Co

De

Receive doi:10.5

Abstra

Experim expecta the ban likeliho Logit, P all man The res has bee accurac firms w

Keywo

omparin

Analy

Depar

Tel

epartment o

Te

ed: Decemb 5296/ajfa.v5

ct

mental stud ations in cap nkruptcy of ood of manu

Probit, and nufacturing f

sults showed en81, 80, an cy of Logit with high acc

rds: Bankru

ng Log

ysis Mo

rtment of Bu Is l: 98-912-2

Ma of Accountin

Si el: 98-916-6

ber 31, 2012 5i1.2977

dies across pital market

the compan ufacturing f Multiple-di firms listed d that the p nd % 70 res

model and curacy in th

uptcy, Logi

git, Prob

odels in

Co

Khalili usiness Man

lamic Azad 217-2635

akvandi, Sar ng, Science istan and Ba

621-6032

2 Accept URL: http

the world t is their abi nies. For thi firms and c iscriminant in Stock Ex redictability spectively. T

also Multip he level logi

it model, Pr

bit and

n Predic

ompani

i Araghi, M nagement, S d University

E-mail: m

ra (Corresp e and Resear

aluchestan, E-mail: sa

ted: January p://dx.doi.or

d show tha ility in pred is purpose, comparing t analysis. St xchange of y of Logit, The results ple discrim it model.

robit model,

Multip

cting B

ies

Maryam Science and y, Tehran, Ir m.khaliliarag

onding auth rch Branch,

Zahedan, Ir aramakvand

y 16, 2013 rg/10.5296/a

at one of i dicting the s this study the predicta tatistical po Tehran sinc Probit, and also showe minant analy

, Multiple-d

ple Disc

ankrup

d Research B ran

ghi@gmail.c

hor)

, Islamic Az ran

di@ymail.co

Publish ajfa.v5i1.29

investors an tatus of acti tries to pred ability powe opulation of

ce 2000-20 Multiple-d ed the highe ysis method

discriminant

crimina

ptcy of

Branch

com

zad Univers

om

hed: June 1, 977

nd other a ivity consis dict the ban er of 3 met f the study i

10. discriminant

er predictab ds identify b

t model

ant

sity

2013

activists’ stency or nkruptcy thods of included

1. Intro

Predicti 3 decad its cons very im compan (Tonatiu Unrelia that ma in the s patterns assuran Many fi 1. They

2. Con physica 3. A pa which a

Regardi debt. The com causes value de reduces Therefo bankrup commo standard variable stateme

2. Rese

Bankrup of the c bankrup others, predict reduce estimate

oduction

ing bankrup des (Ching– sequences a mportant for ny leads spr uh Pena et a ability from ay discourag same year, s for foreca nce to invest

firms get ban y have to sel

flicts amon al damage an art of compa

are not as im

ing these ca

mpanies lac increase in ecrease enh s the current ore it seem ptcy of co on techniqu d modeling es used in ents (Etemad

earch theor

ptcy always community ptcy. But it Manageme bankruptcy the risk of e the comp

ptcy has bee –Ching Yeh affect the ec r variety of read of crisi

al.2009). survival of ge investme and is out asting firm t in stock m nkrupt annu ll their prop

ng creditors nd inventor any value is mportant as

ases, bankru

cking debt h bankruptcy hances becau

t value of th ms necessar

mpanies. S ues in bank g technique

Building di,2007 ).

ries and bac

s has divert . It is very can be claim ent, investor y, not only t

f your port pany's finan

en a challen h et al.2010 conomy of public and s to other p

f the existin ent in the S of stock. T ms that are market with t ually becaus perties with

s may dela ry depreciati s spent for l

1 and 2.

uptcy cost i

have never b y likelihood use of the c he company ry to find Statistical t kruptcy pre es and has these mod

ckground

ed wide ran difficult to med that it rs, creditors

o prevent th tfolio (Etem ncial bankru

nging issue 0). Bankrupt

the country d commercia parts of the f

ng company Stock Excha Therefore w

going bank the lower ri se such situ low price.

