The Implied Benchmark Rate in the Credit Default Swap Market of Sovereign Bonds

Full text

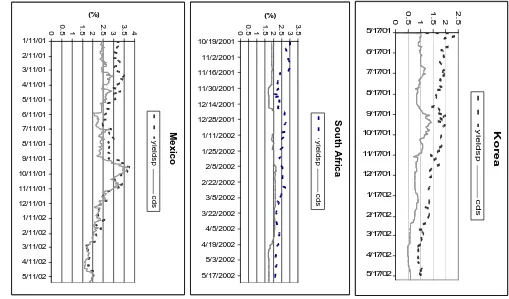

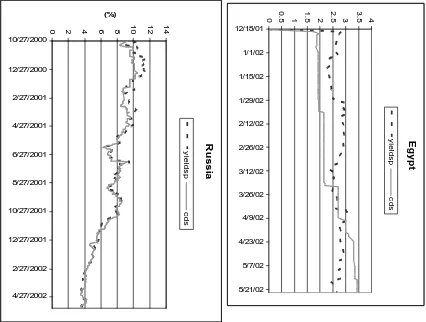

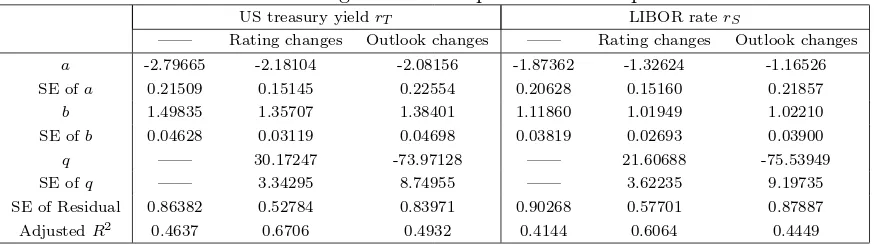

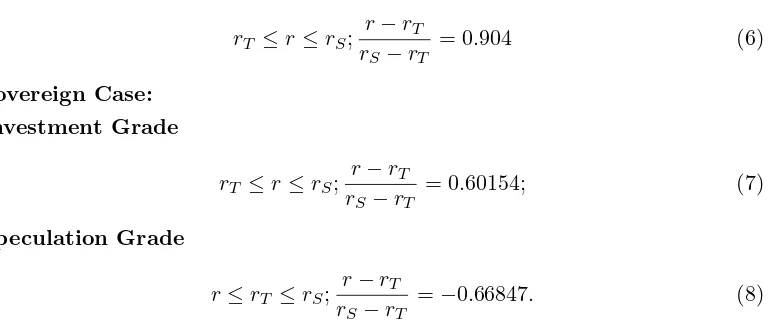

Figure

Related documents

For the non-optimized pY907 PARP-1, QVina2 actually predicted stronger binding affinities for all three PARPi, with the average docking score of -10.5 kcal/mol (Table 10).

EYCE wants to tackle the questions above by organising a training course with the following main themes: theoretical overview on policies facilitating integration and

We presented a quadratic lower bound on the number of iterations performed by Howard’s algorithm for finding Minimum Mean-Cost Cycles (MMCCs)... lower bound is quadratic in the

Figure 4: (left) Relaxation strength Δε i of the i-th process in comparison to the relative high frequency permittivity ε ∞ , (right) apparent direct current electrical

Furthermore, to determine the performance of the engine over the entire cruise phase of flight, the relation between the overall installation force

According to more recent research, HGFs often perceive access to finance more problematic than less rapidly growing firms and nearly 20% of high growth ventures consider access

Utilizing data from Federal Reserve Y-9 reports, Bloomberg Government estimated that the top 10 bank holding companies by assets, the smallest of which had assets of $172

Likewise, the observers , with average levels of brand tacit engagement (and reduced tendencies of brand exhibiting, brand patronizing and especially brand deal seeking) mirror