EFFECT OF FIRM CHARACTERISTICS ON FINANCIAL DISTRESS

OF NON-FINANCIAL FIRMS LISTED AT NAIROBI SECURITIES

EXCHANGE, KENYA

GATHECHA JOHN WANGIGE

D58/CTY/PT/22360/12

A RESEARCH THESIS SUBMITTED TO THE SCHOOL OF BUSINESS

IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE

AWARD OF THE DEGREE OF MASTER OF SCIENCE IN FINANCE

IN THE SCHOOL OF BUSINESS OF KENYATTA UNIVERSITY

i

DECLARATION

This project is my original work and has not been presented for a degree in any other

university or for any other award.

JOHN WANGIGE GATHECHA

____________________________ ____________________________

Sign Date

This is to confirm that this thesis has been carried out by the candidate under our supervision

as the appointed Kenyatta University Supervisor.

____________________________ ____________________________

Sign Date

DR. EDDIE MUNGAMI SIMIYU

Department of Accounting and Finance,

Kenyatta University.

____________________________ ____________________________

Sign Date

MR. GERALD ATHERU

Department of Accounting and Finance,

ii

DEDICATION

I dedicate this research project to Almighty God whose grace has been sufficient so far in my

life. I also wish to dedicate this research project to my wife Ann and my children, Alvin,

Claudia and Telvin. This work would not have been possible without their moral support that

iii

ACKNOWLEDGEMENT

First and foremost, I express my appreciation to the Almighty God my savior, who have

enabled me achieve my dream in pursuing my degree in Masters in Science Finance Option.

Special appreciation goes to my supervisors Dr. Eddie Simiyu, Dr. Lucy Wamugo and Mr.

Gerald Atheru for their continuous support, motivation and endurance in my work. I

appreciate them for equipping me with immense knowledge which has led to value addition

to this body of knowledge. I would also like to thank my seniors at St. Paul’s University who

ensured that I had enough time to carry out my research work. Special thanks go to Dr. Paul

Gesiba, for his tireless effort accorded to me during the research work. My appreciation goes

to my fellow students, whom we teamed up to help one another, my workmates, I salute you

and may the living God bless you all abundantly. Finally, I wish to appreciate my immediate

family; Jane, Jacinta, Nancy, Catherine, Ann, Felister, George and my mum Rosemary who