ay liquidati ion increase lawyers’ fee

is high. It j

been bankru d and reduc costs of bank y, enhancing

a model th techniques ediction. Th

focused o dels is the

nge of indiv o provide a will be influ s, competito he risk of bu madi,2007 ) uptcy, becau

for many sc tcy is impo y. In fact, b al organizat financial sy

y in Stock E ange, becau

with the de kruptcy, Ca sk (Rekabd ations:

ing the ass es.

e, court cos

ust occurs f

upt. So, fina ce earnings. kruptcy. Inc g its capital

hat can pre are consid his model n signs bu

informatio

viduals, orga an accurate uenced ban ors, and leg urning their ). Hence, T use in case

cientific stu rtant in fina ankruptcy p tions. Becau stem and ca

Exchange is use perhaps esign and p an be gave ar et al,200

sets. Then

st, and organ

for the com

ancial provis As a resul creasing ban

costs (Briga edict the fi dered as th

has been usiness failu n containe

anizations a definition kruptcy phe gal institutio r capital, bu They are th of bankrup

udies during ancial studi prediction h

use the fail ause system

s one of the bankrupt c propose app e the invest 06 ).

the probab

nizational e

mpanies whi

sions throug lt, the likeli

nkruptcy lik am,2003 ). financial cr he most ba

used from ure. Genera ed in the f

and the gen for interest enomena m ons. Investo ut its use as

he ways tha ptcy, stock

g the last ies since has been lure of a mic crisis

e factors company propriate tors this

bility of

expenses

ich have

gh debts ihood of kelihood

isis and asic and m classic ally, the financial

eral part t groups more than

ors with a tool to at could

compan taken in impact to corp bankrup Theref process Comme For pre viewpo strategi models likeliho Bankrup intellige univaria discrim adjustm Artifici machin techniqu and the Bankrup risk.(Fir Komija model t multiva liabilitie power al(2011 The res model h t-2, resp years t, a resear regressi third re way the did a r compar nies sharply nto conside on lending porate loan ptcy. fore, accura s and the Co

ercial units eventive me int, tools pr c actions an is one of th ood of bankr

ptcy predic ence, and t ate and m minant analy

ment process al neural n es, Sion-ba ues eoretical m

ptcy theor rouziyan et ani et al (20

to predict t ariate probi es,gross pro than comp )compared sults showe have better pectively, %

t-1 and t-2, rch titled" ion to class espectively %

e logit mod research tit red two mod

y decreases eration wide

decisions fo ns demand

ate and tim ontinuance o managers a easures wh redicting fin nd avoided he techniqu ruptcy estim tion models theoretical. multivariate. ysis models, ses. networks, g ased reaso

models is a ry of gam

al,2010) 005) condu the econom t and logit ofit to sale pany econo

Ohlson log d Ohlson lo than perfor %96, %91 , respective Accounting sify the com

%85.1, %87 del to discr tled "Bankr del of Logit

(Rasoulzad ely in Acco for creditors

they shou

mely predict of credit ins also can be

ich prevent nancial ban from bankr ues and tool mate with co

s can be cla Statistical . Multivari , linear prob

enetic algo ning and

also includ mbling, Ca

ucted a rese mic bankrupt t models w s and net p omic bank git analysis ogit analysi rmance. Oh and %89, ly, %85, % g Data and mpanies stu 7.6 and %8 riminate ana ruptcy pred t and Multip

deh,2000). P ounting and s and also th uld be abl

tion of ban stitutions (A informed t t bankruptc nkruptcy pro

ruptcy(Arab ls to predict ompositions assified in th models th iate statist bability, log orithms, rec fuzzy logi ding criterio ash manage earch titled tcy of comp with explana profit to cu kruptcy in s and multip is model th hlson model While the

