Defined benefit pensions and homeownership in the post Great Recession era

Full text

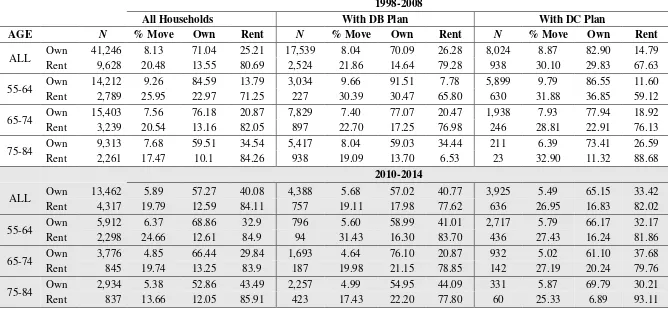

Figure

Related documents

*Hypothetical example: Maximum contribution limits for a 52-year old earning $300,000 in W-2 income and retiring in 10 years. Defined benefit plans enable the self-employed to build

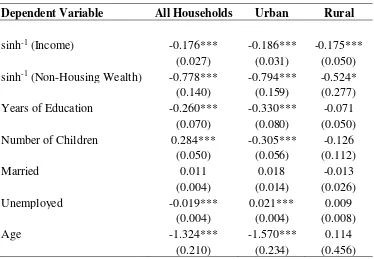

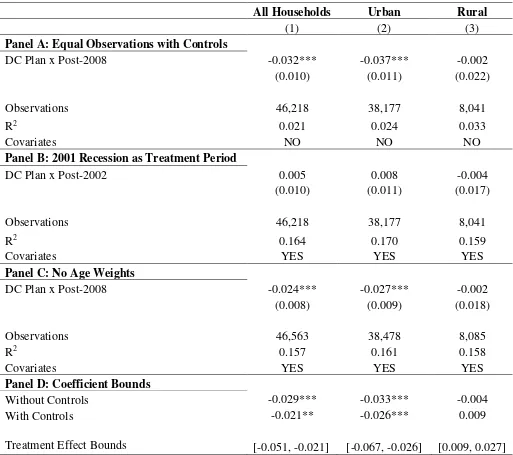

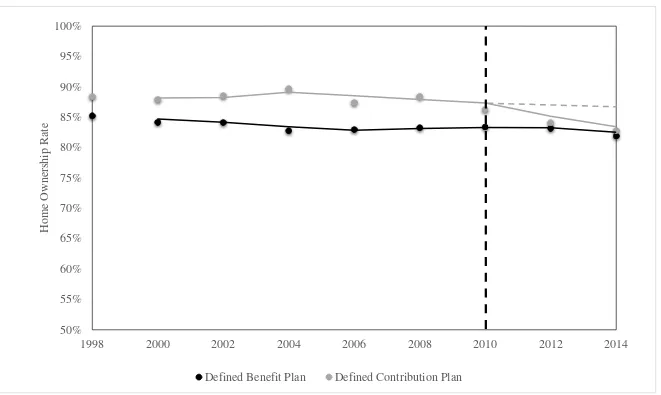

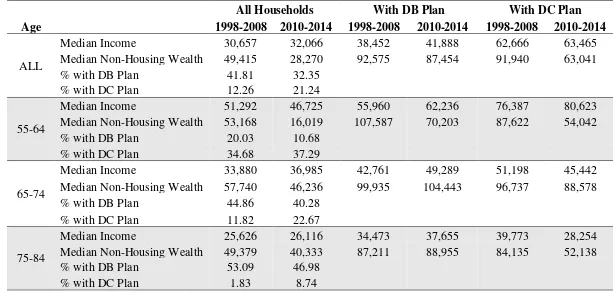

Defined benefit plans traditionally pay benefits in the form of an income stream, and people enjoying a stable private income stream for the duration of a retirement are less

This paper explores the shift from defined benefit to defined contribution pension plans when the payout rate from social security is set optimally.. This paper shows that when

• If a DB plan fails, the Employee Retirement Income Security Act (ERISA) requires guaranteed payment of benefits through the Pension Benefit Guaranty Corporation (PBGC).. The

While Social Security is the largest source of retirement income for households with someone aged 65 or older, other financial assets such as pension income from defined benefit

Offering a low-cost, guaranteed fixed annuity in a defined contribution plan is an effective way to help participants build savings and bridge the retirement income gap..

BACKGROUND AND SUMMARY For plan years beginning after December 31, 2007, single-employer defined benefit plans covered by ERISA, are subject to new funding requirements ,

If an employer sponsors both a defined benefit pension plan and a defined contribution plan that covers some of the same employees, the total deduction for all plans for a plan year