iv

TABLE OF CONTENTS

DECLARATION... i

DEDICATION... ii

ACKNOWLEDGEMENT ... iii

LIST OF FIGURES ... viii

LIST OF TABLES ... ix

OPERATIONAL DEFINITION OF TERMS ... x

ABBREVIATION AND ACRONYMS ... xii

ABSTRACT ... xiii

CHAPTER ONE: INTRODUCTION ... 1

1.1 Background of the Study ... 1

1.1.1 Firm Characteristics ... 4

1.1.2 Bankruptcy Act in Kenya ... 5

1.1.3 The Nairobi Security Exchange ... 5

1.2 Statement of the Problem ... 6

1.3 General Objective ... 8

1.3.1 Specific Objectives ... 8

1.4 Research Hypothesis ... 8

1.5 Significance of the Study ... 9

1.5.1 Policy Perspective ... 9

1.5.2 Industrial Perspective ... 9

1.5.3 Theoretical Perspective ... 9

v

1.7 Limitation of the Study ... 10

1.8 Assumptions of the Study ... 10

1.9 Organization of the Study ... 10

CHAPTER TWO: LITERATURE REVIEW ... 11

2.1 Introduction ... 11

2.2 Theoretical Review ... 11

2.2.1 Pecking order Theory ... 11

2.2.2 Agency Theory... 12

2.2.3 Keynesians theory ... 12

2.2.4 Wreckers theory of Financial Distress ... 13

2.3 Empirical Review ... 13

2.4 Conceptual Framework ... 19

CHAPTER THREE : RESEARCH METHODOLOGY ... 21

3.1. Introduction ... 21

3.2 Research Philosophy ... 21

3.3 Research Design ... 21

3.4 Panel Logit Regression Model ... 22

3.5. Operationalization and measurement of variables ... 25

3.6 Target Population ... 26

3.7 Sampling... 27

3.8 Data collection Instrument ... 27

3.9 Data collection Procedure ... 27

vi

3.11 Diagnostic testing ... 28

3.11.1 Multicollinearity ... 28

3.11.2 Heteroscedasticity ... 28

3.11.3 Overall evaluation of the model using likelihood ratio test ... 29

3.12 Ethical Standards ... 29

CHAPTER FOUR : DATA ANALYSIS AND PRESENTATION ... 30

4.1 Introduction ... 30

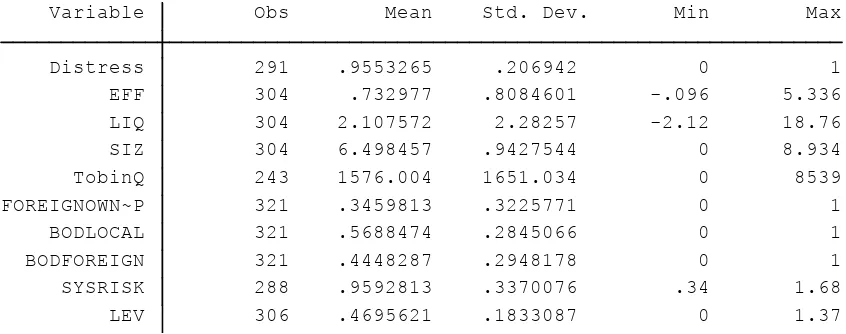

4.2 Summary of Descriptive Statistics ... 30

4.3 Diagnostic Tests ... 31

4.3.1 Heteroscedasticity Test ... 31

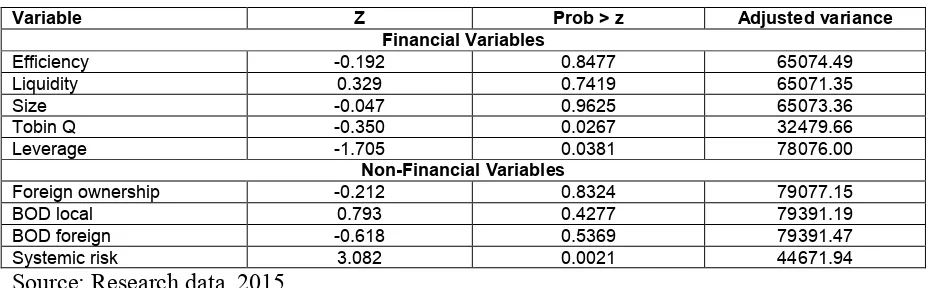

4.3.2 Mann-Whitney Wilcoxon test ... 32

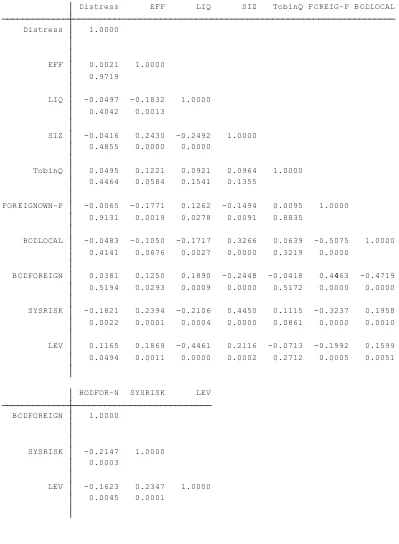

4.4 Correlation Among Variables ... 34

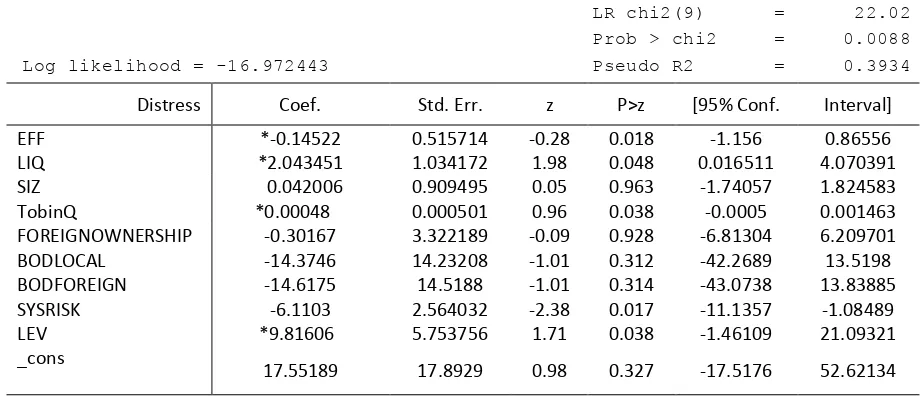

4.5 Panel Logit Regression Results ... 36

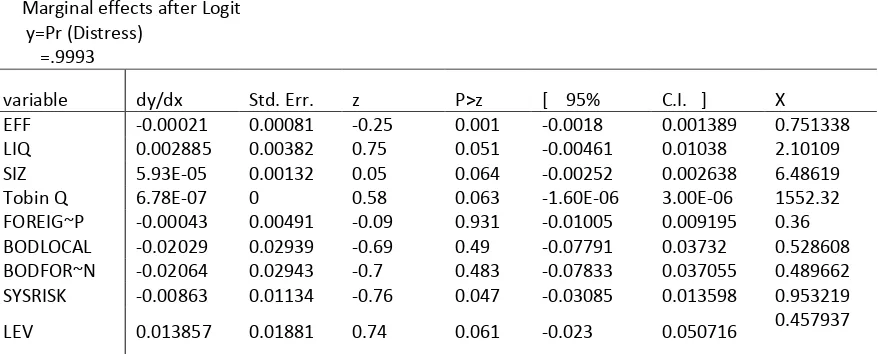

4.6 Marginal Effects (mfx) ... 38

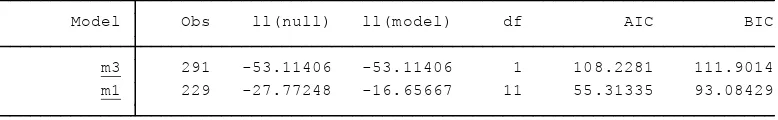

4.7 Likelihood Ratio Test ... 39

4.8 Multicollinearity Diagnostics ... 40

4.9 Discussions ... 41

CHAPTER FIVE : SUMMARY, CONCLUSION AND RECOMMENDATIONS ... 43

5.1 Introduction ... 43

5.2 Summary of the findings ... 43

5.3 Conclusion ... 45

5.4 Recommendations and Policy Implications ... 46

vii

REFERENCES ... 48

APPENDICES ... 54

Appendix I: Data Graphs... 54

Appendix II: Kernel Density Graphs ... 54

viii

LIST OF FIGURES

Figure 2.1: Conceptual framework ... 20

ix

LIST OF TABLES

Table 2.1: Summary of Literature review ... 17

Table 3.1: Operationalization and measurement of study variables ... 25

Table 4.1: Summary of Descriptive Statistics... 31

Table 4.2: Wilcoxon-Mann-Whitney test ... 33

Table 4.3: Pearson correlation ... 35

Table 4.4: Panel Logistic Regression ... 36

Table 4.5: Marginal Effects (mfx) ... 39

x

OPERATIONAL DEFINITION OF TERMS

Business Cycle This is a process under which a business entity under goes during its lifetime. It includes four stages namely; recession,

depression, recovery and finally boom.

Financial Distress Process This is a continuous process which befalls a firm when it fails to meet its obligation resulting to financial distress. It is a slow

process which takes a long period and results to bankruptcy if

no interventions are made.

Financial Impairment This is a situation in a firm when the book value of a non-current asset exceeds the recoverable amount. This means that

such an asset has diminished in value.

Firm Characteristics These are factors that affect the firm directly. These are internally generated within a firm. They include financial and

non- financial factors. Financial factors includes: efficiency,

liquidity, and leverage. Non-financial factors include;

Shareholding, labour, age of the firm and board of director

characteristics.

Restructuring This refers to the re-organization of the organization in terms of ownership, management or structure wise in order to make the

firm become more profitable. This is done to avoid bankruptcy,

repositioning or buyout.

Non Bankrupt This relates to the current position of a firm, when it has a positive profit after tax.

Insolvency /Solvency Solvency refers to a situation where the current assets of an entity exceed current liability. Insolvency entails lack of

liquidity within an entity. Insolvency is also referred to as

xi

Macroeconomic Variables These are factors that affect a firm due to economic changes. Economic changes include; Interest rates, systematic risks,

Gross domestic product, money supply among others.

Systematic Risk This is risk inherent to the entire market segment. It is normally referred as ‘diversifiable risk’ ‘’or ‘market risk’ volatility. The

risk affects the entire market and is unpredictable neither can it

be avoided can be mitigated by hedging. The study computed

CAPM on each firm selected.

Leverage This refers to the firm’s ability to buy assets using borrowed funds with believes that income generated from that asset was

more than the cost of borrowing.

Efficiency This is a ratio used by firms in order to evaluate their current performance.

xii

ABBREVIATION AND ACRONYMS AIES Artificial Intelligence and Expert Systems

CAMELS Capital Adequacy, Assets, Management Capability, Earnings, Liquidity, Sensitivity

CAPM Capital Asset Pricing Model

CARAMELS Capital Adequacy, Asset Quality, Reinsurance, Adequacy of Claim Provisions, Management, Earning Quality, Liquidity,

Subsidiaries/Self-dealing.

CBR Case Based Reasoning Model.

CHIN Scaled Change In Net Income.

EBIT/TA Earnings before Interest and Taxes to Total Asset

GDP Gross Domestic Product.

IRA Kenya Insurance Regulatory Authority.

MWW Mann-Whitney Wilcoxon Test

MDA Multiple Discriminant Analysis.

MVE/ TL Market Value of Equity to Total Liability.

NACOSTI National Commission for Science, Technology and Innovation

NI/TA Net Income to Total Asset.

SVM Support Vector Machine

xiii

ABSTRACT

1

CHAPTER ONE INTRODUCTION 1.1 Background of the Study

Every decision made by management, determines the direction the firm takes in future.

However, decisions are based on shareholding composition, financial prospects based on

current firm potential, corporate governance and the economic condition prevailing in the

market (Changing, 2011). Financial distress relates to a broad concept with several situations

in which a firm faces financial difficulty. These common situations defining financial distress

include bankruptcy, insolvency and failure (Maina and Sakwa, 2012). Schmidt (2010) defines

financial distress as a situation that affects the firm under unclear circumstances. Senbet and

Wang (2012) relate financial distress to a situation where the firm’s contract to creditors are

broken or honored with difficulty. Financial distress falls in tight cash situations when the

firm is not able to pay the owed amount within the due date. This is in line with the leverage

position of a firm. If no interventions are injected, this condition can force a firm into

bankruptcy or liquidation (Hu, 2011). This condition arises from wrong financial decisions

made by firm managers in the long run operations of a firm (Filberk and Krueger, 2005).