74and 76% d the Predic

udied. His m 82.6.Hough

alysis techn diction: an ple-discrimi

Predicting f d financial heir profitab

le to predi

nkruptcy ha Arabmazar e timely of th cy (Etemad

ovides this bmazar et a

t the future s a group of hree groups hemselves a

ical model git, probit,th

ursive Afra ic, are com

on analysis ement theo

"The cond panies in Ir atory variab urrent debt Iran. (Ko ple discrim an multiple prediction fulmer mod 6.(Vadiee et ction of Bu model accu hton in their niques.(Hou investigati inant analys financial ba field. Such bility. Befor ict possibil

as a signific et al,2007 ). he risk of b di,2007). Fr possibility al,2007).Ban

state of the f financial ra , statistical are divided l is comp he total cum

az, rough s mposed art

s of sheet ory and t

ditional like ran". The r bles curren have maxim mijani et minant analy e discrimina accuracy is del predicti t al,2011)H usiness Fail uracy was fo

r study conc ughton 1994, on of cash sis models. T

ankruptcy h research h re creditors lity of com

cant impact

bankruptcy rom a mana

to adoption nkruptcy pr e company' atio.

modeling, a d into two posed of M mulative and sets, suppor tificial inte / entropy theories of elihood of results show nt assets to imum of pr

al 2005, )Va ysis fulmer ant analysis s for years t ion accurac Houghton (19

lure" using or the first

cluded that 4)Aziz et a h flow Mo The results

has been has great respond mpany’s

t on the

adopt to agement n timely rediction s in that

artificial groups, Multiple d Partial rt vector elligence theory, f credit optimal wed four current redictive adiee et models. s Fulmer t, t-1and cy is for

better p discrim The res compar overall to 89 p sample importa size, in and Pro (Lennox Thus, th Exchan bankrup 3. Meth

In this probit, busines the rank likeliho followin

Where, paramet

p(z) wil resultin event o include Probit m the valu to Logi than cum

performance minant analy

ults showed re with desi

accuracy be percent (Az

including ant bankrup ndustrial sec obit models x, 1999). his study to nge, compa ptcy such L hodology

study, we and multip ss failures. B

king of eve ood in a def

ng formula:

Xi (i=1,…

ters of the m ll tend to ze ng likelihoo or not, predi a range of model is use ues 0 and 1.

t models. B mulative lo

e of logistic sis.

d better perf igned mode etween 79% ziz et al,198

949 Englis ptcy factors ction, and e

s, compared

o predict the aring the re

ogit, Probit

use to pre le discrimin By allocatin ery sample finite group.

:

, n) shows model. P (z)

ero and if Z od equal to0

icted likelih values betw ed when the . (Such as b But, the form

gistic funct

c regression

formance of el based on 9 to %92 an 88).Lennox( sh compani include pr economic cy

d with disc

e bankruptcy esults of t t, and Multip

dict corpor nant analys ng some w company. . Success or

1 1 e

independen

) likelihood Z move into 0.5.Logit an hood of the ween 0 and

e dependent ankruptcy a mer uses cu

ion.

, a

P

a

n model, th

f designed m n multiple d

nd was accu (1999)exam ies since 1 rofitability,

ycles. The criminant an

y likelihood the applica

ple-discrim

rate bankru sis. Logit m weights to in This ranki r failure lik

1 e

nt variables d is a numb

+∞, p(z) w analysis inst event. Thu

1.

t variable,w and non-ban umulative li

a

=

e model wa

model by th discriminan uracy of dis mined the re 1978-1994. financial le results show nalysis in p

d of manufa tion of 3 minant analy

uptcy from t model has w ndependent

ing is used kelihood in t

1

...

s, and a an er between will tend to tead of pre us dependen

was qualitati nkruptcy)Pr ikelihood fu

a

as designed

he logistic re t analysis. criminant a easons for t Based on everage, cas wed higher predicting c

acturing firm statistical sis.

