Managerial Opportunism? Evidence from Directors and Officers Insurance Purchases

Full text

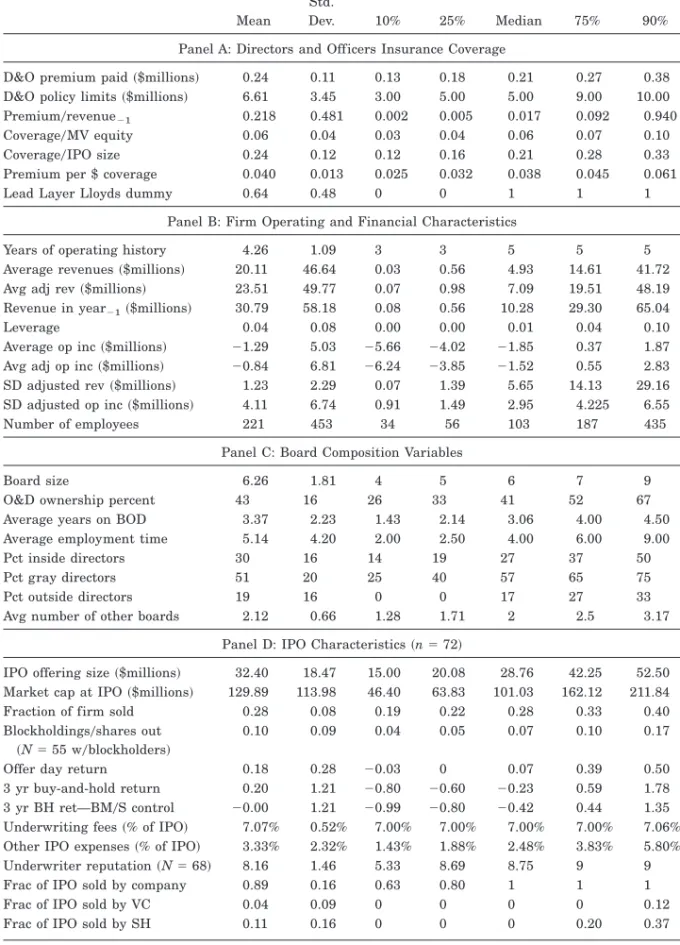

Figure

Related documents

Situation An investor brought suit against the insured alleging misrepresentation and.. omissions in the private placement memorandum and unit

However, with allocation decisions making the insurer responsible for the bulk of the defense and settlement costs on any claim asserted against both the directors and officers

Directors and officers The company The company as a defendant in securities claims only What is at risk? Personal assets Company assets Company assets Cover? D&O Insurance:

Association Liability insurance (Directors & Officers Liability insurance) can help provide protection to the directors, officers, employees, and volunteers for all of these

The new elite wording is a package policy comprising: • Directors & Officers Liability Insurance (D&O) • Outside Directors Liability (ODL) • Professional Indemnity

Directors and Officers Liability Insurance (D&O policies). D&O policies should cover wrongful acts that allege mismanagement of association affairs. Scope of Coverage. Not

The Accumulated Amount shall be the amount accumulated from the Insurance Premiums paid during the Insurance Period (after deduction of the Fees established under

• SHOP health insurance premiums paid through employee FSA. accounts – previously insurance premiums could not be paid from