Financial distress has affected many investors and huge cash outflow has been lost as a result

of this problem, Baker (2011). Business failure is problematic to both developed and

developing economies. There is therefore the need to investigate the main determinants of

financial distress specifically for developing markets specifically Kenyan economy Kemboi

(2012).

According to Pandey (2005), creditors, suppliers and investors, react differently on firm’s

facing financial problems. Suppliers, automatically discontinue granting credit to the firm due

2

additional capital to the distressed firm or set high cost with rigid terms and conditions.

Shareholders on the other hand may be tempted to undertake risky projects. If this project

succeeds, they gain but if it fails, the creditors will suffers loss.

Over the last four decades, academics and practitioners have carried out vigorous research on

financial distress without drawing consensual conclusions; Among the studies done

includes, Akbar (2013), Dimitras, Zanakis & Zopudinis. (1996) Zmijewski’s (1984) and

Ohlson (1980). Business failure prediction models remain unsolved puzzle to date. In

addition, various models have been developed. Akbar (2013) carried a study using Falmer

and Toffler models in financial distress prediction suggesting superiority of Falmers’ model

in prediction. Dimitras et al., (1996) conducted a multi- dimensional research on business

crisis prediction. Altman model has several draw backs; it is an outdated model and would

not be best to use in classification of todays’ firm. In addition, researchers using the model

assume that their model is stable across economic conditions that change with time. The

business environment in 1968 may not be the same as today. The model only relied on

manufacturing firms which is not practicable today. The main demerit of Olson Logit model

is that by use a dependent variable that is not binomial, the researcher is required to test the

assumption of linearity before including it in the model. Zmijewski’s model is limited to

financial ratios therefore does not incorporate other factors. Panel Logit regression overcomes

these problems experienced in the above models and has binomial output. The researcher is

able to monitor firm’s state at different stages; healthy state, impairment state, and recovery

states and determine whether the firm is bankrupt or not. The study adopted panel Logit

regression model which have a dichotomous output of being failed or non-failed firm.

According to Outechever (2007), financial distress is a gradual dynamic process where a

3

stages have specific attributes and consequences as they contribute differently to business

failure. Financial distress varies with time. Therefore as a firm enters one state, it does not

stay in the same state until it recovers or is liquidated. The change in financial condition

triggers the transition from one state of financial distress to another. If these conditions are

not aggravated, this may lead the firm into bankruptcy problems. Aasen (2011) points out two

types of financial distress costs. Direct bankruptcy costs comprising of legal and

administrative costs, and indirect bankruptcy costs which relates to the difficulty of managing

a firm during bankruptcy.

Business failure symptoms include internal organization problems which are characterized

by financial signals resulting from weak performance leading to bankruptcy and finally to

financial distress. The firm takes a downward spiral trend due to inadequate resource

deployment, resulting to a weak strategic positioning which is evidenced by significant drop

in sales, poor profitability, and decline in cash flow and liquidity levels (Crutzen and Van

Caillie 2007).

According to Rose et al,. (1996) bankruptcy is the legal status in an entity which cannot repay

debts to its creditors; this may lead to liquidation or administration. Insolvency on the other

hand, is a financial condition within an entity when its liabilities exceed the assets, a situation

referred to as “balance sheet insolvency”. This calls for immediate action to rectify the

situation in order to avoid bankruptcy. Such actions include minimizing overhead costs,

negotiating current debts and debt repayments. Cash flow insolvency; entails lack of liquidity

to honor debts when they fall due while balance sheet insolvency refers to presence of

4

1.1.1 Firm Characteristics

Determinants of financial distress can be classified into three categories financial factors,

non-financial factors and macro-economic factors. Financial factors include leverage,

liquidity, firm size and investment among others. According to Brealey et,.al. (2000)

,liquidity is the ability of an asset to be converted into cash quickly and at low cost. Firm size

has a major influence in determination of whether a firm is distress or not. This is due to the

fact that large firms can access external finance cheaply due to their ability to influence the

rate of interest to their advantage. Large firms can also survive during crisis than small firms

due to accumulated reserves (Ooghe & Prijcker, 2008). Firms efficiency also referred as

turnover ratios, measures the productivity level of a firm after using its assets Brealey et al.

(2000). Leverage is the firm’s ability to buy assets using borrowed funds with believe that

income generated from that asset will be more than the cost of borrowing. In this case, the

risk of borrowing cost is presumed to be larger than income generated from the asset leading

to losses in the long run. During recession firms borrow more funds in order to pay off debts

as they mature. Such firms with high leverage are likely to end up with potential risk of

bankruptcy Khalid (2012). Firms’ efficiency ratio is used to evaluate current performance. It

relates to the operating expenses computed as percentage over revenue. An increase of this

ratio indicates increase in cost or reduction in revenue Taylor (2008).Investment on the other

hand incorporates market value of all companies on the stock market and is computed by

using the market value of a firm divided by the replacement value of the entity’s asset.

Non-financial factors relates to corporate governance factors of a firm; Board of directors’

composition is in line with local and foreign directors within the management of a firm.

These are the decision making organ in a firm. Firm’s ownership comprises of major and

minor shareholders. Major shareholders have a large influence in decision made within a firm

5

the financial markets. Risk depends on the type of portfolio investors have undertaken.

Systematic risk is computed using capital asset pricing model Acharya et al.,(2010).

1.1.2 Bankruptcy Act in Kenya

Bankruptcy Act CAP 53 Laws of Kenya demonstrates the relationship between the debtor

and the creditor. In addition, the act demonstrates the relationship between the firms and

external parties. This Act has its base on the England statutes (Committee of Experts, 2010).

The Act however, is faced by many challenges. First, the act is too old and no amendments

have been made in relation to incorporate the current market dynamics. Despite the fact that

the act exists in Kenyan laws, many firms have pending litigations which have not been

concluded to date. This has caused some entities to go into liquidation while others have

restructured themselves for survival. The main demerit of the law is that despite its existence,

many firms have failed to survive and have closed down despite its existence.

1.1.3 The Nairobi Security Exchange

The study focused ideally on financial distress prediction on listed firms on Nairobi security

market. NSE is regulated by the capital market authority (CMA). The study is of importance

since the problem has prevailed for several decades in the Nairobi security market since

1990s’. Nairobi security exchange was constituted in 1954 under the society’s Act as a

voluntary association for stock brokers and was restricted to European community only. After

the attainment of independence in 1963, the share dealing business was opened to the resident

of European community, NSE (2014).

However after independence the security market activities slumped as a result of uncertainty

on Kenya’s future independence trend. The NSE has been privatized since 1988 by the

6

Depository and Settlement Corporation (CDSC). NSE has been operating currently with 62

listed firms. Firms listed in NSE are expected to be financially stable in order to build

investors’ confidence and contribute to economic growth. During listing period, these firms

must meet the set criteria set by NSE. However, despite meeting the set listing requirements,

firms are exposed to market dynamics which affect them either positively or negatively.

These dynamics may be caused by the government policies, risk perceptions, management

decisions and investment decisions (NSE, 2014). Currently, many firms have been delisted

due to financial distress problem with others being placed on receivership and therefore the

need for the study.

