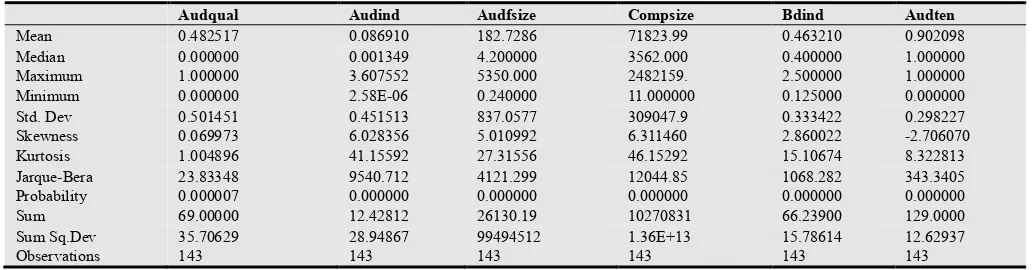

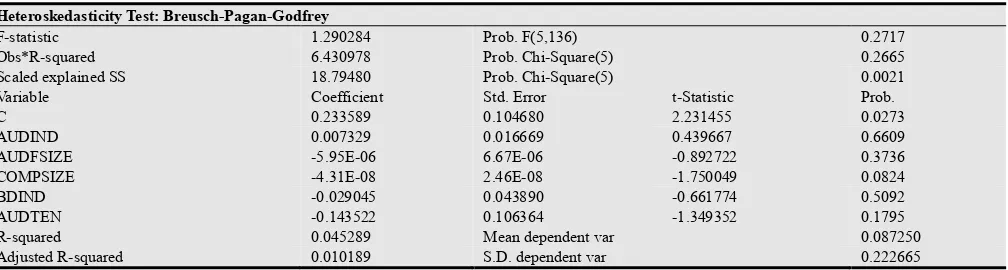

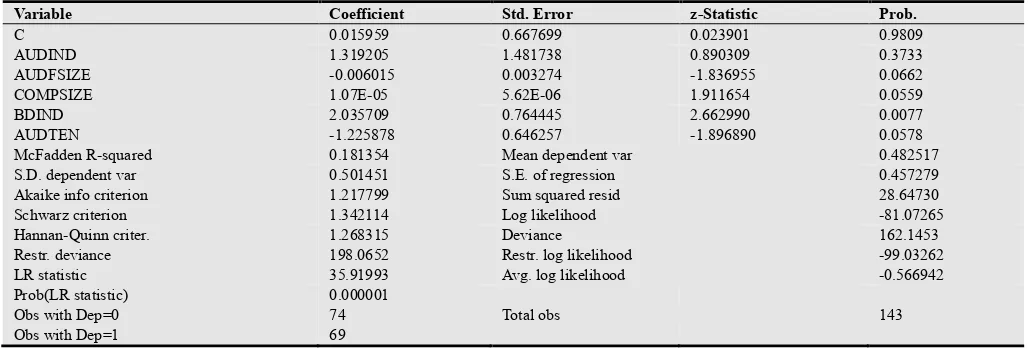

Audit Firm Characteristics and Audit Quality in Nigeria

Full text

Figure

Related documents

We’ll explore how the onrush of exponential technologies will pressure investors to think differently, and force wealth managers to keep up if they want to stay in

How Parmalat’s Experiences Will Shape Strategies in International Dairy Markets • Parmalat’s downfall confirms the notion that size and profitability don’t necessarily

The dynamic capabilities literature posits that ambidexterity as a dynamic capability rests on the ability of leaders/managers to not only articulate their firm’s strategic

An important question that must be asked is “will home country bias diminish as managers move to a sector/country allocation framework?” For if the answer is “no”, then

neuropsychology and contains a planned sequence of training in all of the areas cited above. Students will enter the program with credentials at the specialist level of

Alzheimer’s Disease Center (MADC) housed in the same building as the Neuropsychology Section. The MADC aims to: a) conduct and promote research on Alzheimer’s disease and

Neuropsychological and psychological evaluations with adults, adolescents, and children with neurological, psychiatric, and other medical conditions; individual,

Career prospects: The agricultural productions of intensive farming that address the social and production needs in our society increases the demand for professionals with