Optimal Investment Strategy for Defined Contribution Pension Scheme under the Heston Volatility Model

Full text

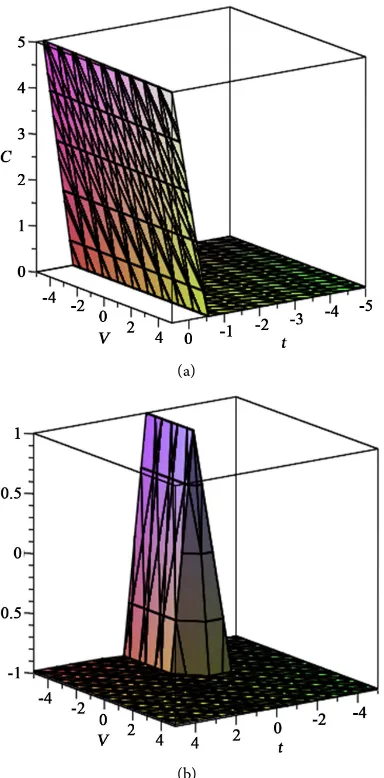

Figure

Related documents

When depressed patients maintain continuous therapy for the recommended treatment duration, health care resource costs are reduced compared with patients who discontinue

Entrepreneurial behaviour, on the part of the firm is considered by many researchers to be a competitive response to the current business climate (Burgelman, 1984). Thus,

Using a grounded theory methodology comprising, four case studies in local government and HE, it investigates the relationship between strategic planning, accounting and

If endothelial dysfunction occurs prior to insulin resistance, and elevations in serum ADMA represent a reversible abnormality that contributes to the increased cardiovascular

The results demonstrate that (a) this epithelium functions in the absorption of protein from the duct lumen, (b) large coated vesicles serve as heterophagosomes to

In the case that the stand exceeds the load capacity of the hall floor, the use of a special structure may be required and it must be provided by the exhibitor.. Fira de

Taking into account the results of applied model (mild response of Central Bank to oil prices), it may mean that optimally Central Bank should include oil price into its

Costa Philippou Project Manager - Business Development Medilink East Midlands Ltd. Becky Sharpe Project Leader - Marketing & Events Medilink East