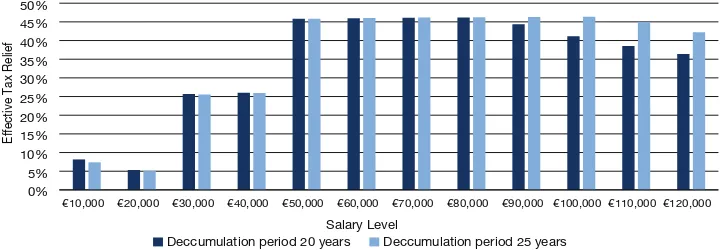

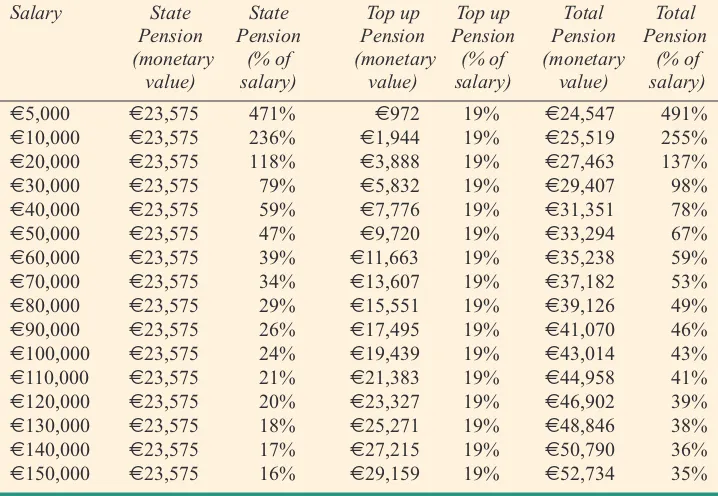

An Analysis of Taxation Supports for Private Pension Provision in Ireland

Full text

Figure

Related documents

Time series and tabulated average values of mechanical thrust, power, torque, and rotational speed as well as electrical variables of generator power, electromagnetic torque,

22.9 hours of cred- it, including 1.2 hours of ethics credit, from those states granting credit hours on a 50-minute basis (21.5 hours including 1 hour of ethics credit from NY

The user may mix the hot water with cold water, but normally this is not recommended: The increased total flow (Hot plus Cold) will reduce the inlet pressure; which in turn,

The case of India clearly illustrates the rebound dynamic: the initial calculation shows there is no change in household fossil fuel energy consumption (this is due to negligible

When Hungarian started marking the secondary topic role of the object by verbal agreement, the inherent primary topic status of the first and second persons came to be manifested

Credit Management (Allowance for Loan Loss)-NPL<10% Government SACCO Regulations (2008) SACCO Financial Performance - Total Assets - Return on Assets