1.2 Statement of the Problem

Firms are presumed to be operating on a going concern basis and hence have perpetual life.

In reality, this may not be the case as companies often fail under unforeseen circumstances

(Schmidt, 2010). Despite good rating and aggressive strategies, firms still encounter financial

distress problems. Business success depends heavily on the ability of financial managers and

the stakeholders in the execution of business operations. In Kenya, some firms have been

placed under statutory management, (Wamugo, Makau and Kosimbei, 2014). Financial

distress is a global problem affecting both developed and developing economies. In Kenya

specifically, several firms have been delisted from stock market; Mumia sugar, Eveready

Lonho East Africa, Pearl dry cleaners, East African Packaging and Uchumi supermarkets are

good examples. Mumia Sugar Company currently has been undergoing serious financial

distress. The company has been in the news lately with reported incidences of directors being

hauled to courts Kakah (2015) and Mburu (2014). The share price of the company has

dropped significantly from a high of Sh. 60 per share to the current average of Sh. 2 per

7

been revamped by the government by injecting additional capital to prevent its closure.

Uchumi supermarket having over 30years of operation was declared bankrupt in 2006 and

was put under specialized receiver manager (SRM) and interim management. Through

government intervention in 2010, the company had a turnaround and was relisted in NSE

(NSE 2010). Currently the firm has closed down some of its branches and has challenges in

paying its creditors. The question then arises on what factors really cause financial distress in

Kenya? The study sought to examine these individual factors and determine the extent to

which they affect financial distress of non-financial firms listed in NSE using Logit model.

Much of empirical evidence has relied on financial models in financial distress prediction

incorporating different factors. These models have proved that firm characteristics cannot be

ignored during decision making process. Among these models includes Falmer and Toffler

models, Akbar (2013) and Altman’s model (2008) among others. Memba and Abuga (2013)

carried a study on the causes of financial distress and its effects on firms. The study

concluded that financial distress is caused by poor capital decisions, poor internal

management shortage of skilled labor and lack of access of credit. Mandi (2014) carried out

an assessment using Z score model on Kenyan sovereign risk, concluding that financial

factors contribute heavily on firm’s future direction. Talian (2012) concluded that financial

variables were more reliable when predicting financial distress in Kenya.

The influence underlying non-financial and macro-economic factors have been ignored to the

detriment of many firms. This implies that studies done on causes of financial distress

incorporating firm characteristics have not given proper attention by the concerned

shareholders. None of the above studies examined the effect of shareholding composition,

share ownership, leverage and systematic risks on listed non-financial firms in Kenya. The

8

firm from being financially distressed. This is the research gap that the study sought to fill.

The focal point of the study is to test the effect of firm characteristics on financial distress on

Kenyan firms.

1.3 General Objective

The main objective of the study is to establish the effects of firm characteristics on financial

distress on listed non-financial firms in NSE, Kenya.

1.3.1 Specific Objectives

(i) To establish the effect of financial factors on financial distress of listed non-financial

firms in NSE, Kenya.

(ii)To determine the impact of financial variables on financial distress on listed

non-financial firms in NSE, Kenya.

(iii)To establish the moderating effect of systematic risk on the relationship between firm

characteristics and financial distress of listed firms in NSE, Kenya.

1.4 Research Hypothesis

The study seeks to test the following null hypothesis:

H01: Financial factors have no influence on financial distress on listed firms in NSE,

Kenya.

H02: Non-financial factors have no influence on financial distress of listed firms in NSE,

Kenya.

H03: Systematic risk has no moderating effect on the relationship between firm

9

1.5 Significance of the Study

The significance of the study was based on the following perspectives: The policy

perspective (Government through Capital market authority), industrial perspective

(Investors), and theoretical perspective (scholars).

1.5.1 Policy Perspective

The study adds knowledge to policy decision makers the government, through Capital

market authority. The government should develop policies and regulation framework that will

ensure that non-financial firms do not encounter challenges of financial distress. The

government should set market trends indicators and thus evaluate early symptoms of

bankruptcy. Through this framework, the government will put interventions where possible;

example, during inflation it may implement monetary policies.

1.5.2 Industrial Perspective

The study boosts market trends analysis by investors, who have different motives towards the

market. Financial institutions that lend money will need to evaluate financial health of such

firms in order to determine their debt repayment potential and probability of default.

Creditors (Suppliers) will be able to analyze firms’ ability to meet its obligations and if not,

develop strategies to settle obligations in case of bankruptcy. Auditors are mainly concerned

with the going concern of the firm as watchdogs, acting on behalf of shareholders who have

pegged their interests on returns of their investments in form of dividends.

1.5.3 Theoretical Perspective

The study provides a base to scholars and researchers as for secondary literature in emerging

markets specifically in Kenya. In this case, the study boosts the existing body of knowledge

10

1.6 Scope of the Study

The scope of the study on non-financial firms listed in Nairobi securities exchange, Kenya

covered the period between 2004-2012. This helped in monitoring market risk trend, during

various business cycle stages. Insurance and commercial banks have separate regulatory

bodies which regulate them. During this period, many firms faced financial distress problems

with some being closed down.

1.7 Limitation of the Study

The study focused on firm characteristics of listed non-financial firms in NSE only hence the

results do not represent all firms listed in NSE in Kenya.

1.8 Assumptions of the Study

The diagnostic tests used in the study were carried out to ensure that the data suits the basic

assumptions of Logit regression model.

1.9 Organization of the Study

The study is structured as follows: Chapter one provides research background, research

objectives, and significance of the study, scope and the limitation of the study. Chapter two

comprises the literature review on theories and conceptual framework. Chapter three entails

the methodology of the study and various bankruptcy models. Consecutively, the findings

and interpretation are presented in chapter four with conclusions and suggestions of the study

11

CHAPTER TWO LITERATURE REVIEW 2.1 Introduction

The following literature provides research background on theoretical and empirical review of

financial distress. The chapter lays emphasis on financial distress stages, research gap on

previous research and their findings. The literature survey includes both local and

international research. Local research is included to provide an indication of financial distress

within NSE, listed firms in Kenya.

2.2 Theoretical Review

There are three theories which support the research objectives. These theories discuss the

effects of financial, non-financial and systematic risk variables on financial distress.

2.2.1 Pecking order Theory

The Peking order theory by Donaldson, (1961) is a capital structure theory. The theory was

modified by Myers and Majluf. According to Myers and Majluf (1984) businesses adhere to

a hierarchy of financing sources. Hence prefer internal sources when available, debt is

preferred over equity. Finance managers who are assumed to have a better perspective of the

firm’s true condition than investors may make adverse decision which would affect the firm

performance. Example, Managerial decisions on new equity may lead to overvaluation of the

firm hence drop in share price. Too much leverage in a firm is dangerous to a firm. Debt

finance has a tax shield advantage. However in the long-term, increase in cost of debt may

lead the firm to be financially overstretched leading financial distress crisis, (Frank and

Goyal, 2005). The management must therefore evaluate financial variables fully before

12

2.2.2 Agency Theory

Agency theory was proposed by Jensen and Meckling (1998). The theory relates to decisions

made by firm by managers (C.EOs) and shareholders. This is a principal agent relationship.

