Financial Portfolios based on Tsallis Relative Entropy as the Risk Measure

Full text

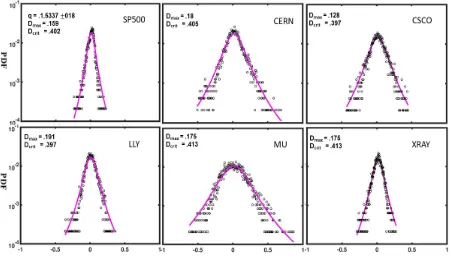

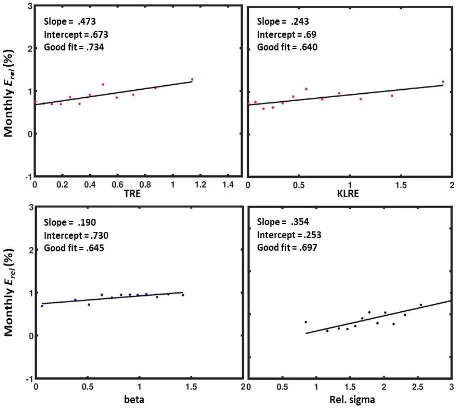

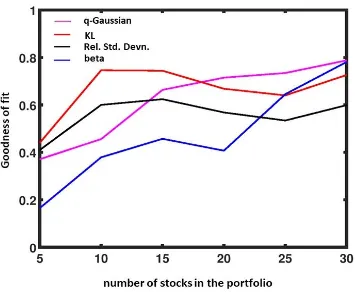

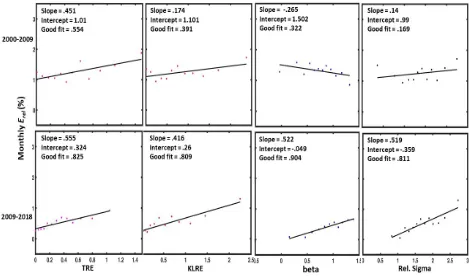

Figure

Related documents

C ARPET BEETLES, clothes moths, and cigarette beetles are responsible for about 99 percent of the insect damage to fabrics and animal products used for clothing

Therefore, it follows that the terms and conditions regarding the employment of the staff of the Inspector General of Taxation are determined by the Public Service

Figure 15: This plot shows the tightness of our schedulability test and scheduling algorithm for the augmented self-suspending task model where one half D ˆ = 1 2 of the

Conclusions: Postoperative hypertension requiring IVMED after CEA is associated with increased perioperative mortality, stroke, and cardiac complications, whereas

In this paper, we investigate both local manifold and global constraints in the data and propose a novel melanoma detection method based on Mahalanobis distance learning and

With a spiking implementation like the SSLCA, where input spikes are suppressed during an output spike, we would have expected the spiking to con- sume less power so long as (1 − K