three statist wide applica variables, t for determ this model i

nd bi (i=1,…

0 and 1.If 1.when Z i edicting wh nt variable c

ve and be a robit models unction whi

d based on m

egression m Logit mode analysis betw

the bankrup Lennox, th ash flows, c

r accuracy o companies'

ms in Tehra models to

tical model ations in pr this model mining mem

is calculate

…, n) are es f Z move in is equal to z hat will be could encom

able to prov s are mostly ich is norma

multiple

model, in els have ween 73 ptcy of a he most company

of Logit failures

an Stock predict

ls, logit, redicting

predicts mbership d by the

stimated nto ∞, zero, the actually mpass to

Multipl into dis among For suc prerequ context identifie contain this me achieve Classifi Multiva point, it the dis Equatio

:T where ‘ compan

x : T

:Coe

u :is th

The firs corpora had mo

3.1 Var

To iden principa large nu several the who highest collecti This ap variable Varianc called t analyzin

le-discrimin stinct group the groups ch predictio uisite for MD

of ratio-b ed: the firs s companie thod, a com ed score and

ication w ariable-discr

t was regard scriminant on 1 gives

The value th ‘ k’ represe nies. ‘ fkm’ The value fo efficients as

he constant st time Altm ate failure.T

deling more

riables

ntify the m al compone umber of in

principal c ole variance amount in ons of varia proach will e with each ce explained the specific

ng principa

nant analysi ps with diff

and predict ons, some DA is that based mode st group in es that are s mpany was d the maxim was done

riminant an ded as a non

function, a the general

hat the disc nts either th

is also know or the financ

sociated wi

term or the man (1968) This study a e than one v

most importa ent analysis nitial variab omponents e. At first Sp n total var ables that ha l apply to se factor is cal d by each fa c value. Th

al compone

s is a multiv ferent quali t the likelih quantitativ a data item els for sign ncludes com still a going attributed to mum similar

based o nalysis mode n-bankrupt c and the fin

specificatio

u u x

criminant fu he group of wn as the sc cial ratio ‘i’ ith each fina

intercept. suggested m lot attentio variable.

ant financia was used. bles into a

are to revie pss, selects c iance. This ave the high elect the thir

lled factor l factor equal he first spec ents, the va

variable me ities. This s hood of a co ve independ m could be c naling corp mpanies tha g concern. o a bankrup rities.

on optimu el. If the sco company.T nancial rati on of the M

u x

unction gen f collapsed core.

’ for compan ancial ratio

multiple dis on because f

al ratios fo In principa small num ewed so tha combination s collection hest contribu rd, fourth an lodding and

to the squa cific value alues over

ethod in whi study aimed ompany’s de dent variab classified in porate colla at have col

The data it pt or non-ba

um short ore of a com

he mathema ios are cal MDA-based m

⋯ u

nerates for c companies

ny ‘ m’ in g ‘x ’.

scriminant a for the first

or selecting al componen mber of new at the new v n of variable n makes fi ution in expl nd subseque d their Value are of the fa of the high 1 were reg

ich the phen d to recogn ependency t bles were u nto two or m

apse, two g lapsed and tem is there

ankrupt gro

cut point mpany was atical equat lled discrim model.

u x

company ‘ or the grou

group ‘ k ’.

analysis me time in ban

main varia nt analysis, w variables variables ha es that their irst factor.

laining the r ent factors. e fluctuates actor loddin hest and is garded and

nomena are nize the dif to a specifi used.Thus, more group groups are d the secon

efore a com oup accordin

t, identifi lower than tion is referr minating va

m’ in grou up of non-c

ethod for pr nkruptcy pr

ables of th convert all that the sa ave a large r correlation Second F remaining v Correlation between -1 ng .This var

greater tha d used as th

e divided fferences c group. a basic s. In the

readily d group mpany.In

ng to its

ed for shortcut red to as ariables.

up ‘ k ’, ollapsed

redicting rediction

e study, lowing a ame first share of ns are the Factor is

variance. n of each and +1. riance is an 1 . In

signific proport or 90 p was ide Indepen -Return -Debt ra -Debt c -Collect -Invento -Debt to -Produc

-Depen 4. Resu

Statistic Exchan 134 no Busines the half bankrup 1. The c 2. Their 3. Finan 4.They 2000- 2

