Improving Bilingual Projections via Sparse Covariance Matrices

Full text

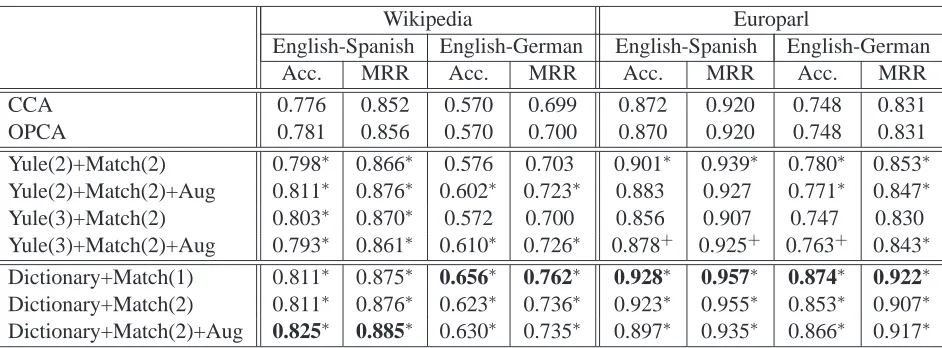

Figure

Related documents

This study investigated oral corrective feedback provided by the teacher and students’ uptake following teacher’s corrective feedback in accelerated class. The

Importantly, the impact of levan doses was slightly more than that of the rats fed with inulin as positive control, demonstrating the potential prebiotic

It can keep Windows XP running in parallel with Windows 7/8.1 migration and uncover additional time to resolve and test application compatibility issues, ease users into the

The two-on-one pursuit-evasion differential game in the Euclidean plane is con- sidered for the case where the holonomic players have equal speed, but at least one of the Pursuers

Given the choice of the target lane and given the lane-changing mechanism, the subject driver 13. accept/rejects the

Severity of combat-related PTSD is further examined within the literature regarding military or veteran populations by demographics, family history and factors, gender, current

∑ In the case where the system is cointegrated, the long-run and short run models in equations 11 and 12 respectively are estimated and the error correction term which enters

This strong growth was fueled by robust collections from the corporate income tax, which record- ed revenue growth of 22.5 percent, and from Maine’s two largest taxes, the