMarcusWallenberg Foundation[MMW2012.0019]is gratefullyacknowledged.

References

Alford,A.W.,Boatsman,J.R.,1995.Predictinglong-termstockreturnvolatility:implicationsforaccountingandvaluationofequity derivatives.TheAccount.Rev.70(4),599–618.

Byström,H.,2013.Stockpricesandstockreturnvolatilitiesimpliedbythecreditmarket.WorkingPaper2013,25LundUniversity. Byström,H.,2015.Credit-impliedequityvolatility– long-termforecastsandalternativefeargauges.J.FuturesMarkets35,753–775. Campa,J.M.,Chang,P.H.K.,1995.Testingtheexpectationshypothesisonthetermstructureofvolatilitiesinforeignexchangeoptions.

J.Finan.50,529–547.

CreditGrades,2002.CreditGrades.TechnicalDocument.RiskMetricsGroup.

Egelkraut,T.M.,Garcia,P.,Sherrick,B.J.,2005.Thetermstructureofimpliedforwardvolatility:recoveryandinformationalcontent inthecornoptionsmarket.AmericanJ.Agric.Econ.89,1–11.

Glasserman,P.,Wu,Q.,2011.Forwardandfutureimpliedvolatility.Int.J.Theor.Appl.Finan.14,407–432.

Heynen,R.,Kemna,A.,Vorst,T.,1994.Analysisofthetermstructureofimpliedvolatilities.J.Finan.Quant.Anal.29,31–56. Mixon,S.,2007.Theimpliedvolatilitytermstructureofstockindexoptions.J.Empir.Finan.14,333–354.

Stein,J.,1989.Overreactionintheoptionsmarket.J.Finan.44,1011–1023.