4.1. log

Logit re

cant specifi ional of the percent, to e entified.

ndent variab n on equity (

atio over ratio tion period ory turnove o equity rati ct to workin

dent variab ults

cal populati nge of Tehra on- bankrupt ss Law in Ir f of their c pt companie companies s r fiscal year ncial inform should hav 2010.

git model

egression m

c values.To e change tot express initi

bles of the s (ROE)

er io

ng capital ra

le was the l

ion of the s an since 200 t companies ran, based o capital must

es was base should be m r should end mation of the ve 10 succ

model fitness

o choose t tal percenta ial changes.

study includ

atio

ikelihood o

study includ 00-2010. To s were used on which th t declare ba

d on the fol manufacturin

d in Septem e companie cessive yea

s was tested

the number age cumulat

Thus After

de:

of bankruptc

ded all man o measure m d. Bankrupt he firms wit ankruptcy o llowing con ng.

mber. s should be ars of activ

d based on th

1 1

r of main tive so that r examining

cy or non- b

nufacturing model fitnes tcy measure th minimum or capital lo nditions:

accessible. vity in Stoc

he followin

e e

ε

variables c the this ma g 22 financi

bankruptcy o

companies ss, the data o e in this stud m accumulat

oss. Sample

ck Exchang

ng equation:

can be con ain compone ial ratios, 7

occurrence.

s accepted i of 55 bank dy was Act ted loss, eq e selection

ge of Tehra

nsidered ents, 80 7 factors

in Stock rupt and 141 of qual with

of non-

Table 1

Table 2

0.000

Table 3

RO Inv Co Pro De De De Co

Accord conclud coeffici gives th

48

Table 4

Observed B Percent

Estimat bankrup

.

1 Regressi

Coeffi Nagel 0.273

.

2 Significa

3. Logistic r

OE

ventory turnov llection period oduct of work

bt ratio bt to equity ra bt coverage ra nstant

ing to likeli ded that the

ient it identi he following

7.667 0.0 0

4. To accura

Bankruptcy

tion accurac pt companie

ion statistics

icient of deter kerke

ant regressio

Sig.

regression c

ver d

ing capital rat

atio atio

ihood value e model is ifies %27 o g formula:

024 0. 0.005X ε

ately estima

0 1

cy was %81 es shown in s

Co Co rmination

0.