The theory states that, with low monitoring level to the organization and low discipline in

decision making, managers might decide to invest in projects with negative net present

values. In situations where shareholding is regulated by few individuals being the major

shareholders, decision making power, vests on them unlike the CEOs. In such situations,

managers have no say on the firms’ growth direction. Alternatively, where the B.O.D has

corporate governance problems, the firm is faced with financial decision problems.

According to Ngugi (2008), shareholders can manipulate liquid asset at the expense of

debt-holders using it as a proxy for asset substitution. According to Jensen (1986) availability of

free cash flow makes managers invest in projects with negative NPVs due to conflict of

interest. Decisions on non-financial variables may affect the firm heavily in the long run and

if no interventions are made, this may lead to financial distress.

2.2.3 Keynesians theory

Keynesian theory is an economic theory proposed by Maynard Keynes (1936). According to

Keynes (1936), liquidity preference is the main reason why firms hold cash during tough

economic times. The multiplier effect causes a small decrease in consumption or investment

which in return causes a decline throughout the economy. This theory brought about

structural inadequacies such as unemployment which causes imbalance in demand leading to

contraction in the economy. Most businesses under go business cycle process. The cycle is

influenced by macroeconomic factors majorly systematic risks. Most firms experiencing

systematic risk embark on hedging in order to mitigate this problem. In circumstances where

13

production concurrently. In circumstances where the economy is not regulated, the cost of

borrowing increases and unemployment level rises. If regulations by the government are not

enforced, firms become overstretched financially and may not able to meet their obligations

leading to financial distress. Such interventions by the government include fiscal and

monetary policies Duda and Schmidt (2010).

2.2.4 Wreckers theory of Financial Distress

According to Daniel, Hirshleifer, and Subrahmanyam, (1998); Fama, (1998) the authors

independently explored the concept that stocks of financially distressed firms consistently

underperform those of financially sound firms. This is normally motivated by the desire

among investors to opt out before the firm ultimately fails and they lose their investment. The

act of withdrawing funds from already financially distressed firms who quite to the contrary

badly need those funds is referred to as “wrecking”. The action can also be explained as the

process of pre-emptive destruction of a company before its value ultimately plummets to a

value beyond salvage. Investors withdraw resources from the firm as private, non-dividend

benefits. Financially distressed firms shareholders will only suffer opportunity cost if the firm

recovers, however if it defaults on its obligations, the withdrawal of funds is deemed to be a

free source of funds which can be reinvested somewhere else for an acceptable return. This

act is compared to the traditional concept of ripping apart an old ship which is beyond or too

expensive to repair and utilizing its individual parts to put another newer one hence not

economically worth (Kalckreuth, 2005).

2.3 Empirical Review

The section reviews various empirical studies in view of the study variables.

Hamid & Nasil (2014) carried a study on Pakistanian manufacturing sector from July 2003 to

14

exchange. The study used Zmijewski model to test the distress level on these companies. The

findings revealed that the probit model performed well on predicting financially distressed

firms and non-distressed firms, based on; Net income, Shareholders equity and cash flows.

The study however relied heavily on ratios ignoring other factors that lead to financial

distress.

Warutere (2013) conducted a study on the applicability of logistic regression in financial

distress prediction in Nairobi security exchange. The study was conducted on sixteen

companies between the ranges 1997-2011. The findings revealed that Logit regression was

successful in prediction of business failure one year before it occurred. The study relied on

secondary data obtained from CMA and NSE. The study used financial ratios in financial

distress prediction. Moreover, the study did not factor in other factors that cause financial

distress within the regression model so as to make it more reliable such as corporate

governance.

Samira (2012) investigated on listed companies in Nairobi security exchange from 1996 to

2012. The study tested the utility of statistical technique majorly multiple discriminant

analysis (MDA) in bankruptcy prediction on these listed firms. The firm used ratios to

determine bankruptcy levels. The study used descriptive research designs and relied on

secondary data. The finding from the study revealed the accuracy of the Z score multi

discriminant financial analysis model in bankruptcy prediction of non-manufacturing firms.

This study was only limited to financial ratios excluding other non-financial variables which

also contribute to financial distress.

Taliani (2012) study used financial ratios to predict financial distress. The independent

15

study revealed the ability of financial ratios in determining the firm going concern. The study

used secondary data obtained from the banks’ financial statements. The study used a

discriminant model and incorporated all the above ratios. The study revealed that, none of

activity and turn over ratios was critical in predicting financial distress in commercial banks

in Kenya. However, the study differed with those of Altman (1968) who concluded that

profitability and efficiency ratios were most crucial and that liquidity ratios were not

significant. The study however relied on financial ratios only ignoring other factors.

Jiming and Weiwei (2011) carried out a study focusing on 50 manufacturing firms listed in

China stock market during 2005-2007. The study incorporated financial and non–financial

variables and used Logit regression model. The independent variables used were; profitability

operating capacity, cash-flow indicators, ownership concentration and board characteristics.

The findings revealed that, the model with non-financial indicators proved to be more reliable

in financial distress prediction and the timeliness and long-run validity of the mix model was

much better in comparison with the model with only financial indicators. However, the study

ignored the macro-economic variables which contribute significantly, specifically during

business cycle period.

Wu, Gaunt and Gray (2011), carried out a study on developing a bankruptcy model. They

selected various factors from Z –score, O –score, Probit, Hazard, and Hillegeist Keating,

cram and Lundstedt (2004) models and used ratios in financial distress prediction. They also

included one fresh factor as proxy for diversification level in a company. The findings

revealed a negative relationship on new factor with financial distress. This model proved to

be more reliable than the previous ones, when it was subjected to a sample as well as outside

16

Odipo and Sitati (2010) conducted a study using Altman’s model in bankruptcy prediction at

the Nairobi securities exchange. The study used twenty firms listed between 1989 and 2008.

The study used Altman’s model which incorporated, total assets, retained earnings, earnings

before interest and taxes, book value of equity, and sales as independent variables. The

findings of the study revealed that Altman’s model was found to be applicable with 80%

successful prediction. The study relied on secondary data from NSE and CMA. However,

this study was only limited to financial ratios in bankruptcy prediction.

In a study on assessing corporate financial distress in South Africa, Bothwell (2010)

investigated to develop a model for bankruptcy prediction. The study used 28 companies and

grouped 64 ratios, classifying firms into failed and non-failed firms. The independent

variables used were Times Interest Earned, Cash to Debt and Working Capital to Turnover.

The findings revealed that the model correctly classified about 75% of failed and non-failed

firms. The study used simple random sampling design and used multiple discriminant model

methodology. This study however relied only on ratios ignoring other factors which

contribute to financial distress.

In a study conducted to test bankruptcy and financial distress prediction in the mobile Telkom

industry in Ghana, Kpodoh (2010) used Z score bankruptcy prediction model. The study used

qualitative and quantitative data (modified single case design) which was collected using

questionnaires issued using survey method. Secondary data was obtained from financial

statements. The findings revealed the strength of Z score in bankruptcy prediction. It also

confirmed the correlation between corporate governance and corporate failure. The study

however concentrated on ratios and corporate governance excluding macroeconomic factors

17

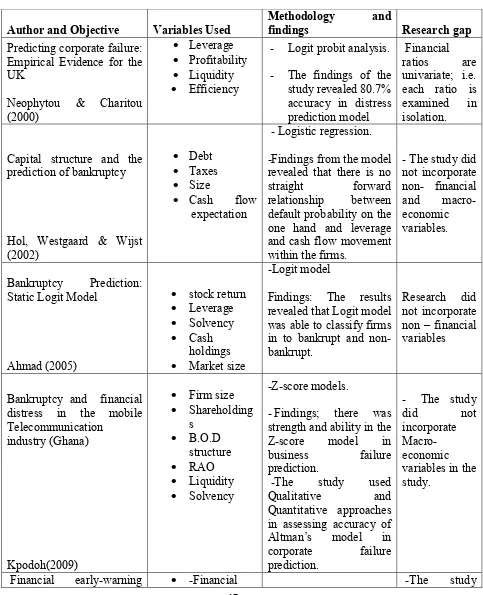

The tabulation below reveals various researches carried out, methodology used and the

research gap in research studies.

