Annex 3.1 Tables on socio-economic position

Full text

Figure

Related documents

The positive effect of mobile machine interactivity on e-retailers’ operational performance also indicates that e-retailers need to provide commonly applied functionalities such

Employer information, length of employment, gross income, or any other sources of income including pension, social security, etc.. Funds to Close

Gross monthly income is the sum of monthly gross pay; any additional income from overtime, part-time employment, bonuses, income from self-employment,

If your self employed income has changed since your business accounts were audited please complete this form.. If there has been no change to your self employed income since

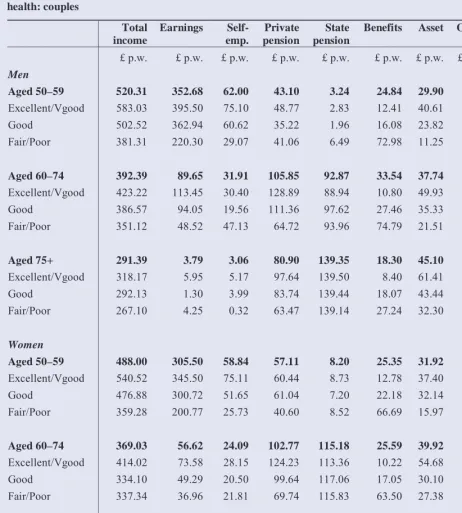

First Applicant Second Applicant Pension Income £ £ Investment Income £ £ State benefits £ £ Other Income £ £ Total income £ £. Current tax rate % %

(3) Adjusted EBITDA defined as net income (loss) plus: (1) provision for income taxes; (2) other (income) expense, net; (3) depreciation of property and equipment, including

Gross Monthly Income (before taxes and deductions) from salary and wages, including commissions, bonuses, overtime, self- employment, business income, other jobs, and

Income for surcharge purposes is the sum of taxable income (including the net amount on which family trust distribution tax has been paid); exempt foreign employment