on test

7

coefficients

Sig. 1 0.000

1 0.09

1 0.761

1 0.927 tio

1 0.005

1 0.004

1 0.691

1 0.054

e in significa statistically f distributio

003 0

ε

ate of bankr

Estimation 0

133 35

1. For non-b n Table4.

oefficient of d ox & Snell .191

df

40.055

Wald df

14.26 1.000

2.821 1.000

0.092 1.000

0.008 1.000

7.983 1.000

8.214 1.000

0.158 1.000

3.723 1.000

ance test (P y significan on. Table 3

.0004X

ruptcy

n of bankrupt 1 1 2

bankrupt co

determination

5

St d Statistic

0.0 64

0.0 0.0 2

0.0 8

0.0 3

0.0 4

0.0 8

25 3

=0.000) sho nt and due

shows logis

0.001X

cy 1 1 20

mpanies, it

-2 Log like 187.898

tandard deviat 006

002 001 007 078 080 012 52.742

own in Tabl to its resu stic regressi

0.220X

Percentag 99.3 36.4 81.0

was %99 a

elihood

C

Coeffic tion

0.024 -0.003 0.0004 0.001 0.220 0.228

-0.005 -487.667

le 1 and 2, i ulted determ

ion coeffici

0.228X

ge of accuracy

and it was %

Chi-square

cient

7

it can be mination ents and

y

4.2 Pro

Probit r

Table 5

0.000

Table 6

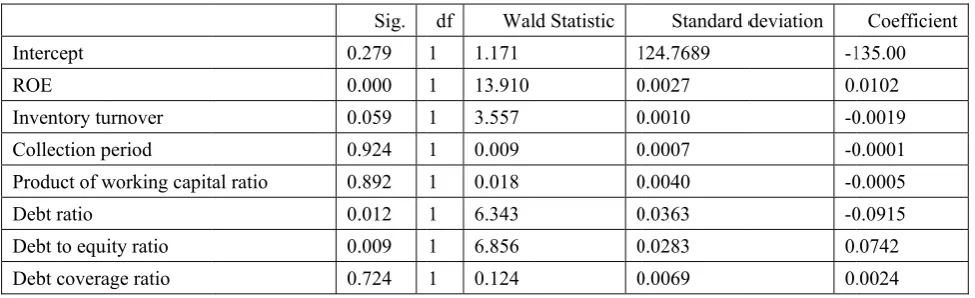

Intercept ROE Inventory tu Collection p Product of w Debt ratio Debt to equ Debt covera

Accord conclud coeffici

Table 7

obit model

regression m

5. Significan

6. Probit reg

urnover period working capit

uity ratio age ratio

ing to like ded that th

ients and giv

1 0

7. To accura

Obser

Percen

model was m

nt regressio

Sig. 7

gression coe

al ratio

lihood valu he model i ves the follo

135 0 0.0742X

ately estima

rved Bankrupt

nt

measured ba

1

on test

7

efficients

Sig. 0.279 0.000 0.059 0.924 0.892 0.012 0.009 0.724

ue in signif is statistica owing form

0.0102 0.0024X

ate of bankr

Estim 0 133 0 tcy 1 37

ased on the

df

34.984

Wal df

1.171 1

13.910 1

3.557 1

0.009 1

0.018 1

6.343 1

6.856 1

0.124 1

ficance test ally signific mula:

0.0019 ε

ruptcy

mation of ban 1 1 18

following e

4

ld Statistic 1 0 0 0 0 0 0 0

t (P=0.000) cant. Table

0.0001X

Per nkruptcy

99 33 8

80.

equation:

ε

Standard d 124.7689 0.0027 0.0010 0.0007 0.0040 0.0363 0.0283 0.0069

) shown in e 6 shows

X 0.0005

rcentage of ac

0

deviation 1 -0.

0

-0

-0

-0 -0. 0.

n Table5, it s probit re

5X 0.09

ccuracy

Chi-square

Coefficient 135.00

.0102 0.0019 0.0001 0.0005 0.0915 .0742 .0024

t can be gression

Estimat bankrup

4.3 Mu

Multipl

Table 8

Table 9

Sig. 0.243

Table 1

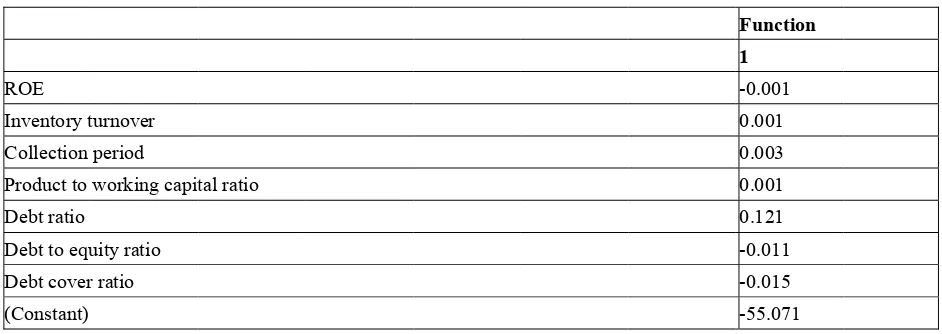

ROE Inventory t Collection Product to Debt ratio Debt to equ Debt cover (Constant)

Regardi signific 8 and Table formula

Canonical C 0.220

tion accura pt companie ultiple-discr le-discrimin

8. Table eig

9. Table me

10. Table no

turnover period working capit

uity ratio r ratio

ing the lik cance level,

9.