Table 2.1: Summary of Literature review

Author and Objective Variables Used

Methodology and

findings Research gap

Predicting corporate failure: Empirical Evidence for the UK

Neophytou & Charitou (2000)

• Leverage • Profitability • Liquidity • Efficiency

- Logit probit analysis.

- The findings of the study revealed 80.7% accuracy in distress prediction model

Financial ratios are univariate; i.e. each ratio is examined in isolation.

Capital structure and the prediction of bankruptcy

Hol, Westgaard & Wijst (2002)

• Debt • Taxes • Size

• Cash flow expectation

- Logistic regression.

-Findings from the model revealed that there is no straight forward relationship between default probability on the one hand and leverage and cash flow movement within the firms.

- The study did not incorporate non- financial and macro- economic variables.

Bankruptcy Prediction: Static Logit Model

Ahmad (2005)

• stock return • Leverage • Solvency • Cash

holdings • Market size

-Logit model

Findings: The results revealed that Logit model was able to classify firms in to bankrupt and non- bankrupt.

Research did not incorporate non – financial variables

Bankruptcy and financial distress in the mobile Telecommunication

industry (Ghana)

Kpodoh(2009)

• Firm size • Shareholding s • B.O.D structure • RAO • Liquidity • Solvency -Z-score models.

- Findings; there was strength and ability in the Z-score model in business failure prediction.

-The study used Qualitative and Quantitative approaches in assessing accuracy of Altman’s model in corporate failure prediction.

- The study did not incorporate Macro-economic variables in the study.

18

models on cross-holding groups.

Lieu, Lin & Yu (2008)

structure, • -Solvency, • -Profitability, • -Cash flow

indicators • Corporate

governance.

-Logit regressions model.

-The finding of the study was that financial ratio variables were the key variables for predicting corporate failure unlike non-financial variables such as corporate governance.

majorly relied on financial and non-financial variables excluding macroeconomi c variables.

Review of the prediction power of Altman & Ohlson Models in predicting bankruptcy of Listed Companies in Tehran Stock Exchange – Iran

Moghadam, & Mohammad Fard (2010)

• Size • Working

capital over total assets • Retained Earnings over total assets • Earnings before

interest and tax (EBIT) to total assets • Equity

market value to book value of Total assets

• A Net worth to Total Liabilities • Sales to Total

assets

-Altman and Ohlson Models.

-The findings revealed that Original Ohlson (1980) model had more power in prediction of bankruptcy issue on Iranian listed companies than the Altman model.

The study did not consider non-financial and macro-economic variables.

An Empirical Study on the Corporate Financial Distress Prediction Based on Logistic Model: Evidence from China’s Manufacturing Industry • Financial • Profitability • Operating capacity (T/O) • Cash-flow indicators • Ownership concentration • Board characteristic s -Logistic Model

The model with non-financial indicators proved to be more reliable in financial distress prediction and the timeliness and long-run validity of the mix model was much better in comparison with the model with only financial

The model incorporated financial and non- financial variable

19

Jiming & Weiwei (2011). indicators.

Bankruptcy prediction of firms listed at the Nairobi securities exchange

Mohamed (2012)

• Leverage • Profitability • Liquidity • Efficiency • Asset turn

over • Earning

power

Altman’s Z –score model.

- Financial ratios can be used to predict bankruptcy. Altman’s (1993) Z” score model is an efficient tool in predicting bankruptcy prediction.

-The model relied only on financial ratios hence did not incorporate non- financial factors.

Discriminant Analysis and the Prediction of Corporate Bankruptcy in the Banking Sector of Nigeria

Pam (2013)

• Leverage • Profitability • Liquidity • Efficiency • Asset turn

over • Security

prices

- Altman’s model (Multiple Discriminant Analysis)

-The findings revealed that MDA model was found to be a potent tool in the prediction of the potential of failure

-The model did not consider

macro-economic and non-financial variables.

Source: Author (2015)

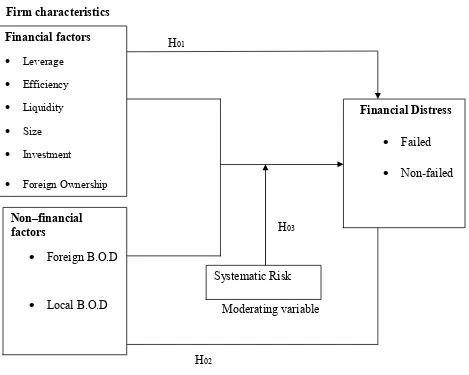

2.4 Conceptual Framework

A conceptual framework is diagrammatical representation showing the relationship between

independent and dependent variables in the study. The conceptual framework shows how

firm characteristics under the three categories affected financial distress. The independent

variables were classified into financial variables, non-financial variable and systematic risk as

a moderating variable. Financial variable included leverage, efficiency, liquidity and Size.

Non-financial variables included shareholdings and Board of director’s characteristics. This

revealed how corporate governance could lead to financial distress to a firm. Systematic risk

was the moderating variable between the independent variables and dependent variable. The

dependent variable under investigation was financial distress which had a binary output

20

adopted Altman’s decision rule in predicting financial distress on the dependent variable. A

score below 1.8 meant that the company was probably headed for bankruptcy hence failed

firm, while companies with scores above 3.0 were not likely to go bankrupt hence non-failed

firm. The lower / higher the score, the lower / higher the likelihood of bankruptcy.

Independent Variables Dependent

Firm characteristics

H01

H03

Moderating variable

H02

Figure 2.1: Conceptual framework

Source: Author (2015)

Systematic Risk

Non–financial factors

• Foreign B.O.D

• Local B.O.D

Financial Distress

• Failed

• Non-failed

Financial factors • Leverage

• Efficiency

• Liquidity

• Size

• Investment

21

CHAPTER THREE

RESEARCH METHODOLOGY 3.1. Introduction

This chapter presents the research methodology used in the study. It covers the research

philosophy, modeling, research design, target population, data collection instruments and

procedures, data analysis tool and diagnostic tests was carried out on the study.

3.2 Research Philosophy

This study was based on Positivism research philosophy. Positivism is based on believe of

stable reality which can be described from an objective perspective (Saunders & Lewis,

2000). In this case, the phenomena being studied is not interfered with. Positivism involves

manipulation of reality with variations on single independent variable in order to identify

regularities and establish the relationship that exists between the elements in social world.

Positivism supports this study since it aims at working with observable reality (testing the

effect of firm characteristics on financial distress on listed firms on Nairobi securities

exchange market). In this case the researcher collected data independently and analyzed it

with statistical tools. Neither the subject influenced the researcher nor did the researcher

influence the subject.

3.3 Research Design

A research design is the blue print of every research and outlines the procedure for collecting

and analyzing data. According to Kothari(2004), a research design is arrangement of the set

condition for data collection and analysis. This arrangement is done in such a manner that its

aims at combining relevance to the study with the economy in procedure. It defines the

22

design. This is in line with Ghauri and Gronhaug (2005) who defined causal research as

research with cause and effects with the main task being to isolate the causes and attempt to

conclude the extent of these causes. Causal research design helped to establish the cause and

effects of the relationship between independent variables and dependent variable hence

testing the hypothesis set for the study. The aim of the study was to establish the effect of

firm characteristics on financial distress on non-financial firms operating in different sectors

on NSE, Kenya.

3.4 Panel Logit Regression Model

This study adopts the Panel Logit model. Panel Logit model is a probabilistic statistical

model which measure the relationship between dependent variables and one or more

independent variables Agresti (1996). According to Pallant (2007), there are three

assumptions underpinning logistic regressions. The assumption concerning the number of

cases in the sample and the number of independent variables included in the model. Research

analysis might have problems with small samples with large number of independent

variables. The second assumption requires checking for interconnections among independent

variables or multicollinearity. These variables have to be strongly related to dependent

variables but not strongly related to each other. This implies that highly intercorrelating

variables have to be removed (Pallant, 2007). Third assumption refers to checking for the

presence of outliers within the logistic regression model. Outliers can influence the results of

logistic regression.

Panel Logit regression regression reflects the interactions terms and non-linearity random

effect of maximum-likelihood estimation of Logit regression that simultaneously relates to

explanatory variables. The regression is based on a panel of 42 non-financial firms with some

23

as a continuous process where a firm moves from one state to another. In this case, the

process of a firm from healthy state, distress state and recovery can be easily traced by using

the model. Panel Logit regression output has a dependent dummy binary variable. The

variable expresses a financial state, where it takes the value 1 if the specific company

in the certain time period is on financial distress and value 0 if is characterized by

financial stability.

Panel Logit model is computed using dependant variable which are dichotomous. In this

study the output y is a binary dummy variable taking value 1 if is a financial distress

period and value zero (0) otherwise (financial stability period). The independent

predictor variable can take any form. The model aims at discovering the relationship between

variables (Tabachnick & Fidell 1996). Where panel Logit represents the probability of

financial distress for the firm,

x

1 represents the set of n independent variables for the firm.These independent variables are ratios which were computed using the firms financial

statements. The intercept and coefficients of these independent variables are denoted by α

and β . This model is based on maximum likelyhood- estimation procedure. The independent

variables in the study can be analyzed in the model as follows:

i) Leverage = Total liabilities/ Total asset(X1,LEV)

ii) Efficiency = EBITDA/Total asset (X2,EFF)

iii) Liquidity = working capital/ Total assets (X3LIQ)

iv) Firm size = (natural logarithm of assets) = ln(assets) (X4. FSZ)

v) Investment (Tobin Q) = Total Market value of firm/ Total asset (X5 TBQ)

24

vii) Board of director characteristics= Local/foreign (X7 BOD)

viii) Systematic risk (X8,SMR)

The model can be analyzed as follows:

Logit (E[Yі| x1,i ………xm,i]) = Logit (pi) = ln Pi = β0+β1,x1, m i +…+βmxm,i +

ᶓ

01 - Pi

Therefore the empirical model:

Logit (pi)= β0+ β1(LEV)im+ β (EFF) im + β (LIQ) im + β 4(FSZ) im + β 5(INV) im + β 6(SHG) im + β7(BOD im)+ β 8(SMR) im + ᶓ0

Where; i = observations

ᶓ

0 = Error termm = 2004-2012 (Period/ time) β = the coefficient of the predictor variables

x = variables

The decision criterion on the dependent variable was based on Altman’s Z - score model. A

score below 1.8 meant that the firm was probably headed for bankruptcy, while firms with

scores above 2.99 were not likely to go bankrupt. The lower or higher the score, the lower or

25

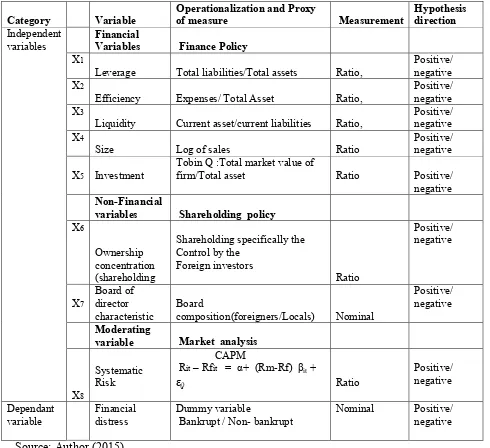

3.5. Operationalization and measurement of variables

The table below shows how the independent variables and the dependent variables have been

operationized. In addition, the proxy of measure and the direction of the hypothesis is

tabulated.

Table 3.1: Operationalization and measurement of study variables

Category Variable

Operationalization and Proxy

of measure Measurement

Hypothesis direction

Independent variables

Financial

Variables Finance Policy

X1

Leverage Total liabilities/Total assets Ratio,

Positive/ negative X2

Efficiency Expenses/ Total Asset Ratio,

Positive/ negative X3

Liquidity Current asset/current liabilities Ratio,

Positive/ negative X4

Size Log of sales Ratio

Positive/ negative

X5 Investment

Tobin Q :Total market value of

firm/Total asset Ratio

Positive/ negative

Non-Financial

variables Shareholding policy X6

Ownership concentration (shareholding

Shareholding specifically the Control by the

Foreign investors Ratio Positive/ negative X7 Board of director characteristic Board

composition(foreigners/Locals) Nominal

Positive/ negative

Moderating

variable Market analysis

Systematic Risk

CAPM

Rit – Rfit = α+ (Rm-Rf) βit +

ᶓ0 Ratio

Positive/ negative X8 Dependant variable Financial distress Dummy variable

Bankrupt / Non- bankrupt

Nominal Positive/ negative

26

3.6 Target Population

The target population consisted of all non-financial firms listed in Nairobi securities

exchange (NSE). The NSE had 42 listed non-financial firms out of 62 listed firms by 31st

December 2012. This is in line with Ogula (2005) who defined a target population as a group

of objects which have similar characteristics. The criterion on failed firms was based on the

fact that, some firms have been suspended or delisted up to the current date. Banking and

insurance firms was excluded from the sample. Banking institutions are highly regulated by

the central bank in Kenya and uses Capital Adequacy, Assets, Management Capability,

Earnings, Liquidity, Sensitivity (CAMEL) rating model for bankruptcy prediction, Santos

(2001). Insurance firms are regulated by Insurance regulation Authority (IRA) and use

Capital adequacy, asset quality, reinsurance, adequacy of claim provisions, Management,

Earning quality, Liquidity, Subsidiaries (CARAMEL) models in bankruptcy prediction. This

study adopted a census approach due to the small number of non- financial firms listed at the

NSE. According to (Saunders, Thornhill and Lewis 2009) the approach enhances data

validity by ensuring inclusion of certain vital information for the study. Listed firms at NSE

are classified in the following categories; Agriculture, commercial and services,

telecommunication, Automobile and accessory, Banking, energy and petroleum, Insurance,

Investment, manufacturing, construction and allied and growth enterprise market segment

sectors.