10 shows a:

Correlation

acy was 80 es, shown in riminant mo nant model w

genvalue fun

eaningful tes

df 7

on-standard

tal ratio

kelihood va it can be sa

non-standa

C

%

0 . For no n Table7. odel

was examin

v

nction

st

C 9

dized coeffic

alue in sig aid that the m

ardized coe

Cumulative % 100.0

on-bankrupt

ned based on

b b

Chi-square 9.130

cient Focal

gnificance model is sta

efficient Fo

t companie

n the follow

b xj

functions

test (P=0.2 atistically in

ocal functio

% of Varianc 100.0

s, it was %

wing equatio

Wilks' Lam 0.951

243) and c nsignificant

ons and gi

ce

%99 and %

on:

mbda

Function 1

0.001 -0.001 0.003 0.001 0.121 0.011

-0.015

-55.071

-comparing t, as shown

ives the fo

Eigenvalue 0.051a

33 % for

it with in Table

Table 1

Observed

Percent

Estimat was %8 Table 1 regressi

Multiple

Table. Multipl regressi Multipl

Conclu

In this analysis model w Logit m model f indicati The res corpora compan non-ban bankrup showed model.

55.07 0

11. To accu

Bankruptcy

tion accurac 84 for non-b 12. Ratio t ion.

discriminant

12 show le-discrimin ion is not h le-discrimin

usion

study we c s models to was %81, fo model, Could

from 55 ba ive high pow sults of Pro ate bankrup nies is %9 nkrupt com pt companie d that Probit

7 0.001 0.015X

urately estim

Estim 0 112 0

35 1

cy in the sa bankrupt co test for com

analysis Data e

ws the Ra nant regress

higher. Also nant regressi

compared p o predict b or identify n

d predict fro ankrupt com wer logit mo obit model c ptcy has % 99 and for mpanies wer es has been t model to

0.001

mate of bank

mation of ban

ample is sh ompanies an mparing th

envelopment a

atio test f ion.The res o,Z test res ion and DE

redicting p ankruptcy.T non-bankrup om 134 non mpany, have odel in pred confirm tha

80

% .accurac r bankrupt

re able to p n able to co

identify ban

0.003X

kruptcy

nkruptcy 1 22 20

hown in Ta nd %36 for he models

69.8 72.0 analysis

for compa sults show th sults don’t EA.

ower of Lo The results pt companie n-bankrupt c e been able diction of co at can predi cy of the P

companies predict corr orrectly pred

nkruptcy fir

X 0.001X

able11. Esti r bankrupt c of efficien

Accura 8%

0%

aring the hat the accu confirm a s

ogit, probit showed th es %99 and companies,

to predict b orporate ban ict power th Probit mod s is 33 pe rectly133 dict bankru rms, no sig

X 0.121

Percen 83.6 36.4

69.8

imation acc ompanies. cy and Mu

p- value acy

0.325

models o uracy of Mu significant d

and multiv hat predictin d %36 for ba 134 compa bankruptcy nkruptcy. his model i dels to iden

ercent.This companies uptcy 18 co

nificant dif

X 0.011

ntage of accur

curacy was

ultiple-discr

Z t

0.4

of efficien ultiple-discr

difference b

variate discr ng power o ankrupt com anies correct

20 compan

in the predi ntify non-b model fro and also f ompany.The fference in t

1X

racy

%70. It

riminant

test

453

cy and riminant between

riminant of Logit mpanies.

tly. This nies that

The res about % corpora This m correctl recogni perform and pre has a pe has a lo bankrup

Referen

Arabma Accoun Aziz, A flow M Brigam Ching-C set and

Applica

Etemad

monthly

Firouzia bankrup Stock E Hought of Prio http://dx Komija the econ Lennox DEA http://dx Rasoulz compan

Rekabd in predi

ults of the M %70. Accur ate bankrupt model could ly. The resu ition of ban mance comp edictive pow erformance ower predic pt companie

nces

azar, M., & ntant month A., Emanuel odels. Jour

m,W. (2003). Ching, Y., D d support

ation, 37(2), di, H., & De

y, 5, 40. an, M., Jav ptcy predict Exchange. R

ton, K. A. ( ors and th

x.doi.org/10 ani, A., & S

nomic bank x, C. (1999) approache x.doi.org/10 zadeh, M. nies. Tadbir

dar,G. H., C iction of ban

Multiple dis racy of the tcy and %36 d predict on ults show th nkrupt comp pared to pro wer of logist near to log ctive power es probit mo