27

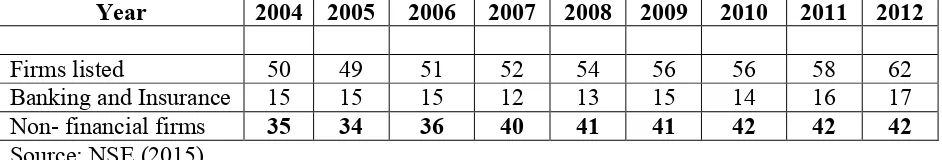

Table 3.3 Target Population

Source: NSE (2015)

3.7 Sampling

The resercher conducted a census of all non financial firms using the inclusion exclusion

criteria derived from different characteristics. This is in line with Bhatnagar (1995) who

stated that inclusion charactristics being prospective subjects must have if they are to be

included in the study, while exclusion criteria are those characteristics that disqualify

prospective subjects from inclusion in the study.

3.8 Data collection Instrument

The study used secondary data. Data for all variables was arranged in Panels. Data

incorporated all non-financial companies including delisted ones in order to avoid

survivorship biasness in the study.

3.9 Data collection Procedure

This study used panel data. This enhanced quantity and quality of data at all levels.

According to Kothari (2004), when deciding on data collection procedure, one needs to

safeguard against bias and unreliability of the procedure used. This study used secondary data

from NSE hand books and published financial statements. In addition, the study collected

secondary data from investment funds. From the financial statements the researcher

considered income statement, statement of financial position and notes to the accounts for the

stated period of the study. Data was arranged in data collection schedules. All listed firms

Year 2004 2005 2006 2007 2008 2009 2010 2011 2012

28

were given equal chance regardless of their delisting period. This controlled biasness within

the study.

3.10 Data Analysis and Presentation

Quantitative data is analyzed using inferential statistics which include; panel multiple

regression correlation and analysis of variance. The output of data analysis through Stata 13.0

was presented in a tabular form. For clear presentation the output data was cleaned for better

interpretation.

3.11 Diagnostic testing

The study carried out the following diagnostic tests on the data.

3.11.1 Multicollinearity

Multicollinearity refers to a situation in which two or more explanatory variables in a

multiple regression model are highly linearly related. In order to check multicollinearity in

the nine factors, the study checked on the interconnection among these factors.

Multicollinearity occurs when these factors are highly correlated with the value of r being

less than 0.9 (Tabachick and Fidell, 2007. This test was carried out under Pearson correlation

and the output was explained in chapter four.

3.11.2 Heteroscedasticity

Heteroscedasticity is a serious problem for Logit as it causes the estimates to be inconsistent. Verbeek (2009) argued that since these models are usually estimated using

cross-sectional data then the problem likely to be encountered quite often. The study carried

29

3.11.3 Overall evaluation of the model using likelihood ratio test

A logistic model is said to provide a better fit to the data if it demonstrates an improvement

over the intercept-only model (also called the null model). Likelihood ratio test is based on

the difference in deviance without any predictor in the model minus the deviance with all

predictors in the model. An intercept-only model serves as a good baseline because it

contains no predictors (Peng et al., 2002). In this study, all observations were predicted to

belong to the largest outcome category. An improvement over this baseline was examined by

using the likelihood ratio inferential statistical tests.

3.12 Ethical Standards

This is in line with the moral principles guiding the research work all the way from inception,

completion to publication of the research work. The researcher ensured that the study

obtained a valid consent on every person from whom the data was gathered from. The

researcher wrote emails and used official research letters from NACOSTI and University to

seek this consent. In addition, the researcher ensured confidentiality on the information.

Information obtained from participants during the study was treated as confidential unless

otherwise advised. In situations where confidentiality would not be guaranteed, the

participants were informed in advance before engaging them in the study. The researcher also

exercised justice on equitable selection of the participants. All the stake holders involved in

30

CHAPTER FOUR

DATA ANALYSIS AND PRESENTATION 4.1 Introduction

This chapter presents data analysis. It contains statistical summary and results from empirical

analysis and the interpretations of the statistical inferences derived from the compiled data

strived to accomplish the objective of the study. The econometric evaluation of the model

was conducted by the use of Logit model with output being either, failed or non-failed firms

in financial distress.

The secondary data was obtained from the annual NSE hand books, published financial

statements and investment funds. From the financial statements the researcher considered

income statement, statement of financial position and notes to the accounts for the stated

period of the study (2004-2012) of eight years.

4.2 Summary of Descriptive Statistics

The study carried out descriptive statistics of the eleven study variables and are presented in

31

Table 4.1: Summary of Descriptive Statistics

LEV 306 .4695621 .1833087 0 1.37 SYSRISK 288 .9592813 .3370076 .34 1.68 BODFOREIGN 321 .4448287 .2948178 0 1 BODLOCAL 321 .5688474 .2845066 0 1 FOREIGNOWN~P 321 .3459813 .3225771 0 1 TobinQ 243 1576.004 1651.034 0 8539 SIZ 304 6.498457 .9427544 0 8.934 LIQ 304 2.107572 2.28257 -2.12 18.76 EFF 304 .732977 .8084601 -.096 5.336 Distress 291 .9553265 .206942 0 1 Variable Obs Mean Std. Dev. Min Max

Source: Research data, 2015.

The Table 4.1 presents the summary of the all variables under study that explained the

financial distress of the non financial firms listed in the NSE. All of the variables were

converted in ratio formats before analysis. A mean of 0.732 [.808] was obtained on

efficiency, liquidity had mean of 2.11[2.28], firm size had mmean of 6.50 [0.943], TobinQ

mean of 1576 [1651.03], foreign ownership had a mean of .346 [.322], local BOD

composition had a mean of .569[.284], foreign BOD composition had a mean of .445[.295],

leverage and systemic risk had mean of .470 [.183] and .960 [.337] respectively.

4.3 Diagnostic Tests

4.3.1 Heteroscedasticity Test

The Pagan test is designed to detect any linear form of heteroscedasticity.

Breusch-Pagan / Cook-Weisberg test, the null hypothesis that the error variances are all equal versus

32

Breusch-Pagan test was carried out and high Chi value obtained (259.32) with significant p

value (<0.05) indicates presence of heteroscedasticity among the study variables.

Figure 4.1: Breusch-Pagan Heteroscedasticity test

Prob > chi2 = 0.0000 chi2(1) = 259.32

Variables: fitted values of Distress Ho: Constant variance

Breusch-Pagan / Cook-Weisberg test for heteroskedasticity

Source: Research data, 2015.

4.3.2 Mann-Whitney Wilcoxon test

The Wilcoxon-Mann-Whitney test is a non-parametric analog to the independent samples

t-test and can be used when one does not assume that the dependent variable is a normally

distributed interval variable. It is normally referred as the Mann-Whitney U test or the

Wilcoxon rank sum test. Anderson, Sweeney and Williams (2008) concluded that both the

Mann-Whitney U test and Wilcoxon rank sum test are equivalent. The test was developed

jointly by Mann, Whitney and Wilcoxon. Therefore, present studies refer these two tests as

the Mann-Whitney-Wilcoxon (MWW) test. The Wilcoxon-Mann-Whitney test was carried

and the results are presented Table 4.2. The MWW test was used to test hypothesis 1,

hypothesis 2, and hypothesis 3. The test revealed key factors that were significant in

explaining financial distress in listed non- financial firms in NSE.

The study sought to test the following hypotheses.

H01: Financial factors have no influence on financial distress on listed firms in