Akbari, M ly, 200, 34 l, D., & Law

nal of Mana

. Financial

Der Jang, C vector mac , 1535-1541 ehkordi, H.

vid, D., & N tion and co

Review of ac

1994). Acco he Age of

0.2307/2490 Saadatfar, J.

kruptcy of co ). Identifyin es. Journ

0.1016/S014 (2000). Ap

monthly, 12

hinipardaz, nkruptcy. Jo

scriminant a e Discrimin 6.4 for the nly 112 co hat Multipl panies in c obit model. tic regressio git model bu r in compar odel has bet

. (2007)Pre

wson, H. (1

agement Stu managemen

Ch., & Ming chines for 1.

(2007). A r

Najmodini, ompared wit

ccounting an

ounting Dat f Data. Jo

0717 (2005). Th ompanies in ng failing c

al of E

48-6195(99 pplication A

20, 100.

R., & Solim

ournal of Ap

analysis mo nant analys prediction o ompanies fr

e discrimin compared to

The resear on is higher ut in lower re to two o tter perform

edicting corp

988). Bank

udies, 25(5)

nt. Translate g, Fu, H. (2

business

review of b

N. (2010). th Altman Z

nd auditing

ta and the P

ournal of

he condition n Iran. Jour

companies:

Economics

9)00009-0 Altman mo

mani, B. (2

pplied Math

odel showed sis models of corporate rom 134 no nant analysi

o logit mod rch results s

r than the ot level, Mult other model mance.

porate bank

ruptcy pred ), 437-419.

ed by Abdeh 2010). A hyb failure pre

bankruptcy p

Application Z model Co

g in Iran, 65

Prediction o

Accounting

nal likelihoo

rnal of Hum

A re-evalua

and B

odel at stat

006). The D

hematics, 12

d that accura %83.6 for e bankruptcy on-bankrup

s model ha del level an show that th ther two mo iple discrim ls. But in c

kruptcy usin

diction:an in

h, H, Pishbo brid approa ediction. Ex

prediction m

n of genetic ompanies li

, 100. of Business

g Research

od of optim

an Sciences

ation of the

Business,

tus determi

Discriminan

2, 25-15.

acy of this m r the distin cy.

pt firms, to as high accu nd has muc

he overall a odels. Prob minant analy

contrast, to

ng neural ne

nvestigation

ord,PP21 ach of DEA

xpert Syste

models. Acc

c algorithm isted on the

Failure: the

h, 22(1), 3

mal model to

s, 57, 28-3. e Logit, Pro

51(4), 3

ination ban

nt analysis o

model is ction of

predict uracy in ch better accuracy

it model ysis also identify

etworks,

n of cash

A ، rough

em with

countant

ms in the e Tehran

e Setting 361-368.

o predict

obit, and 347-364.

nkruptcy

Tonatiu Mexico Vadiee, analysis

research

Copyri

Copyrig This ar Creativ

uh Pena, C. o Working P M., & Mi s and multip

h, 13, 23-1. ight Disclai

ght reserved rticle is an

e Commons

Serafin Ma Paper. Bankr

resmaeeli, ple discrimi .

imer

d by Maryam n open-acce

s Attributio

artinez, & J. ruptcy Pred H. (2011). inant analys

m Khalili A ess article d

n license (h

. Bolanle, A diction: A Co

Predicting sis Fulmer A

Araghi and S distributed http://creativ

A. (2009). L omparison o

bankruptcy And compa

Sara Makva under the vecommons

Learning Tec of Some Sta y by using

re them. Ac

ndi.

terms and s.org/license

chniques. B atistical Mo ohlson logi

ccounting a

d conditions es/by/3.0/).

Banco de odels.

it model

nd audit